What Is Poll Tax

The concept of a poll tax, also known as a head tax or capitation tax, has a complex history and significant social and political implications. In this article, we delve into the intricacies of the poll tax, exploring its definition, historical context, variations across different regions, and its controversial role in shaping societal structures.

Unraveling the Concept of Poll Tax

A poll tax is a type of taxation that imposes a fixed amount on each eligible individual, regardless of their income, wealth, or other economic factors. It is a flat-rate tax that treats all individuals equally, at least in theory. The term “poll” in this context refers to the head or individual being taxed.

The origins of poll taxes can be traced back to ancient civilizations, where various forms of head taxes were used to fund public works, military campaigns, and other government expenses. Over the centuries, poll taxes have taken on different forms and served diverse purposes, often becoming a contentious issue in political and social discourse.

Historical Context and Variations

Throughout history, poll taxes have been implemented in various regions and periods, each with its own unique characteristics and implications. Let’s explore some notable instances:

Ancient Rome

In ancient Rome, a poll tax known as the tributum capitis was levied on citizens and non-citizens alike. This tax was a crucial source of revenue for the Roman Empire, funding its expansive military and infrastructure projects. The tax amount varied based on an individual’s status, with higher rates for wealthier citizens.

Medieval Europe

During the Middle Ages, poll taxes, or “scutages,” were commonly used to finance wars and support the nobility. These taxes were often tied to military service, where individuals could pay a fixed sum in lieu of serving in the army. However, the burden of these taxes was not evenly distributed, with the poor often bearing a disproportionate share.

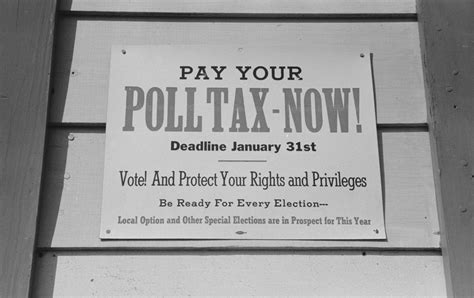

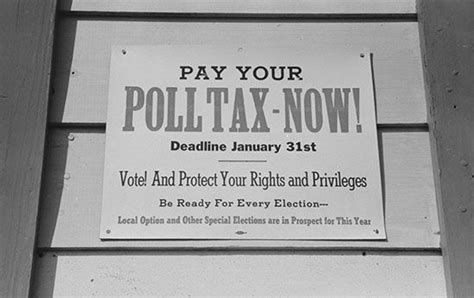

19th Century United States

In the post-Civil War era, several southern states in the United States implemented poll taxes as a means to restrict voting rights, particularly among African Americans. These taxes, combined with literacy tests and other barriers, were part of a broader strategy to suppress the political participation of marginalized communities. The poll tax became a symbol of racial discrimination and a significant obstacle to equal voting rights.

Modern Contexts

In more recent times, poll taxes have resurfaced in various forms. Some countries have introduced poll taxes as a means to fund specific social programs or as a way to encourage voter registration. However, these modern iterations have sparked debates over their fairness and potential impact on democratic participation.

The Controversy Surrounding Poll Taxes

Poll taxes have consistently been a source of controversy and debate due to their potential impact on social and economic equity. Here are some key points of contention:

Equality and Progressivity

Proponents of poll taxes argue that they promote equality by treating all individuals equally. However, critics argue that a flat-rate tax disregards the principle of progressive taxation, where those with higher incomes contribute a larger share. This criticism highlights the potential regressive nature of poll taxes, which can disproportionately affect low-income individuals.

Voting Rights and Civic Engagement

In the context of voting, poll taxes have historically been used to suppress the political participation of certain groups. The imposition of a financial barrier to voting can deter individuals from exercising their democratic rights, especially those facing economic hardships. This issue remains relevant in discussions about voter turnout and access to the political process.

Revenue Generation and Efficiency

From a fiscal perspective, poll taxes can be seen as a straightforward and efficient way to raise revenue. However, critics argue that they may not generate sufficient funds to support public services, especially in comparison to more progressive tax systems. The effectiveness of poll taxes as a revenue-generating tool is a subject of ongoing debate among economists and policymakers.

The Future of Poll Taxes: A Balancing Act

As societies evolve and priorities shift, the role of poll taxes continues to be scrutinized. While they may offer certain advantages, such as simplicity and ease of administration, the potential drawbacks, particularly in terms of social and economic fairness, cannot be ignored.

Moving forward, policymakers and economists must carefully consider the implications of poll taxes within the broader context of taxation and societal goals. Striking a balance between efficiency, fairness, and the promotion of democratic principles will be crucial in shaping the future of poll tax policies.

Conclusion

The poll tax, with its complex history and ongoing debates, serves as a reminder of the intricate relationship between taxation, societal structures, and individual rights. As we navigate the evolving landscape of taxation policies, a thoughtful and inclusive approach is essential to ensure that tax systems contribute to a fair and prosperous society.

FAQ

What is the primary purpose of a poll tax?

+

The primary purpose of a poll tax is to generate revenue by imposing a fixed amount on each eligible individual, regardless of their economic status. This flat-rate tax is often used to fund public services, military campaigns, or specific social programs.

Are poll taxes still used today, and if so, where?

+

Poll taxes are not widely used in their traditional form today. However, some countries have implemented variations of head taxes or capitation taxes as a means to fund specific initiatives or encourage voter registration. These modern iterations are subject to ongoing debates about their fairness and impact.

How do poll taxes affect voting rights and civic engagement?

+

Poll taxes, when used as a requirement for voting, can deter individuals from exercising their democratic rights, particularly those facing financial constraints. This suppression of voting rights has historically been a contentious issue, especially in relation to racial discrimination and equal access to the political process.

What are the key criticisms of poll taxes in modern contexts?

+

Modern criticisms of poll taxes often revolve around their potential regressive nature, where low-income individuals bear a disproportionate burden. Additionally, concerns are raised about their impact on democratic participation and their effectiveness as a revenue-generating tool compared to progressive tax systems.