When Are California Taxes Due

Tax deadlines are an important aspect of financial planning, and understanding when your tax obligations are due is crucial to ensure timely compliance and avoid any penalties or interest charges. In the state of California, tax due dates are set by the Franchise Tax Board (FTB) and can vary depending on the type of tax and the taxpayer's specific circumstances.

In this comprehensive guide, we will delve into the world of California taxes and provide you with an in-depth analysis of the various tax due dates applicable to individuals and businesses in the Golden State. From income taxes to sales and use taxes, we will cover it all, ensuring you have a clear understanding of your tax obligations and when they are due.

Understanding California’s Tax System

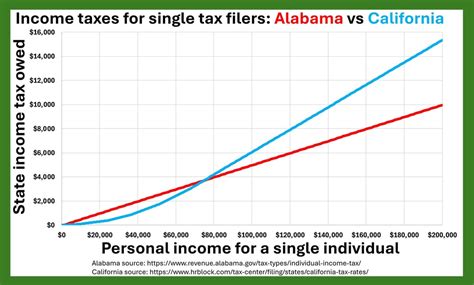

California, being the most populous state in the United States, has a complex and diverse tax system to support its extensive infrastructure and public services. The state collects various taxes to fund its operations, including income taxes, sales and use taxes, property taxes, and various business-related taxes. Each type of tax has its own due dates and filing requirements, making it essential for taxpayers to stay informed and organized.

The Franchise Tax Board (FTB) is the primary authority responsible for administering and enforcing tax laws in California. They provide guidance, resources, and support to taxpayers, ensuring compliance and facilitating a fair and efficient tax system. Understanding the FTB's role and the resources they offer can greatly assist taxpayers in navigating the complexities of California's tax landscape.

Income Tax Due Dates

Income taxes are a significant source of revenue for the state of California, and taxpayers are required to file their annual income tax returns by a specific deadline. The income tax due date in California generally aligns with the federal tax deadline, which is typically April 15th of the year following the tax year.

For instance, the income tax due date for the tax year 2023 is April 15, 2024. However, it's important to note that this deadline may be extended by the FTB in certain circumstances, such as during a state of emergency or natural disaster. It's always advisable to check the FTB's official website for any updates or extensions to ensure you are aware of the most current due date.

If a taxpayer is unable to meet the income tax due date, they have the option to request an extension. The FTB allows taxpayers to request an automatic six-month extension by filing Form FTB 3519. This extension provides additional time to file the income tax return but does not extend the deadline for paying any taxes owed. It's crucial to note that interest and penalties may still apply if the taxes are not paid by the original due date.

Key Points to Remember:

- Income tax returns are typically due by April 15th of the year following the tax year.

- Check the FTB’s website for any updates or extensions to the income tax due date.

- Extensions are available but do not relieve taxpayers from paying taxes owed by the original due date.

- Penalties and interest may apply if taxes are not paid by the due date, even with an extension.

Sales and Use Tax Due Dates

Sales and use taxes are an essential component of California’s tax system, as they generate significant revenue for the state. These taxes are imposed on the sale of goods and services and are collected by businesses to be remitted to the FTB.

The due dates for sales and use taxes vary depending on the taxpayer's filing frequency and the amount of tax liability. Businesses in California are required to register with the FTB and determine their filing frequency, which can be monthly, quarterly, or annually.

Monthly Filing:

Businesses with a monthly filing frequency are required to file and pay their sales and use taxes by the 20th day of the month following the reporting period. For example, sales and use taxes for the month of January would be due by February 20th.

Quarterly Filing:

Quarterly filers, on the other hand, have four specific due dates throughout the year. The deadlines for quarterly filers are as follows:

- First Quarter: April 20th

- Second Quarter: July 20th

- Third Quarter: October 20th

- Fourth Quarter: January 20th of the following year

Annual Filing:

Annual filers, typically small businesses with low sales, have a due date of February 20th of the year following the tax year. However, it’s important to note that annual filers must still make estimated tax payments throughout the year to avoid penalties.

Extensions for Sales and Use Taxes:

Similar to income taxes, businesses can request an extension for filing their sales and use tax returns. The FTB provides Form FTB 3522 for this purpose, which allows businesses to extend the filing deadline by up to six months. However, it’s crucial to note that extensions do not relieve businesses from their obligation to pay the taxes owed by the original due date.

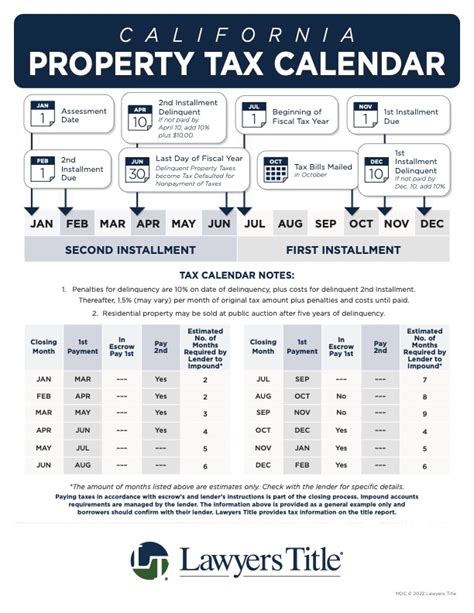

Property Tax Due Dates

Property taxes in California are assessed and collected by local counties. While the Franchise Tax Board (FTB) does not directly administer property taxes, it is still essential for taxpayers to understand the due dates and payment options for this type of tax.

Property tax bills are typically mailed to property owners by the county assessor's office in late August or early September. The due date for the first installment of property taxes is typically November 1st, and the second installment is due by February 1st of the following year. However, it's important to note that the exact due dates may vary slightly from county to county.

If a property owner fails to receive their tax bill, they are still responsible for paying the taxes on time. It's advisable to contact the county assessor's office to obtain a copy of the bill and ensure timely payment. Late payments of property taxes may result in penalties and interest charges, which can accumulate over time.

Business Taxes and Due Dates

California imposes various taxes on businesses operating within the state, including corporate income taxes, franchise taxes, and employment taxes. The due dates for these taxes depend on the specific tax type and the business’s filing requirements.

Corporate Income Tax Due Dates:

Corporations in California are generally required to file their corporate income tax returns by the 15th day of the fourth month following the close of their tax year. For example, a corporation with a tax year ending on December 31st would have a due date of April 15th for filing its corporate income tax return.

Franchise Tax Due Dates:

Franchise taxes are levied on certain businesses for the privilege of doing business in California. The due date for franchise taxes is typically the same as the due date for corporate income taxes, which is the 15th day of the fourth month following the close of the tax year. However, some entities, such as banks and financial institutions, may have different due dates specified by the FTB.

Employment Tax Due Dates:

Employment taxes in California include payroll taxes, unemployment insurance taxes, and disability insurance taxes. The due dates for these taxes vary depending on the amount of tax liability and the filing frequency of the business. Generally, employment taxes are due on a monthly or quarterly basis, with specific due dates set by the FTB.

Late Filing and Payment Penalties

Missing tax due dates can result in penalties and interest charges, which can significantly increase the taxpayer’s overall tax liability. The FTB imposes penalties for late filing and late payment of taxes, and these penalties can vary depending on the tax type and the amount of time the return or payment is overdue.

For instance, the FTB may impose a late filing penalty of up to 5% of the tax due for each month or part of a month the return is late, up to a maximum of 25%. Additionally, a late payment penalty of 0.5% per month, or fraction thereof, may be applied to any unpaid tax balance.

It's important for taxpayers to be aware of these penalties and plan accordingly to ensure timely filing and payment of their taxes. Seeking professional tax advice or utilizing the resources provided by the FTB can help taxpayers navigate the complexities of California's tax system and avoid unnecessary penalties.

Resources and Support from the Franchise Tax Board

The Franchise Tax Board (FTB) offers a wealth of resources and support to assist taxpayers in understanding their tax obligations and meeting their due dates. The FTB’s website provides a comprehensive guide to various taxes, due dates, and filing requirements. Taxpayers can access forms, publications, and instructional videos to help them navigate the tax process.

Additionally, the FTB offers a variety of payment options, including electronic payments, direct debit, and payment plans for those who may have difficulty paying their taxes in full by the due date. Taxpayers can also reach out to the FTB's Customer Service Center for assistance with specific tax-related inquiries or to request forms and publications.

Staying Informed and Organized

Navigating California’s tax system can be complex, but staying informed and organized can help taxpayers meet their tax obligations and avoid any potential penalties. Here are some tips to help you stay on top of your tax due dates:

- Set reminders for all tax due dates, including income taxes, sales and use taxes, property taxes, and business taxes.

- Utilize the FTB's resources and stay updated on any changes or extensions to tax due dates.

- Keep accurate records and documentation to support your tax filings.

- Consider seeking professional tax advice or utilizing tax preparation software to ensure accurate and timely filings.

- Plan your tax payments in advance to avoid late fees and penalties.

By staying informed and organized, taxpayers can navigate California's tax system with confidence and ensure compliance with the state's tax laws. Remember, timely filing and payment of taxes not only helps maintain a positive relationship with the FTB but also contributes to the state's ability to provide essential services and support its thriving economy.

Can I request an extension for my income tax return if I cannot meet the deadline?

+Yes, you can request an extension for your income tax return by filing Form FTB 3519. This extension provides additional time to file the return but does not extend the deadline for paying any taxes owed. It’s important to note that penalties and interest may still apply if taxes are not paid by the original due date.

What happens if I miss the sales and use tax due date for my business?

+Missing the sales and use tax due date can result in penalties and interest charges. The FTB imposes late filing and late payment penalties, which can vary depending on the amount of time the return or payment is overdue. It’s advisable to contact the FTB to discuss your options and potential penalties.

Are there any payment plans available for taxpayers who cannot pay their taxes in full by the due date?

+Yes, the FTB offers various payment options, including payment plans, to assist taxpayers who may have difficulty paying their taxes in full by the due date. These payment plans allow taxpayers to make regular payments over a specified period of time to satisfy their tax obligations. Contact the FTB to inquire about eligibility and available payment plans.