Missouri Tax Exempt Form

The Missouri Tax Exempt Form is an essential document for organizations and individuals seeking tax-exempt status in the state of Missouri. Understanding the process and requirements for obtaining tax-exempt status can provide significant benefits and ease administrative burdens. This comprehensive guide aims to delve into the intricacies of the Missouri Tax Exempt Form, offering a detailed analysis of its purpose, eligibility criteria, application process, and potential advantages.

Understanding the Missouri Tax Exempt Form

The Missouri Tax Exempt Form, officially known as Form MO-ST, is a legal document used by various entities to claim tax-exempt status for purchases of goods and services in the state. This form serves as a critical tool for nonprofit organizations, government agencies, and other qualifying entities to ensure they are not subject to certain state taxes, including sales and use taxes.

Tax exemption in Missouri is not a one-size-fits-all concept. It is tailored to accommodate a range of entities, each with its own unique eligibility criteria and application process. This guide will explore these nuances, providing a comprehensive understanding of how to navigate the Missouri tax exemption landscape.

Eligibility Criteria for Tax-Exempt Status

Determining eligibility for tax-exempt status in Missouri involves a careful review of the entity’s nature and purpose. Generally, organizations that are considered tax-exempt under federal law, such as those classified as 501©(3) nonprofits, often meet the criteria for Missouri tax exemption. However, the state also recognizes other types of entities, including:

- Charitable organizations

- Religious institutions

- Educational institutions

- Governmental entities

- Certain veterans' organizations

- Hospitals and medical facilities

- Literary and artistic societies

- Agricultural cooperatives

- Scientific research organizations

Each of these entities must demonstrate a specific purpose and adhere to certain operational guidelines to qualify for tax-exempt status. For instance, charitable organizations must have a primary purpose of providing services to the community without generating profit. Similarly, religious institutions must primarily engage in religious activities and not operate for the benefit of any individual or group.

Specific Criteria for Nonprofit Organizations

Nonprofit organizations seeking tax-exempt status in Missouri must meet the following criteria:

- The organization must be officially registered as a nonprofit corporation with the Missouri Secretary of State.

- It should have a valid federal tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

- The organization's purpose and activities must align with the Missouri statutes governing nonprofit corporations.

- It should maintain proper documentation, including articles of incorporation, bylaws, and annual reports.

- The nonprofit must have a governing body that oversees its operations and ensures compliance with legal and financial obligations.

Meeting these criteria is a prerequisite for nonprofit organizations to qualify for tax exemption in Missouri.

Application Process for Missouri Tax Exempt Form

The process of obtaining the Missouri Tax Exempt Form involves several steps, which can vary slightly depending on the type of entity applying. However, the general procedure includes the following:

Step 1: Determine Eligibility

Before initiating the application process, it is crucial to confirm whether your organization meets the eligibility criteria for tax exemption in Missouri. This involves a thorough review of your organization’s purpose, activities, and legal status.

Step 2: Gather Required Documentation

Once eligibility is confirmed, gather the necessary documentation. This typically includes articles of incorporation, bylaws, proof of federal tax-exempt status, and any other relevant legal documents. Ensure that all documents are up-to-date and accurately reflect your organization’s current status.

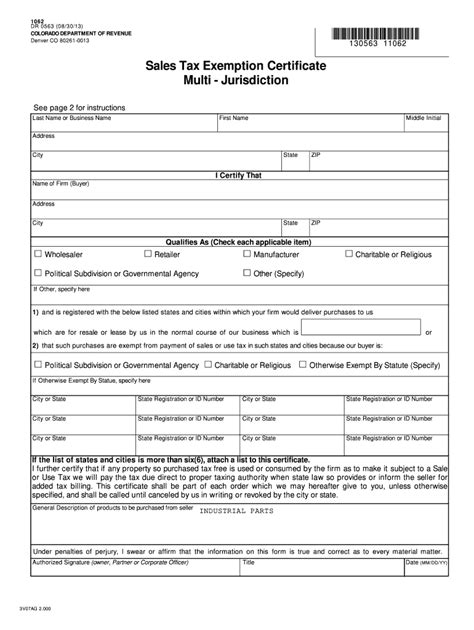

Step 3: Complete the Missouri Tax Exempt Form

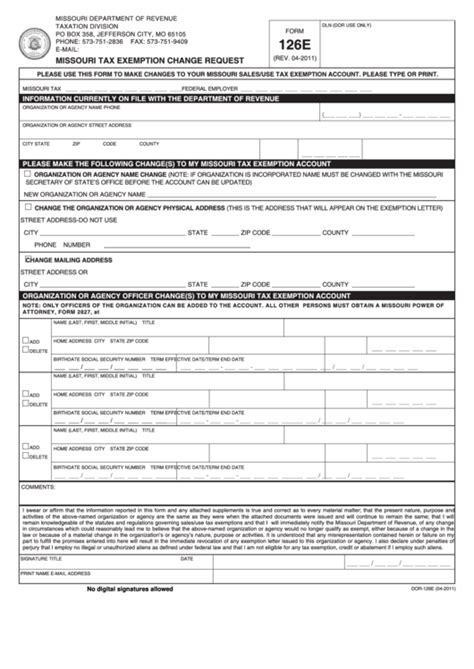

Access and complete Form MO-ST, providing all the required information. The form requires details about your organization, including its legal name, address, federal tax identification number, and the specific reason for requesting tax-exempt status. Ensure that you understand the instructions and complete the form accurately.

Step 4: Submit the Application

Submit the completed Missouri Tax Exempt Form along with the required documentation to the Missouri Department of Revenue. You can do this online through the department’s website or by mail. Ensure that you meet the submission deadline to avoid any delays in processing.

Step 5: Await Processing and Decision

After submission, allow the Missouri Department of Revenue sufficient time to process your application. The processing time can vary, so it is essential to plan accordingly. Once processed, you will receive a decision regarding your tax-exempt status. If approved, you will be provided with a certificate of tax exemption, which you must keep on file and present when making tax-exempt purchases.

Benefits of Tax-Exempt Status in Missouri

Obtaining tax-exempt status in Missouri can provide significant advantages to eligible organizations. These benefits can ease financial burdens and support the organization’s mission and operations.

Sales and Use Tax Exemption

The primary benefit of tax-exempt status is the exemption from sales and use taxes in Missouri. This means that when your organization makes purchases of goods and services, it is not required to pay the state’s sales tax. This can result in substantial savings, especially for organizations with significant operational expenses.

Enhanced Financial Planning

Tax-exempt status provides organizations with greater control over their financial resources. By not having to pay sales tax on purchases, organizations can allocate these funds toward their core mission, programs, and services. This enhanced financial planning capability can lead to more efficient operations and the ability to serve more individuals or communities.

Streamlined Administrative Processes

Tax-exempt status simplifies administrative processes for organizations. With a valid tax exemption certificate, organizations can easily provide this documentation to vendors and suppliers, avoiding the need for complex tax calculations and compliance procedures. This can save time and resources, allowing organizations to focus on their primary objectives.

Increased Credibility and Trust

Obtaining tax-exempt status in Missouri can enhance an organization’s credibility and trustworthiness. It demonstrates a level of financial responsibility and compliance with state regulations. This can be particularly beneficial when seeking donations, grants, or partnerships, as it assures donors and stakeholders that their contributions are supporting legitimate, well-managed organizations.

Maintaining Tax-Exempt Status

Once tax-exempt status is granted, it is essential to maintain compliance with the relevant regulations to avoid revocation. This includes:

- Ensuring that all purchases are made with the valid tax exemption certificate.

- Maintaining proper documentation and financial records.

- Adhering to the organization's stated purpose and mission.

- Regularly updating the Missouri Department of Revenue with any changes in legal status or organizational structure.

Failing to maintain compliance can result in the loss of tax-exempt status, so it is crucial to stay informed and proactive in managing your organization's tax obligations.

Conclusion

The Missouri Tax Exempt Form is a powerful tool for organizations seeking to operate more efficiently and effectively within the state. By understanding the eligibility criteria, application process, and benefits of tax-exempt status, organizations can navigate the process with confidence and maximize the advantages that come with tax exemption. This comprehensive guide provides a solid foundation for entities looking to embark on the journey of obtaining tax-exempt status in Missouri.

How often does the Missouri Tax Exempt Form need to be renewed?

+The Missouri Tax Exempt Form does not require renewal. Once approved, the tax-exempt status remains valid indefinitely as long as the organization continues to meet the eligibility criteria and maintains compliance with state regulations.

Are there any penalties for misuse of tax-exempt status?

+Yes, misuse of tax-exempt status can result in penalties. This includes using the tax-exempt status for ineligible purchases or failing to maintain proper documentation. Penalties may involve monetary fines and, in severe cases, revocation of tax-exempt status.

Can individuals apply for tax-exempt status in Missouri?

+Individuals generally do not qualify for tax-exempt status in Missouri. Tax exemption is primarily designed for organizations and entities with specific purposes and structures. However, individuals can explore other tax benefits and deductions based on their personal circumstances.