Washington State Vehicle Sales Tax

Understanding the intricacies of state-specific taxes is crucial, especially when it comes to significant purchases like vehicles. Washington State, known for its diverse landscapes and vibrant cities, has a unique approach to vehicle sales tax that impacts both residents and those considering a move to the Evergreen State. In this comprehensive guide, we'll delve into the specifics of Washington's vehicle sales tax, exploring its rates, exemptions, and the factors that contribute to the overall cost of purchasing a vehicle in this beautiful region.

The Fundamentals of Washington State Vehicle Sales Tax

Washington State imposes a sales tax on the purchase of vehicles, which is a critical revenue source for the state government. The sales tax applies to both new and used vehicles, and its calculation can significantly influence the overall cost of ownership. Let’s break down the key aspects of this tax structure.

Sales Tax Rates

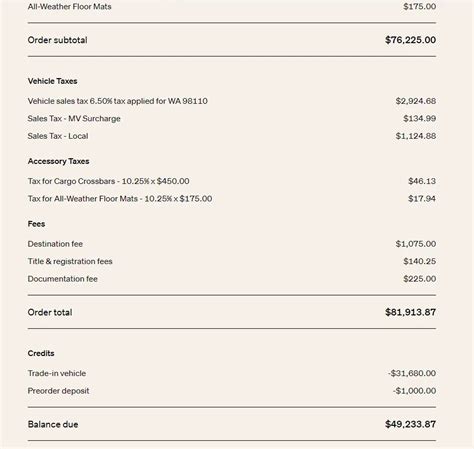

The sales tax rate for vehicles in Washington State is not a flat percentage. Instead, it is determined by the vehicle’s purchase price and the county where the sale takes place. The base rate is 6.5%, but counties have the authority to add a local sales tax on top of this, which can range from 0% to 3.1%.

For instance, in King County, which includes Seattle, the total sales tax rate for vehicles is 9.5%, consisting of the base rate of 6.5% and an additional 3% local tax. This means that a 20,000 vehicle would incur a sales tax of 1,900 in King County.

Exemptions and Special Considerations

While the sales tax is a standard requirement for vehicle purchases, there are certain exemptions and considerations that buyers should be aware of. These include:

- Military Exemption: Active-duty military personnel and their spouses are exempt from paying sales tax on vehicle purchases made in Washington State. This exemption is a way to show gratitude for their service and can result in significant savings.

- Trade-In Allowance: When trading in an old vehicle as part of a new purchase, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This can reduce the overall tax burden.

- Low-Income Assistance: Washington State offers a Sales Tax Rebate program for low-income individuals. Those who qualify can receive a rebate on the sales tax paid for their vehicle purchase, providing some financial relief.

Vehicle Purchase Process and Taxes

When buying a vehicle in Washington State, the sales tax is typically included in the overall cost. Dealers will calculate the tax based on the agreed-upon purchase price and the applicable tax rate for the county where the dealership is located. It’s essential for buyers to understand this process to ensure there are no surprises at the time of purchase.

| County | Sales Tax Rate | Example Tax on $20,000 Vehicle |

|---|---|---|

| King County | 9.5% | $1,900 |

| Pierce County | 8.1% | $1,620 |

| Snohomish County | 8.7% | $1,740 |

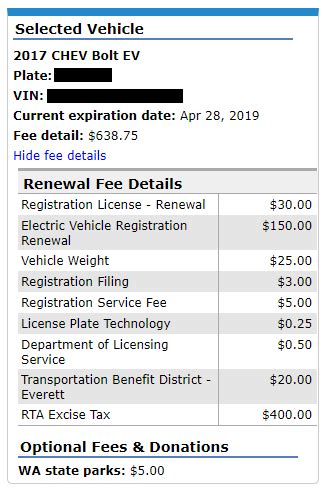

Registration and Title Fees

In addition to sales tax, vehicle buyers in Washington State must also consider registration and title fees. These fees are separate from the sales tax and are charged by the Department of Licensing (DOL) to cover the cost of registering and titling the vehicle.

Registration fees vary based on the type of vehicle and its weight. For instance, a standard passenger vehicle with a weight of 6,000 pounds or less has a registration fee of $45.50. Heavier vehicles, such as trucks, have higher registration fees.

Impact on Vehicle Ownership Costs

The sales tax and additional fees associated with vehicle purchases in Washington State can significantly impact the overall cost of ownership. For example, a 30,000 vehicle purchased in King County would incur a sales tax of 2,850, not including registration and title fees. This highlights the importance of budgeting and financial planning when considering a vehicle purchase in this state.

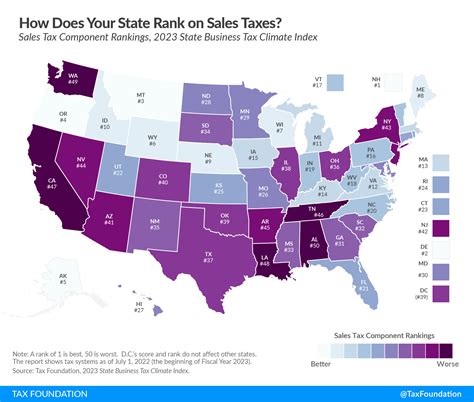

Comparative Analysis: Washington State vs. Other States

Washington State’s vehicle sales tax structure is unique compared to many other states. While some states have a flat sales tax rate for vehicles, others, like Washington, have a more complex system with varying rates based on location. This can make it challenging for potential residents or visitors to compare the overall cost of vehicle ownership across states.

State-by-State Comparison

To provide a clearer picture, let’s compare Washington State’s vehicle sales tax with that of a few other states:

- California: California has a flat sales tax rate of 7.25% for vehicle purchases. However, counties can add additional local taxes, similar to Washington.

- Texas: Texas has a slightly higher base sales tax rate of 6.25% for vehicles, but unlike Washington, there are no additional local taxes.

- New York: New York’s sales tax rate for vehicles varies by county, similar to Washington. The base rate is 4%, but with local taxes, the total rate can exceed 8% in some areas.

The Impact on Buyers and Residents

The varying sales tax rates across states can influence consumer behavior and purchasing decisions. For individuals considering a move to Washington State or purchasing a vehicle while visiting, understanding the sales tax structure is crucial. It can affect the decision to buy a vehicle in-state versus importing it from another state with potentially lower taxes.

Future Outlook and Potential Changes

As with any tax structure, Washington State’s vehicle sales tax is subject to potential changes and revisions. These changes can be driven by a variety of factors, including economic conditions, political landscapes, and shifts in consumer behavior.

Potential Scenarios

- Economic Downturn: In times of economic hardship, the state government might consider adjusting tax rates to stimulate spending and support the automotive industry.

- Political Shifts: Changes in state leadership or legislative priorities can lead to tax reforms, including modifications to sales tax rates or structures.

- Electric Vehicle Incentives: Washington State has shown support for electric vehicles (EVs) with various incentives. Future tax reforms could focus on reducing taxes for EV purchases to encourage their adoption.

Implications for Vehicle Buyers

Vehicle buyers in Washington State should stay informed about potential tax changes. While it’s challenging to predict specific outcomes, being aware of the factors that can influence tax structures can help buyers make more informed financial decisions when it comes to vehicle purchases.

Conclusion

Understanding Washington State’s vehicle sales tax is essential for anyone considering a vehicle purchase in this region. The state’s unique tax structure, with varying rates based on location, adds an extra layer of complexity to the purchasing process. By breaking down the specifics of the sales tax, exemptions, and potential future changes, this guide aims to provide a comprehensive resource for informed decision-making.

FAQ

Are there any ways to reduce the sales tax burden when purchasing a vehicle in Washington State?

+Yes, there are a few strategies. One is to trade in your old vehicle, as the sales tax is calculated on the difference between the trade-in value and the new vehicle’s purchase price. Additionally, active-duty military personnel and their spouses are exempt from sales tax on vehicle purchases. Finally, low-income individuals may qualify for a Sales Tax Rebate program.

What happens if I buy a vehicle in a county with a lower sales tax rate and then move to a county with a higher rate?

+If you purchase a vehicle in a county with a lower sales tax rate and then move to a county with a higher rate, you may be required to pay the difference in sales tax. It’s essential to update your vehicle registration and ensure compliance with the new county’s tax requirements.

Are there any online resources or tools to help calculate the exact sales tax for my vehicle purchase in Washington State?

+Yes, the Washington State Department of Revenue provides an online Sales Tax Calculator that can help estimate the sales tax based on the purchase price and county. This tool is a valuable resource for prospective vehicle buyers to get an accurate estimate.