City Of Hartford Tax Collector

Welcome to the city of Hartford, a vibrant urban center with a rich history and a bustling economy. Today, we delve into the essential role of the City of Hartford Tax Collector, an office that plays a crucial part in the city's financial administration and overall governance.

The City of Hartford Tax Collector: A Pillar of Financial Management

The Tax Collector’s Office in Hartford is more than just a revenue collection entity; it is a vital cog in the city’s machinery, ensuring the smooth operation of public services and infrastructure. With a dedicated team, the Tax Collector’s Office manages a range of financial responsibilities, contributing significantly to the city’s fiscal health and stability.

In this article, we will explore the various facets of the Tax Collector's role, from property tax collection to financial administration and the broader implications for the city's economic development. We will also delve into the strategies and initiatives implemented by the Tax Collector to optimize revenue collection and enhance financial management practices.

Understanding the Role: The Tax Collector’s Responsibilities

The Tax Collector in Hartford is entrusted with a range of critical responsibilities that impact the city’s financial landscape. At the core of their role is the collection of property taxes, which form a significant portion of the city’s revenue stream. This involves sending out tax bills, collecting payments, and managing delinquencies to ensure a steady flow of funds into the city’s coffers.

Beyond property taxes, the Tax Collector's Office also handles other revenue streams, including business taxes, special assessments, and license fees. These diverse revenue sources require careful management and accurate record-keeping to ensure the city's finances are well-organized and transparent.

| Revenue Stream | Description |

|---|---|

| Property Taxes | Levied on real estate properties within the city, based on their assessed value. |

| Business Taxes | Taxes imposed on businesses operating within Hartford, including sales taxes and business license fees. |

| Special Assessments | Charges levied on property owners for specific improvements or services, such as street lighting or sewer connections. |

| License Fees | Fees paid by individuals or businesses for various licenses, such as dog licenses, construction permits, or occupational licenses. |

The Tax Collector's Office also plays a pivotal role in financial administration, overseeing the city's budget, managing debt, and facilitating financial reporting. This involves working closely with other city departments to ensure fiscal responsibility and transparency. The Tax Collector is also responsible for implementing and maintaining effective financial systems and processes to support the city's financial operations.

Strategies for Optimal Revenue Collection

The Tax Collector’s Office employs various strategies to maximize revenue collection and ensure timely payments. These strategies are designed to balance the need for efficient revenue generation with the city’s commitment to providing quality public services.

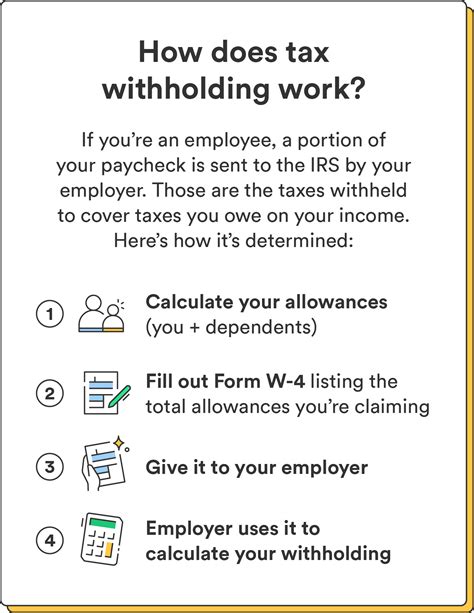

One key strategy is the implementation of a robust billing and collection system. This system ensures that property owners and taxpayers receive accurate and timely tax bills. It also provides multiple payment options, such as online payments, direct debits, and in-person payments, to cater to different preferences and circumstances.

To address delinquencies and late payments, the Tax Collector's Office has a comprehensive collection strategy in place. This includes sending out reminder notices, offering payment plans, and, if necessary, taking legal action to recover outstanding taxes. The goal is to encourage voluntary compliance while ensuring the city's revenue stream is not disrupted.

Additionally, the Tax Collector's Office actively engages with taxpayers and property owners through public outreach and education programs. These initiatives aim to increase awareness about tax obligations, explain the city's tax system, and address any concerns or queries. By fostering a culture of transparency and communication, the Tax Collector's Office aims to build trust and encourage timely tax payments.

Enhancing Financial Management Practices

Beyond revenue collection, the Tax Collector’s Office is dedicated to improving financial management practices across the city. This involves working collaboratively with other city departments to implement best practices and ensure financial accountability.

One key focus area is budget management. The Tax Collector's Office assists in preparing and monitoring the city's annual budget, ensuring that revenue projections are accurate and that expenditures are aligned with the city's strategic priorities. This involves regular financial reviews, performance assessments, and the implementation of cost-saving measures where necessary.

The Tax Collector's Office also plays a vital role in debt management. This includes managing the city's debt portfolio, ensuring timely repayments, and exploring opportunities for refinancing or debt restructuring to optimize the city's financial position. By effectively managing debt, the city can maintain its creditworthiness and access favorable borrowing terms.

Furthermore, the Tax Collector's Office is committed to strengthening financial systems and controls. This involves implementing robust accounting practices, enhancing internal controls, and ensuring compliance with relevant financial regulations and standards. By doing so, the city can minimize the risk of financial irregularities and maintain the integrity of its financial operations.

The Impact on Hartford’s Economic Development

The role of the City of Hartford Tax Collector extends beyond financial administration. Effective tax collection and financial management have a direct impact on the city’s economic development and overall prosperity.

By ensuring a steady flow of revenue, the Tax Collector's Office provides the financial foundation for the city's operations and investments. This includes funding essential public services, maintaining infrastructure, and supporting community development initiatives. A well-managed tax system also fosters economic growth by attracting businesses and investors, who value a stable and transparent financial environment.

Moreover, the Tax Collector's Office contributes to the city's long-term financial sustainability. Through prudent financial management and strategic planning, the office helps ensure that Hartford is well-positioned to weather economic downturns and seize opportunities for growth. This stability is crucial for maintaining the city's credit rating, which in turn influences its ability to access capital markets and pursue major development projects.

Conclusion: A Critical Pillar of Hartford’s Governance

The City of Hartford Tax Collector is an indispensable part of the city’s governance structure. Through their work in revenue collection and financial management, the Tax Collector’s Office ensures the city’s financial health, stability, and long-term prosperity.

By implementing effective strategies and initiatives, the Tax Collector's Office maximizes revenue collection, optimizes financial management practices, and contributes to the city's economic development. This vital role underscores the importance of efficient financial administration in the smooth functioning of a city and its ability to deliver quality public services.

As Hartford continues to evolve and grow, the Tax Collector's Office will remain a key driver of its financial success and a cornerstone of its governance.

What are the hours of operation for the Tax Collector’s Office in Hartford?

+

The Tax Collector’s Office in Hartford is typically open from 8:30 a.m. to 4:30 p.m., Monday through Friday, excluding public holidays. These hours may be subject to change, so it’s always advisable to check the official website or contact the office directly for the most up-to-date information.

How can I pay my property taxes in Hartford?

+

There are several convenient ways to pay your property taxes in Hartford. You can pay online through the city’s official website, set up direct debit payments, or make payments in person at the Tax Collector’s Office. Additionally, you can mail your payment to the Tax Collector’s Office, ensuring it is received by the due date to avoid penalties.

What happens if I miss the property tax payment deadline in Hartford?

+

If you miss the property tax payment deadline in Hartford, you may be subject to late fees and interest charges. It’s important to note that these additional charges can accumulate quickly, so it’s best to make your payments on time. If you’re facing financial difficulties, you can contact the Tax Collector’s Office to discuss potential payment plans or options to avoid delinquency.