How to Effectively Amend My Tax Return for a Refund

Filing taxes accurately is a crucial step in ensuring your financial integrity and compliance, yet even the most diligent taxpayers sometimes encounter discrepancies or overlooked deductions that necessitate amendments. Understanding the intricate processes and interconnected components involved in effectively amending your tax return for a refund is essential for optimizing your financial outcomes and maintaining trustworthiness within the tax system. This comprehensive exploration employs a systems thinking framework, mapping out the various interconnected parts—from initial filing, recognizing errors, to the procedural steps for amendments—that influence the success and efficiency of your correction process.

The Fundamental Framework of Tax Return Amendments

At the core of amending a tax return lies the recognition that tax systems operate as complex, dynamic networks. An individual taxpayer’s filing interacts with multiple interconnected components, including IRS or relevant tax authority protocols, tax laws, documentation standards, and even digital interfaces. When an error or omission occurs, the ripple effects can cascade through these systems, influencing processing times, refund calculations, audit risk, and future compliance actions.

To effectively navigate this landscape, one must understand the entire life cycle of a tax return—from initial submission to post-amendment processing—and how each stage is influenced by systemic interdependencies. For example, incorrect reporting of income affects not only the calculation of owed taxes but also eligibility for certain credits and deductions, thereby impacting subsequent amendments and recalculations.

Initial Filing: The Network of Data and Assumptions

Initial filing represents a nexus point where the taxpayer’s financial data intersects with tax laws, software systems, and agency validations. Errors often originate here through misreported income, overlooked deductible expenses, or misclassified items. The accuracy of the initial data input, combined with the understanding of applicable tax legislation, determines how smoothly subsequent amendments proceed.

Efficient initial filing involves integrating various data streams—such as W-2s, 1099s, and receipts—within tax preparation tools calibrated against current tax codes. Automation, while reducing human error, cannot eliminate oversight entirely, thus requiring taxpayers to review inputs meticulously. Recognizing systemic vulnerabilities during this stage prepares taxpayers for potential amendments, especially when discrepancies are identified post-submission.

Recognition of the Need to Amend

Detecting the necessity of an amendment usually arises from feedback, such as received IRS notices, or internal review processes. This recognition triggers a vital feedback loop—a system point where data discrepancies, overlooked deductions, or misreported income are identified. The capacity for timely detection influences the overall efficiency of the amendment process, prevents unnecessary penalties, and optimizes refund recovery.

| Key Metric | Impact on Amendment Process |

|---|---|

| Time lag between initial filing and detection of errors | Increased lag can delay refunds and escalate penalties |

The Systemic Pathway to Amending a Tax Return

Amending a tax return does not occur in isolation; it is intricately linked to related financial and administrative systems. The process involves several interconnected stages—preparation, submission, processing, and resolution—all influenced by external factors like legislative updates and technological upgrades.

Preparation and Documentation

Once the need for an amendment is recognized, the taxpayer must gather supporting documentation—receipts, amended W-2s, corrected 1099 forms—that serve as tangible evidence within the correction system. The completeness and accuracy of these documents influence the subsequent validation process conducted by the IRS or relevant authority.

| Documentation Completeness | Effect on Processing Time |

|---|---|

| High | Accelerates review and approval |

| Low | Causes delays and potential rejection |

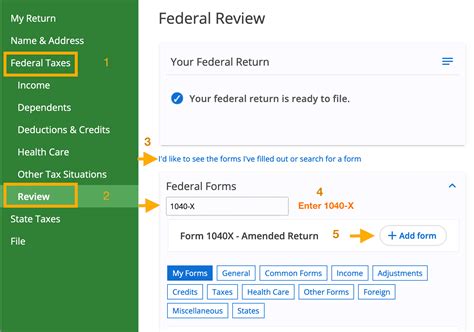

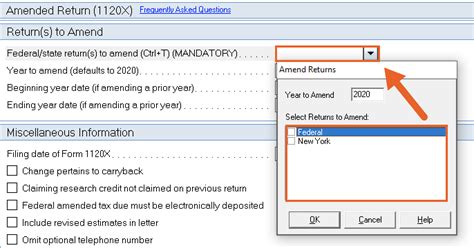

Submission of the Amended Return

In the United States, Form 1040-X serves as the standard tool for amendments. Its submission triggers a new data flow into the IRS’s processing systems, which then reevaluate the return within an interconnected web of computational and human review stages. The system’s capacity to process amendments efficiently depends on adherence to proper formatting, accurate data entries, and timely submission.

Processing and Review System Dynamics

IRS and other tax authorities operate on complex, layered processing systems that include automated checks, manual reviews, and cross-system validations. The correction triggers a recalibration of tax liabilities and refunds, which must pass through multiple interconnected checks—statutory compliance, cross-referencing with prior filings, and possibly audit triggers.

| Processing Time | Typical Range |

|---|---|

| IRS | 8-12 weeks for standard amendments |

| Factors Influencing Duration | Complexity, backlog, completeness of submission |

Influences of Policy, Legislation, and Technology

The broader context within which amendments occur evolves constantly, driven by legislative changes, technological advancements, and policy shifts. Automated flagging systems, AI-driven compliance checks, and data integration capabilities across government agencies have transformed this process into a more dynamic and efficient system, yet also introduce new complexities and interdependencies.

Legislative Impact on Amendment Procedures

Tax law revisions can alter refund calculations, qualification criteria for deductions and credits, or even the permissible formats for amendments. Staying informed about policy updates ensures amendments are compliant and beneficial.

Technological Enhancements and Digital Interfaces

Secure online portals facilitate submission, tracking, and communication with tax authorities, integrating multiple subsystems—such as identity verification, data encryption, and automated processing. These interconnected digital frameworks enable faster resolution but require high technical literacy from users.

| Technology Adoption Rate | Effect on Process Efficiency |

|---|---|

| High | Reduces processing times, improves accuracy |

| Low | Increases manual errors, delays |

Practical Strategies for an Effective Amendment Process

Integrating an understanding of the systemic interdependencies into practical steps can substantially improve your experience when amending a tax return for a refund. These strategies include meticulous record-keeping, timely filings, leveraging digital tools, and maintaining awareness of policy developments.

Proactive Error Detection

Implement routine reviews of your tax documents and recent notices to identify discrepancies early. Systematic cross-referencing of data inputs against supporting documents helps catch errors before submission and reduces systemic bottlenecks during processing.

Leveraging Technology and Digital Platforms

Using reputable tax software and IRS portals expedites submission and offers real-time status updates, enhancing transparency within the interconnected processing network. Keep digital copies of all relevant documents and utilize reminders for key deadlines to stay synchronized within this systemic ecosystem.

Engaging with Professional Assistance

Tax professionals possess a nuanced understanding of layered systemic interactions and can navigate complex issues such as audit triggers or policy changes. Their expertise acts as an interface optimizing the interconnected processes involved in amendments.

| Best Practice | Impact |

|---|---|

| Regular review of filing status and notices | Prevents oversight, facilitates prompt amendments |

| Use of updated tax software | Reduces manual errors, streamlines submission |

Conclusion: Navigating the System of Tax Amendments

Effectively amending a tax return for a refund entails understanding and managing a highly interconnected system—one where each component, from initial input to final processing, influences the overall outcome. Recognizing these interdependencies, staying informed about legislative and technological developments, and employing strategic practices can transform a potentially cumbersome process into an efficient, transparent, and beneficial experience.

What is the typical timeline for IRS to process a Form 1040-X?

+The IRS generally processes amended returns within 8 to 12 weeks, but timelines can vary depending on complexity, backlog, and submission accuracy.

How do I track the status of my amended return?

+You can use the IRS Where’s My Amended Return tool online or their mobile app for real-time updates, provided you’ve filed electronically and included correct tracking information.

What common errors can delay the processing of an amendment?

+Insufficient documentation, incorrect form completion, or inconsistent data between original and amended returns often cause delays or rejections in processing.