Tracing the Origin and Evolution of the mn state tax refund

Amidst the labyrinth of state fiscal policies and taxation mechanisms, the narrative of "Tracing the Origin and Evolution of the MN State Tax Refund" unfolds as a compelling case study in economic history, policy adaptation, and fiscal resilience. Minnesota’s tax refund system, a vital cog in its fiscal machinery, reflects years of legislative adjustments, economic pressures, and social expectations—each chapter revealing the state's response to dynamic financial realities. To truly appreciate this system’s current form and future trajectory, one must delve deeply into its origins, subsequent evolutions, and the intricate interplay of economic, political, and social factors that shaped it.

Historical Roots of Minnesota’s Tax Refund System

Understanding the genesis of Minnesota’s tax refund system begins in the early 20th century—a period marked by expanding government functions and burgeoning public expectations for equitable taxation. Initially, the system was rudimentary, primarily aimed at providing relief for lower-income residents and offsetting burgeoning property taxes. As Minnesota transitioned through the Great Depression, World War II, and the post-war economic boom, the state’s approach to tax refunds matured, reflecting both economic necessity and political will.

By the 1950s, legislation formalized various refund mechanisms, including income-dependent refunds and sales tax rebates, designed to stabilize disposable income during turbulent economic cycles. These early reforms were guided by a combination of budgetary constraints and the emerging recognition of tax equity’s role in social equity. Their historical context underscored an ongoing tension: balancing revenue needs with maintaining public support for taxation policies.

The Evolution Through Legislative Reforms and Economic Shifts

Over subsequent decades, the system evolved through a series of legislative amendments, driven by shifting political landscapes and economic shifts. The 1970s and 1980s, for example, saw notable reforms in response to inflation, recessionary pressures, and demographic changes. During this period, Minnesota introduced targeted rebates aimed at offsetting inflation-driven tax burdens, often linked closely to income levels and family status. Such reforms were emblematic of a broader national trend towards income-based relief mechanisms, but Minnesota’s approach also reflected local preferences for direct, tangible benefits over vague tax credits.

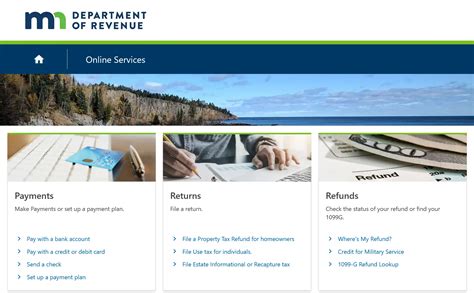

Critical to this evolution was the advent of computerized tax processing systems in the late 20th century, which enhanced administrative efficiency and allowed more nuanced refund calculations. These technological developments coincided with fiscal crises—most notably in the early 2000s—prompting legislative debates on the sustainability of refund programs amidst fluctuating state revenues. During these periods, reforms often aimed to curb excessive refunds and introduce income caps, balancing fiscal conservatism with social fairness.

Contemporary Framework and Functional Mechanics of the MN State Tax Refund

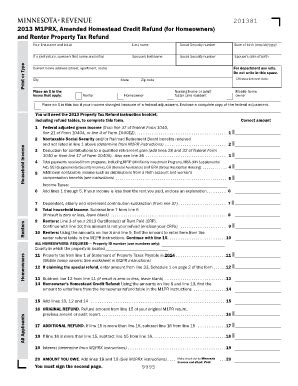

Today, Minnesota’s tax refund system functions within a complex web of state statutes, administrative guidelines, and economic indicators. The primary target remains low- to middle-income taxpayers, with refunds designed to mitigate the impact of sales, income, and property taxes. The contemporary system employs a blend of automated calculations and manual oversight, factoring in income brackets, tax credits, and recent legislative adjustments annexed in annual budget bills.

The operational framework hinges on several core principles: transparency, fairness, efficiency, and compliance. Minnesota’s Department of Revenue introduces annual modifications based on economic forecasts and political priorities, which influence the refund structure. For instance, recent reforms have expanded eligibility criteria, include temporary relief measures during economic downturns like the COVID-19 pandemic, and incorporated inflation adjustments to ensure industry relevance.

Direct Impact on Socioeconomic Equity and Fiscal Stability

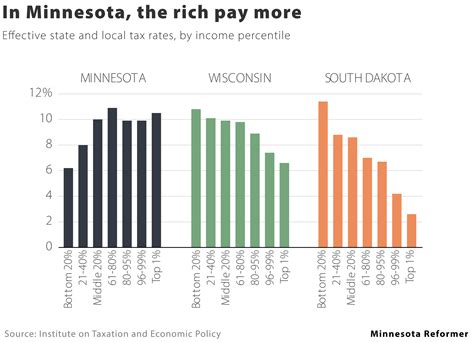

The importance of the tax refund system extends beyond mere fiscal calculations; it’s a social safety net that shapes economic stability and societal equity. For lower-income families, refunds can constitute a significant portion of annual income, influencing consumption patterns, debt levels, and overall well-being. For policymakers, the challenge is maintaining a delicate equilibrium—providing sufficient relief without jeopardizing fiscal sustainability.

Empirical data suggest that, in recent years, the average Minnesota taxpayer received refunds averaging 1,200—an amount that varies considerably across income brackets and household compositions. According to the Minnesota Department of Revenue, about 54% of households filed for refunds annually, underscoring the program's broad reach and its pivotal role in household economic planning.</p> <table> <tr><th>Relevant Category</th><th>Substantive Data</th></tr> <tr><td>Average Refund Amount</td><td>1,200 (2023) with a standard deviation of 350</td></tr> <tr><td>Percentage of Filers Receiving Refunds</td><td>54% of households</td></tr> <tr><td>Refund Distribution by Income Bracket</td><td>80% of refunds go to households earning below 60,000/year Annual Budget Allocated to Refund Programs$1.8 billion (2023), accounting for approximately 4% of total state revenue

Major Challenges and Future Directions in the MN Tax Refund System

As Minnesota continues to refine its tax refund mechanisms, it confronts a constellation of challenges, including demographic shifts, economic volatility, and political contestation. The aging population exerts upward pressure on property taxes, demanding recalibrated refund formulas that address shifting needs of retirees and pensioners. Meanwhile, technological advances open possibilities for more personalized refunds but also introduce security and privacy concerns.

One significant challenge lies in ensuring the system remains fiscally sustainable amidst fluctuating revenue streams. Recessionary periods, characterized by upticks in unemployment and decreased consumer spending, threaten to strain state budgets and ignite debates over the extent of refund generosity. Recent proposals advocate for more targeted aid, possibly leveraging machine learning models to predict and efficiently allocate refunds based on socio-economic data, thereby improving efficacy and reducing waste.

Innovative Approaches and Policy Innovations

Policy innovations under consideration include expanding refundable credits linked directly to healthcare expenses or housing costs—both vital aspects influencing economic stability. Additionally, integrating real-time data collection and blockchain technologies proposes a future where refunds could be processed rapidly, transparently, and securely, significantly reducing administrative overhead and fraud risks.

In the arena of political discourse, debates often revolve around the fairness of refunds versus broader tax reforms—an ongoing tug-of-war between social equity and economic prudence. The direction Minnesota moves forward will likely incorporate a hybrid model, balancing automatic stabilizers against discretionary legislative measures, crafted with meticulous attention to the state’s evolving demographic and fiscal landscape.

Key Points

- Historical context: Minnesota’s tax refund system originated in early 20th-century fiscal reforms, reflecting shifting economic realities and legislative priorities.

- Evolution analysis: Through decades of legislative amendments, technological advancements, and economic upheavals, the system has become a multifaceted instrument balancing fiscal and social objectives.

- Contemporary mechanics: Current operations incorporate automated calculations, income-based criteria, and responsive legislative modifications to optimize relief delivery.

- Socioeconomic impact: Refunds significantly influence household stability, especially among lower-income families, reinforcing the need for targeted, fair relief.

- Future outlook: Challenges include demographic shifts, economic volatility, and technological integration—potentially addressed through innovative policy measures and data-driven approaches.

What factors influence the size of Minnesota’s tax refunds?

+The size of refunds depends on income levels, tax credits, legislative adjustments, and recent economic conditions. Income brackets, deductions, and targeted relief policies all play crucial roles in determining individual refund amounts.

How does technological advancement shape Minnesota’s refund system?

+Technological improvements, including automation and data analytics, enable more precise, faster, and secure processing of refunds. They also facilitate real-time adjustments and reduce administrative costs, enhancing overall efficiency and transparency.

What are the future challenges for Minnesota’s tax refund policies?

+Future challenges include demographic aging, economic volatility, cybersecurity risks, and ensuring equitable distribution amid fiscal constraints. Policy innovation and technological integration will be key to navigating these issues successfully.