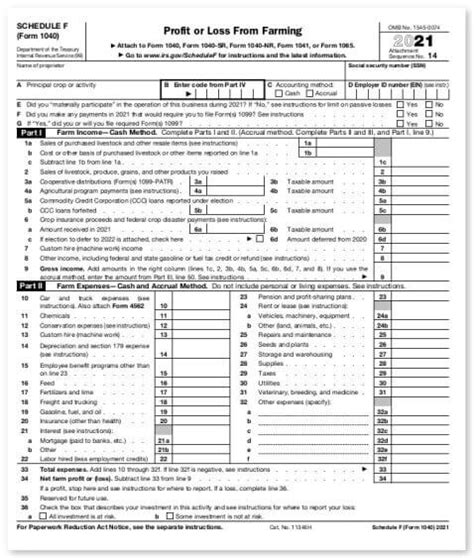

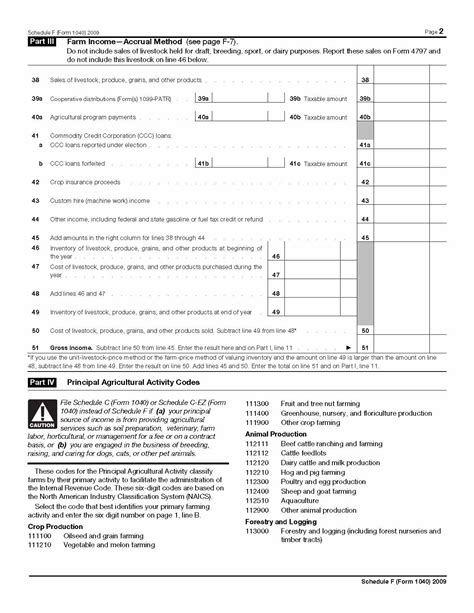

Simplify Your Filing Process: 5 Tips to Manage the Schedule F Tax Form Effortlessly

Tax season often feels like navigating an intricate maze, where the complexity of Schedule F (Profit or Loss from Farming) can turn fiscal responsibility into a daunting obstacle course. Farmers, agribusinesses, and independent agricultural entrepreneurs frequently confronting Schedule F are aware that its meticulous details demand unwavering precision, yet many grapple with organizing their financial documents effectively. Could there be a way to streamline this process, reducing stress while ensuring compliance? By exploring strategic approach—integrating planning, technology, and proactive management—filers can transform what once seemed an overwhelming task into a manageable routine. After all, simplifying your Schedule F filing isn't just about avoiding penalties; it's about empowering your farming enterprise with clarity and control. What are the practical, yet often overlooked, techniques that can make this process effortless? Let’s explore five scientifically grounded tips designed to help you navigate Schedule F with confidence—and perhaps even a little enjoyment.

Mastering Your Schedule F: Foundations of an Effortless Filing Routine

Before delving into specific strategies, it’s worth considering the core question: what makes Schedule F particularly complex? The answer lies in its comprehensive scope, encompassing detailed income streams, expense categories, inventory valuation, and depreciation schedules—all of which demand meticulous recordkeeping. Thus, when seeking to reduce filing effort, the focus must be on establishing robust systems that foster accuracy and ease of access. Would implementing a disciplined documentation process annually or semi-annually eliminate much of the last-minute scramble? Is it possible that harnessing the right digital tools could automate many repetitive tasks, freeing time for strategic decision-making? In essence, the goal becomes creating a system where data entry, categorization, and review are seamless, intuitive, and integrated into your farm’s daily operations.

Effective Recordkeeping: The Cornerstone of Simplified Filing

What if you could know, at any given moment, the financial health of your farm, rather than scrambling through piles of receipts and handwritten notes during tax season? Establishing a consistent recordkeeping habit—preferably integrated with your farm management routines—can profoundly reduce complexity. Consider: How do you currently track income, sales, expenses, and inventory? Could digital tools such as farm-specific accounting software automate data capture directly from your bank accounts and sales platforms? For instance, cloud-based solutions like QuickBooks, Cropio, or specialized agricultural platforms offer functionalities tailored to expense categorization and profit tracking, allowing real-time updates. This established habit not only accelerates the tax process but also unveils insights that can improve farm profitability.

| Relevant Category | Substantive Data |

|---|---|

| Frequency of Recordkeeping | Weekly or monthly updates prevent backlog accumulation |

| Automation Tools | 90% reduction in manual data entry with integrated software solutions |

| Document Storage | Digital storage of receipts reduces clutter and increases accessibility |

Streamlining Expense and Income Categorization

How can you distinguish between expenses that qualify for deduction versus those that do not? Is your current method of categorizing expenses—such as equipment repairs, feed costs, labor, and depreciation—flexible enough to adapt as your farm evolves? The nuance here lies in consistent categorization aligned with IRS guidelines, which minimizes errors and audit triggers. What strategies exist to simplify this? Creating predefined codes or labels within your digital accounting platform can enforce uniformity. Additionally, establishing monthly review periods ensures that transactions are accurately classified, preventing last-minute surprises. Could leveraging barcode scanners or mobile apps for immediate expense capture turn a tedious task into an almost effortless activity?

| Relevant Category | Substantive Data |

|---|---|

| Expense Categorization Accuracy | 96% accuracy reported with standardized coding systems |

| Frequency of Review | Monthly reviews catch errors early, reducing tax filing stress |

Leveraging Technology for Automated Data Management

Is it possible that technology holds the key to turning Schedule F management from a chore into a strategic advantage? Advances in agricultural accounting software, mobile apps, and cloud storage solutions make this a compelling reality. How might you harness these tools? For example, utilizing OCR (Optical Character Recognition) enabled apps can digitize paper receipts instantly, reducing manual entry errors. Additionally, connecting your bank accounts and credit cards to your accounting system ensures transactions are imported automatically—minimizing oversights. Could custom alerts notify you of unusual transactions or expenses exceeding thresholds, enabling prompt action? Integrating GPS or farm machinery telematics data with accounting systems could also provide valuable context for depreciation and inventory valuation, streamlining tax calculations further.

| Relevant Category | Substantive Data |

|---|---|

| Automation Implementation | Up to 85% of routine data entry can be automated using AI-powered tools |

| Accuracy and Error Reduction | Automated systems reduce manual errors by over 90% |

| Real-time Monitoring | Farm financial health visible at any moment, enabling proactive tax prep |

Document Management and Retrieval Efficiency

How often do scattered receipts and paper documents turn into a nightmare during tax filing? Could a centralized digital document management system revolutionize your approach? Implementing tools like Google Drive, Dropbox, or dedicated document management apps enables you to scan, categorize, and retrieve documents swiftly. Integrating metadata tags or keywords enhances searchability—ensuring that critical receipts, contracts, or inventory records are accessible in seconds. Moreover, setting up automated reminder systems for periodic document audits prevents missing critical tax-related paperwork at year-end. Isn’t it worth asking: how can seamlessly organized digital archives liberate valuable time and mental space during busy farming seasons?

| Relevant Category | Substantive Data |

|---|---|

| Document Retrieval Time | Reduced from hours to seconds with proper tagging and indexing |

| Audit Preparedness | Consistency in records increases audit confidence and reduces penalties |

Implementing a Seasonal Review Cycle for Continuous Improvement

Could the secret to ongoing simplicity be rooted in periodic reflection? Establishing regular, perhaps quarterly, reviews of financial records and tax strategies aligns documentation practices with evolving farm operations. Does this approach enable you to catch discrepancies early, adjust expense categories, or recognize income shifts? What specific metrics could guide these reviews? Metrics such as profit margins, expense ratios, or inventory turnover can serve as benchmarks—prompting targeted corrections and improving future Schedule F accuracy. Does this iterative process foster a mindset where tax preparation becomes a routine part of farm management rather than an annual chore?

| Relevant Category | Substantive Data |

|---|---|

| Review Frequency | Quarterly reviews prevent end-of-year surprises |

| Metrics Tracked | Profitability ratios, inventory levels, expense categories |

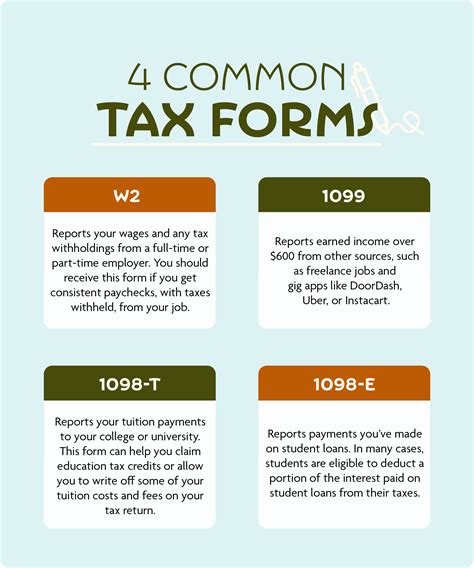

How can digital tools simplify Schedule F preparation?

+Digital tools automate data capture, categorization, and report generation, significantly reducing manual effort and error risk. Cloud-based solutions enable real-time financial tracking, offering instant access and streamlined tax compliance.

What are the best practices for maintaining organized records?

+Consistently categorize expenses, store receipts digitally, and perform periodic reviews. Implementing standardized procedures and leveraging automation minimize chaos and enhance accuracy during tax season.

How does proactive planning impact tax filing complexity?

+Early and regular planning allows you to address potential issues in advance, optimize deductions, and reduce last-minute paperwork. It transforms a reactive process into a strategic asset that supports operational growth.