Tax Wizard Myths Debunked: Why They’re Not Just Magicians of Money

In the intricate labyrinth of personal finance and fiscal policy, the figure of the ‘tax wizard’ has grown into a legendary archetype—an elusive master capable of conjuring savings from seemingly thin air. Images of bespectacled geniuses slicing through tax codes with a flick of their wand, or hyper-efficient accountants lauded as financial sorcerers, flood the cultural landscape. But as with any myth, these narratives often distort reality, building castles in the air that don’t hold up under scrutiny. Dissecting the mythos of the tax wizard reveals a complex interplay of strategic knowledge, meticulous planning, and regulatory understanding, far from the mystical powers often attributed to them.

Unmasking the Myth: Who Are the Tax Wizards Really?

At its core, the idea of a tax wizard rests on the misconception that a select few have access to some hidden, secret knowledge—an esoteric mastery of tax law that allows them to reduce liabilities with effortless ease. But truth whispers otherwise: tax planning is predominantly rooted in well-established strategies, comprehensive understanding, and disciplined application. These professionals are not magicians but highly trained experts—certified public accountants, tax attorneys, and financial strategists—whose skills rest on years of education, experience, and continuous learning.

To appreciate what these practitioners do, we must first acknowledge the intricate architecture of tax systems. Governments worldwide design multi-layered, ever-evolving codes that aim to balance revenue generation with economic incentives. Their complexity requires not mystical intuition but rigorous analysis, pattern recognition, and application of legal precedents. For example, the U.S. Internal Revenue Code (IRC), a labyrinthine document exceeding 75,000 pages, demands a nuanced understanding akin to navigating a dense forest rather than casting spells through a wand.

Distinguishing Strategy from Superstition

Many misconceptions stem from stories of extraordinary tax savings claimed to be attainable by a handful of ‘insiders.’ While some tax planning techniques—like utilizing retirement accounts, establishing certain types of trusts, or leveraging business deductions—are indeed powerful, their effectiveness depends on compliance, meticulous documentation, and adherence to the law. The idea that someone can effortlessly remove all liabilities through a magical loophole misrepresents the disciplined practice of tax strategy.

| Category | Data and Context |

|---|---|

| Average Tax Savings with Expert Planning | Between 10-30% of taxable income, depending on income level and jurisdiction, achieved through legitimate strategies like credits, deductions, deferments, and entity structuring. |

| Time Investment | Typically ranges from 10 to 50 hours annually for comprehensive planning, emphasizing ongoing education and legal compliance rather than shortcut methods. |

| Common Misconception | That there are ‘hidden’ or ‘secret’ loopholes—most strategies are well-documented and open to public record, accessible to anyone willing to learn and apply them. |

The Evolution of Tax Strategies: From Simple Deductions to Sophisticated Planning

Tax planning has undergone a remarkable journey—initially a straightforward exercise of claiming basic deductions, evolving into a sophisticated profession characterized by a deep understanding of legal frameworks, economic incentives, and digital tools. This evolution reflects broader trends: globalization, technological advancements, and an increasingly complex economic environment have expanded the toolkit of tax professionals.

Historical Context of Tax Planning

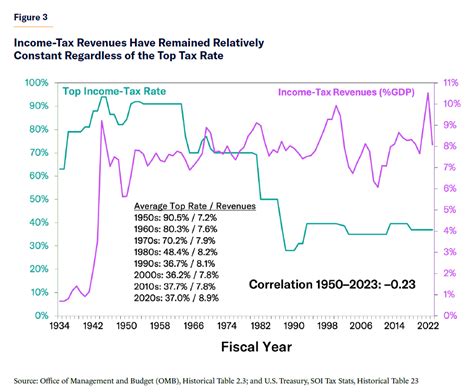

Historically, tax avoidance existed in rudimentary forms—such as claiming personal exemptions or the earliest forms of charitable deductions. As tax systems grew more complex during the 20th century, especially post-World War II with rapid economic expansion, professional tax planning became a specialized domain, driven by the need for businesses and individuals to optimize their financial positions amidst changing regulations.

Modern techniques encompass cross-border tax structuring with the aid of tax treaties, transfer pricing strategies, and sophisticated estate planning, often enabled by digital platforms and data analytics. These are highly targeted, legal, and strategic operations—distinguishable from superstition through meticulous documentation and alignment with applicable law.

| Era | Key Developments |

|---|---|

| Pre-20th Century | Basic deductions, simple income declarations |

| Mid-20th Century | Introduction of complex tax codes, growth of professional expertise |

| 21st Century | Globalization, digitalization, increased compliance requirements |

Common Myths and Misconceptions About Tax Wizards

Myth 1: Tax Wizards Find Hidden Loopholes No One Else Knows

This myth feeds into the narrative of secretive, almost mythic, knowledge passed among a hidden elite. However, most ‘loopholes’ are well-documented and legally available to anyone who invests time in learning them. Tax laws are purposefully made accessible, ensuring that diligent taxpayers can, within the boundaries of compliance, optimize their bills.

Myth 2: Tax Planning is a Shortcut for Massive Savings

While strategic planning can reduce liabilities, claims of enormous, effortless savings often overreach. For example, the typical savings from legal strategies hover around 10–30%. These are achieved through careful planning, documentation, and continued compliance—not magic tricks that eliminate taxes altogether.

Myth 3: Only the Wealthiest Benefit from Tax Wizards

The reality reveals a broader landscape. Small business owners, freelancers, and even middle-income taxpayers utilize strategic tax planning—sometimes through simple methods like maximizing deductions for home offices, health savings accounts, or retirement contributions, which do not require elaborate schemes but rather disciplined application of available tools.

| Myth | Reality |

|---|---|

| Secret loopholes confer unfair advantage | Most are available to all, just requiring knowledge and effort |

| Significant savings are effortless | Requires ongoing effort, compliance, and expertise |

| Only the rich benefit | Accessible across income levels with tailored strategies |

Why Understanding the Real Mechanics Matters

Recognizing that effective tax planning hinges on knowledge, discipline, and compliance rather than illusionary powers can democratize financial literacy. This understanding demystifies the process, empowering individuals and small businesses to leverage available legal strategies without fear of accusations of trickery or evasion—fostering a culture of responsible financial stewardship.

Implications for Policy and Practice

Policy-makers need to realize that targeting ‘loopholes’ often misses the broader picture: creating transparent, equitable systems requires continuous legislative clarity, simplified tax codes, and accessible education. For practitioners, emphasizing compliance and ethical strategies ensures their role aligns with societal expectations of fairness and accountability.

| Strategy | Implementation Example |

|---|---|

| Retirement Account Contributions | Maximizing IRA or 401(k) contributions to defer income |

| Entity Structuring | Forming LLCs or S-corps to optimize payroll taxes |

| Tax Credits | Utilizing credits like the Earned Income Tax Credit or Child Tax Credit |

Conclusion: The Reality Behind the Magician’s Curtain

As the smoke clears from the myth of the tax wizard, a clearer picture emerges: success in tax planning resides in disciplined application, continuous education, and legal ingenuity—characteristics that distinguish seasoned professionals from the realm of mere magic. In a landscape where laws continually shift and complexities deepen, understanding the mechanics and maintaining integrity remains the most potent form of financial magic attainable. It’s a craft built on expertise, not enchantments—a truth accessible to those willing to invest the effort, and perhaps, a little bit of curiosity.

Can anyone learn effective tax planning?

+While professional expertise accelerates and deepens understanding, many effective strategies are accessible to diligent individuals through education, research, and proper documentation, making tax planning more democratic than ever before.

Are there risks involved in aggressive tax strategies?

+Yes, aggressive strategies can border on non-compliance and trigger audits or penalties. Responsible tax planning emphasizes legality, transparency, and adherence to current laws.

How often do tax laws change, and how does it affect planning?

+Tax laws are revised frequently—sometimes annually—requiring ongoing education and adaptation to ensure strategies remain effective and compliant.