New Jersey Sales Tax Cars

In the state of New Jersey, the sales tax on vehicles is an important consideration for both car buyers and dealers. Understanding the ins and outs of this tax can help individuals make informed decisions when purchasing a new or used car. This comprehensive guide will delve into the specifics of New Jersey's sales tax on cars, covering everything from tax rates to exemptions and the impact on vehicle pricing.

Understanding New Jersey’s Sales Tax on Cars

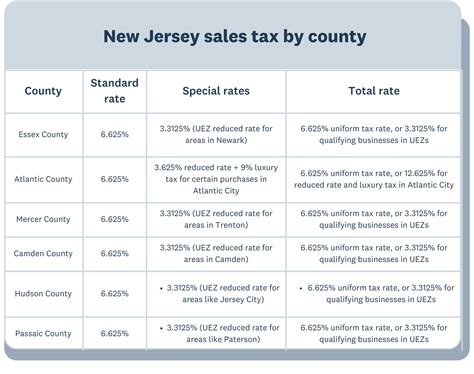

New Jersey imposes a 6.625% sales tax on the purchase of motor vehicles. This tax is applicable to both new and used cars, and it is calculated based on the total purchase price of the vehicle, including any additional fees and options.

For instance, if you are purchasing a new car with a base price of $30,000 and opt for additional features worth $2,000, the total purchase price would be $32,000. The sales tax would then be calculated as follows:

| Total Purchase Price | Sales Tax Rate | Sales Tax Due |

|---|---|---|

| $32,000 | 6.625% | $2,120 |

This means that, in addition to the purchase price, you would owe $2,120 in sales tax to the state of New Jersey.

Exemptions and Special Cases

While the standard sales tax rate of 6.625% applies to most vehicle purchases, there are certain exemptions and special cases to be aware of:

- Lease-to-Own Vehicles: If you are leasing a vehicle with an option to purchase it at the end of the lease term, the sales tax is calculated based on the total lease payments, not the purchase price. This is known as a "lease-to-own" transaction.

- Trade-Ins: When trading in your old vehicle as part of the purchase, the trade-in value is subtracted from the total purchase price before calculating the sales tax. This ensures that you are only taxed on the net amount paid.

- Military Personnel: Active-duty military personnel stationed in New Jersey may be eligible for a sales tax exemption on vehicle purchases. This exemption is part of the state's support for military service members and their families.

- Vehicles for Business Use: If you are purchasing a vehicle primarily for business purposes, you may be able to claim a partial sales tax exemption. This is determined based on the vehicle's intended use and the nature of your business.

Impact on Vehicle Pricing

The addition of sales tax to the purchase price of a vehicle can significantly impact the overall cost. To illustrate this, let’s consider a few examples:

Example 1: New Car Purchase

You’ve decided to purchase a new sedan with a base price of 25,000. After adding some optional features, the total purchase price becomes 27,500. Here’s a breakdown of the costs:

| Base Price | Optional Features | Total Purchase Price | Sales Tax |

|---|---|---|---|

| $25,000 | $2,500 | $27,500 | $1,831.25 |

In this scenario, the sales tax adds an additional $1,831.25 to the total cost of the vehicle.

Example 2: Used Car Purchase

You’re in the market for a used SUV, and you find a great deal on a 3-year-old model with a price tag of $20,000. Here’s how the sales tax would factor into the purchase:

| Used Car Price | Sales Tax |

|---|---|

| $20,000 | $1,325 |

Even for a used car, the sales tax can still represent a significant portion of the overall cost.

Example 3: Vehicle with High Purchase Price

Let’s say you’re considering the purchase of a luxury sports car with a base price of $100,000. Here’s how the sales tax would impact the total cost:

| Base Price | Optional Features | Total Purchase Price | Sales Tax |

|---|---|---|---|

| $100,000 | $15,000 | $115,000 | $7,681.25 |

In this case, the sales tax adds a substantial amount to the already high purchase price.

Comparison with Other States

New Jersey’s sales tax on cars is relatively competitive compared to other states. While some states have lower sales tax rates, others can have significantly higher rates, making New Jersey’s 6.625% rate a moderate figure in the national context.

Here's a table comparing New Jersey's sales tax with a few other states:

| State | Sales Tax Rate on Vehicles |

|---|---|

| New Jersey | 6.625% |

| New York | 4% |

| Pennsylvania | 6% |

| California | 7.25% |

| Texas | 6.25% |

Future Implications

The sales tax on cars in New Jersey is subject to change based on state legislation and economic conditions. While it’s difficult to predict future changes, it’s important for car buyers to stay informed about any potential tax adjustments that could impact their purchases.

Additionally, the evolving landscape of electric vehicles (EVs) and alternative fuel vehicles may lead to new tax considerations and incentives. New Jersey, like many states, is encouraging the adoption of EV technology through various incentives, which could further impact the sales tax landscape for vehicles in the future.

How often does New Jersey revise its sales tax rates?

+New Jersey’s sales tax rates are typically revised on an annual basis, often in conjunction with the state’s budget process. These revisions can include changes to the standard sales tax rate, as well as adjustments to specific tax exemptions and incentives.

Are there any online resources to help calculate sales tax on a vehicle purchase in New Jersey?

+Yes, the New Jersey Division of Taxation provides an online Sales Tax Calculator that can help estimate the sales tax due on a vehicle purchase. This tool considers the purchase price, any applicable exemptions, and the sales tax rate to provide an accurate estimate.

What happens if I purchase a vehicle from a private seller in New Jersey?

+When purchasing a vehicle from a private seller, you are still responsible for paying the applicable sales tax. You will need to work with the seller to ensure the proper paperwork is completed and the tax is paid to the state.