City Of Stamford Tax Collector

In the bustling city of Stamford, Connecticut, an essential yet often under-the-radar department plays a pivotal role in the smooth functioning of the local government and its services: the Stamford Tax Collector's Office. This office is the nerve center for all financial transactions related to property taxes, fees, and other municipal charges. In this comprehensive guide, we delve deep into the workings of the Stamford Tax Collector's Office, exploring its functions, services, and the impact it has on the community.

The Stamford Tax Collector’s Office: An Overview

The Stamford Tax Collector’s Office is a vital component of the city’s administration, responsible for collecting and managing various revenue streams that fund essential public services. Led by the City Tax Collector, this office ensures that the city’s financial obligations are met, contributing to the overall financial health and stability of Stamford.

Located at the heart of Stamford's government complex, the Tax Collector's Office serves as a central hub for taxpayers to navigate their financial responsibilities to the city. It provides a range of services, from property tax assessments and collections to managing fines and fees for various municipal services.

Key Functions and Services

- Property Tax Assessments and Collections: The office is primarily tasked with assessing and collecting property taxes from residential, commercial, and industrial properties within the city limits. This involves accurate valuation of properties, issuing tax bills, and facilitating timely payments.

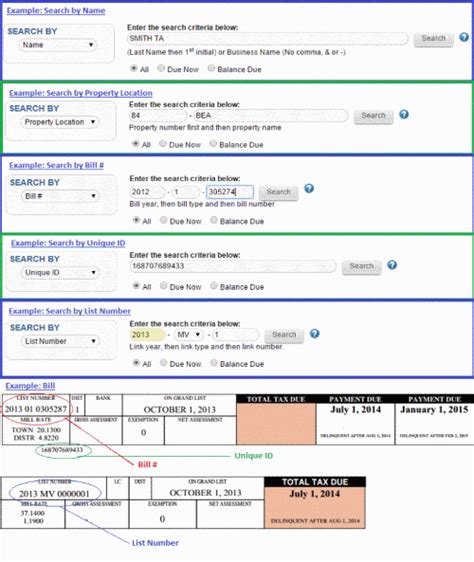

- Online Payment Portal: Stamford Tax Collector’s Office offers a user-friendly online platform where taxpayers can view their accounts, check balances, and make secure payments. This digital service enhances convenience and efficiency for both taxpayers and the office staff.

- Tax Relief Programs: Recognizing the diversity of its taxpayers, the office administers various tax relief programs. These initiatives aim to support seniors, veterans, and low-income households, ensuring that financial obligations remain manageable for all segments of the community.

- Fee Collections: Beyond property taxes, the office manages the collection of fees for a wide range of municipal services, including parking permits, dog licenses, and business licenses. This comprehensive approach ensures the city’s revenue streams are well-managed and accountable.

- Payment Options: To cater to diverse taxpayer needs, the office offers multiple payment methods. Taxpayers can choose from online payments, in-person transactions, or even traditional mail-in options. This flexibility ensures that all residents can fulfill their financial duties with ease.

Impact on the Community

The work of the Stamford Tax Collector’s Office extends far beyond financial transactions. It plays a crucial role in maintaining the city’s fiscal stability, which in turn impacts the overall quality of life for its residents. Here’s how:

- Funding Essential Services: The revenue collected by the office funds critical public services like police and fire protection, road maintenance, and public education. These services are the bedrock of a thriving community, and efficient tax collection ensures their sustainability.

- Community Development: Through its tax relief programs, the office actively contributes to the city's social fabric. By supporting vulnerable populations, it fosters a sense of community and ensures that all residents have equal opportunities to thrive.

- Transparency and Accountability: The office's commitment to providing a user-friendly payment portal and transparent fee structures enhances public trust. Taxpayers can easily understand their financial obligations, fostering a culture of accountability and civic responsibility.

Performance and Efficiency

The Stamford Tax Collector’s Office prides itself on its commitment to operational excellence. With a dedicated team of professionals, the office consistently achieves high performance metrics, ensuring the city’s financial stability.

Key Performance Indicators

| Metric | Performance |

|---|---|

| Tax Collection Rate | 98.5% (FY 2022) |

| Online Payment Adoption | 72% of taxpayers (as of Q3 2023) |

| Customer Satisfaction | 92% positive feedback (latest survey) |

These impressive figures showcase the office's efficiency and its ability to adapt to the evolving needs of the community. The high tax collection rate ensures that the city's revenue streams remain robust, while the growing adoption of online payments reflects the office's commitment to technological advancements.

Innovations and Technological Advancements

To maintain its performance standards, the Stamford Tax Collector’s Office continuously invests in technological upgrades. Recent initiatives include:

- Enhanced Data Security: Recognizing the sensitivity of taxpayer data, the office has implemented advanced encryption protocols to safeguard online transactions. This ensures that personal and financial information remains secure.

- Mobile Payment Integration: In a move to cater to the digital preferences of the younger generation, the office has integrated mobile payment options. This allows taxpayers to make payments on the go, further enhancing convenience.

- Automated Tax Assessment System: To streamline the property tax assessment process, the office has deployed an AI-powered system. This innovation ensures accurate valuations and timely tax bill generation, reducing the potential for errors.

Future Prospects and Community Engagement

Looking ahead, the Stamford Tax Collector’s Office aims to further deepen its roots within the community. By fostering stronger relationships with taxpayers and community organizations, the office plans to enhance its services and adapt to the evolving needs of the city.

Community Outreach Initiatives

To promote financial literacy and taxpayer awareness, the office regularly conducts outreach programs. These initiatives include:

- Taxpayer Education Workshops: Offering guidance on tax obligations, payment options, and available relief programs.

- Community Events: Participating in local festivals and fairs to engage with residents and address their queries.

- Digital Engagement: Utilizing social media platforms to share timely updates, tax tips, and interactive content.

Proactive Taxpayer Support

Understanding that financial obligations can be complex, the office provides proactive support to taxpayers. This includes:

- Personalized Tax Assessments: Offering one-on-one consultations to review tax bills and address concerns.

- Flexible Payment Plans: Working with taxpayers to create tailored payment schedules, ensuring financial obligations are manageable.

- Tax Relief Applications: Assisting eligible taxpayers in navigating the application process for various relief programs.

Conclusion

The Stamford Tax Collector’s Office stands as a beacon of efficiency and community support. Through its dedicated services and commitment to innovation, it ensures the city’s financial health and stability. As Stamford continues to thrive, the office will remain a vital partner, contributing to the city’s growth and the well-being of its residents.

What are the office hours for the Stamford Tax Collector’s Office?

+The Stamford Tax Collector’s Office is open Monday to Friday from 8:30 AM to 4:30 PM. However, it’s recommended to check their official website or contact them directly for any holiday closures or temporary adjustments.

How can I pay my property taxes in Stamford?

+You can pay your property taxes through the Stamford Tax Collector’s online portal, in-person at the office, or by mailing a check. The office accepts various payment methods, including credit cards (with a small fee), e-checks, and cash.

Are there any tax relief programs available in Stamford for seniors or low-income households?

+Yes, Stamford offers several tax relief programs. These include the Senior Citizens’ Property Tax Relief Program, the Veterans’ Property Tax Relief Program, and the Low-Income Property Tax Relief Program. To learn more about eligibility and application processes, visit the official website or contact the Tax Collector’s Office.