Sales Tax In Austin Texas

The topic of sales tax is an essential aspect of consumer spending and business operations, especially in regions like Austin, Texas, where a vibrant economy and diverse industries thrive. In this article, we delve into the intricacies of sales tax in Austin, exploring its rates, applicability, and the unique aspects that make it relevant to both residents and businesses in the city.

Understanding Sales Tax in Austin

Sales tax in Austin, Texas, is a critical component of the state’s revenue system, contributing significantly to the city’s economic health and development. The city’s sales tax structure is multifaceted, comprising a blend of state, county, and municipal taxes, each with its own rate and purpose.

For businesses and consumers in Austin, understanding the sales tax system is crucial. It impacts pricing strategies, consumer behavior, and the overall financial health of businesses. Let's unravel the layers of sales tax in Austin, shedding light on its complexities and providing clarity for those navigating the city's economic landscape.

State Sales Tax

The foundation of Austin’s sales tax system is the state sales tax, levied by the state of Texas. As of the most recent information, Texas imposes a state sales tax rate of 6.25%, which is applicable to most tangible personal property and certain services. This base rate forms the cornerstone of the city’s sales tax structure, providing a standard against which other rates are compared.

The state sales tax is a significant revenue stream for Texas, contributing to various state-wide initiatives and programs. It funds essential services like education, healthcare, infrastructure development, and public safety, making it a crucial aspect of the state's economic strategy.

Local Sales Tax: A City-Specific Rate

In addition to the state sales tax, Austin, like many other cities in Texas, imposes its own local sales tax rate. This additional tax is a unique feature of Austin’s sales tax landscape, reflecting the city’s specific needs and initiatives. As of recent records, Austin’s local sales tax rate stands at 1.25%, bringing the total sales tax rate within the city to 7.5%.

The city's local sales tax is a critical component of Austin's economic strategy. It funds vital city projects, including infrastructure improvements, community development initiatives, and local public services. The revenue generated from this tax plays a pivotal role in shaping the city's future, ensuring its continued growth and prosperity.

| Sales Tax Category | Rate (%) |

|---|---|

| State Sales Tax | 6.25 |

| Local Sales Tax (Austin) | 1.25 |

| Total Sales Tax in Austin | 7.5 |

Sales Tax Exemptions: Navigating the Exceptions

While the sales tax rates in Austin are relatively straightforward, it’s important to note that certain goods and services are exempt from sales tax. These exemptions are designed to alleviate the tax burden on specific industries, promote economic growth, and provide essential services to the community.

For instance, certain agricultural products, prescription drugs, and medical devices are exempt from sales tax in Texas. This not only encourages economic growth in these sectors but also ensures that essential goods and services remain accessible to the public. Additionally, nonprofit organizations and government entities often qualify for sales tax exemptions, further supporting community development and public services.

Online Sales and Sales Tax: A Complex Relationship

In today’s digital age, online sales have become an integral part of the retail landscape. The impact of online sales on sales tax collection is a complex issue, often requiring specialized understanding. In Austin, as in many other cities, the sales tax applicability on online sales can vary depending on the seller’s location, the buyer’s location, and the nature of the goods or services being sold.

For businesses operating in Austin, understanding the nuances of sales tax in the digital realm is crucial. It involves navigating a complex web of state and local regulations, often requiring professional guidance to ensure compliance. Failure to comply with sales tax regulations on online sales can result in significant penalties and legal complications.

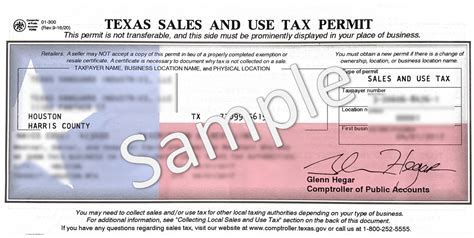

Sales Tax Compliance: A Shared Responsibility

Sales tax compliance is a shared responsibility between businesses and consumers in Austin. While businesses are responsible for collecting and remitting sales tax to the appropriate authorities, consumers have a role to play in ensuring they pay the correct tax on their purchases.

For businesses, sales tax compliance involves a meticulous process of tax collection, record-keeping, and timely remittance. It requires a deep understanding of the sales tax system, including the rates, exemptions, and reporting requirements. Non-compliance can lead to substantial penalties, legal issues, and a negative impact on the business's reputation.

Consumers, on the other hand, have a responsibility to understand the sales tax rates and ensure they pay the correct amount. This involves being aware of the tax rates, checking receipts for accuracy, and reporting any discrepancies to the appropriate authorities. By doing so, consumers contribute to the city's revenue stream, supporting the various initiatives and services funded by sales tax.

The Role of Technology in Sales Tax Compliance

In today’s digital era, technology plays a pivotal role in facilitating sales tax compliance. Many businesses in Austin utilize specialized software and tools to manage their sales tax obligations effectively. These technologies automate various processes, from tax calculation and collection to reporting and remittance, ensuring accuracy and timely compliance.

For instance, cloud-based tax software can integrate seamlessly with a business's accounting system, automatically calculating and collecting sales tax based on the applicable rates. This not only reduces the risk of human error but also streamlines the compliance process, allowing businesses to focus on their core operations.

Future Implications: Sales Tax and Austin’s Economic Landscape

As Austin continues to thrive and evolve, the role of sales tax in its economic landscape is set to become even more significant. The city’s vibrant economy, driven by a diverse range of industries, positions it as a key player in the state’s economic growth.

Looking ahead, the city's sales tax revenue is expected to play a critical role in funding infrastructure development, attracting new businesses, and supporting community initiatives. The city's ability to effectively manage and utilize its sales tax revenue will be a key determinant of its economic success and long-term prosperity.

Furthermore, the evolving nature of the digital economy and the increasing prevalence of online sales present both challenges and opportunities for Austin's sales tax system. As the city adapts to these changes, it will need to strike a delicate balance between tax revenue collection and fostering a business-friendly environment that encourages economic growth.

Conclusion: Navigating Austin’s Sales Tax Landscape

Sales tax in Austin is a multifaceted system, comprising a blend of state and local taxes, each with its own unique rate and purpose. For businesses and consumers alike, understanding this system is crucial for effective financial planning and compliance.

As we've explored, the sales tax rates in Austin are not just numbers on a page. They are a reflection of the city's economic strategy, its commitment to community development, and its vision for the future. By understanding the intricacies of sales tax, businesses and consumers can contribute to Austin's economic growth, ensuring a thriving and prosperous city for generations to come.

What is the total sales tax rate in Austin, Texas, as of the most recent information?

+The total sales tax rate in Austin, Texas, as of the most recent information, is 7.5%. This includes the state sales tax rate of 6.25% and the local sales tax rate of 1.25%.

Are there any sales tax exemptions in Austin, and what goods or services are exempt?

+Yes, there are sales tax exemptions in Austin. Certain goods and services are exempt from sales tax in Texas, including agricultural products, prescription drugs, and medical devices. Nonprofit organizations and government entities may also qualify for sales tax exemptions.

How does the sales tax system in Austin impact online sales and purchases?

+The sales tax system in Austin applies to online sales and purchases, but the specifics can be complex. The taxability of online sales depends on various factors, including the seller’s and buyer’s locations, and the nature of the goods or services being sold. Businesses in Austin should seek professional guidance to ensure compliance with online sales tax regulations.