Ann Arbor Property Tax

Ann Arbor, a vibrant city in Michigan, is known for its thriving culture, educational institutions, and vibrant community. As a resident or property owner in this dynamic city, understanding the intricacies of the Ann Arbor property tax system is crucial. This comprehensive guide aims to demystify the property tax landscape, offering an in-depth analysis and expert insights to help you navigate this essential aspect of homeownership.

Understanding Ann Arbor Property Taxes: An In-Depth Guide

Property taxes are a significant financial responsibility for homeowners, and Ann Arbor, with its diverse real estate market and unique tax structure, presents a complex yet fascinating topic. This guide will delve into the specifics, providing a comprehensive understanding of how property taxes work in this region.

The Fundamentals of Ann Arbor Property Taxes

Property taxes in Ann Arbor are levied on real estate properties, including residential homes, commercial buildings, and land. These taxes are a primary source of revenue for the city, funding essential services and infrastructure development. The tax rate is determined by the local government and can vary based on factors such as property type, location, and assessed value.

The property tax assessment process involves evaluating the property's value, which is then used to calculate the tax amount. This assessment is typically conducted by the Washtenaw County Equalization Department, ensuring fairness and accuracy in the taxation process. The assessed value takes into account various factors, including the property's location, size, improvements, and recent sales data.

| Assessment Factors | Description |

|---|---|

| Location | Properties in prime locations may have higher assessments due to desirability and market demand. |

| Size & Improvements | Larger properties or those with significant improvements (e.g., additions, renovations) may be assessed at a higher value. |

| Sales Data | Recent sales of similar properties in the area are considered to ensure the assessment reflects the current market. |

Tax Rate and Calculation

The property tax rate in Ann Arbor is expressed as a millage rate, which is the number of dollars in taxes paid per $1,000 of the property’s taxable value. The rate is typically determined by the local government and can vary from year to year. For the current tax year, the millage rate is set at [insert current millage rate], which is applied to the taxable value of your property.

To calculate your property taxes, the assessed value is first multiplied by the State Equalized Value (SEV) ratio, which is a factor determined by the Michigan Department of Treasury to ensure uniformity across the state. This SEV is then multiplied by the millage rate to arrive at the total tax amount. Here's a simplified calculation:

- Assessed Value x SEV Ratio = Taxable Value

- Taxable Value x Millage Rate = Total Property Taxes

For example, if your property has an assessed value of $300,000 and the SEV ratio is 0.5, your taxable value would be $150,000. With a millage rate of 40 mills, your annual property taxes would amount to $6,000.

Payment Options and Due Dates

Ann Arbor offers several payment options to cater to different preferences and financial situations. Property owners can choose to pay their taxes in full or opt for a payment plan. The due dates for property tax payments are typically in the summer and winter, with specific dates announced by the local government.

Online payment portals and mobile apps make it convenient for taxpayers to manage their payments. Additionally, property owners can set up automatic payments to ensure timely submissions and avoid any late fees or penalties.

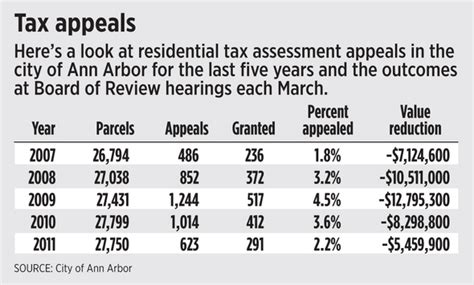

Appealing Your Property Tax Assessment

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The process involves submitting an appeal to the local tax assessment office within a specified timeframe, usually after receiving your tax assessment notice. It’s advisable to gather evidence, such as recent sales data of similar properties, to support your case.

An appeal can potentially result in a reduced assessed value, leading to lower property taxes. However, it's essential to understand the appeal process and gather sufficient evidence to make a strong case. Seeking professional guidance from tax consultants or lawyers can be beneficial in navigating this process effectively.

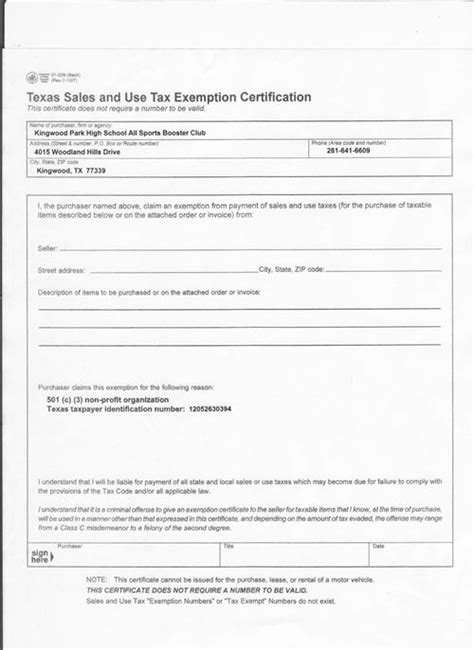

Property Tax Exemptions and Relief

Ann Arbor offers various property tax exemptions and relief programs to support certain groups of residents. These include exemptions for senior citizens, veterans, and individuals with disabilities. Additionally, the city provides tax relief programs for homeowners facing financial hardships or those who have made significant improvements to their properties, such as energy-efficient upgrades.

These exemptions and relief programs can significantly reduce the property tax burden for eligible residents, making homeownership more affordable. It's essential to stay informed about these programs and understand the eligibility criteria to take advantage of the benefits they offer.

The Impact of Property Taxes on the Community

Property taxes play a vital role in funding essential services and community development projects. The revenue generated from these taxes contributes to maintaining and improving infrastructure, such as roads, parks, and public facilities. It also supports local schools, emergency services, and social programs, ensuring a high quality of life for residents.

Additionally, property taxes encourage community engagement and investment. By actively participating in the local government's decision-making processes, residents can influence how tax revenue is allocated, ensuring it aligns with the community's needs and priorities.

Future Outlook and Considerations

The property tax landscape in Ann Arbor is constantly evolving, influenced by various factors such as economic trends, real estate market fluctuations, and changes in local governance. Staying informed about these changes is crucial for property owners to make informed decisions and plan their financial strategies effectively.

As the city continues to grow and develop, the demand for essential services and infrastructure will likely increase. This could lead to potential changes in the tax rate or assessment methods to ensure sustainable funding. Regularly reviewing and understanding these changes will help property owners adapt to any new tax regulations or assessment practices.

Conclusion

Understanding Ann Arbor’s property tax system is a crucial aspect of homeownership in this vibrant city. By comprehending the assessment process, tax calculation methods, payment options, and the impact of taxes on the community, property owners can make informed decisions and actively participate in shaping their city’s future. With the right knowledge and strategies, managing property taxes can be a seamless and beneficial process.

FAQ

What is the current millage rate in Ann Arbor for property taxes?

+

The current millage rate for Ann Arbor property taxes is [insert current millage rate] as of [current year]. This rate is subject to change annually and is determined by the local government.

How often are property tax assessments conducted in Ann Arbor?

+

Property tax assessments in Ann Arbor are typically conducted annually. However, there may be instances where reassessments are triggered by significant changes to the property, such as additions or renovations.

Are there any property tax exemptions available in Ann Arbor?

+

Yes, Ann Arbor offers various property tax exemptions, including those for senior citizens, veterans, and individuals with disabilities. Additionally, there are relief programs for homeowners facing financial hardships or making energy-efficient upgrades.

How can I appeal my property tax assessment in Ann Arbor?

+

To appeal your property tax assessment in Ann Arbor, you need to submit a formal appeal to the local tax assessment office within a specified timeframe. It’s recommended to gather evidence, such as recent sales data of similar properties, to support your case. Consulting with tax professionals can provide valuable guidance.

What are the payment options and due dates for Ann Arbor property taxes?

+

Ann Arbor offers flexible payment options for property taxes, including full payment or payment plans. The due dates are typically in the summer and winter, and taxpayers can make use of online portals or set up automatic payments for convenience.