Miami Dade County Taxes Paid

Taxes play a significant role in the functioning and development of any county, and Miami-Dade County is no exception. This article delves into the intricacies of Miami Dade County taxes, exploring the types of taxes paid by residents and businesses, the revenue generated, and how these funds contribute to the county's growth and services.

Understanding Miami Dade County’s Tax Structure

Miami-Dade County, with its vibrant economy and diverse population, has a comprehensive tax system designed to support its operations and infrastructure. The tax structure encompasses various forms of taxation, each playing a unique role in funding the county’s endeavors.

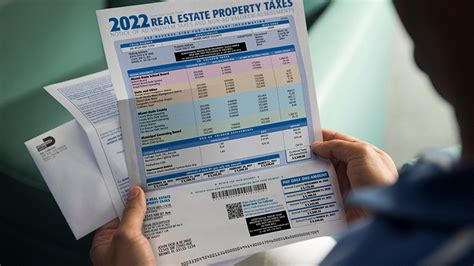

Property Taxes: A Key Revenue Source

Property taxes are a significant contributor to Miami Dade County’s revenue stream. These taxes are levied on both real estate and personal property owned within the county. The assessment process involves determining the taxable value of properties, which is then used to calculate the tax liability.

The county’s property tax rates are set annually and vary based on the type of property and its location. For instance, the millage rate, which represents the tax rate per thousand dollars of assessed property value, may differ for residential, commercial, and agricultural properties.

To illustrate, consider a residential property in Miami-Dade County with an assessed value of 300,000. If the millage rate for that property type is 10 mills, the annual property tax would be 3,000. This calculation provides a glimpse into how property taxes are a substantial source of revenue for the county.

Sales and Use Taxes: Supporting Consumer-Based Revenues

Sales and use taxes are another crucial component of Miami Dade County’s tax structure. These taxes are imposed on the sale of goods and services within the county, with the revenue generated being a significant contributor to the county’s budget.

The sales tax rate in Miami-Dade County is typically composed of a state sales tax and a local option sales tax, which may vary based on the municipality. For instance, the combined sales tax rate in Miami-Dade County is 7%, comprising the state sales tax of 6% and a local option sales tax of 1%.

Additionally, Miami-Dade County also levies a tourist development tax on short-term rentals and accommodations. This tax, often referred to as the “bed tax,” contributes to the county’s tourism-related initiatives and infrastructure.

Income Taxes: Contributing to County Revenue

Miami-Dade County, like many other counties in the United States, does not levy an income tax at the county level. However, Florida does have a state income tax, which contributes to the state’s overall revenue and, subsequently, to Miami-Dade County through various state-funded programs and initiatives.

It’s important to note that the absence of a county-level income tax can make Miami-Dade County an attractive destination for businesses and individuals seeking tax-friendly environments.

Revenue Generation and Allocation

The revenue generated from Miami Dade County’s tax structure is allocated to various sectors and services, ensuring the county’s continued growth and development.

Funding Essential Services

A significant portion of the tax revenue is directed towards funding essential services, such as public safety, education, and infrastructure development. These services are vital to the well-being and progress of the county’s residents and businesses.

For instance, property taxes contribute to funding public schools, police and fire departments, and other critical public services. Sales taxes, on the other hand, support infrastructure projects, such as road maintenance and improvements, public transportation, and cultural and recreational facilities.

Economic Development and Tourism Initiatives

Miami-Dade County’s tax revenue also plays a crucial role in supporting economic development and tourism initiatives. The county’s vibrant tourism industry generates significant revenue through various taxes, including the tourist development tax and sales taxes on tourism-related activities.

These funds are utilized to enhance the county’s tourism infrastructure, promote cultural events and attractions, and support local businesses, ensuring a thriving tourism economy.

Community Programs and Social Services

Tax revenue is not only directed towards physical infrastructure and services but also towards community programs and social services. Miami-Dade County recognizes the importance of investing in its residents’ well-being and provides funding for various social initiatives.

These initiatives include affordable housing programs, community development projects, healthcare assistance, and support for vulnerable populations. The county’s commitment to social welfare is a testament to its inclusive and progressive approach to development.

Tax Incentives and Exemptions

Miami-Dade County, in an effort to promote economic growth and attract businesses, offers various tax incentives and exemptions. These measures aim to stimulate investment, job creation, and overall economic development.

Enterprise Zones and Tax Abatements

The county has designated specific Enterprise Zones, offering tax abatements and incentives to businesses operating within these zones. These incentives can include reduced tax rates, tax credits, and waivers on certain taxes, depending on the business’s size, industry, and contribution to the local economy.

For instance, a manufacturing business located within an Enterprise Zone might benefit from a reduced sales tax rate on its products or a tax credit for job creation, making Miami-Dade County an attractive location for such enterprises.

Homestead Exemptions: Supporting Homeownership

Miami-Dade County offers homestead exemptions, which provide property tax relief to homeowners. These exemptions reduce the taxable value of a homeowner’s primary residence, resulting in lower property taxes.

The homestead exemption is particularly beneficial for long-term residents and encourages homeownership, making it an essential component of the county’s tax structure.

Other Tax Incentives

In addition to the above, Miami-Dade County offers various other tax incentives, such as tax credits for energy-efficient improvements, incentives for small businesses, and tax breaks for certain types of investments. These incentives aim to foster a business-friendly environment and promote sustainable development.

Performance Analysis and Future Implications

Analyzing the performance of Miami Dade County’s tax system provides insights into its effectiveness and potential areas for improvement. Understanding the tax revenue trends and their impact on the county’s development is crucial for sustainable growth.

Revenue Trends and Budgetary Allocations

Over the years, Miami-Dade County has experienced a steady increase in tax revenue, primarily driven by the growth in property values and a thriving tourism industry. This growth has allowed the county to allocate funds towards various infrastructure projects and community initiatives.

However, it’s essential to monitor these trends to ensure that the tax system remains equitable and sustainable. Rising property values, for instance, could lead to an increase in property tax burden, impacting homeowners and businesses.

Equitable Tax System and Social Equity

Miami-Dade County strives to maintain an equitable tax system, ensuring that the tax burden is distributed fairly among residents and businesses. This approach is crucial for fostering social equity and ensuring that all segments of the community benefit from the county’s growth and development.

The county’s commitment to social equity is evident in its tax structure, with provisions like the homestead exemption and targeted tax incentives for specific communities or industries.

Sustainable Development and Future Planning

As Miami-Dade County continues to grow and develop, sustainable development practices become increasingly crucial. The county’s tax revenue plays a vital role in funding these sustainable initiatives, from green infrastructure projects to renewable energy investments.

By allocating tax revenue towards sustainable development, Miami-Dade County ensures its long-term viability and resilience, attracting businesses and individuals who share its vision for a sustainable future.

Frequently Asked Questions

What is the current sales tax rate in Miami-Dade County?

+The current combined sales tax rate in Miami-Dade County is 7%, comprising the state sales tax of 6% and a local option sales tax of 1%.

How does Miami-Dade County’s tax revenue compare to other counties in Florida?

+Miami-Dade County’s tax revenue is among the highest in Florida due to its large population, vibrant economy, and diverse tax base. However, it’s important to note that tax structures and revenue generation can vary significantly between counties.

Are there any upcoming changes to Miami-Dade County’s tax structure?

+While there are no significant changes planned for the immediate future, Miami-Dade County’s tax structure is subject to periodic reviews and adjustments. Any proposed changes would go through a comprehensive public consultation process.

How does Miami-Dade County allocate its tax revenue for infrastructure projects?

+Miami-Dade County allocates tax revenue for infrastructure projects based on identified needs and priorities. This includes funding for road improvements, public transportation, water and sewer infrastructure, and other critical infrastructure upgrades.

What is the impact of Miami-Dade County’s tax incentives on business development?

+Miami-Dade County’s tax incentives, such as Enterprise Zone tax abatements and other business-friendly measures, have a positive impact on business development. These incentives encourage investment, job creation, and economic growth, making the county an attractive destination for businesses.