Oxnard Sales Tax

Welcome to the comprehensive guide on Oxnard's sales tax, a critical component of the city's economic landscape. This article will delve into the intricacies of sales tax in Oxnard, California, providing an in-depth analysis of its structure, rates, and implications for both businesses and consumers. With a focus on expert insights and industry-specific knowledge, we aim to demystify the complexities of Oxnard's sales tax system and offer valuable information to all stakeholders.

Understanding Oxnard’s Sales Tax: A Citywide Overview

Oxnard, a vibrant city nestled in the heart of Ventura County, boasts a unique sales tax structure that influences its economic growth and consumer behavior. With a rich agricultural heritage and a diverse range of industries, Oxnard’s sales tax plays a pivotal role in funding essential city services and infrastructure development.

The sales tax in Oxnard comprises a combination of state, county, and city-specific taxes, each with its own rate and purpose. This layered structure ensures that revenue generated from sales transactions is distributed across various levels of government, contributing to the overall fiscal health of the region.

Key Components of Oxnard’s Sales Tax

Let’s break down the key components of Oxnard’s sales tax to gain a deeper understanding of its composition and impact:

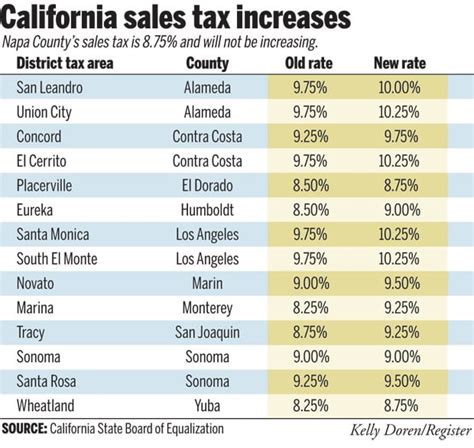

- State Sales Tax: The base rate for California's state sales tax is 7.25%, which applies uniformly across the state. This rate is determined by the California State Board of Equalization and serves as the foundation for Oxnard's sales tax structure.

- County Sales Tax: Ventura County, where Oxnard is located, imposes an additional sales tax of 0.25%, bringing the total county-wide sales tax to 7.50%. This supplementary tax is allocated towards funding county-wide initiatives and services.

- City Sales Tax: Oxnard itself levies a city sales tax of 1.00%, resulting in a combined city and county sales tax rate of 1.25%. This dedicated city sales tax is a crucial source of revenue for the city's operations and development projects.

- Special District Sales Tax: In addition to the state, county, and city sales taxes, Oxnard is also part of various special districts, each with their own sales tax rates. These special districts, such as the Oxnard School District or the Ventura County Transportation Commission, may impose additional sales taxes to support specific projects or services within their jurisdictions.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Ventura County | 0.25% |

| City of Oxnard | 1.00% |

| Special Districts | Varies (up to 2.00%) |

Impact of Oxnard’s Sales Tax on Businesses and Consumers

Oxnard’s sales tax structure has a significant impact on both businesses and consumers within the city. Understanding these effects is crucial for stakeholders to make informed decisions and navigate the local economic landscape effectively.

Businesses

For businesses operating in Oxnard, the sales tax structure influences their pricing strategies, operational costs, and overall competitiveness in the market. Here’s how it breaks down:

- Pricing and Profitability: The sales tax rate directly impacts the final price that businesses charge for their goods and services. With a combined sales tax rate of 9.25% (including state, county, city, and potential special district taxes), businesses must carefully consider their pricing strategies to remain competitive and maintain profitability.

- Operational Costs: Sales tax collection and remittance are integral parts of a business's financial operations. Businesses must ensure accurate calculation and timely payment of sales taxes, which can be a complex and time-consuming process, especially for those with multiple locations or online sales.

- Compliance and Audits: Businesses in Oxnard are subject to sales tax audits by the California State Board of Equalization and local authorities. Non-compliance with sales tax regulations can result in penalties and legal consequences, highlighting the importance of maintaining meticulous records and adhering to tax laws.

- Strategic Planning: Businesses often engage in strategic planning to optimize their sales tax obligations. This may involve exploring tax-exempt purchases, implementing tax-efficient pricing strategies, or considering the impact of sales tax on their target markets.

Consumers

Consumers in Oxnard also feel the impact of the city’s sales tax structure, which influences their purchasing decisions and overall spending habits. Here are some key considerations:

- Price Sensitivity: With a relatively high sales tax rate, consumers may become more price-sensitive when making purchases. This can lead to a shift in shopping behavior, with consumers seeking out sales, discounts, or alternative shopping destinations with potentially lower tax rates.

- Budgeting and Financial Planning: Understanding the sales tax rate is essential for consumers to effectively budget and plan their finances. Consumers may need to allocate a larger portion of their disposable income towards sales tax, especially when making significant purchases.

- Online Shopping Trends: The convenience of online shopping has become increasingly popular, and consumers in Oxnard may opt for online purchases to avoid sales tax or seek out lower-priced options. This trend can impact local businesses and their ability to compete with online retailers.

- Tax Awareness: Educating consumers about the sales tax structure and its implications can empower them to make informed purchasing decisions. This awareness can lead to more thoughtful spending habits and a better understanding of the economic impact of their choices.

Oxnard’s Sales Tax: A Dynamic Landscape

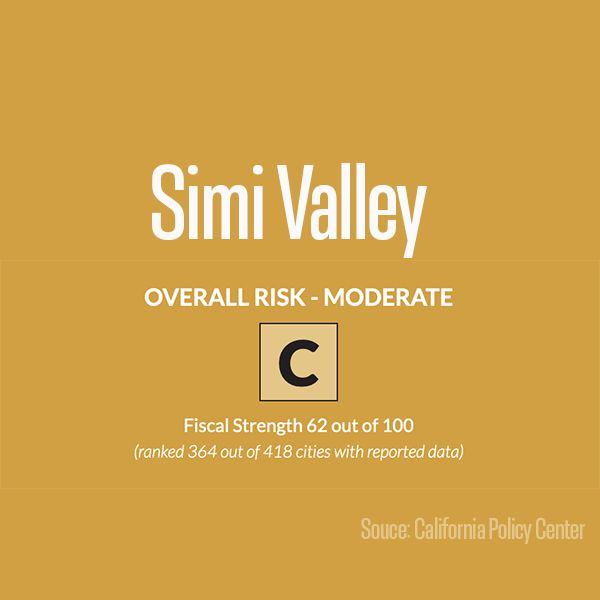

Oxnard’s sales tax structure is not static; it evolves in response to economic trends, legislative changes, and community needs. Understanding the dynamics of this landscape is essential for businesses, consumers, and policymakers alike.

Economic Impact and Revenue Allocation

The revenue generated from Oxnard’s sales tax has a significant impact on the city’s economic health and development. Here’s a closer look at how the funds are allocated:

- General Fund: A substantial portion of the sales tax revenue goes towards Oxnard's General Fund, which supports essential city services such as public safety, parks and recreation, community development, and infrastructure maintenance.

- Specific Projects and Initiatives: Certain sales tax revenues are earmarked for specific projects or initiatives, such as infrastructure improvements, affordable housing development, or public transportation enhancements. These targeted allocations ensure that sales tax revenue directly benefits the community's most pressing needs.

- Economic Development: Sales tax revenue also plays a role in supporting economic development initiatives. This may include funding for business attraction and retention programs, small business grants, or initiatives to promote tourism and hospitality industries.

Future Implications and Considerations

As Oxnard continues to evolve and adapt to changing economic conditions, the sales tax structure may undergo further adjustments. Here are some key considerations for the future:

- Legislative Changes: State and local governments may propose legislative changes to the sales tax structure, which could impact the rates or the distribution of revenue. Staying informed about these potential changes is crucial for businesses and consumers to adapt their strategies accordingly.

- Economic Trends: Economic fluctuations, such as recessions or periods of strong growth, can influence sales tax revenue and its impact on the city's budget. Understanding these trends and their potential effects is essential for long-term planning and financial stability.

- Community Engagement: Oxnard's sales tax structure is closely tied to community needs and priorities. Engaging with the community through public forums, surveys, and town hall meetings can help shape future sales tax initiatives and ensure that revenue is allocated in a manner that aligns with the values and aspirations of the residents.

- Online Sales and E-commerce: The rise of e-commerce and online shopping platforms has presented new challenges and opportunities for sales tax collection. Oxnard, like many other cities, may need to adapt its sales tax structure to address the complexities of online transactions and ensure fair revenue generation.

Conclusion

Oxnard’s sales tax is a multifaceted aspect of the city’s economic ecosystem, influencing businesses, consumers, and the overall fiscal health of the region. By understanding the intricacies of this sales tax structure, stakeholders can make informed decisions, adapt to changing circumstances, and contribute to the vibrant and thriving community of Oxnard.

What is the current sales tax rate in Oxnard, California?

+The current sales tax rate in Oxnard, California, is 9.25%, which includes the state sales tax rate of 7.25%, the county sales tax rate of 0.25%, and the city sales tax rate of 1.00%. Additional special district sales taxes may also apply, depending on the specific location within Oxnard.

How often does the sales tax rate change in Oxnard?

+The sales tax rate in Oxnard can change periodically due to legislative decisions or ballot initiatives. However, major changes to the sales tax rate are relatively infrequent and typically occur every few years. It’s important for businesses and consumers to stay updated on any sales tax rate changes to ensure compliance and accurate pricing.

Are there any sales tax exemptions or special considerations in Oxnard?

+Yes, there are certain sales tax exemptions and special considerations in Oxnard. For example, certain goods and services, such as prescription medications, some medical devices, and certain food items, are exempt from sales tax. Additionally, specific industries or sectors may have tax incentives or programs that can impact their sales tax obligations. It’s recommended to consult with a tax professional or the relevant tax authorities for detailed information on sales tax exemptions and special considerations in Oxnard.

How can businesses in Oxnard optimize their sales tax obligations?

+Businesses in Oxnard can optimize their sales tax obligations by staying informed about sales tax regulations and changes. They should ensure accurate calculation and timely remittance of sales taxes, and consider implementing tax-efficient pricing strategies. Additionally, exploring tax-exempt purchases, staying updated on industry-specific tax incentives, and leveraging technology for sales tax compliance can help businesses streamline their sales tax processes and minimize potential risks.

What resources are available for consumers to understand Oxnard’s sales tax structure?

+Consumers in Oxnard can access various resources to understand the city’s sales tax structure. These include the official websites of the California State Board of Equalization, the Ventura County government, and the City of Oxnard. These websites provide detailed information on sales tax rates, exemptions, and consumer rights. Additionally, local tax professionals or community workshops can offer valuable insights and guidance on navigating Oxnard’s sales tax landscape.