North Carolina Income Tax Rate

When it comes to income taxes, understanding the rates and regulations is crucial for individuals and businesses alike. In the state of North Carolina, the income tax system is structured with a progressive rate schedule, meaning the tax rate increases as taxable income rises. This article will delve into the specifics of the North Carolina income tax rate, providing an in-depth analysis and insights for those interested in the financial landscape of the state.

Understanding the North Carolina Income Tax Rate Structure

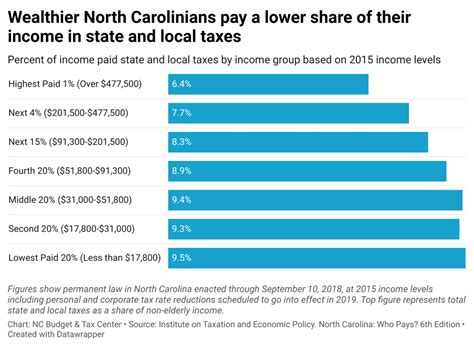

North Carolina’s income tax system is designed to be progressive, ensuring that those with higher incomes contribute a larger proportion of their earnings towards state revenue. The state currently employs a six-tiered tax rate system, which applies to various income brackets. Here’s a breakdown of the current income tax rates in North Carolina:

| Income Bracket | Tax Rate |

|---|---|

| Up to $21,500 (single) / $32,250 (joint) | 5.25% |

| $21,501 - $75,000 (single) / $32,251 - $120,000 (joint) | 5.50% |

| $75,001 - $100,000 (single) / $120,001 - $160,000 (joint) | 5.75% |

| $100,001 - $250,000 (single) / $160,001 - $300,000 (joint) | 5.95% |

| $250,001 - $300,000 (single) / $300,001 - $500,000 (joint) | 6.00% |

| Over $300,000 (single) / Over $500,000 (joint) | 6.25% |

It's important to note that these rates are subject to change, as the state's tax laws can be revised periodically. As of my last update in January 2023, these rates reflect the current tax structure in North Carolina.

Taxable Income Calculation

The taxable income for individuals and families is determined after various deductions and exemptions are applied. North Carolina offers standard deductions, as well as the option to itemize deductions for those who qualify. Additionally, the state provides certain tax credits that can further reduce the taxable income.

Local Income Taxes

While North Carolina does not have a state-wide local income tax, some counties and municipalities have implemented their own local income taxes. These local taxes are in addition to the state income tax and can vary significantly across different regions. For instance, Charlotte, the largest city in the state, has a local income tax rate of 0.5%, while Wake County levies a 0.45% local income tax.

Taxation for Businesses in North Carolina

Businesses operating in North Carolina are subject to corporate income tax, with rates varying based on the type of business and its legal structure. For C corporations, the tax rate stands at 2.5% on the first $250,000 of taxable income, and 3% on income above that threshold. S corporations, partnerships, and LLCs are taxed at a flat rate of 3%.

Sales and Use Taxes

North Carolina imposes a 4.75% state sales and use tax on most tangible personal property and certain services. However, local governments have the authority to levy additional sales and use taxes, resulting in varying total sales tax rates across the state. For example, in Asheville, the total sales tax rate is 7.25%, including both state and local taxes.

Property Taxes

Property taxes in North Carolina are determined at the local level, with rates varying significantly from one county to another. The state’s average effective property tax rate is 0.73%, which is slightly lower than the national average. However, it’s essential to research the specific property tax rates in the desired location before making any financial decisions.

North Carolina’s Tax Climate and Incentives

North Carolina has been praised for its relatively low tax burden and its efforts to attract businesses and investors. The state offers various tax incentives and credits to promote economic growth and job creation. These incentives include:

- Job Development Investment Grant (JDIG) for companies creating new jobs in the state.

- One North Carolina Fund, which provides grants to support businesses that are expanding or relocating to the state.

- Rural Business Relief Grant, aimed at supporting businesses in rural areas.

- Historic Preservation Tax Credit for the rehabilitation of historic structures.

- Film and Entertainment Grant Program, offering incentives for film and television productions.

The Impact of Tax Reform

In recent years, North Carolina has undergone significant tax reforms. These reforms have aimed to simplify the tax system, reduce rates, and enhance the state’s competitiveness in attracting businesses and investments. One notable change was the introduction of the six-tiered income tax rate structure, replacing the previous flat tax rate of 5.75%. This reform benefited taxpayers across all income levels, with the lowest rates being reduced and the highest rates remaining unchanged.

Future Outlook and Potential Changes

As with any tax system, North Carolina’s income tax rates are subject to potential changes and reforms. While the current rates provide a stable and competitive environment, future economic conditions, political landscapes, and fiscal needs could influence the state’s tax policies. It’s essential for individuals and businesses to stay informed about any proposed or enacted tax changes that may impact their financial planning.

Conclusion

North Carolina’s income tax rate structure is designed to be progressive and competitive, offering benefits to taxpayers across different income levels. The state’s tax reforms and incentives have made it an attractive destination for businesses and individuals alike. By understanding the current tax rates and potential future changes, taxpayers can make informed decisions regarding their financial strategies.

How often are North Carolina’s income tax rates revised?

+North Carolina’s tax rates are typically revised every few years, often as part of broader tax reform efforts or to address specific economic conditions. The last significant revision was in 2013, when the state implemented the six-tiered income tax rate structure.

Are there any tax breaks or deductions available for homeowners in North Carolina?

+Yes, North Carolina offers a homestead exemption, which provides a tax credit for homeowners who occupy their property as their primary residence. Additionally, the state has a property tax exclusion for seniors and disabled veterans.

What is the impact of North Carolina’s local income taxes on businesses and individuals?

+Local income taxes can significantly impact the overall tax burden for businesses and individuals. While North Carolina does not have a state-wide local income tax, certain counties and municipalities have implemented their own taxes, which can add to the overall tax rate. It’s essential to research these local taxes when considering a move or business expansion in North Carolina.