Louisiana Property Tax

Welcome to a comprehensive guide on the complex world of property taxes in the unique state of Louisiana. Known for its vibrant culture, diverse landscapes, and, of course, its iconic cuisine, Louisiana also boasts a property tax system with its own set of rules and regulations. This article aims to demystify the process, offering a deep dive into the specifics of Louisiana property taxes, from assessment to appeal, with a focus on helping homeowners navigate this essential aspect of homeownership.

Understanding Louisiana’s Property Tax Landscape

Louisiana’s property tax system is governed by a comprehensive set of laws and regulations, ensuring a fair and equitable process for all property owners. This system, while intricate, is designed to fund vital public services such as education, infrastructure development, and local government operations. Understanding this landscape is crucial for homeowners to ensure they are contributing their fair share and also to identify any potential avenues for tax savings.

One of the distinctive features of Louisiana's property tax system is its reliance on a market-based assessment approach. Unlike some other states that use formulas or income-based methods, Louisiana assesses property taxes based on the property's current market value. This market-based system aims to ensure that property owners pay taxes proportional to the value of their property, reflecting the true economic reality.

Property Assessment Process

The assessment process in Louisiana is handled by local Assessor’s Offices, with each parish (the equivalent of counties in other states) having its own Assessor. These assessors are responsible for determining the taxable value of all properties within their jurisdiction, which can include residential, commercial, and industrial properties. The process involves a detailed evaluation of the property’s features, including its size, location, improvements, and any recent sales data.

Here's a breakdown of the assessment process:

- Property Inspection: Assessors conduct regular inspections to ensure the accuracy of property records. This includes verifying the physical characteristics of the property and any recent changes or improvements.

- Market Analysis: The assessor's office utilizes market data, including recent property sales, to determine the fair market value of the property. This analysis takes into account factors such as location, size, and any unique features that might affect the property's value.

- Assessment Notice: Once the assessment is complete, property owners receive a notice detailing the assessed value of their property and the corresponding tax liability. This notice is typically sent out before the tax payment deadline, providing homeowners with sufficient time to review and, if necessary, appeal the assessment.

It's important to note that Louisiana law requires assessors to maintain accurate and up-to-date property records. This means that any significant changes to a property, such as additions, renovations, or even damage that reduces the property's value, should be reported to the Assessor's Office to ensure the property's assessed value remains fair and accurate.

Tax Rates and Calculations

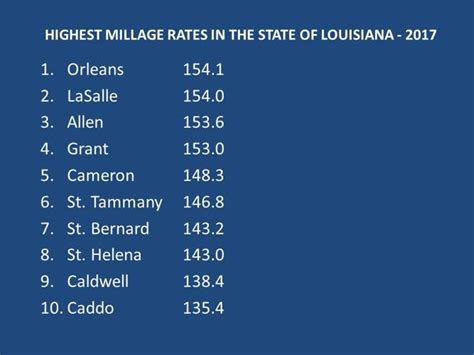

Louisiana’s property tax rates are established at the local level, with each parish setting its own tax rates. These rates are expressed as millages, which represent the amount of tax owed per dollar of assessed property value. For instance, a millage rate of 100 mills equates to 1 of tax for every 1,000 of assessed property value.

The tax calculation is straightforward: the assessed value of the property is multiplied by the applicable millage rate. For example, if a property is assessed at $200,000 and the millage rate is 100 mills, the property tax liability would be $2,000.

| Parish | Millage Rate (as of 2023) | Taxable Value |

|---|---|---|

| Orleans | 98.68 | $200,000 |

| Jefferson | 111.72 | $300,000 |

| East Baton Rouge | 114.32 | $150,000 |

These rates can vary significantly from one parish to another, so it's essential for homeowners to be aware of the specific millage rates in their area. This information is typically available on the local Assessor's Office website or through the parish government's tax office.

Navigating Property Tax Appeals

While Louisiana’s property tax system aims for fairness and accuracy, there may be instances where property owners disagree with their assessed value. In such cases, the state provides a formal process for appealing the assessment, ensuring homeowners have a chance to have their concerns heard and potentially reduce their tax liability.

Reasons for Appeals

Property owners may consider appealing their assessment for a variety of reasons. The most common reasons include:

- Overvaluation: If the assessed value of the property is significantly higher than the property's actual market value, an appeal can be made to correct this discrepancy.

- Assessment Errors: Mistakes can occur in the assessment process, such as incorrect property dimensions, missing improvements, or outdated information. These errors can lead to an inaccurate assessment and provide grounds for an appeal.

- Unequal Taxation: In cases where similar properties in the same area are assessed at significantly lower values, this can be a valid reason for an appeal. The principle of equal taxation ensures that properties with similar characteristics should be taxed similarly.

- Recent Damage or Loss: If a property has suffered damage or loss that has not been reflected in the assessment, an appeal can be made to have the assessed value adjusted downward.

The Appeal Process

The property tax appeal process in Louisiana is a formal, multi-step procedure. Here’s an overview of the steps involved:

- Filing an Appeal: Property owners must first file a formal appeal with the local Assessor's Office within a specified timeframe, usually within a few months of receiving the assessment notice. This appeal should clearly state the reasons for disagreement with the assessment and any supporting evidence or documentation.

- Informal Review: After the appeal is filed, the Assessor's Office conducts an informal review of the case. This review may involve a re-inspection of the property, a re-evaluation of the market data, or a simple review of the appeal documentation. If the Assessor's Office agrees with the appeal, the assessment may be adjusted without further action.

- Board of Review: If the Assessor's Office does not grant the appeal, the case moves to the Board of Review, an independent body responsible for hearing property tax appeals. The Board of Review conducts a hearing, where the homeowner can present their case and any supporting evidence. The Board then makes a decision, which can uphold, reduce, or increase the assessment.

- District Court: If the homeowner is still dissatisfied with the decision, they have the right to appeal to the District Court. This is a more formal legal process, where the homeowner must present their case to a judge. The judge's decision is final and binding.

It's important to note that the appeal process can be complex and time-consuming. Engaging a tax professional or attorney with experience in property tax appeals can be beneficial, especially in cases where significant tax savings are at stake.

Strategies for Managing Property Taxes

Managing property taxes effectively is a key aspect of homeownership in Louisiana. Here are some strategies and tips to help homeowners navigate the process and potentially reduce their tax burden.

Stay Informed

Knowledge is power when it comes to property taxes. Stay informed about changes in tax laws, assessment procedures, and local tax rates. This includes keeping up-to-date with any legislative changes that might affect property taxes and being aware of the assessment schedule in your parish.

Regular Property Reviews

Regularly review your property’s records with the Assessor’s Office. Ensure that all information, including the property’s dimensions, improvements, and any recent changes, is accurate and up-to-date. This helps prevent unexpected increases in your property’s assessed value and ensures that you are only paying taxes based on the true value of your property.

Explore Tax Relief Programs

Louisiana offers various tax relief programs to eligible homeowners. These programs can provide significant savings on property taxes, especially for low-income homeowners or those with certain disabilities. Some common relief programs include the Homestead Exemption, which reduces the assessed value of a primary residence, and the Property Tax Relief Program, which provides rebates for eligible homeowners.

Consider Tax Strategies

Consult with a tax professional or financial advisor to explore tax-saving strategies specific to your situation. This could include strategies such as deferring tax payments, leveraging tax credits, or considering the potential benefits of home improvements that might increase your property’s value but also qualify for tax deductions.

Engage with Local Authorities

Build a relationship with your local Assessor’s Office and tax authorities. They can provide valuable insights into the assessment process, answer specific questions about your property’s assessment, and guide you through any necessary procedures. A positive relationship with these offices can also help in case of any disputes or appeals.

Stay Updated on Market Trends

Keep an eye on the local real estate market. Fluctuations in property values can affect your property’s assessed value. If property values in your area are decreasing, this could lead to a lower assessment and, consequently, lower property taxes. Conversely, if property values are rising, it’s important to be prepared for potential increases in your tax liability.

The Impact of Property Taxes on Homeownership

Property taxes play a significant role in the overall cost of homeownership in Louisiana. While they are an essential source of revenue for local governments and public services, they can also be a substantial financial burden for homeowners, especially those on fixed incomes or with limited financial resources.

Financial Implications

Property taxes can significantly impact a homeowner’s financial planning and overall budget. For many, property taxes are a fixed, predictable expense, but they can also be a source of financial strain, especially if the tax liability increases unexpectedly. This is why it’s crucial for homeowners to understand their property tax obligations and explore any available avenues for tax savings.

Community Development and Public Services

On the other hand, property taxes are a vital source of revenue for local governments, funding essential public services such as education, public safety, and infrastructure development. This revenue is used to maintain and improve schools, build and maintain roads, and provide a range of other services that enhance the quality of life in communities across Louisiana.

Equity and Fairness

Louisiana’s property tax system, with its market-based assessment approach and appeal process, aims to ensure equity and fairness. By assessing properties based on their market value and providing a mechanism for appeals, the state strives to ensure that all property owners pay their fair share, based on the true value of their property. This approach helps maintain a balanced tax system, ensuring that no one is overburdened and that public services are adequately funded.

Future Outlook and Potential Reforms

As with any tax system, Louisiana’s property tax landscape is subject to ongoing review and potential reforms. Here’s a look at some of the potential future developments and reforms that could impact property taxes in the state.

Potential Reforms

There have been ongoing discussions about potential reforms to Louisiana’s property tax system. Some of the proposed reforms include:

- Simplification of the Assessment Process: Proposals have been made to streamline the assessment process, making it more efficient and less complex. This could involve standardizing assessment procedures across parishes or implementing more advanced technologies to improve accuracy and efficiency.

- Income-Based Tax Relief: While Louisiana currently offers tax relief programs based on property values, there are discussions about implementing income-based relief programs. These programs would provide tax relief to homeowners based on their income levels, potentially helping those with lower incomes who may struggle to pay high property taxes.

- Cap on Tax Increases: Some proposals suggest implementing a cap on annual tax increases, limiting the amount by which property taxes can rise each year. This would provide stability for homeowners, ensuring that their tax liabilities do not increase significantly from one year to the next.

Impact of Economic Changes

Economic changes, such as fluctuations in the real estate market or shifts in the state’s economy, can significantly impact property taxes. For instance, a downturn in the real estate market could lead to lower property values, which would in turn result in lower property taxes. Conversely, a robust economy with increasing property values could lead to higher tax liabilities for homeowners.

Technological Advances

The integration of technology into the property tax system could bring about significant changes. Advanced property assessment technologies, such as satellite imaging and AI-based valuation systems, could improve the accuracy and efficiency of the assessment process. Additionally, online platforms and digital tools could make it easier for homeowners to access information, file appeals, and manage their property tax obligations.

Conclusion

Louisiana’s property tax system, while complex, is designed to be fair and equitable. By understanding the assessment process, tax calculation methods, and appeal procedures, homeowners can effectively manage their property tax obligations and potentially save on their tax liabilities. Furthermore, by staying informed about potential reforms and economic changes, homeowners can stay ahead of the curve and make informed decisions about their homeownership journey.

In conclusion, property taxes are an integral part of the homeownership experience in Louisiana. While they may present challenges, with the right knowledge and strategies, homeowners can navigate the system successfully, ensuring they pay their fair share while also maximizing any available tax savings. As Louisiana continues to evolve and adapt, its property tax system will likely follow suit, ensuring a balanced and equitable approach to funding vital public services.

What is the typical timeline for the property tax assessment process in Louisiana?

+The property tax assessment process in Louisiana typically begins with an inspection and market analysis, which can take several months. Once the assessment is complete, property owners receive a notice of their assessed value, usually a few months before the tax payment deadline. It’s important to note that the timeline can vary slightly depending on the parish and the specific circumstances of the property.

Are there any tax relief programs available for Louisiana homeowners?

+Yes, Louisiana offers several tax relief programs for eligible homeowners. These include the Homestead Exemption, which reduces the assessed value of a primary residence, and the Property Tax Relief Program, which provides rebates for certain homeowners. There are also income-based tax relief programs for low-income homeowners and those with disabilities.

How can I stay informed about changes in Louisiana’s property tax laws and rates?

+Staying informed about changes in property tax laws and rates is crucial. You can subscribe to newsletters or alerts from your local Assessor’s Office or tax authority. Additionally, local newspapers and online news sources often cover significant changes in tax laws and rates. It’s also a good idea to attend local government meetings or engage with community groups to stay updated on tax-related matters.

What should I do if I disagree with my property’s assessed value in Louisiana?

+If you disagree with your property’s assessed value, you have the right to appeal. The process involves filing a formal appeal with the local Assessor’s Office, providing reasons for your disagreement, and any supporting evidence. If the Assessor’s Office does not resolve the issue, you can further appeal to the Board of Review and, if necessary, the District Court.