Pay Car Taxes South Carolina

When it comes to vehicle ownership, understanding the tax obligations is crucial. In the state of South Carolina, vehicle taxes are an important aspect of maintaining compliance and ensuring smooth vehicle registration processes. This comprehensive guide will delve into the specifics of paying car taxes in South Carolina, covering the various aspects and providing valuable insights for vehicle owners.

Understanding the Vehicle Property Tax in South Carolina

South Carolina imposes a property tax on vehicles, which is an annual assessment based on the vehicle’s value. This tax is a significant revenue source for local governments and is used to fund various services and infrastructure projects within the state. Understanding the vehicle property tax is essential for vehicle owners to stay compliant and avoid penalties.

The vehicle property tax in South Carolina is calculated based on the assessed value of the vehicle. The assessed value is determined by the county in which the vehicle is registered, and it takes into account factors such as the vehicle's make, model, age, and condition. This value is then multiplied by the applicable tax rate set by the local government.

It's important to note that the vehicle property tax is separate from other vehicle-related taxes and fees, such as the sales tax paid when purchasing a vehicle or the registration fees. The property tax is an annual assessment, and vehicle owners are typically required to pay this tax every year, even if the vehicle's value has decreased.

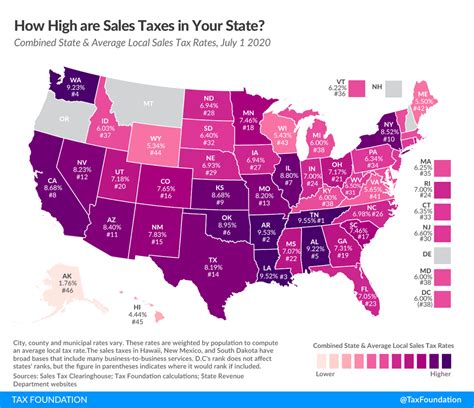

Tax Rates and Assessments

The tax rate for vehicle property taxes in South Carolina varies across different counties. Each county sets its own tax rate, which can range from 0.5% to 2% of the vehicle’s assessed value. This means that the actual tax amount can differ significantly depending on the county in which the vehicle is registered.

| County | Tax Rate |

|---|---|

| Anderson County | 0.6% |

| Charleston County | 0.8% |

| Greenville County | 0.7% |

| Horry County | 1.0% |

| Spartanburg County | 0.9% |

The assessed value of a vehicle is determined by the South Carolina Department of Motor Vehicles (DMV) in collaboration with local assessors. This value is typically based on the vehicle's fair market value, taking into account its age, mileage, and condition. It's important for vehicle owners to be aware of the assessed value as it directly impacts the amount of tax they will need to pay.

Payment Options and Deadlines

South Carolina offers several payment options for vehicle property taxes, providing convenience and flexibility to vehicle owners. The payment options include:

- Online Payment: Vehicle owners can pay their property taxes online through the South Carolina Department of Revenue's website. This option is quick, secure, and available 24/7. It's a convenient choice for those who prefer digital transactions.

- Mail-in Payment: If you prefer a more traditional method, you can mail your property tax payment to the county treasurer's office. Ensure that you include the correct amount and all necessary information, including your vehicle's details and contact information.

- In-Person Payment: Visit your local county treasurer's office to make an in-person payment. This option allows for immediate resolution of any queries or concerns you may have regarding your vehicle's tax assessment.

- Electronic Funds Transfer (EFT): Some counties in South Carolina offer the option of electronic funds transfer, allowing you to set up automatic payments for your vehicle property taxes. This method ensures timely payments and can be a convenient choice for those who prefer automatic transactions.

It's crucial to be aware of the payment deadlines to avoid late fees and penalties. The due date for vehicle property tax payments typically aligns with the vehicle registration renewal deadline. In South Carolina, vehicle registrations expire annually, and the tax payment must be made by the registration renewal date.

For instance, if your vehicle registration expires on June 30th, you must ensure that your property tax payment is made by this date to avoid penalties. Failure to pay the tax by the due date may result in additional fees, and your vehicle registration may be subject to suspension until the tax is paid in full.

Late Payment Penalties

South Carolina imposes penalties for late payment of vehicle property taxes. The penalty amount varies depending on the number of days the payment is overdue. Here’s a breakdown of the penalty structure:

| Days Overdue | Penalty Amount |

|---|---|

| 1–30 days | 5% of the tax amount |

| 31–60 days | 10% of the tax amount |

| 61–90 days | 15% of the tax amount |

| 91–180 days | 20% of the tax amount |

| Over 180 days | 25% of the tax amount |

It's important to note that these penalties are in addition to the original tax amount, so it's advisable to make timely payments to avoid incurring additional costs.

Exemptions and Special Considerations

South Carolina offers certain exemptions and special considerations for vehicle property taxes. These exemptions can provide relief to specific categories of vehicle owners. Here are some of the key exemptions and considerations:

Veteran and Military Exemptions

Veterans and active-duty military personnel may be eligible for exemptions or reduced tax rates on their vehicle property taxes. The eligibility criteria and the extent of the exemption vary depending on the individual’s military service and disability status. It’s advisable for veterans and military personnel to check with their local county assessor’s office or the South Carolina Department of Revenue for specific details regarding these exemptions.

Senior Citizen Exemption

South Carolina provides a property tax exemption for senior citizens who meet certain income and residency requirements. This exemption applies to vehicle property taxes as well. To qualify, individuals must be at least 65 years old, have a combined household income below a certain threshold, and have owned and occupied their primary residence for at least five consecutive years. The exemption amount is based on the individual’s income level and can significantly reduce the property tax burden for eligible senior citizens.

Disabled Persons Exemption

Individuals with disabilities may be eligible for an exemption or reduced tax rate on their vehicle property taxes. The eligibility criteria typically involve a disability-related vehicle modification or the use of an adapted vehicle. This exemption aims to provide financial relief to individuals with disabilities and promote accessibility.

Low-Income Exemptions

South Carolina offers property tax relief programs for low-income individuals and families. These programs can provide exemptions or reduced tax rates for vehicle property taxes. The eligibility criteria and the extent of the relief vary depending on the individual’s income level and other factors. It’s recommended for low-income individuals to inquire about these programs with their local county assessor’s office or the South Carolina Department of Revenue.

Staying Informed and Seeking Assistance

Staying informed about vehicle property taxes in South Carolina is essential for vehicle owners. Here are some additional resources and tips to keep in mind:

- County Assessor's Office: Reach out to your local county assessor's office for specific information regarding tax rates, assessment processes, and any unique considerations in your area. They can provide tailored guidance based on your county's regulations.

- South Carolina DMV: The South Carolina Department of Motor Vehicles (DMV) is a valuable resource for vehicle-related information. Their website offers guidance on vehicle registration, tax payments, and other relevant topics. Visit https://www.scdmvonline.com for more details.

- South Carolina Department of Revenue: The Department of Revenue is responsible for administering property taxes in South Carolina. Their website provides comprehensive information on tax rates, payment options, and exemptions. Visit https://dor.sc.gov for detailed guidance.

- Local Tax Professionals: Consider consulting with local tax professionals or accountants who specialize in vehicle-related taxes. They can provide personalized advice and ensure that you are taking advantage of all applicable exemptions and deductions.

By staying informed and seeking assistance when needed, vehicle owners can navigate the vehicle property tax process in South Carolina with confidence and ensure compliance with the state's regulations.

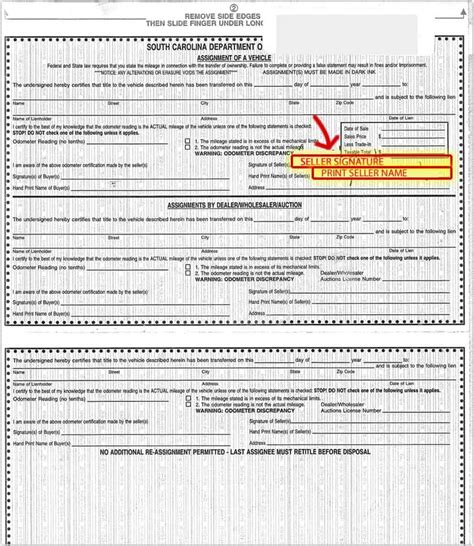

What happens if I sell my vehicle before the tax due date?

+If you sell your vehicle before the tax due date, it’s important to notify the South Carolina Department of Revenue. They will guide you through the process of transferring the tax liability to the new owner. This typically involves providing the necessary documentation and ensuring that the new owner assumes responsibility for the tax payment.

Can I pay my vehicle property tax in installments?

+South Carolina does not typically offer installment plans for vehicle property taxes. However, it’s advisable to check with your local county assessor’s office or the Department of Revenue to inquire about any potential payment arrangements, especially if you are facing financial difficulties.

How can I estimate my vehicle’s assessed value for tax purposes?

+Estimating your vehicle’s assessed value can be done by researching similar vehicles in your area. Online resources and local dealerships can provide insights into the current market value of your vehicle. Additionally, you can consult with your local county assessor’s office for guidance on how they determine the assessed value.

Are there any discounts or incentives for early payment of vehicle property taxes?

+South Carolina does not offer specific discounts or incentives for early payment of vehicle property taxes. However, paying your taxes promptly can help avoid late fees and penalties, ensuring a more straightforward process.

Can I deduct my vehicle property taxes on my federal or state tax returns?

+Vehicle property taxes in South Carolina are typically not deductible on federal or state tax returns. However, it’s advisable to consult with a tax professional to understand any potential deductions or credits that may be applicable to your specific situation.