City Of Lansing Taxes

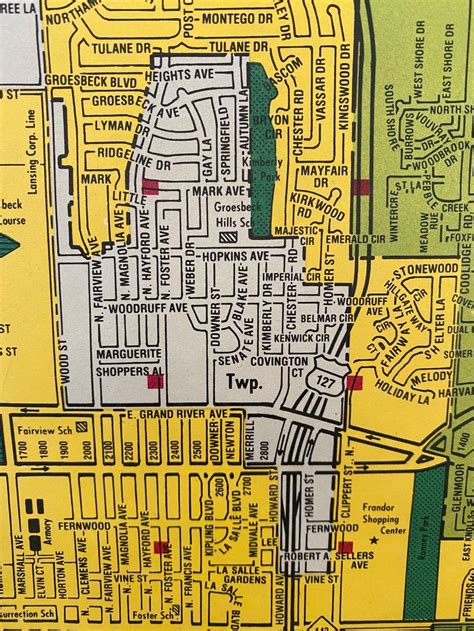

Understanding the intricacies of local taxation is essential for residents and businesses alike, as it directly impacts their financial obligations and planning. In the heart of Michigan, the city of Lansing, often referred to as the "Capital City," has a unique tax structure that warrants a detailed exploration. This article aims to demystify the tax landscape of Lansing, shedding light on its various tax types, rates, and how these taxes are administered, to offer a comprehensive guide for taxpayers.

Tax Structure of Lansing, Michigan

Lansing, like many other municipalities, employs a multifaceted tax system to generate revenue for its operations and services. The city’s tax structure is governed by state laws and local ordinances, which together determine the types of taxes levied and the rates applicable to residents and businesses.

Property Taxes: A Significant Revenue Stream

Property taxes form a substantial part of Lansing’s revenue. The city assesses property values, taking into account factors such as location, improvements, and market conditions. These assessed values are then used to calculate the tax liability for each property owner. The tax rate, expressed as a millage rate, is approved by the city council and can vary based on the property’s classification, such as residential, commercial, or industrial.

| Property Type | Millage Rate |

|---|---|

| Residential | 15.30 mills |

| Commercial | 22.45 mills |

| Industrial | 28.90 mills |

It's important to note that these rates are subject to change annually, influenced by the city's budget requirements and property value fluctuations.

Income Tax: A City-Specific Levy

In addition to property taxes, Lansing imposes an income tax on its residents and businesses. This tax is applied to earned income, including wages, salaries, and net profits from self-employment. The income tax rate in Lansing is currently set at 1.5%, making it one of the highest municipal income tax rates in the state. This tax is collected by the Michigan Department of Treasury and is distributed to the city based on the taxpayer’s place of residence or business location.

Sales and Use Taxes: Consumer and Business Impact

Lansing, like the rest of Michigan, applies a sales tax to the purchase of goods and certain services. The sales tax rate in Lansing is 6%, which includes both the state and local tax components. This tax is collected by retailers and remitted to the Michigan Department of Treasury. Additionally, a use tax is applicable when goods are purchased from out-of-state vendors and used within Lansing, ensuring that all consumer purchases are taxed equally.

Special Assessment Taxes: Funding Local Improvements

Lansing may also levy special assessment taxes to fund specific local improvements or services. These assessments are typically tied to a particular project, such as road construction or stormwater management, and are assessed on properties that directly benefit from the improvement. The tax is calculated based on the estimated benefit to each property and is often spread over several years to minimize the financial burden on taxpayers.

Other Taxes and Fees

Beyond the aforementioned taxes, Lansing may impose various other fees and taxes to support specific services or initiatives. These can include vehicle registration fees, hotel/motel taxes, and licensing fees for businesses. Each of these taxes and fees is designed to support specific aspects of the city’s operations and services, contributing to the overall tax landscape of Lansing.

Administration and Collection of Taxes

The administration and collection of taxes in Lansing are handled by several entities, each with a distinct role. The Lansing Assessor’s Office is responsible for assessing property values, ensuring accuracy, and providing property owners with assessment notices. The city’s Treasurer’s Office collects property taxes, issues tax bills, and oversees tax payment processes.

For income taxes, the Michigan Department of Treasury acts as the collection agency, distributing the collected funds to the city based on residency or business location. The state's Department of Treasury also collects and administers sales and use taxes, ensuring compliance and distributing the funds to the appropriate municipalities.

Tax Payment Options and Deadlines

Taxpayers in Lansing have various options for paying their taxes, including online payment portals, wire transfers, and traditional methods like checks or money orders. Property taxes are typically due twice a year, with specific deadlines set by the city. Income taxes are due on a quarterly or annual basis, depending on the taxpayer’s classification, and are payable to the Michigan Department of Treasury.

Sales and use taxes are collected by businesses and remitted to the state on a monthly, quarterly, or annual basis, depending on the business's tax liability and volume of sales. Late payments or non-compliance with tax obligations can result in penalties and interest, as outlined in the city's tax ordinances and state tax laws.

Tax Incentives and Exemptions

To encourage economic development and support specific sectors, Lansing, in collaboration with the state, offers various tax incentives and exemptions. These can include tax abatements for new businesses, property tax exemptions for certain types of improvements, and tax credits for research and development activities.

Additionally, certain properties may be eligible for tax exemptions based on their ownership or use. For instance, properties owned by non-profit organizations or those used exclusively for religious or charitable purposes may be exempt from property taxes. Similarly, veterans and seniors may be eligible for property tax relief programs.

Impact on the Local Economy

The tax structure of Lansing has a significant impact on the local economy. High property tax rates can make homeownership less affordable, potentially impacting the housing market and community development. Conversely, the income tax can provide a steady revenue stream for the city, supporting essential services and infrastructure projects.

The sales tax, though it may discourage consumer spending, also provides a stable revenue source for the city. Special assessment taxes can fund necessary local improvements, enhancing the quality of life for residents. The balance between these taxes is a delicate one, requiring careful consideration by the city's policymakers to ensure economic growth and sustainability.

Looking Ahead: Future Tax Trends

As Lansing continues to evolve, its tax structure is likely to adapt to meet the changing needs of the city and its residents. Future tax trends may include adjustments to tax rates, the introduction of new taxes or fees to support emerging services, and further incentives to attract businesses and stimulate economic growth.

The city's commitment to transparency and accessibility in tax matters is evident through its online resources and community engagement. Lansing's taxpayers can access information on tax rates, due dates, and payment options through the city's website, ensuring clarity and ease of compliance. The city's proactive approach to tax administration is a testament to its commitment to its residents and businesses.

How often do property tax rates change in Lansing?

+Property tax rates in Lansing can change annually, typically in response to the city’s budgetary needs and property value fluctuations. These changes are proposed by the city council and are subject to public hearings and approval.

Are there any tax relief programs for seniors or veterans in Lansing?

+Yes, Lansing offers several tax relief programs for seniors and veterans. These programs provide property tax relief based on income and service-related disabilities, helping to make homeownership more affordable for these groups.

How can businesses stay updated on Lansing’s tax incentives and exemptions?

+Businesses can stay informed about Lansing’s tax incentives and exemptions by regularly checking the city’s website, which provides updates on tax policies and programs. Additionally, consulting with tax professionals or the city’s economic development office can offer valuable insights.