Nc Sales Tax On Automobiles

The sales tax on automobiles is an important consideration for many car buyers in the state of North Carolina. Understanding the tax regulations and how they impact the overall cost of purchasing a vehicle can be crucial in making informed financial decisions. This comprehensive guide will delve into the intricacies of the NC Sales Tax on Automobiles, providing valuable insights for consumers and automotive enthusiasts alike.

Unraveling the NC Sales Tax on Automobiles

North Carolina, like many other states, imposes a sales tax on the purchase of vehicles. This tax contributes to the state’s revenue and helps fund various public services and infrastructure projects. The NC Department of Revenue oversees the collection and distribution of these taxes, ensuring compliance with the state’s tax laws.

The sales tax on automobiles in North Carolina is based on the purchase price of the vehicle, including any additional features, options, and fees. This means that the higher the price of the vehicle, the more tax you can expect to pay. However, it's essential to note that there are specific regulations and exemptions that can impact the final tax amount.

Calculating the Sales Tax

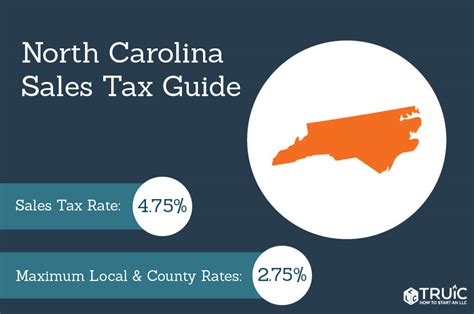

The sales tax rate in North Carolina varies depending on the county where the vehicle is purchased. While the statewide base rate is set at 4.75%, individual counties can add their own local sales tax rates on top of this. This means that the total sales tax rate can vary from one county to another, making it crucial for buyers to be aware of the specific tax rate in their area.

To calculate the sales tax on a vehicle, you can use the following formula:

Total Sales Tax = Purchase Price x (State Sales Tax Rate + County Sales Tax Rate)

For example, if you're purchasing a vehicle in a county with a total sales tax rate of 6.25% (including the statewide base rate), and the purchase price of the vehicle is $30,000, the sales tax would be calculated as follows:

Total Sales Tax = $30,000 x 0.0625 = $1,875

So, in this case, the buyer would pay an additional $1,875 in sales tax on top of the purchase price.

Exemptions and Special Considerations

It’s important to note that there are certain exemptions and special considerations when it comes to the NC sales tax on automobiles. These exemptions can significantly impact the final tax amount, so it’s crucial to be aware of them.

- Military Personnel: Active-duty military personnel and their spouses are exempt from paying sales tax on vehicles purchased in North Carolina. This exemption is a way for the state to show appreciation for the service and sacrifice of military families.

- Disabled Veterans: North Carolina offers a sales tax exemption for disabled veterans who are at least 50% disabled due to service-connected injuries. This exemption is an acknowledgment of their service and the sacrifices they have made.

- First Responders: Certain first responders, including law enforcement officers, firefighters, and emergency medical personnel, may be eligible for a sales tax exemption. This is another way the state expresses gratitude for their dedication and service to the community.

- Trade-Ins: If you're trading in your old vehicle as part of the purchase of a new one, the trade-in value can be deducted from the purchase price of the new vehicle, potentially reducing the sales tax amount. However, it's essential to consult with a tax professional to ensure compliance with the specific regulations.

Performance Analysis and Comparison

To provide a clearer picture of how the NC sales tax on automobiles compares to other states, let’s take a look at some performance analysis and comparative data.

Statewide Sales Tax Rates

| State | Sales Tax Rate |

|---|---|

| North Carolina | 4.75% (statewide base rate) |

| California | 7.25% |

| Texas | 6.25% |

| Florida | 6% |

| New York | 4% |

As shown in the table above, North Carolina's statewide base rate is relatively lower compared to states like California and Texas. However, it's important to consider the county-specific rates, as these can significantly impact the overall sales tax.

Average Sales Tax on Vehicles

According to recent data, the average sales tax paid on vehicles in North Carolina is approximately 6.22%. This figure takes into account the statewide base rate and the average county-specific rates.

In comparison, the national average sales tax on vehicles is around 5.43%. This means that, on average, North Carolina residents pay a slightly higher sales tax on vehicles than the national average.

Tips and Strategies for Navigating NC Sales Tax on Automobiles

Understanding the NC sales tax on automobiles is just the first step. Here are some tips and strategies to help you navigate the tax regulations and potentially save money on your vehicle purchase:

- Research County-Specific Rates: Before making a purchase, take the time to research the sales tax rate in the county where you plan to buy the vehicle. This simple step can help you budget effectively and potentially negotiate a better deal.

- Explore Exemptions: If you or a family member qualify for any of the exemptions mentioned earlier, be sure to claim them. These exemptions can result in significant savings and are a benefit you shouldn't overlook.

- Consider Trade-Ins Strategically: When trading in your old vehicle, aim for a trade-in value that aligns with the market price. This can help maximize your savings by reducing the taxable purchase price of the new vehicle.

- Negotiate the Price: While the sales tax is a fixed percentage, you can still negotiate the purchase price of the vehicle. By negotiating a lower price, you can indirectly reduce the amount of sales tax you pay.

- Explore Financing Options: Different financing options can impact the overall cost of your vehicle purchase. Explore various financing plans and compare interest rates to find the most cost-effective option for your financial situation.

Future Implications and Trends

The NC sales tax on automobiles is subject to potential changes and developments that can impact buyers. Here are some future implications and trends to consider:

Legislative Changes

The North Carolina General Assembly has the authority to modify the state’s tax laws, including the sales tax on automobiles. While significant changes are not expected in the near future, it’s essential to stay informed about any potential legislative developments that could impact the tax rate or regulations.

Economic Factors

Economic conditions can influence the demand for vehicles and, consequently, the sales tax revenue. During economic downturns, vehicle sales may decrease, impacting the state’s revenue from sales tax. On the other hand, economic booms can lead to increased vehicle sales and higher tax revenue.

Technology and Electric Vehicles

The rise of electric vehicles (EVs) and advancements in automotive technology can also impact the sales tax landscape. As more consumers opt for EVs, the state may need to consider adjusting tax regulations to accommodate these changing trends. Additionally, the potential introduction of road usage fees or similar measures for EVs could impact the overall tax structure.

Conclusion

The NC sales tax on automobiles is a critical aspect of purchasing a vehicle in North Carolina. By understanding the tax regulations, calculating the sales tax accurately, and exploring exemptions and strategies, buyers can make more informed decisions. Stay up-to-date with any legislative changes, economic factors, and technological advancements to ensure you’re well-prepared for any future developments in the automotive sales tax landscape.

Frequently Asked Questions

How often are the sales tax rates updated in North Carolina?

+

The statewide sales tax rate is relatively stable, but county-specific rates can change annually. Counties may adjust their local sales tax rates to fund specific projects or initiatives. It’s recommended to check the current rates before making a vehicle purchase.

Are there any hidden fees or additional taxes aside from the sales tax?

+

In addition to the sales tax, there may be other fees and taxes associated with vehicle purchases, such as title and registration fees, environmental fees, and dealer processing fees. These additional charges can vary depending on the county and the dealership.

Can I get a refund if I move out of state shortly after purchasing a vehicle in North Carolina?

+

Yes, if you move out of North Carolina within a certain timeframe after purchasing a vehicle, you may be eligible for a sales tax refund. The specific refund process and requirements vary, so it’s essential to consult with the NC Department of Revenue or a tax professional for accurate guidance.

Are there any online resources or tools to calculate the sales tax on automobiles in North Carolina?

+

Yes, there are online calculators and resources available that can help estimate the sales tax on a vehicle purchase. These tools consider the purchase price, the state and county sales tax rates, and any applicable exemptions. It’s a good idea to use these resources as a starting point for budgeting.