Sales Tax In New York

Sales tax is an essential component of any economy, and understanding its intricacies is crucial for both consumers and businesses alike. In the state of New York, the sales tax system is quite comprehensive and unique, with various rates and regulations that impact everyday purchases. This article aims to delve into the specifics of sales tax in New York, exploring its rates, exemptions, and the overall impact on consumers and businesses within the state.

The Basics of Sales Tax in New York

Sales tax in New York is a state-imposed tax levied on the sale of goods and certain services. It is a crucial revenue stream for the state government, contributing significantly to its overall budget. The state of New York, being one of the most populous and economically vibrant regions in the United States, has a complex sales tax system to accommodate its diverse population and business landscape.

The sales tax in New York is not a flat rate across the state. Instead, it is comprised of a combination of state and local sales taxes, which can vary depending on the county and city where the purchase is made. This structure is designed to allow local governments to generate revenue for their specific needs, such as infrastructure development and public services.

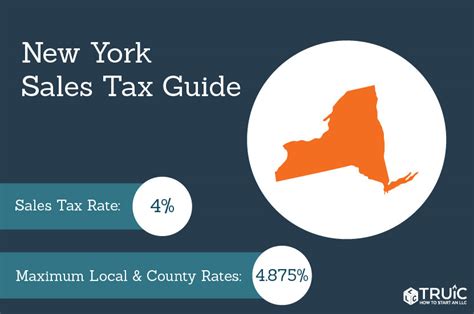

State Sales Tax Rate

As of my last update in January 2023, the state of New York imposes a base sales tax rate of 4%. This rate applies to most tangible personal property and certain specified services. The state sales tax is a fixed rate and does not vary across the state.

Local Sales Tax Rates

In addition to the state sales tax, local governments in New York are authorized to levy their own sales taxes. These local sales taxes can significantly impact the overall sales tax rate a consumer pays. Local sales tax rates can vary widely, from 0% to 4.5%, depending on the jurisdiction. This means that in some areas of New York, the combined state and local sales tax rate can be as high as 8.5%, while in others, it remains at the base state rate of 4%.

| County | Local Sales Tax Rate |

|---|---|

| Albany County | 3.0% |

| Erie County | 3.0% |

| Nassau County | 4.0% |

| Suffolk County | 4.0% |

| Westchester County | 3.75% |

It is important for consumers and businesses to be aware of these local variations, as they can have a significant impact on the final cost of goods and services. For instance, a purchase made in Manhattan (New York County) would be subject to a 4.5% local sales tax, resulting in a total sales tax rate of 8.5%, while a purchase in certain rural areas might only incur the 4% state sales tax rate.

Sales Tax Exemptions in New York

While most tangible personal property and certain services are subject to sales tax in New York, there are specific exemptions and exclusions that can reduce or eliminate the tax burden for certain items or transactions. These exemptions are designed to promote specific economic or social goals, such as encouraging certain industries or supporting essential services.

Food and Groceries

One of the most notable exemptions in New York is the exemption on unprepared food and non-taxable groceries. This means that items like raw fruits and vegetables, uncooked meats, and other staple food items are not subject to sales tax. However, it’s important to note that this exemption does not apply to prepared foods, hot foods, or meals sold at restaurants or food establishments.

Clothing and Footwear

New York offers a sales tax exemption on clothing and footwear items priced under 110</strong>. This exemption is a significant benefit for consumers, especially those on a budget, as it allows them to purchase essential items without incurring additional sales tax. However, if an item of clothing or footwear costs more than 110, the entire purchase becomes taxable.

Prescription Medications

Sales tax is not applicable to prescription medications in New York. This exemption ensures that essential healthcare items remain accessible and affordable for residents. However, it’s important to note that over-the-counter medications and non-prescription healthcare items are subject to sales tax.

Educational and Cultural Institutions

Certain sales to educational and cultural institutions are exempt from sales tax in New York. This includes sales to schools, colleges, universities, museums, and other non-profit cultural organizations. This exemption aims to support these institutions in their vital roles within the community.

Impact on Consumers and Businesses

The sales tax system in New York has a profound impact on both consumers and businesses. For consumers, the varying sales tax rates across the state can influence their purchasing decisions and overall cost of living. Higher sales tax rates can make certain areas less attractive for large purchases, especially for those living close to county or city borders where rates may differ significantly.

On the other hand, businesses in New York must carefully navigate the sales tax landscape to ensure compliance and maintain a competitive edge. They must accurately calculate and collect sales tax based on the location of the sale, which can be a complex task given the varying rates. Additionally, businesses must stay updated on any changes to sales tax laws and regulations to avoid penalties and maintain a positive relationship with their customers.

Moreover, the sales tax system in New York can impact the state's economic competitiveness. Higher sales tax rates can make the state less attractive for businesses looking to establish operations, potentially leading to a loss of investment and job opportunities. On the other hand, a well-managed sales tax system can provide stable revenue for the state, supporting vital public services and infrastructure development.

Staying Informed and Compliant

Given the complexity of the sales tax system in New York, it is crucial for both consumers and businesses to stay informed about any changes or updates to sales tax laws and regulations. The New York State Department of Taxation and Finance provides comprehensive resources and guidance to help navigate the sales tax landscape. Their website offers detailed information on tax rates, exemptions, and filing requirements, ensuring that individuals and businesses can stay compliant and avoid penalties.

For businesses, staying compliant with sales tax regulations is not only a legal obligation but also a matter of maintaining trust with customers and partners. Accurate sales tax collection and remittance demonstrate a commitment to ethical business practices and can enhance a company's reputation.

Conclusion

The sales tax system in New York is a dynamic and essential component of the state’s economy. It impacts consumers’ purchasing decisions, businesses’ operations, and the overall economic landscape. Understanding the rates, exemptions, and variations across the state is crucial for making informed financial choices and ensuring compliance with the law.

As the state of New York continues to evolve and adapt to changing economic conditions, the sales tax system will likely undergo further refinements and adjustments. Staying informed and engaged with these changes will be vital for all stakeholders to navigate the complex world of sales tax effectively.

How often are sales tax rates updated in New York?

+Sales tax rates in New York are typically updated annually, often effective from April 1st of each year. However, local governments may propose changes at any time, subject to approval from the New York State Department of Taxation and Finance.

Are there any online resources to help calculate sales tax in New York?

+Yes, the New York State Department of Taxation and Finance provides an online sales tax calculator tool on their website. This tool allows users to input the purchase price, location, and other relevant details to estimate the total sales tax amount.

Can I claim a refund for overpaid sales tax in New York?

+Yes, if you believe you have overpaid sales tax in New York, you can file a refund claim with the Department of Taxation and Finance. The process involves completing the appropriate refund form and providing supporting documentation to substantiate your claim.