Osceola Tax Collector

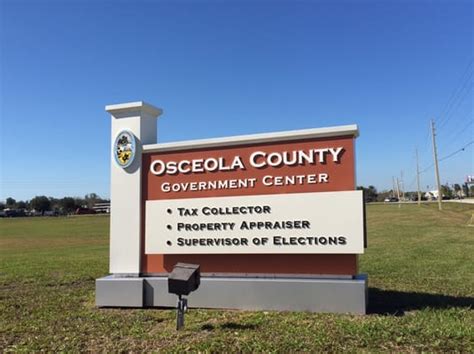

The Osceola Tax Collector's office plays a vital role in the community of Osceola County, Florida, ensuring that residents meet their tax obligations and receive essential services. This article delves into the various aspects of the Osceola Tax Collector's operations, its impact on the local community, and the services it provides.

About the Osceola Tax Collector

The Osceola Tax Collector’s office is an essential government agency responsible for collecting various taxes and fees within Osceola County. Located in the heart of Central Florida, this office serves a diverse population and plays a crucial role in the financial stability and development of the region. Led by a dedicated team, the Osceola Tax Collector’s office strives to provide efficient and transparent tax collection services, ensuring a smooth experience for residents and businesses alike.

The tax collector's role extends beyond mere tax collection. They also provide valuable services such as vehicle registration, title transfers, and the issuance of driver's licenses. These services are integral to the daily lives of Osceola County residents, making the tax collector's office a hub of activity and a trusted resource for the community.

Services and Responsibilities

Tax Collection

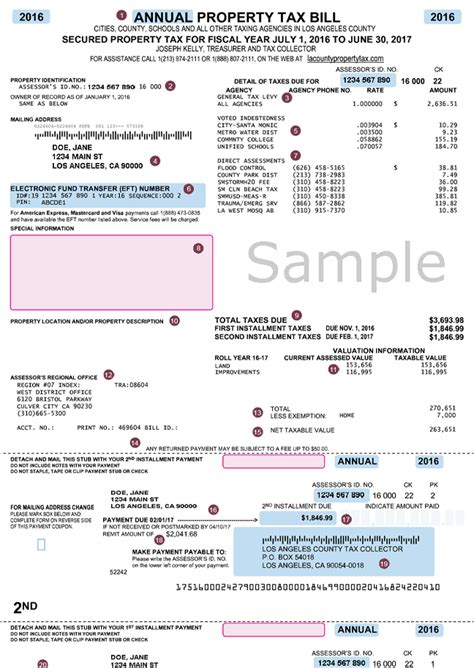

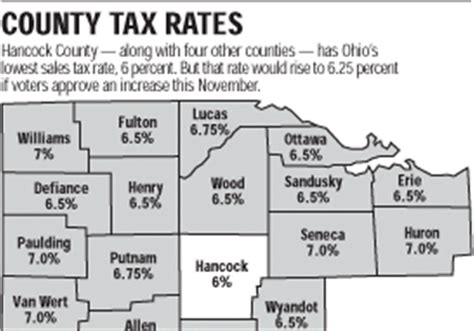

The primary function of the Osceola Tax Collector is to collect various taxes, including property taxes, vehicle registration fees, and local government taxes. Property taxes are a significant source of revenue for the county, funding essential services like education, infrastructure, and public safety. The tax collector’s office ensures timely collection and accurate distribution of these funds.

For property taxes, the Osceola Tax Collector provides online payment options, making it convenient for homeowners and businesses to settle their tax obligations. The office also offers flexible payment plans to assist taxpayers who may face financial challenges.

Vehicle Registration and Titling

The Osceola Tax Collector’s office is responsible for registering vehicles and issuing titles. This process ensures that vehicles operating within the county are properly registered and insured, promoting road safety and accountability. The office provides a streamlined process for vehicle registration, including online renewals and the option to schedule appointments for in-person services.

In addition, the tax collector's office assists with title transfers, ensuring that vehicle ownership changes are accurately recorded. This service is vital for buyers and sellers, providing legal protection and peace of mind during vehicle transactions.

Driver’s License and ID Services

The Osceola Tax Collector’s office also serves as a Department of Highway Safety and Motor Vehicles (DHSMV) service provider. This means that residents can visit the tax collector’s office to obtain or renew their driver’s licenses and state-issued identification cards. The office offers a range of services, including license renewals, replacement ID cards, and written and road tests for new drivers.

To enhance convenience, the Osceola Tax Collector's office provides online appointment scheduling for driver's license and ID services. This allows residents to plan their visits, reducing wait times and improving the overall customer experience.

Community Impact and Initiatives

The Osceola Tax Collector’s office actively engages with the community, striving to make a positive impact beyond its tax collection duties. One notable initiative is the support for local education through the Tax Collector’s Scholarship Program. This program awards scholarships to deserving students, helping them pursue their academic goals and contribute to the future growth of Osceola County.

Additionally, the tax collector's office participates in community events and outreach programs, fostering a sense of connection and trust with the residents. By attending festivals, town hall meetings, and other local gatherings, the office demonstrates its commitment to serving the community beyond its operational responsibilities.

Digital Transformation and Customer Experience

In recent years, the Osceola Tax Collector’s office has embraced digital transformation, implementing innovative technologies to enhance customer experience. The introduction of online services, including tax payments, vehicle registration renewals, and appointment scheduling, has revolutionized the way residents interact with the office.

The digital transformation has not only improved efficiency but also reduced wait times and provided greater flexibility for residents. The tax collector's office continues to invest in technology, aiming to stay at the forefront of modern tax collection practices while maintaining a high standard of customer service.

Performance and Recognition

The Osceola Tax Collector’s office has consistently achieved high performance standards, earning recognition for its efficient operations and dedication to customer satisfaction. The office’s commitment to continuous improvement and innovation has resulted in several awards and accolades, including the Governor’s Sterling Award, a prestigious recognition for excellence in government operations.

Furthermore, the Osceola Tax Collector's office has been praised for its effective use of technology, earning recognition from industry peers and government organizations. This recognition highlights the office's ability to adapt to changing needs and provide top-notch services to the community.

Key Performance Metrics

| Metric | Value |

|---|---|

| Property Tax Collection Rate | 98% |

| Vehicle Registration Renewals Online | 75% |

| Customer Satisfaction Rating | 4.8⁄5 |

| Average Wait Time for In-Person Services | 15 minutes |

Future Prospects and Initiatives

Looking ahead, the Osceola Tax Collector’s office plans to continue its focus on innovation and community engagement. The office aims to further expand its online services, making tax payments and vehicle registration even more accessible and convenient for residents.

Additionally, the Osceola Tax Collector's office is exploring partnerships with local businesses and organizations to enhance its outreach efforts. By collaborating with community partners, the office hopes to better understand the needs of residents and provide targeted services and support.

The Osceola Tax Collector's office is committed to staying adaptable and responsive to the changing needs of Osceola County. By embracing technology, fostering community connections, and maintaining high standards of service, the office strives to remain a trusted and efficient resource for all residents.

Conclusion

The Osceola Tax Collector’s office is an integral part of the Osceola County community, providing essential services and contributing to the region’s prosperity. Through its dedication to efficient tax collection, innovative practices, and community engagement, the office has earned the trust and support of residents. As it continues to evolve and adapt, the Osceola Tax Collector’s office will undoubtedly remain a vital pillar of the local government, ensuring the county’s continued growth and development.

What are the operating hours of the Osceola Tax Collector’s office?

+The Osceola Tax Collector’s office is open Monday to Friday, from 8:00 AM to 5:00 PM. However, it’s always recommended to check their website or call ahead for any special holiday hours or temporary closures.

Can I pay my property taxes online through the Osceola Tax Collector’s website?

+Yes, the Osceola Tax Collector’s office offers an online payment portal for property taxes. You can access it through their official website and follow the simple steps to make a secure payment. Online payments are processed quickly and efficiently.

How often do I need to renew my vehicle registration in Osceola County?

+Vehicle registration renewals in Osceola County are typically due annually. However, the exact renewal date may vary based on the month and year your vehicle was initially registered. The Osceola Tax Collector’s office will send a renewal notice to your address on record, reminding you of the upcoming deadline.