Sales Tax Mn

In the state of Minnesota, sales tax is an essential aspect of the economy and financial system, impacting businesses and consumers alike. With a unique tax structure and various exemptions, understanding sales tax in Minnesota is crucial for both residents and businesses operating within the state.

The Basics of Sales Tax in Minnesota

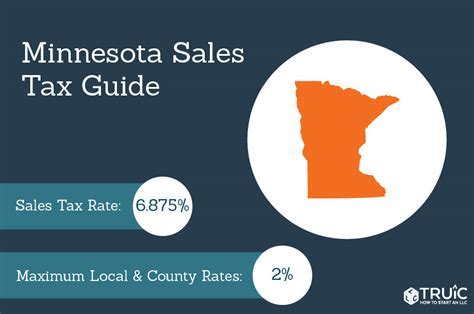

Minnesota’s sales tax is a statewide tax applied to the sale of tangible personal property and certain services. The state of Minnesota imposes a 6.875% sales and use tax on most retail sales, leases, and rentals of tangible personal property, with the exception of certain items that are specifically exempted by law.

The state sales tax rate is composed of a 6.5% state base rate and a 0.375% local government aid rate. This local aid rate is distributed to cities and counties to support various government initiatives. Additionally, there are 103 local units of government that have the authority to levy an additional local sales and use tax of up to 0.25%, which is dedicated to supporting transit systems.

How Sales Tax is Calculated

The sales tax in Minnesota is calculated by multiplying the purchase price of an item by the applicable tax rate. For example, if an item costs 100</strong> and the total sales tax rate is <strong>6.875%</strong>, the sales tax amount would be <strong>6.88 (rounded to the nearest cent). This tax is typically added to the purchase price, making the total cost $106.88 in this case.

| Sales Tax Component | Rate |

|---|---|

| State Base Rate | 6.5% |

| Local Government Aid Rate | 0.375% |

| Potential Local Sales Tax | Up to 0.25% |

It's important to note that the sales tax rate can vary depending on the location of the sale and the type of goods or services being purchased. Some areas in Minnesota have additional local sales taxes, while certain goods, such as groceries and prescription drugs, are exempt from sales tax.

Exemptions and Special Considerations

Minnesota’s sales tax system includes a range of exemptions and special provisions. For instance, qualified food items (such as staple groceries) are generally exempt from sales tax, providing a financial benefit to consumers. Additionally, there are sales tax holidays during which certain items, often back-to-school supplies or clothing, are exempt from sales tax for a designated period.

Businesses engaged in the sale of taxable items must collect sales tax from customers and remit it to the Minnesota Department of Revenue. Failure to comply with sales tax regulations can result in penalties and interest charges.

Sales Tax Compliance and Registration

For businesses operating in Minnesota, understanding and complying with sales tax regulations is crucial. The Minnesota Department of Revenue provides guidelines and resources to help businesses navigate the sales tax landscape.

Sales Tax Registration Process

Businesses that sell taxable goods or services in Minnesota are required to register with the state to obtain a sales and use tax permit. The registration process involves providing detailed information about the business, including its legal name, physical location, and the nature of its operations.

Once registered, businesses are assigned a unique tax identification number (TIN) and are responsible for collecting and remitting sales tax on behalf of the state. The frequency of tax remittance depends on the business's sales volume and can range from monthly to annually.

Sales Tax Compliance Challenges

Sales tax compliance in Minnesota can be complex, especially for businesses with multiple locations or those selling goods and services online. Businesses must ensure that they are collecting the correct tax rate for each transaction, which can vary based on the customer’s shipping or billing address.

Moreover, businesses must stay informed about any changes to the sales tax laws and regulations. Minnesota's sales tax rates and rules are subject to periodic updates, and non-compliance can lead to audits, penalties, and interest charges.

Impact of Sales Tax on Businesses and Consumers

Sales tax in Minnesota has a significant impact on both businesses and consumers. For businesses, sales tax represents a source of revenue that must be accurately calculated, collected, and remitted to the state. Failure to comply can result in legal consequences and financial penalties.

Challenges for Businesses

Businesses face the challenge of staying up-to-date with sales tax laws and regulations, which can be time-consuming and complex. They must also ensure that their point-of-sale systems are configured correctly to calculate the appropriate tax rates for each transaction. Additionally, businesses that sell goods online must navigate the complexities of economic nexus, which can trigger sales tax collection obligations in states where they have no physical presence.

Benefits and Drawbacks for Consumers

For consumers, sales tax adds to the cost of goods and services. While it can be seen as an additional expense, sales tax revenue is used to fund various state and local government services, such as education, healthcare, and infrastructure development. However, the tax burden can vary depending on a consumer’s location and the type of goods they purchase.

On the positive side, certain consumer groups, like seniors and veterans, may be eligible for sales tax exemptions or reduced rates on specific items. Additionally, sales tax holidays can provide temporary relief from sales tax obligations, making it a favorable time for consumers to make larger purchases.

The Role of Sales Tax in State Revenue

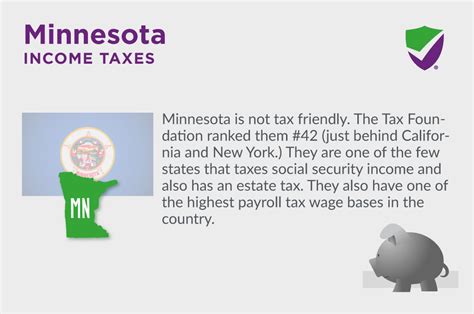

Sales tax is a critical component of Minnesota’s revenue stream. In fiscal year 2021, the state collected over $4.3 billion in sales and use tax revenue, which accounted for approximately 15% of the state’s total general fund revenue.

| Fiscal Year | Sales and Use Tax Revenue (in billions) |

|---|---|

| 2021 | $4.3 |

| 2020 | $3.8 |

| 2019 | $4.0 |

The state's sales tax revenue is projected to grow in the coming years, with estimates suggesting that it will reach $4.6 billion by fiscal year 2024. This growth is attributed to a combination of factors, including a growing economy, increased consumer spending, and potential changes in tax laws.

Sales Tax and E-commerce in Minnesota

With the rise of e-commerce, sales tax collection and compliance have become increasingly complex. Minnesota, like many other states, has implemented laws to address the collection of sales tax from online retailers.

Economic Nexus and Remote Sellers

Minnesota’s economic nexus laws require out-of-state sellers with substantial connections to the state to collect and remit sales tax on transactions with Minnesota customers. This includes online retailers that meet certain sales or transaction thresholds. For example, if an out-of-state retailer has more than $100,000 in annual sales to Minnesota customers or conducts more than 200 separate transactions in the state, it is required to register for a sales tax permit and collect sales tax.

Marketplace Facilitator Rules

Minnesota has also adopted marketplace facilitator laws, which hold online marketplaces and facilitators responsible for collecting and remitting sales tax on behalf of their third-party sellers. This means that platforms like Amazon and eBay may be required to collect sales tax on transactions facilitated through their platforms, even if the individual sellers are not required to register for a sales tax permit themselves.

Online Sales Tax Collection Challenges

Despite these laws, ensuring compliance with sales tax regulations in the e-commerce space can be challenging. Businesses must stay informed about the latest laws and regulations, especially as they pertain to online sales. They also need to have robust systems in place to accurately calculate and collect sales tax, which can be especially complex for businesses selling across multiple states or countries.

Sales Tax Future Outlook and Potential Changes

As Minnesota’s economy and tax landscape continue to evolve, it’s important to consider potential future changes to sales tax laws and regulations.

Potential Sales Tax Rate Adjustments

Minnesota’s sales tax rate has remained relatively stable in recent years, but there is always the possibility of future adjustments. The state legislature could propose changes to the sales tax rate or structure, which could impact businesses and consumers alike. For instance, a higher sales tax rate could generate more revenue for the state, but it could also reduce consumer spending and impact businesses’ bottom lines.

Expanding Sales Tax Base

Another potential change could involve expanding the sales tax base. Currently, Minnesota exempts certain items, such as groceries and prescription drugs, from sales tax. However, there have been discussions about potentially taxing these items, which could generate significant additional revenue for the state but may be unpopular with consumers.

Sales Tax Simplification

There have also been ongoing efforts to simplify the sales tax system in Minnesota. This could involve harmonizing tax rates across the state, reducing the number of local tax jurisdictions, or implementing a more uniform tax base. Simplification could make compliance easier for businesses and reduce administrative burdens, but it may also require careful consideration to ensure that local governments do not lose vital revenue streams.

Emerging Technologies and Sales Tax

Finally, the rise of emerging technologies, such as blockchain and artificial intelligence, could have a significant impact on sales tax collection and compliance. These technologies could streamline the tax collection process, improve accuracy, and reduce the risk of fraud. However, they also present new challenges and complexities that businesses and regulators will need to navigate.

Conclusion

Sales tax in Minnesota is a complex yet critical component of the state’s financial system. It impacts businesses and consumers alike, providing revenue for essential government services while also presenting compliance challenges and opportunities. As the state’s economy and tax landscape continue to evolve, businesses and individuals must stay informed and adapt to any changes in sales tax regulations.

Frequently Asked Questions

What is the current sales tax rate in Minnesota?

+

The current state sales tax rate in Minnesota is 6.875%, which includes a 6.5% state base rate and a 0.375% local government aid rate. Additionally, some local governments may levy an extra local sales tax of up to 0.25%.

Are there any sales tax holidays in Minnesota?

+

Yes, Minnesota has designated sales tax holidays during which certain items, such as clothing and school supplies, are exempt from sales tax. These holidays typically occur around back-to-school season and provide a financial benefit to consumers.

What items are exempt from sales tax in Minnesota?

+

Minnesota exempts a variety of items from sales tax, including qualified food items (groceries), prescription drugs, and certain agricultural products. Additionally, there are exemptions for specific consumer groups, such as seniors and veterans, on certain items.

How often do businesses need to remit sales tax in Minnesota?

+

The frequency of sales tax remittance depends on the business’s sales volume. Businesses with high sales volumes may need to remit sales tax monthly, while those with lower sales may remit annually. The Minnesota Department of Revenue provides specific guidelines for each business’s unique situation.

What are the penalties for non-compliance with sales tax regulations in Minnesota?

+

Non-compliance with sales tax regulations in Minnesota can result in significant penalties and interest charges. The penalties can vary depending on the severity of the violation, but they can include fines, the revocation of the business’s sales tax permit, and even criminal charges in extreme cases.