Annual Gift Tax Exclusion 2026

The Annual Gift Tax Exclusion is a valuable tool in estate planning and wealth management, allowing individuals to make tax-free gifts to their beneficiaries. In the United States, this exclusion amount is adjusted periodically to account for inflation and changing economic conditions. For the year 2026, the Annual Gift Tax Exclusion is projected to play a significant role in tax strategies, impacting the way individuals transfer wealth and plan their estates. In this article, we delve into the specifics of the 2026 Annual Gift Tax Exclusion, its implications, and how it can be strategically utilized to maximize financial benefits.

Understanding the Annual Gift Tax Exclusion

The Annual Gift Tax Exclusion is a provision in the Internal Revenue Code that allows individuals to make gifts of a certain amount to any number of recipients without triggering gift taxes. This exclusion is designed to encourage gift-giving and support intergenerational wealth transfer while ensuring that the Internal Revenue Service (IRS) receives its due taxes on larger gifts or transfers of wealth. Understanding this exclusion and its nuances is crucial for individuals seeking to minimize their tax liabilities and maximize the benefits for their beneficiaries.

The 2026 Annual Gift Tax Exclusion: A Preview

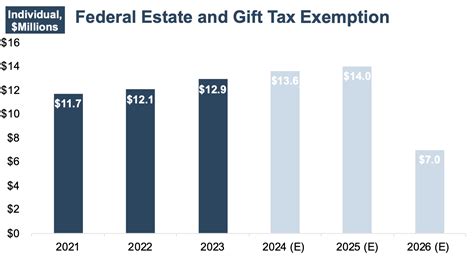

As we look ahead to 2026, the Annual Gift Tax Exclusion is expected to undergo adjustments to keep pace with economic fluctuations. While the exact amount for 2026 is not yet determined, historical trends and economic projections provide valuable insights. Based on these indicators, experts anticipate the 2026 exclusion amount to be notably higher than the current exclusion, reflecting the rising cost of living and the need to adjust tax thresholds accordingly.

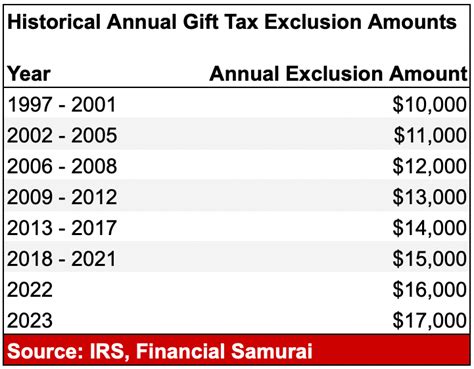

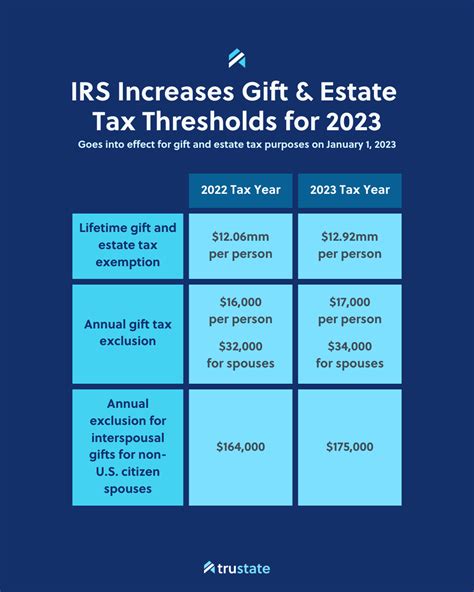

Historically, the Annual Gift Tax Exclusion has been subject to periodic adjustments, usually every few years, to ensure its relevance and effectiveness. These adjustments are influenced by various factors, including inflation rates, economic growth, and changes in tax policies. For instance, in 2021, the exclusion amount was increased from $15,000 to $16,000, reflecting the rising cost of living and the need to accommodate larger gift-giving opportunities.

| Year | Annual Gift Tax Exclusion |

|---|---|

| 2021 | $16,000 |

| 2022 | $16,000 |

| 2023 | $16,000 |

| 2024 (Projected) | $17,000 |

| 2025 (Projected) | $18,000 |

| 2026 (Estimated) | TBD (Expected to be higher) |

While the exact exclusion amount for 2026 is still unknown, it is safe to assume that it will be higher than the projected amounts for 2024 and 2025. This upward trend is consistent with historical adjustments and reflects the ongoing efforts to maintain the exclusion's relevance in the face of economic changes.

Maximizing the Benefits of the 2026 Exclusion

The projected increase in the Annual Gift Tax Exclusion for 2026 presents a unique opportunity for individuals to optimize their gift-giving strategies and plan for the future. Here are some strategies to consider when maximizing the benefits of the 2026 exclusion:

1. Early Planning and Timing

While the 2026 exclusion amount is not yet determined, early planning can be advantageous. By anticipating the potential increase and adjusting your gift-giving strategies accordingly, you can make the most of the higher exclusion limit. Timing your gifts strategically can help you avoid unnecessary tax liabilities and maximize the tax-free transfer of wealth.

2. Utilizing Multiple Years

The Annual Gift Tax Exclusion applies to each calendar year, meaning you can make use of the exclusion multiple times by spacing out your gifts. By spreading your gifts over several years, you can potentially transfer a significant amount of wealth tax-free, taking advantage of the exclusion limit for each year. This strategy is particularly beneficial when planning for larger gifts or transfers of assets.

3. Gift-Giving to Multiple Beneficiaries

The Annual Gift Tax Exclusion applies per recipient, allowing you to make gifts to multiple beneficiaries without triggering gift taxes. This means you can distribute your wealth among your loved ones more evenly and ensure that each recipient receives the maximum benefit from the exclusion. By diversifying your gifts, you can provide financial support to a wider circle of family members or charitable causes.

4. Combining Strategies with Other Tax Benefits

The Annual Gift Tax Exclusion can be combined with other tax benefits to maximize the overall impact of your gift-giving. For instance, you can utilize the exclusion in conjunction with the stepped-up basis provision, which allows for a higher cost basis on appreciated assets for estate tax purposes. By strategically planning your gifts and considering other tax advantages, you can optimize the financial benefits for both yourself and your beneficiaries.

5. Consulting Professional Guidance

Given the complexity of tax laws and the potential impact of the Annual Gift Tax Exclusion, seeking professional guidance is essential. Tax advisors, estate planners, and legal professionals can provide tailored advice based on your specific circumstances. They can help you navigate the intricacies of gift-giving, ensure compliance with regulations, and develop a comprehensive plan that aligns with your financial goals and the needs of your beneficiaries.

Implications for Estate Planning

The Annual Gift Tax Exclusion is a crucial component of estate planning, offering individuals a tax-efficient way to transfer wealth to their heirs. As we anticipate the 2026 exclusion, estate planners and individuals must consider the following implications:

1. Strategic Wealth Transfer

The increased exclusion amount in 2026 will provide individuals with a greater opportunity to transfer wealth to their beneficiaries tax-free. This can be particularly beneficial for those with significant assets or a desire to provide financial support to their loved ones. By utilizing the exclusion strategically, individuals can reduce the overall tax burden on their estates and ensure that more of their wealth is passed on to the intended recipients.

2. Minimizing Estate Taxes

Estate taxes can significantly impact the distribution of wealth upon an individual’s death. The Annual Gift Tax Exclusion, when used effectively, can help minimize the estate tax liability. By making gifts during one’s lifetime, individuals can reduce the overall value of their estate and potentially avoid or reduce the estate tax burden. This strategy is particularly advantageous for those with substantial assets and a desire to preserve wealth for future generations.

3. Planning for Generational Wealth

The 2026 Annual Gift Tax Exclusion can be a powerful tool for individuals seeking to establish a legacy and build generational wealth. By utilizing the exclusion to make strategic gifts, individuals can ensure that their beneficiaries receive a substantial portion of their wealth tax-free. This approach not only benefits the immediate recipients but also sets the stage for future generations to inherit a more substantial financial foundation.

4. Charitable Giving and Philanthropy

The Annual Gift Tax Exclusion is not limited to gifts made to individuals; it also applies to charitable donations. This means that individuals can support their favorite causes and organizations while also enjoying tax benefits. By making charitable gifts within the exclusion limit, individuals can make a positive impact on their communities and receive financial advantages. This aspect of the exclusion encourages philanthropy and allows individuals to leave a lasting legacy through their generosity.

5. Flexibility and Control

The Annual Gift Tax Exclusion provides individuals with flexibility and control over their wealth distribution. By making gifts during their lifetime, individuals can ensure that their wealth is distributed according to their wishes and preferences. This level of control allows for personalized estate planning, ensuring that the distribution of assets aligns with the individual’s values and goals. The exclusion empowers individuals to take an active role in shaping their legacy.

Future Outlook and Considerations

As we anticipate the 2026 Annual Gift Tax Exclusion, it’s essential to consider the broader context and potential future developments. Here are some key considerations for individuals and professionals:

1. Economic Factors

The determination of the Annual Gift Tax Exclusion is influenced by economic factors, including inflation rates and overall economic growth. As such, monitoring economic trends and projections is crucial for understanding the potential exclusion amount for 2026. Economic stability and growth can impact the exclusion, making it important to stay informed about the financial landscape.

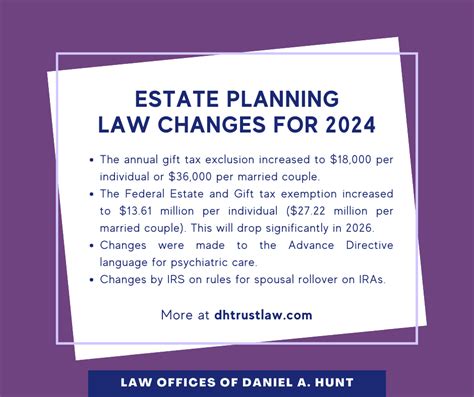

2. Tax Policy Changes

Tax policies are subject to change, and any modifications to the tax code can impact the Annual Gift Tax Exclusion. It is essential to stay updated on any proposed or enacted changes that may affect the exclusion amount or its applicability. Tax professionals and estate planners should closely follow legislative developments to ensure that their strategies remain aligned with the latest regulations.

3. Long-Term Planning

While the 2026 exclusion is an important consideration, long-term planning is essential for effective estate management. Individuals should develop comprehensive strategies that consider not only the current exclusion but also future projections and potential changes. By taking a holistic approach to estate planning, individuals can ensure that their wealth is transferred efficiently and effectively over the long term.

4. Collaboration with Professionals

Estate planning and tax strategies are complex, and collaboration with professionals is crucial. Tax advisors, estate planners, and legal experts can provide specialized knowledge and guidance to ensure that individuals make the most of the Annual Gift Tax Exclusion and other relevant provisions. By working with a team of professionals, individuals can optimize their financial strategies and achieve their wealth transfer goals.

5. Staying Informed

The world of tax and estate planning is dynamic, with frequent updates and changes. Staying informed about the latest developments, news, and regulations is essential for individuals and professionals alike. Subscribing to relevant newsletters, attending industry events, and engaging with professional networks can help ensure that individuals and their advisors remain up-to-date with the latest information and best practices.

Conclusion

The Annual Gift Tax Exclusion for 2026 presents a unique opportunity for individuals to optimize their gift-giving strategies and plan for the future. By understanding the implications, maximizing the benefits, and staying informed about potential changes, individuals can effectively utilize this exclusion to transfer wealth, minimize tax liabilities, and build a lasting legacy. With strategic planning and professional guidance, the 2026 Annual Gift Tax Exclusion can be a powerful tool for achieving financial goals and supporting loved ones.

What is the Annual Gift Tax Exclusion?

+The Annual Gift Tax Exclusion is a provision in the tax code that allows individuals to make gifts of a certain amount to any number of recipients without incurring gift taxes. It encourages gift-giving and wealth transfer while ensuring the IRS receives its due taxes on larger gifts.

How often is the Annual Gift Tax Exclusion adjusted?

+The Annual Gift Tax Exclusion is typically adjusted every few years to account for inflation and economic changes. The exact timing of adjustments can vary, but it is generally done to maintain the exclusion’s relevance and effectiveness.

What are the implications of the 2026 Annual Gift Tax Exclusion for estate planning?

+The 2026 Annual Gift Tax Exclusion is expected to provide individuals with a greater opportunity to transfer wealth tax-free, minimize estate taxes, and build generational wealth. It also encourages charitable giving and allows for more flexibility and control in wealth distribution.

How can individuals maximize the benefits of the 2026 exclusion?

+Individuals can maximize the benefits of the 2026 exclusion by planning early, utilizing multiple years, making gifts to multiple beneficiaries, combining strategies with other tax benefits, and consulting professional guidance.

What are the key considerations for the future outlook of the Annual Gift Tax Exclusion?

+Key considerations for the future outlook include economic factors, tax policy changes, long-term planning, collaboration with professionals, and staying informed about the latest developments in tax and estate planning.