Ark Property Tax

Welcome to this comprehensive guide on Ark Property Tax, a subject of great importance for property owners and investors in the United States. Ark Property Tax, or the Arkansas Property Tax, is a vital component of the state's tax system, playing a crucial role in funding essential public services and infrastructure. This article aims to provide an in-depth analysis of Ark Property Tax, covering its history, calculation methods, assessment procedures, and the implications it has for property owners across the state.

Understanding Ark Property Tax: An Overview

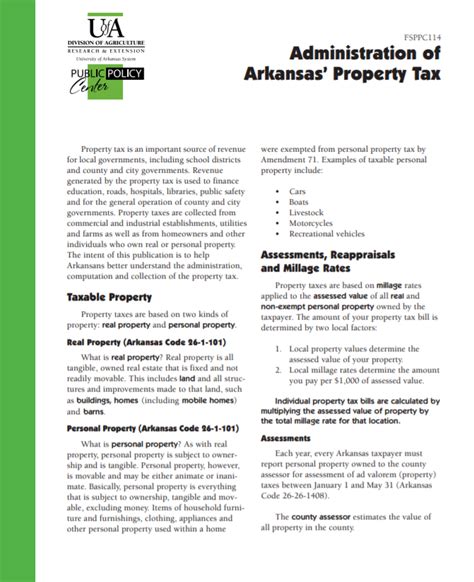

Ark Property Tax is a local tax imposed on real estate property owners in the state of Arkansas. It is an essential source of revenue for local governments, school districts, and special taxing districts, ensuring the provision of vital services such as education, public safety, and infrastructure maintenance.

The tax is typically levied annually and is calculated based on the assessed value of the property and the applicable tax rate, which can vary depending on the location and the type of property. The revenue generated from Ark Property Tax is distributed among different taxing entities, each with its own role in maintaining and improving the community's well-being.

Key Components of Ark Property Tax

- Assessment: The process of determining the value of a property is a critical step in Ark Property Tax calculation. Certified assessors conduct regular assessments to ensure an accurate reflection of a property's value.

- Tax Rates: Tax rates are established by local governments and can vary from one county or municipality to another. These rates are crucial in determining the final tax liability for property owners.

- Tax Relief Programs: Arkansas offers several tax relief programs aimed at assisting eligible property owners. These programs include homestead credits, senior citizen exemptions, and other incentives to reduce the tax burden for specific groups.

- Appeal Process: Property owners have the right to appeal their assessed value if they believe it to be inaccurate. The appeal process ensures transparency and fairness in the assessment system.

Now, let's delve deeper into the specifics of Ark Property Tax, exploring its historical context, current trends, and the potential future implications for property owners and the state as a whole.

The Evolution of Ark Property Tax

Ark Property Tax has a long and complex history, evolving over the years to adapt to the changing needs of the state and its residents. The origins of property taxation in Arkansas can be traced back to the early days of statehood, with the first property tax laws enacted in the mid-19th century.

Initially, property taxes were primarily used to fund local governments and their basic functions. As the state's economy and population grew, so did the demand for public services, leading to the expansion of property tax revenue allocation to include education, transportation, and other critical areas.

One of the significant milestones in the evolution of Ark Property Tax was the introduction of the ad valorem tax system, which bases tax assessments on the actual value of the property. This system, adopted in the early 20th century, aimed to ensure a more equitable distribution of the tax burden among property owners.

Modernizing Property Taxation in Arkansas

In recent decades, Arkansas has made efforts to modernize its property tax system to keep up with the changing dynamics of the real estate market and the evolving needs of its citizens. These efforts have included:

- Assessment Reforms: The state has implemented various assessment reforms to improve accuracy and consistency. These reforms have standardized assessment procedures and introduced new technologies to enhance data collection and analysis.

- Tax Relief Initiatives: Recognizing the importance of tax relief for certain segments of the population, Arkansas has expanded its tax relief programs. This includes initiatives like the Homestead Credit, which provides a credit against property taxes for eligible homeowners.

- Online Tax Services: The Arkansas Department of Finance and Administration (DFA) has developed online platforms to streamline tax payment processes and provide taxpayers with easy access to tax information and resources.

Calculating Ark Property Tax: A Detailed Breakdown

Understanding how Ark Property Tax is calculated is crucial for property owners to estimate their tax liability accurately. The calculation process involves several steps, each influenced by specific factors and regulations.

Assessing Property Value

The first step in determining Ark Property Tax is assessing the value of the property. Certified assessors conduct thorough evaluations, considering factors such as:

- Market Value: The current market value of the property is a key determinant. Assessors analyze recent sales of similar properties to estimate the fair market value.

- Property Improvements: Any improvements or upgrades made to the property, such as renovations or additions, can impact its value.

- Economic Factors: Local economic conditions, including supply and demand, can influence property values and, consequently, tax assessments.

Once the assessment is complete, the property's assessed value is determined, serving as the basis for tax calculation.

Applying Tax Rates

The assessed value of the property is then multiplied by the applicable tax rate to determine the property's tax liability. Tax rates can vary significantly depending on the location of the property and the type of taxing district it falls within.

For instance, a property located in a densely populated urban area with a high demand for public services may have a higher tax rate compared to a rural property. Similarly, properties within special taxing districts, such as fire protection districts or water improvement districts, may have additional tax rates to support these specific services.

Calculating Tax Liability

To calculate the final tax liability, the assessed value is multiplied by the applicable tax rate(s). This calculation results in the total tax amount owed by the property owner. However, it's important to note that various credits, exemptions, and deductions can reduce the final tax bill.

For example, eligible homeowners can claim the Homestead Credit, which provides a dollar-for-dollar reduction in their property tax bill. Other tax relief programs, such as the Senior Citizen Exemption, can further reduce the tax burden for qualified individuals.

Ark Property Tax in Practice: Real-World Examples

To illustrate the practical application of Ark Property Tax, let's explore a couple of real-world scenarios. These examples will help demonstrate how the tax is calculated and its potential impact on property owners.

Scenario 1: Urban Property Owner

Imagine a homeowner, Mr. Johnson, who owns a residential property in Little Rock, the capital city of Arkansas. The property has an assessed value of $250,000, and the applicable tax rate is 1.25%.

Using the formula:

Tax Liability = Assessed Value x Tax Rate

Mr. Johnson's tax liability would be calculated as follows:

Tax Liability = $250,000 x 0.0125 = $3,125

However, Mr. Johnson is eligible for the Homestead Credit, which reduces his tax liability by $500. Therefore, his final tax bill would be $2,625.

Scenario 2: Rural Property Owner

Now, consider Mrs. Smith, a homeowner with a rural property in a small town in Arkansas. Her property has an assessed value of $150,000, and the applicable tax rate is 1.0%.

Using the same formula:

Tax Liability = Assessed Value x Tax Rate

Mrs. Smith's tax liability calculation would look like this:

Tax Liability = $150,000 x 0.01 = $1,500

In this case, Mrs. Smith is not eligible for any additional tax relief programs, so her final tax bill would be $1,500.

Implications and Future Outlook

Ark Property Tax has significant implications for property owners, local governments, and the state's overall fiscal health. Here are some key considerations and potential future developments:

Impact on Property Owners

For property owners, Ark Property Tax is a significant financial obligation that can impact their overall cost of living and investment decisions. Understanding the tax system and taking advantage of available tax relief programs can help reduce the financial burden.

Local Government Funding

Ark Property Tax is a critical source of revenue for local governments and school districts. It enables them to provide essential services, maintain infrastructure, and support economic development initiatives. The distribution of tax revenue ensures that local governments can meet the needs of their communities effectively.

Potential Reforms and Challenges

While Arkansas has made significant strides in modernizing its property tax system, there are still areas for improvement. Some of the potential challenges and reforms include:

- Assessment Accuracy: Ensuring that property assessments are fair and accurate remains a priority. Further improvements in assessment methodologies and technology can enhance transparency and trust.

- Tax Relief Expansion: Exploring additional tax relief programs or expanding existing ones can provide greater support to property owners, especially those facing financial challenges.

- Online Services Enhancement: Continued development of online platforms and resources can make it easier for taxpayers to access information, pay taxes, and manage their accounts.

Conclusion

Ark Property Tax is a vital component of Arkansas' tax system, playing a crucial role in funding public services and maintaining the state's infrastructure. Understanding the intricacies of this tax, from assessment procedures to calculation methods and tax relief programs, is essential for property owners and investors. By staying informed and engaged, property owners can navigate the tax system effectively and contribute to the state's economic growth and well-being.

Frequently Asked Questions (FAQ)

How often is Ark Property Tax assessed and calculated?

+Ark Property Tax is typically assessed and calculated on an annual basis. However, in certain cases, reassessments may occur more frequently, especially if there are significant changes to the property or the local tax rates.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process varies by county, but generally involves submitting an appeal application and providing supporting evidence to the local assessor’s office.

Are there any tax relief programs available for property owners in Arkansas?

+Yes, Arkansas offers several tax relief programs to assist eligible property owners. These include the Homestead Credit, Senior Citizen Exemption, and other incentives. It’s important to research and understand the qualifications and application processes for these programs.

How can I stay informed about changes to Ark Property Tax laws and regulations?

+To stay updated on Ark Property Tax laws and regulations, you can subscribe to newsletters or alerts from the Arkansas Department of Finance and Administration (DFA) or local government websites. Additionally, attending local tax workshops or community meetings can provide valuable insights into any upcoming changes.

What happens if I don’t pay my Ark Property Tax on time?

+Late payment of Ark Property Tax can result in penalties and interest charges. It’s important to pay your taxes on time to avoid additional fees and potential legal consequences. If you’re facing financial difficulties, consider exploring tax relief programs or contacting your local tax office for assistance.