Personal Property Tax Missouri

Personal property tax in Missouri is a crucial aspect of the state's revenue system, impacting individuals and businesses alike. This tax is levied on tangible personal property, which encompasses a wide range of assets, from vehicles and machinery to furniture and equipment. Understanding the intricacies of Missouri's personal property tax is essential for residents and businesses to ensure compliance and optimize their financial strategies.

Understanding Personal Property Tax in Missouri

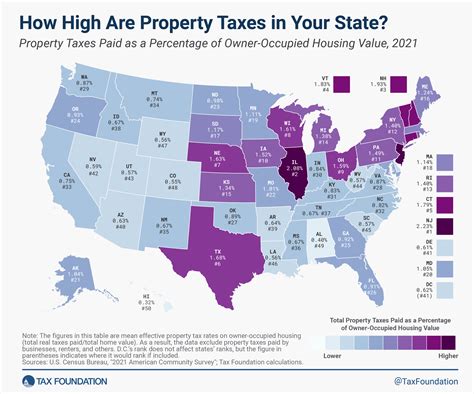

The personal property tax in Missouri is an ad valorem tax, meaning it is based on the assessed value of the property. This tax is distinct from real estate taxes, which are levied on real property such as land and buildings. Instead, personal property tax focuses on the tangible assets owned by individuals and businesses.

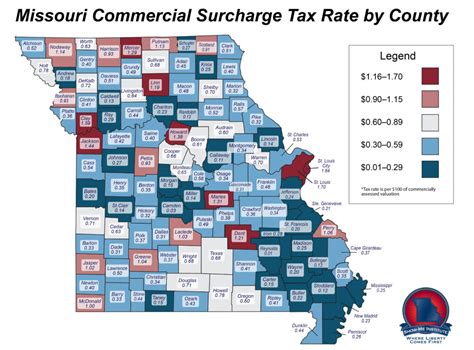

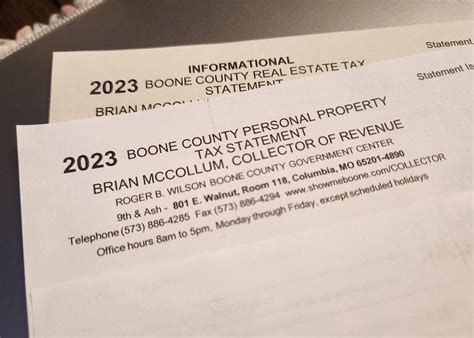

Missouri's personal property tax system is governed by state statutes and administered by local governments, typically at the county level. Each county assesses and collects taxes on personal property, with the revenue generated used to fund various local services and infrastructure projects.

Taxable Property and Exemptions

In Missouri, personal property is classified into two main categories for tax purposes: tangible personal property and intangible personal property. Tangible personal property includes physical assets like vehicles, boats, aircraft, machinery, and equipment. Intangible personal property, on the other hand, refers to non-physical assets such as stocks, bonds, and intellectual property.

While tangible personal property is generally taxable, there are certain exemptions and exclusions. For instance, household goods and personal effects used for personal or family purposes are typically exempt from personal property tax. Additionally, some specific types of property, such as agricultural equipment and certain types of business inventory, may be exempt under certain conditions.

It's important to note that the specific exemptions and exclusions can vary depending on the county and the nature of the property. Understanding these exemptions is crucial for individuals and businesses to accurately assess their tax obligations.

Assessment and Valuation

The assessment and valuation process for personal property tax in Missouri involves several key steps. Property owners are required to report their personal property annually to the county assessor’s office. This report includes a detailed list of the taxable property, along with its value and any applicable exemptions.

The county assessor then evaluates the reported property and determines its taxable value. This valuation process considers factors such as the property's age, condition, and market value. The assessor may also conduct physical inspections or rely on other valuation methods to ensure an accurate assessment.

Once the taxable value is determined, the assessor calculates the tax liability based on the assessed value and the applicable tax rate. The tax rate is set by the local government and can vary from one county to another.

| County | Tax Rate (%) |

|---|---|

| St. Louis County | 0.75 |

| Jackson County | 0.90 |

| Greene County | 0.65 |

| St. Charles County | 0.70 |

| Jefferson County | 0.72 |

It's worth noting that the tax rate may also vary within a county, depending on the specific taxing district or jurisdiction.

Filing and Payment

Property owners in Missouri are typically required to file personal property tax returns annually. The filing deadline varies by county but is generally aligned with the state’s fiscal year, which runs from July 1 to June 30. It’s essential for property owners to stay informed about the specific deadlines and requirements in their respective counties.

Once the tax liability is calculated, property owners are responsible for paying the assessed taxes. Payment methods may vary, with options including online payments, checks, or in-person payments at the county treasurer's office. It's important to ensure timely payment to avoid penalties and interest charges.

Impact on Individuals and Businesses

The personal property tax in Missouri has significant implications for both individuals and businesses. For individuals, this tax can affect their overall financial planning and budgeting, especially for those with valuable personal property assets.

Businesses, on the other hand, face a more complex scenario. The personal property tax can impact a business's bottom line, especially for companies with extensive equipment, machinery, or inventory. Additionally, businesses must navigate the complexities of reporting and valuing their personal property assets accurately to avoid potential disputes or penalties.

Strategies for Compliance and Optimization

To ensure compliance and optimize their financial strategies, individuals and businesses in Missouri can consider the following approaches:

- Stay Informed: Keep up-to-date with the latest personal property tax regulations and exemptions. Understanding the rules and requirements specific to your county is crucial for accurate reporting and assessment.

- Seek Professional Advice: For complex personal property portfolios or business assets, seeking advice from tax professionals or consultants can be beneficial. They can provide guidance on valuation, reporting, and potential strategies to minimize tax liability.

- Utilize Exemptions: Take advantage of the available exemptions and exclusions. By understanding the criteria for exempt property, individuals and businesses can reduce their taxable base and, consequently, their tax liability.

- Accurate Reporting: Ensure that personal property tax returns are completed accurately and on time. Inaccurate or late reporting can lead to penalties and additional costs.

- Consider Tax Planning: Engage in proactive tax planning to optimize your financial strategy. This may involve strategic asset acquisitions, disposals, or other planning measures to manage your tax obligations effectively.

Future Implications and Considerations

As Missouri’s economy and tax landscape continue to evolve, the personal property tax system may also undergo changes. Here are some potential future implications and considerations:

- Economic Impact: The personal property tax contributes significantly to local government revenue, supporting essential services and infrastructure. Changes in the tax system could have broader economic implications, impacting not only property owners but also local businesses and residents.

- Tax Reform: Missouri's tax system is subject to ongoing debates and reforms. Future tax reforms may include adjustments to tax rates, exemptions, or the overall structure of personal property taxation. Staying informed about potential changes is essential for long-term financial planning.

- Technological Advancements: With the rapid advancement of technology, there may be opportunities to streamline the personal property tax process. Digital platforms and online tools could enhance the accuracy and efficiency of reporting, valuation, and payment processes.

- Intergovernmental Coordination: Given the local administration of personal property tax, there may be opportunities for better coordination and standardization across counties. Improved intergovernmental collaboration could lead to more consistent tax policies and procedures.

Conclusion

Personal property tax in Missouri is a critical component of the state’s tax system, impacting the financial strategies of individuals and businesses. Understanding the intricacies of this tax, including taxable property, exemptions, and the assessment process, is essential for compliance and optimization.

By staying informed, seeking professional guidance, and implementing strategic tax planning measures, individuals and businesses can navigate the complexities of personal property tax in Missouri effectively. As the tax landscape evolves, staying attuned to future developments and considerations will be crucial for long-term financial success.

What is the personal property tax rate in Missouri?

+

The personal property tax rate in Missouri varies by county. It’s important to check with your local county assessor’s office for the specific tax rate applicable to your property.

Are there any exemptions or deductions for personal property tax in Missouri?

+

Yes, there are various exemptions and deductions available for personal property tax in Missouri. These may include exemptions for household goods, personal effects, and certain types of business inventory. It’s advisable to consult with a tax professional or review the relevant state statutes for a comprehensive understanding of the available exemptions.

How often do I need to file a personal property tax return in Missouri?

+

Personal property tax returns in Missouri are typically filed annually. The filing deadline varies by county, so it’s essential to stay informed about the specific deadline applicable to your property. Failure to file on time may result in penalties and interest charges.

Can I appeal my personal property tax assessment in Missouri?

+

Yes, property owners in Missouri have the right to appeal their personal property tax assessments. If you believe your assessment is inaccurate or unfair, you can file an appeal with the county board of equalization. It’s advisable to gather supporting evidence and consult with a tax professional to ensure a successful appeal.