Property Tax Information Nj

Property taxes in New Jersey are a significant topic of interest for residents and property owners alike. The Garden State has one of the highest property tax burdens in the nation, and understanding the intricacies of the tax system is crucial for effective financial planning. This comprehensive guide aims to delve into the specifics of property taxes in New Jersey, providing an in-depth analysis of the tax structure, assessment processes, and strategies to navigate the system efficiently.

Understanding the Property Tax Structure in New Jersey

New Jersey’s property tax system is a complex framework designed to generate revenue for local governments, primarily to fund essential services such as education, public safety, and infrastructure. The state’s constitution mandates that all real property be assessed and taxed based on its true value, which forms the basis of the tax system’s fairness and uniformity.

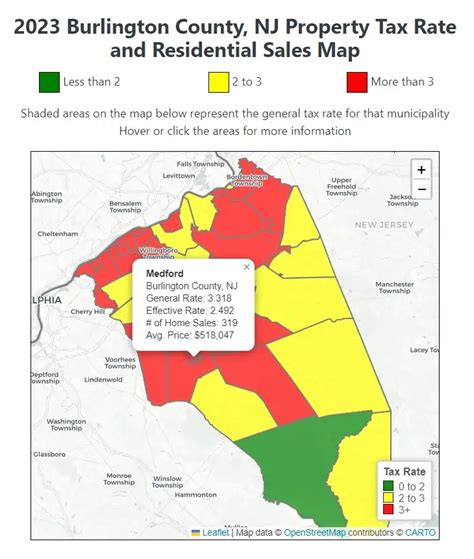

The property tax system in New Jersey operates on a local level, with each of the state's 565 municipalities having the authority to set tax rates. This local control results in significant variations in tax rates and assessments across the state. As of [current year], the average effective property tax rate in New Jersey stands at [average rate]%, with municipalities ranging from [lowest rate]% to [highest rate]%.

The property tax formula in New Jersey is straightforward: tax rate x assessed value = property tax bill. However, understanding the assessment process is crucial to deciphering this formula.

Assessment Process: A Critical Factor

Property assessment in New Jersey is the process of determining the taxable value of a property. Assessors in each municipality are responsible for this task, and they use various methods to estimate the market value of properties. The primary method involves a comparison of the subject property with similar properties that have recently sold in the area, taking into account factors such as size, age, condition, and location.

| Assessment Category | Description |

|---|---|

| Market Value | The most probable price a property would sell for in an open market. |

| Assessed Value | The value placed on a property for tax purposes, often a percentage of its market value. |

| Tax Rate | The rate at which a property is taxed, determined by the local government. |

Assessments are typically performed every [assessment cycle length] years, with interim years seeing minor adjustments to account for market fluctuations. However, property owners can appeal their assessments if they believe the value is incorrect or unfair. The appeal process involves submitting evidence to support the claim and can result in a reduction of the assessed value, leading to lower property taxes.

Strategies for Managing Property Taxes in New Jersey

Given the high property tax burden in New Jersey, property owners seek strategies to manage their tax obligations effectively. Here are some key strategies to consider:

1. Stay Informed About Local Tax Rates

With over 500 municipalities, New Jersey offers a wide range of tax rates. Researching and comparing tax rates in different areas can help prospective buyers and investors make informed decisions. Online resources and real estate agents can provide valuable insights into local tax rates and their impact on property values.

2. Understand the Assessment Process

Knowledge is power when it comes to property taxes. Understanding how assessments are conducted and the factors that influence them can help property owners identify potential issues and take corrective actions. Regularly monitoring local property sales and keeping records of any improvements or upgrades to the property can be beneficial during the assessment process.

3. Explore Tax Relief Programs

New Jersey offers various tax relief programs to ease the burden on certain groups of taxpayers. These include homestead rebates, senior citizen and disabled veteran deductions, and the Farmland Assessment program, which provides lower assessments for eligible agricultural properties. Staying informed about these programs and meeting the eligibility criteria can result in significant tax savings.

4. Appeal Your Assessment

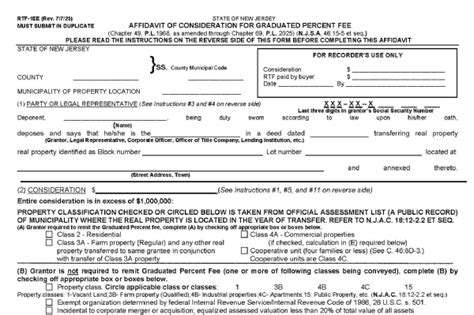

If you believe your property’s assessed value is too high, appealing the assessment is a valid option. The process typically involves submitting an appeal to the county tax board, providing evidence to support your claim, and potentially attending a hearing. Successful appeals can lead to a reduction in your property’s assessed value, resulting in lower taxes.

5. Consider Tax-Efficient Home Improvements

Certain home improvements can increase the value of your property while also providing tax benefits. For instance, energy-efficient upgrades may qualify for tax credits or deductions, and certain improvements may not increase the assessed value of your property, resulting in no additional tax liability. Consulting a tax professional or a local assessor can help identify these opportunities.

The Impact of Property Taxes on Real Estate Decisions

Property taxes are a significant factor in real estate decisions, influencing everything from home purchases to investment strategies. High property taxes can deter potential buyers, especially in a competitive market, and may affect a property’s resale value. Conversely, areas with lower tax rates may see increased demand, driving up property values.

For investors, property taxes play a crucial role in cash flow calculations and overall investment returns. Strategies such as tax-efficient property management and exploring tax-advantaged financing options can significantly impact an investor's bottom line.

Case Study: The Impact of Property Taxes on Investment Decisions

Let’s consider an example of how property taxes can influence investment decisions. Suppose an investor is considering purchasing two similar properties in different municipalities. Property A has a lower purchase price but a higher tax rate, while Property B has a higher purchase price but a lower tax rate. The investor must weigh these factors to determine which property offers the best long-term investment potential, taking into account not only the initial cost but also the ongoing tax obligations.

Future Implications and Trends

New Jersey’s property tax landscape is constantly evolving, influenced by various economic, political, and social factors. While it is challenging to predict the future with certainty, certain trends and potential developments are worth noting:

1. Potential Tax Reform

New Jersey has a history of property tax reform efforts, with various proposals aimed at reducing the tax burden and increasing fairness. While past attempts have faced challenges, ongoing discussions and public pressure may lead to future reforms. Staying informed about these developments is crucial for property owners and investors.

2. Impact of Economic Factors

Economic conditions play a significant role in property tax rates. During economic downturns, municipalities may face budget constraints, leading to increased tax rates to maintain essential services. Conversely, a strong economy can provide municipalities with alternative revenue sources, potentially reducing the reliance on property taxes.

3. Technological Advancements

Advancements in technology, such as AI-powered assessment tools, can improve the accuracy and efficiency of the assessment process. These tools can help assessors analyze large datasets and identify trends, potentially leading to more uniform assessments across the state.

Conclusion

Property taxes in New Jersey are a complex but crucial aspect of property ownership and investment. By understanding the tax structure, assessment processes, and available strategies, property owners and investors can navigate the system effectively, manage their tax obligations, and make informed real estate decisions. Staying informed about local tax rates, exploring tax relief programs, and appealing assessments when necessary are essential components of a comprehensive tax management strategy.

How often are property assessments conducted in New Jersey?

+Property assessments in New Jersey are typically conducted every [assessment cycle length] years. However, interim adjustments may be made to account for market fluctuations.

Can I appeal my property assessment if I believe it’s too high?

+Yes, property owners have the right to appeal their assessments if they believe the value is incorrect or unfair. The appeal process involves submitting evidence to support the claim and may result in a reduction of the assessed value.

What are some tax relief programs available in New Jersey?

+New Jersey offers various tax relief programs, including homestead rebates, senior citizen and disabled veteran deductions, and the Farmland Assessment program. These programs provide tax benefits to eligible taxpayers, reducing their overall tax burden.