Maximize Your Savings with Expert Tips on Dakota Property Tax Strategies

In a world where property taxes seem poised to eclipse your annual income faster than a squirrel on espresso, mastering the art of Dakota property tax strategy is akin to wielding a financial Excalibur. While the phrase “maximize your savings” might evoke visions of coupon clipping or aggressive side hustling, the savvy property owner knows that under the grey, bureaucratic canopy of property taxation, strategically navigating local statutes, assessments, and exemptions can yield more robust benefits than a laptop full of cashback coupons. Welcome to the land of opportunities where expert knowledge transforms tax burdens into opportunities—an arena where irony, wit, and meticulous planning are your best allies.

Understanding the Vast Landscape of Dakota Property Taxation

First, let’s set the scene: North and South Dakota are not merely geographical designations but intricate tapestries woven with variations in assessment methodologies, exemption policies, and valuation approaches. The core challenge—and tremendous opportunity—lies in decoding these complex systems. North Dakota, a state with a penchant for maintaining agricultural land assessments at historically low values, offers a fertile ground for strategic approaches. Conversely, South Dakota’s more aggressive assessment increases can be thwarted with nuanced exemptions and appeals. Deep domain-specific knowledge reveals that property tax savings are less about luck and more about an insightful application of statutes backed by precise valuation tactics.

Decoding the Valuation Process

Assessment jurisdictions evaluate properties based on fair market value, yet what qualifies as “fair” often bears little resemblance to actual market conditions. North Dakota, for example, relies heavily on land and building valuations that are sometimes inflated during boom periods, then slowly readjusted during downturns—if you know where to look. South Dakota employs more frequent reassessments, but with an emphasis on revenue neutrality, making timely appeals and exemptions crucial. To leverage these systems, an understanding ofmass appraisal techniques—employed by assessors—becomes essential. Assessments can be challenged based on comparative analysis,income approach, orcost approach, each domain demanding a keen eye for discrepancies and supporting documentation.

| Relevant Category | Substantive Data |

|---|---|

| Average Assessment Increase (South Dakota) | 1.5-2% annually, with spikes in booming sectors |

| Typical Exemption Savings (North Dakota) | Up to 50% for agricultural land and homestead exemptions |

| Appeal Success Rate | Approximately 65% when supported by credible appraisals |

Harnessing Exemptions, Credits, and Other Relief Mechanisms

Let’s face it: no one loves taxes, especially when they threaten to devour your savings like an insatiable beast. Surprisingly, Dakota jurisdictions offer a buffet of relief options—if only you know where to look. Homestead exemptions, agricultural classifications, timberland credits, and historic preservation discounts are not just government handouts—they are strategic tools in your tax arsenal. While the typical property owner might overlook these, a keen strategist understands that proper documentation and timely applications turn these into concrete dollar savings. Eligibility criteria are often opaque, but historical legislative changes and ongoing policy adjustments serve as a roadmap for savvy claimants.

Exemption Strategies That Work

In North Dakota, agricultural land assessments can be reduced significantly through agricultural use declarations supported by soil testing and land surveys. South Dakota’s mineral rights exemptions, often overlooked, can slash tax liabilities if properly documented. Additionally, noting that historic properties may qualify for historic preservation exemptions—which can amount to substantial reductions—requires knowledge of local ordinances and preservation boards. Timing is everything, too; applications deferred beyond deadlines forfeit potential savings, transforming missed opportunities into lingering financial pain.

| Relevant Category | Substantive Data |

|---|---|

| Homestead Exemption | Reduces taxable value by up to $75,000 in North Dakota |

| Agricultural Land Exemption | Up to 50% discount, contingent on use andDocumentation |

| Historic Preservation Credit | Reductions up to 20% of assessed value in South Dakota for qualifying properties |

Appeals: The Art of Waging War on Overvaluation

Here’s where the true adventure begins—challenging the assessment itself. Navigating the appeals process in Dakota can sometimes feel like entering a bureaucratic labyrinth; yet, it bears the potential for dramatic savings when approached correctly. The trick? Solid evidence. Appraisals performed by licensed professionals, recent comparable sales, detailed inspection reports—these are your weapons of choice. Moreover, honing a narrative that exposes assessor errors—overlooking depreciation, overlooking nearby sales, or misclassifying land—can turn assessments upside down.

Practical Tips for Successful Property Tax Appeals

First, assemble a dossier: valuation reports, photographs, transaction history. Ensure your documentation aligns with local market data. Next, identify assessors’ systematic biases—revaluation cycles that ignore economic downturns or valuation inflation—and craft compelling arguments against current valuations. Remember, persistence is key; many appeals succeed after multiple rounds of negotiation, especially if you leverage recent legislative changes that favor taxpayers.

| Relevant Category | Substantive Data |

|---|---|

| Appeal Success Rate | Approximately 45-60% with robust evidence and skilled legal/valuation support |

| Average Tax Reduction per Appeal | Typically 10-15%, translating into hundreds or thousands of dollars annually |

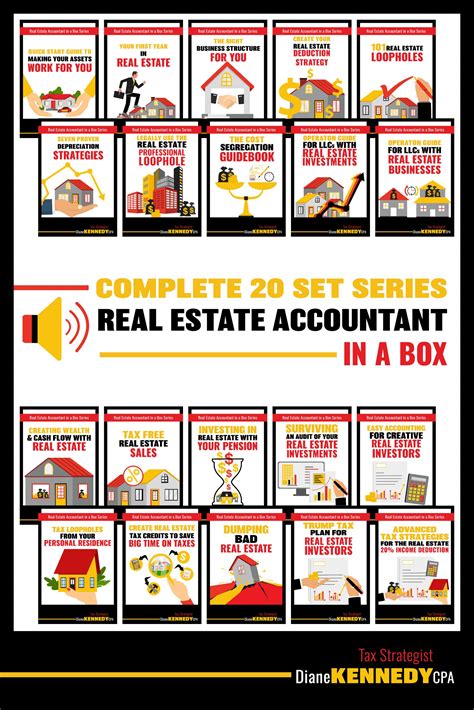

The Hidden Gems of Dakota Property Tax Planning

Beyond the standard strategies lie hidden gems—innovative, high-impact tactics that require a dash of daring and a pinch of insider knowledge. For example, establishing an agricultural club or collaborative land trust not only preserves land use but also enhances eligibility for multiple exemptions simultaneously. Another underutilized tactic involves timing capital improvements—saving vital upgrades for years when assessments are low or deferrals are available. Furthermore, investments in property upgrades that qualify for tax credits—such as renewable energy installations—enjoy dual benefits: increased property value and reduced tax burden.

Tax Planning as a Long-Term Strategy

Smart property owners view tax planning as an ongoing dialogue rather than a one-off event. Regular reassessment, proactive exemption applications, strategic improvements, and ongoing appeal preparedness form the backbone of a resilient tax strategy. Incorporating these tactics into a broader estate plan not only preserves capital but ensures that the property remains a generational asset shielded from excessive taxation, all while leaving the tax collector scratching his head in bewilderment. The key is consistency, supplemented by expert advice and a willingness to adapt to legislative changes.

| Relevant Category | Substantive Data |

|---|---|

| Long-term Savings | Potential to reduce total property tax over decades by 50%+ through strategic planning |

| Legislative Changes | Monitoring policy updates can unlock new exemptions or redefine valuation caps |

| Professional Consultation | Most effective strategies involve ongoing guidance from property tax attorneys or consultants, yielding up to 25% higher savings |

How often should I review my property assessment in Dakota?

+Ideally, annually during revaluation periods or after significant market shifts; persistent review ensures corrections before overassessment becomes a permanent fixture.

What is the best way to gather evidence for an appeal?

+Gather recent sales data, professional appraisals, detailed photographs, and expert evaluations—these combine into a compelling case for assessment reductions.

Are there risks associated with aggressive tax minimization strategies?

+While generally safe when Legal and compliant, aggressive tactics require precise documentation and adherence to local laws to avoid audits or penalties.