Irs Tax Return Leak Data Theft

In recent years, tax-related data breaches and identity theft have become increasingly prevalent, causing significant concerns for taxpayers and government agencies alike. The Internal Revenue Service (IRS) has been at the forefront of these issues, working diligently to combat tax-related crimes and protect sensitive taxpayer information. This article delves into the world of IRS tax return leak data theft, exploring the causes, consequences, and measures taken to prevent such incidents.

Understanding IRS Tax Return Data Leaks

IRS tax return data leaks refer to unauthorized access or disclosure of sensitive taxpayer information, including personal details and financial data. These leaks can occur through various means, such as cyberattacks, insider threats, or even human error. The consequences of such breaches can be severe, leading to identity theft, financial loss, and disruption of tax processes.

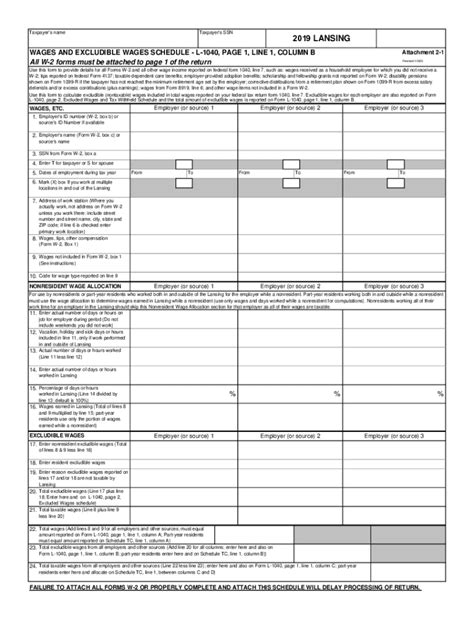

Tax return data contains a wealth of information that is highly valuable to cybercriminals. From names, addresses, and Social Security numbers to financial records and tax refund details, hackers can exploit this data for various fraudulent activities. Additionally, the sensitive nature of tax information makes it a prime target for cyber espionage and state-sponsored hacking attempts.

Recent Incidents and Impact

Over the past decade, several high-profile tax return data breaches have made headlines. In 2015, the IRS disclosed a massive data theft incident where criminals used Social Security numbers and other personal information to access tax accounts of approximately 700,000 taxpayers. This breach highlighted the vulnerability of the IRS systems and the potential impact on taxpayers.

More recently, in 2021, the IRS faced another significant challenge with the emergence of tax-related phishing scams. Criminals used sophisticated techniques to impersonate the IRS, tricking taxpayers into providing sensitive information. These scams not only caused financial losses but also eroded public trust in the tax system.

The impact of tax return data theft extends beyond financial implications. Identity theft victims often face a long and arduous journey to restore their identities, dealing with credit agencies, financial institutions, and law enforcement. The emotional toll and time spent resolving these issues can be significant, affecting individuals' lives and well-being.

| Incident | Year | Number of Affected Taxpayers |

|---|---|---|

| IRS Data Theft | 2015 | 700,000 |

| Tax-Related Phishing Scams | 2021 | Unknown (Multiple Victims) |

Preventing IRS Tax Return Data Theft

The IRS recognizes the critical need to protect taxpayer information and has implemented various measures to enhance security and prevent data theft.

Strengthening Cybersecurity

The IRS has significantly invested in strengthening its cybersecurity infrastructure. This includes implementing advanced security protocols, encryption technologies, and robust authentication mechanisms to safeguard taxpayer data. Additionally, the IRS collaborates with leading cybersecurity experts and conducts regular security audits to identify and address vulnerabilities.

To combat phishing scams, the IRS has launched awareness campaigns, educating taxpayers about common scams and providing tips to identify fraudulent activities. The agency encourages taxpayers to report any suspicious emails or calls claiming to be from the IRS.

Identity Verification and Authentication

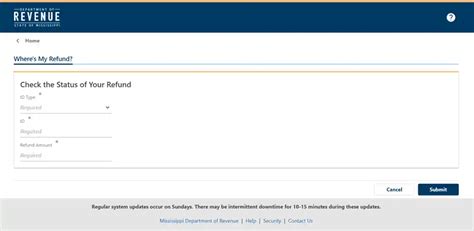

Recognizing the importance of verifying taxpayer identities, the IRS has implemented stricter authentication processes. These measures include requiring taxpayers to provide additional information, such as prior-year tax return data or personal identification numbers, to access their accounts securely.

Furthermore, the IRS is exploring biometric authentication methods, such as facial recognition and fingerprint scanning, to enhance the security of taxpayer accounts. These technologies aim to provide a more robust and convenient way for taxpayers to verify their identities.

Partnerships and Collaboration

The IRS actively collaborates with law enforcement agencies, industry partners, and international organizations to combat tax-related crimes. By sharing intelligence and best practices, the IRS aims to stay ahead of emerging threats and coordinate efforts to disrupt criminal networks.

Additionally, the IRS engages with taxpayers and tax professionals to promote secure practices. The agency provides resources and guidelines to help taxpayers protect their information, such as recommendations for strong passwords and secure data storage.

Future Implications and Continuous Improvement

As cybercriminals continue to evolve their tactics, the IRS remains committed to adapting and improving its security measures. The agency recognizes that a multi-layered approach is necessary to combat sophisticated threats effectively.

Artificial Intelligence and Machine Learning

The IRS is exploring the use of artificial intelligence (AI) and machine learning technologies to enhance its detection and response capabilities. These technologies can analyze vast amounts of data, identify patterns, and detect anomalies, helping the IRS identify potential threats and respond swiftly.

AI-powered systems can also assist in automating routine security tasks, freeing up resources for more complex investigations. By leveraging the power of AI, the IRS aims to stay ahead of emerging threats and improve its overall security posture.

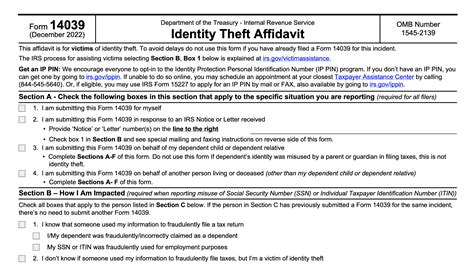

Identity Protection PIN Program

The IRS has introduced the Identity Protection Personal Identification Number (IP PIN) program to help victims of identity theft and prevent future incidents. Taxpayers who have been victims of identity theft are assigned a unique IP PIN, which they must use when filing their tax returns. This PIN helps verify the taxpayer’s identity and prevents unauthorized individuals from filing fraudulent returns.

The IP PIN program has shown promising results in reducing tax-related identity theft. By implementing this program, the IRS aims to provide an additional layer of security for taxpayers and minimize the impact of data breaches.

Frequently Asked Questions

What should I do if I suspect my tax return data has been compromised?

+If you suspect your tax return data has been compromised, it is crucial to take immediate action. First, contact the IRS Identity Protection Specialized Unit at 1-800-908-4490. They will guide you through the necessary steps to secure your account and protect your identity. Additionally, monitor your credit reports and tax accounts for any suspicious activities.

How can I protect my tax return data from cybercriminals?

+Protecting your tax return data requires a combination of secure practices. Here are some tips: use strong, unique passwords for your tax accounts, enable two-factor authentication where available, regularly update your security software, and be cautious of suspicious emails or calls claiming to be from the IRS. Additionally, consider using secure data storage solutions and encrypt sensitive tax documents.

What measures does the IRS take to secure taxpayer data?

+The IRS employs a range of security measures to protect taxpayer data. These include advanced cybersecurity protocols, encryption technologies, and robust authentication processes. The agency also conducts regular security audits and collaborates with industry experts to stay updated on emerging threats. Additionally, the IRS educates taxpayers and tax professionals about secure practices to minimize the risk of data breaches.