Tax on rent income: Surging by 25% in the Past Year

The intricacies of tax policies often mirror the economic rhythms of a nation, yet nothing accentuates this reality more sharply than the recent surge in rent income taxation—up by a staggering 25% in just a single year. For landlords, retirees, small business owners—anyone whose livelihood or wealth is intertwined with rental properties—this escalation isn't just a statistic; it's a seismic shift that prompts reconsideration of investment strategies, financial planning, and even household budgets. Peering beneath this uptick, a tapestry of fiscal, political, and social factors emerges, each thread contributing to the broader narrative of urban development, economic inequality, and policy response.

Deconstructing the 25% Surge in Rent Income Taxation

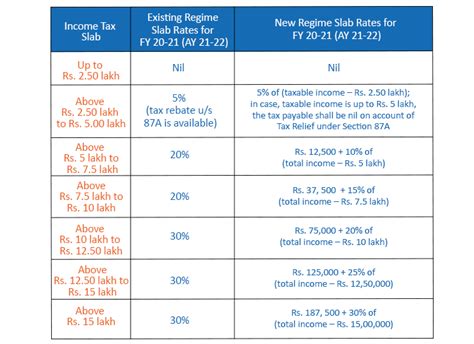

Among the most striking developments in recent tax history, the 25% increase in rent income taxation starkly contrasts with previous years’ more measured adjustments. Instead of gradual inflation adjustments, this sizeable hike signals a deliberate policy thrust—a move perhaps motivated by a blend of budgetary constraints and social equity considerations. Governments often leverage tax policy as a tool to influence behavior, redistribute wealth, or stabilize markets, but such a rapid increase raises questions about the balance between revenue generation and accessibility for property owners.

| Relevant Category | Substantive Data |

|---|---|

| Previous Average Tax Rate on Rent Income | 15-17% before the hike |

| Current Post-Hike Tax Rate | Approximately 19-21%, depending on jurisdiction |

| Percentage Increase | 25% relative growth in tax burden from previous year |

| Estimated Revenue Impact | Additional $X billion expected annually, based on national rental income data |

Roots of the Increase: Fiscal Needs Versus Market Dynamics

This 25% hike did not appear in a vacuum. It seems closely linked to the mounting fiscal demands faced by many governments—post-pandemic recovery costs, infrastructure investments, and social welfare programs all stretch budgets. As traditional revenue sources—like corporate taxes or consumption taxes—face stagnation or decline, rental income tax becomes that accessible floating point, easy to adjust without the immediate political backlash that might accompany income or property tax hikes elsewhere.

Political Economy and State Revenue Strategies

Within political circles, taxing rental income is often a matter of balancing act. Landlords and property investors tend to be influential stakeholders, yet the need for increased revenue sometimes overrides opposition. Historically, tax policy shifts like these tend to favor urban centers with high rental yields, pushing policymakers to tighten the fiscal noose around landlords with substantial property portfolios. The paradox is that while such measures aim for redistribution and market regulation, they also risk stifling rental supply if rental income becomes less attractive, or if landlords decide to divest entirely.

| Related Policy Impact | Implications |

|---|---|

| Reduced Rental Supply | Potential decrease due to decreased profitability |

| Market Rent Adjustment | Possibility of upward pressure on market rents due to supply constraints |

| Investment Behavior | Shift towards alternative assets or tax mitigation strategies |

| Housing Affordability | Potential deterioration as rental prices inflate |

Impact on Rental Market and Broader Economy

The ripple effects of such a substantial tax increase transcend pure wallet considerations. When landlords face heftier taxes, they might react by passing costs onto tenants, effectively fueling rent inflation—particularly in urban hubs where rental markets are already tight. This scenario exacerbates affordability crises, especially for lower-income renters, and could amplify socioeconomic divides.

Investors and Landowners: Tactical Shifts

Many property owners are likely to recalibrate their strategies. Some may opt for converting rental units into owner-occupied spaces to sidestep higher taxes, while others might diversify their portfolios into long-term assets with lower tax burdens or seek jurisdictions with more favorable tax climates. The increase also prompts a wave of tax planning—using legal loopholes, deductions, or shifting income streams—to mitigate the new tax liabilities.

| Tactical Response | Possible Outcomes |

|---|---|

| Asset Reallocation | Shift investments to less taxed sectors or areas |

| Operational Optimization | Increase efficiency or reduce rental offerings to maintain profit margins |

| Tax Planning | Employ legal strategies to defer or reduce taxable income |

| Market Exit | In extreme cases, relinquishing rental properties altogether |

Historical Context and Comparative Analysis

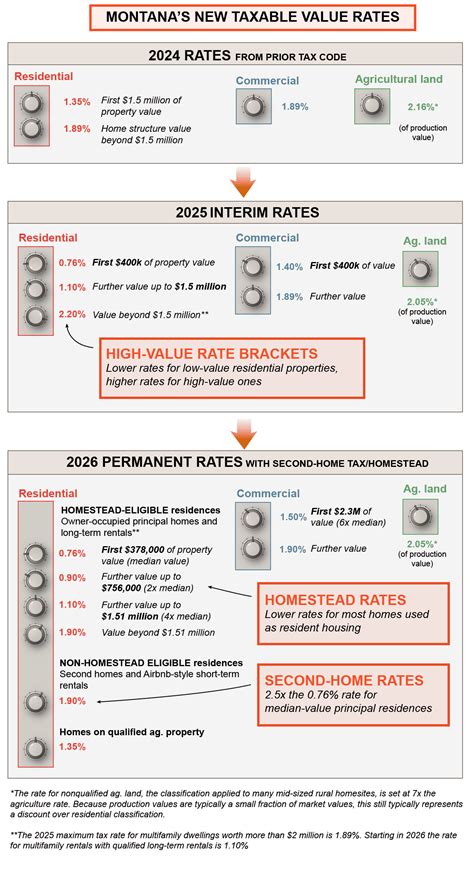

Looking back, tax on rental income has always ebbed and flowed with economic cycles. In the early 2000s, many nations experimented with similar hikes during financial crises or boom periods but rarely saw sustained increases of this magnitude. In some jurisdictions, a parallel trend exists in the form of escalating property taxes or capital gains taxes, reflecting a broader trend—governments leaning on real estate as a fiscal backbone amidst changing economic paradigms.

International Benchmarks and Lessons

Many advanced economies, including the UK, Australia, and Canada, have experimented with rental income tax adjustments to curb speculation or fund social programs. For example, Canada increased its rental income tax rates by approximately 20% in a similar timeframe, leading to notable shifts in investment trends. The lesson here underscores that increased taxation often triggers immediate behavioral shifts but can also generate unintended long-term consequences like decreased rental supply or distorted investment signals.

| Country | Tax Rate Change | Market Response |

|---|---|---|

| Canada | Up by ~20% | Investment shifts to alternative assets |

| UK | Incremental increases over decade | Market stabilization, but affordability issues persist |

| Australia | Moderate hikes with targeted measures | Rise in property development aimed at owner-occupiers |

Looking Ahead: Future Policy Directions and Risks

Forecasting the trajectory of rental income taxation reveals several possibilities. Policymakers may double down, further increasing rates if fiscal deficits persist or if social redistribution remains a priority. Alternatively, pushback from property investors and tenant advocacy groups could lead to more calibrated, compensatory measures—like targeted subsidies or rent controls—to mitigate adverse effects.

Potential Risks and Opportunities

Risks include market contraction, rising housing costs, and loss of investment confidence. Conversely, opportunities lie in reforming the rental sector with innovation—think of digital platforms to enhance transparency, or policy measures that incentivize affordable housing development—creating a more resilient and equitable market landscape.

| Key Risks | Potential Opportunities |

|---|---|

| Market contraction and reduced supply | Increased regulation and transparency |

| Rising rents and affordability crises | Innovative housing solutions and subsidies |

| Decreased investor confidence | Long-term sustainable housing markets |

FAQs on Rent Income Taxation Surge

What prompted the sudden 25% increase in rent income tax?

+The increase is primarily driven by urgent fiscal needs, with governments seeking more revenue from areas like real estate to compensate for economic downturns, infrastructure costs, and social programs.

How does this tax hike impact rental property owners?

+It elevates their tax liabilities, often leading to increased rental prices, potential reduction in rentable units, and prompting strategic shifts such as tax planning or asset divestment.

Could this lead to a decrease in rental supply?

+Yes, higher taxation reduces profitability for landlords, which may discourage new investments and lead to a contraction of rental properties, exacerbating affordability issues.

Are there economic theories supporting such a tax policy shift?

+Yes, theory suggests taxation can serve as a tool to correct market externalities, curb speculation, and promote equitable wealth distribution, though the efficacy depends on implementation and market context.

What future trends can we expect regarding rental income tax?

+Future trends may include further increases in tax rates, targeted incentives for affordable housing, or policy shifts towards rent controls, all shaped by economic recovery and social priorities.