Nc Sales Tax On Cars

When purchasing a car in North Carolina, understanding the sales tax implications is crucial. The sales and use tax is a significant consideration for buyers, as it directly impacts the overall cost of the vehicle. In this article, we delve into the intricacies of the North Carolina sales tax on cars, providing a comprehensive guide to help you navigate this aspect of your automotive purchase.

Understanding North Carolina’s Sales Tax on Vehicles

The sales tax in North Carolina is applied to the purchase of most tangible personal property, including vehicles. This tax is collected by the North Carolina Department of Revenue and is calculated based on the vehicle’s purchase price or trade-in value, whichever is higher.

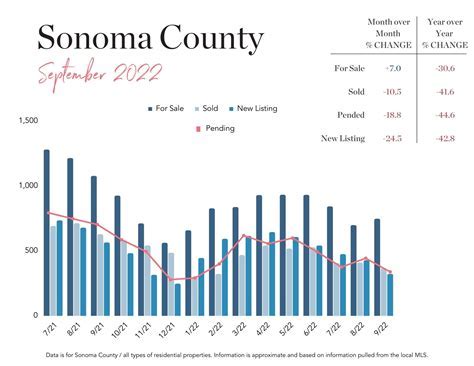

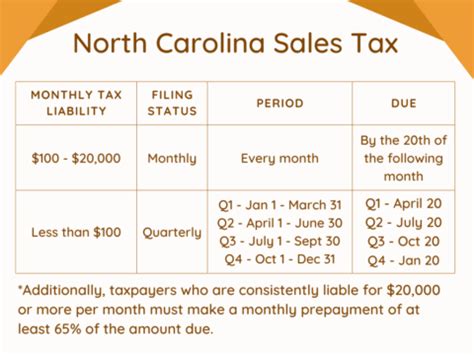

The state of North Carolina imposes a flat 3% sales tax rate on vehicle purchases. However, it's important to note that this rate is in addition to any applicable local taxes, which can vary by county. These local taxes, known as county surtaxes, are added to the state sales tax and can range from 0% to 2.5%, resulting in a combined rate of 3% to 5.5% across the state.

Calculating the Sales Tax on Your Car Purchase

To calculate the sales tax on your car purchase in North Carolina, you’ll need to determine the taxable value of the vehicle. This value is typically the purchase price, but it can be different in certain situations, such as when a trade-in is involved.

If you're purchasing a new car, the taxable value is usually the manufacturer's suggested retail price (MSRP) or the negotiated purchase price, whichever is lower. For used cars, the taxable value is generally the purchase price or the trade-in value of the vehicle you're trading in, whichever results in a higher tax amount.

Once you have the taxable value, you can calculate the sales tax by multiplying this value by the applicable tax rate, which is the sum of the state sales tax rate (3%) and the local county surtax (if any). This calculation will give you the total sales tax you'll owe on your car purchase.

| Tax Rate | Tax Amount |

|---|---|

| State Sales Tax (3%) | $300 |

| Local County Surtax (2%) | $200 |

| Total Sales Tax | $500 |

Sales Tax Exemptions and Special Considerations

While most vehicle purchases in North Carolina are subject to sales tax, there are certain exemptions and special cases to be aware of. These include:

- Military Personnel: Active-duty military members stationed in North Carolina may be eligible for a sales tax exemption when purchasing a vehicle. This exemption applies to both residents and non-residents and can be a significant savings opportunity.

- Trade-Ins: When trading in a vehicle, the taxable value of the new car is often the purchase price minus the trade-in value of the old vehicle. This can result in a lower taxable value and, consequently, a lower sales tax amount.

- Vehicle Type: Certain types of vehicles, such as motorcycles, recreational vehicles (RVs), and boats, may have different sales tax rates or exemptions. It's important to understand the specific regulations for the type of vehicle you're purchasing.

- Vehicle Usage: If the vehicle is primarily used for business purposes, you may be eligible for a reduced sales tax rate or a tax credit. This is commonly referred to as the business use of a vehicle exemption and requires proper documentation.

Sales Tax on Out-of-State Vehicle Purchases

If you purchase a vehicle out of state and bring it into North Carolina, you’ll typically need to pay use tax on the vehicle. This tax is calculated similarly to sales tax and is due when you register the vehicle in North Carolina.

The use tax is designed to ensure that individuals who purchase vehicles out of state and bring them into North Carolina pay the equivalent of sales tax. This prevents individuals from avoiding taxes by making purchases in states with lower tax rates.

Registration and Title Fees

In addition to sales tax, there are other fees associated with purchasing a vehicle in North Carolina. These fees include:

- Title Fee: A one-time fee of $53 is charged for titling a vehicle in North Carolina. This fee covers the cost of processing and issuing the vehicle's title.

- Registration Fee: The registration fee varies depending on the type and weight of the vehicle. For passenger vehicles, the fee is $40 for a two-year registration period. Additional fees may apply for specialized license plates or certain vehicle types.

- Emissions Testing Fee: If your vehicle is subject to emissions testing, there may be a fee associated with this process. The fee varies based on the type of test required and the county where the test is conducted.

Sales Tax on Leased Vehicles

When leasing a vehicle in North Carolina, the sales tax is calculated based on the capitalized cost of the lease. This cost includes the purchase price of the vehicle, any additional fees, and the residual value at the end of the lease term. The sales tax is typically paid up-front at the beginning of the lease.

It's important to carefully review the lease agreement to understand the tax implications and ensure that the sales tax calculation is accurate. Some leasing companies may include the sales tax in the monthly payments, while others may require a separate upfront payment.

Conclusion

Understanding the sales tax implications when purchasing a car in North Carolina is essential for making an informed decision. By calculating the applicable tax rate, considering any exemptions or special considerations, and being aware of additional fees, you can navigate the process with confidence. Remember to consult the North Carolina Department of Revenue for the most up-to-date information and regulations regarding sales tax on vehicles.

Frequently Asked Questions

How is the sales tax on a car calculated in North Carolina?

+The sales tax on a car in North Carolina is calculated by multiplying the taxable value of the vehicle by the applicable tax rate. The taxable value is typically the purchase price or trade-in value, whichever is higher. The tax rate includes the state sales tax (3%) and any local county surtax.

Are there any sales tax exemptions for purchasing a car in North Carolina?

+Yes, there are certain exemptions and special cases. Active-duty military personnel may be eligible for a sales tax exemption, and business use of a vehicle may also qualify for reduced tax rates or credits. Additionally, certain vehicle types like motorcycles or boats may have different tax rates or exemptions.

What is the difference between sales tax and use tax in North Carolina?

+Sales tax is charged on the purchase of a vehicle within North Carolina, while use tax is charged when a vehicle is purchased out of state and brought into North Carolina. Use tax ensures that individuals pay the equivalent of sales tax, even if the purchase was made in a state with a lower tax rate.

Are there any additional fees associated with purchasing a car in North Carolina?

+Yes, in addition to sales tax, there are other fees such as a title fee ($53), registration fee (varies based on vehicle type), and potentially an emissions testing fee. These fees are separate from the sales tax and are required for titling and registering the vehicle in North Carolina.

How is sales tax calculated for leased vehicles in North Carolina?

+Sales tax for leased vehicles is calculated based on the capitalized cost of the lease, which includes the purchase price, fees, and residual value. The sales tax is typically paid upfront at the beginning of the lease. It’s important to review the lease agreement for specific details and tax calculations.