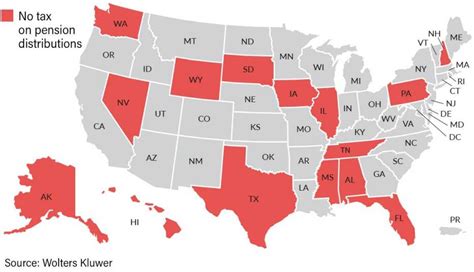

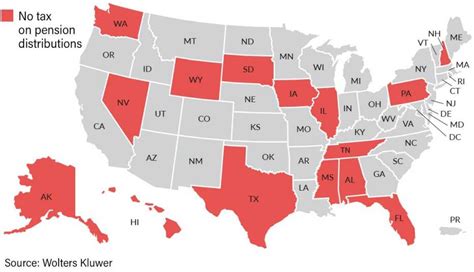

States Don't Tax Pensions

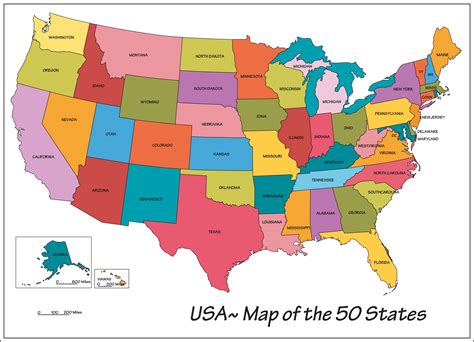

In the United States, pension taxation is a complex and multifaceted topic, with each state having its own unique set of laws and regulations. The taxation of pensions can significantly impact retirees and their financial planning, so it's essential to understand the intricacies of this system.

While the federal government has specific rules regarding pension taxation, the states have a fair amount of autonomy when it comes to taxing retirement income. This means that the treatment of pensions can vary widely from one state to another, creating a diverse landscape for retirees to navigate.

Understanding Pension Taxation: A State-by-State Overview

When it comes to pension taxation, there is no one-size-fits-all approach. Each state has its own tax code, and the way they handle pensions can be quite diverse. Here's a comprehensive look at how different states approach this issue, with a focus on some key aspects:

Tax-Exempt States

Several states have taken a retiree-friendly approach and have exempted pension income from state taxes. These states include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, and Illinois. In these jurisdictions, retirees can enjoy their pension income without worrying about state tax deductions.

For example, Florida's pension exemption is particularly generous, covering all forms of retirement income, including pensions, annuities, and IRA distributions. This has made the Sunshine State a popular destination for retirees seeking tax-friendly environments.

States with Partial Exemptions

Some states offer partial exemptions or deductions for pension income. For instance, Louisiana exempts a certain portion of pension income from state taxes, providing relief to retirees on a case-by-case basis. Similarly, New York allows retirees to deduct a portion of their pension income, making it more affordable for those on fixed incomes.

In California, pension income is subject to state taxes, but the state offers a generous tax credit for retirees. This credit can significantly reduce the tax burden for many pensioners, making it a more retiree-friendly approach.

States with No Exemptions

On the other hand, some states do not offer any specific exemptions or deductions for pension income. This means that retirees in these states may face higher tax burdens, especially if their pension income is their primary source of retirement funding.

For instance, Pennsylvania and Massachusetts are among the states that tax pension income at the same rate as other income sources. This can result in a significant tax liability for retirees, especially those with higher pension incomes.

The Impact of State Pension Taxation

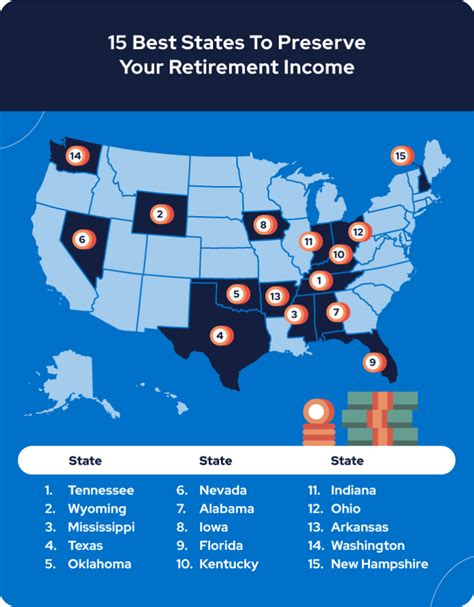

The varying approaches to pension taxation can have a significant impact on retirees' financial planning. Those living in tax-exempt states may find it easier to manage their retirement funds, as their pension income remains untouched by state taxes. On the other hand, retirees in states with no exemptions may need to allocate a larger portion of their income to cover tax liabilities.

Furthermore, the differences in state pension taxation can influence retirement migration. Retirees often consider tax implications when choosing their retirement destinations, and states with favorable pension tax laws may attract more retirees, boosting their local economies.

Case Study: Retiring in Different States

To illustrate the impact of state pension taxation, let's consider the hypothetical case of Mr. Johnson, a retiree with an annual pension income of $60,000.

Scenario 1: Retiring in Florida

If Mr. Johnson chooses to retire in Florida, he can enjoy the state's pension exemption. This means that his entire $60,000 pension income is exempt from state taxes, allowing him to retain more of his retirement funds for his daily expenses and leisure activities.

Scenario 2: Retiring in Pennsylvania

In contrast, if Mr. Johnson decides to retire in Pennsylvania, he will face a different situation. Pennsylvania taxes pension income, and assuming a moderate tax rate of 5%, Mr. Johnson would owe approximately $3,000 in state taxes on his pension income.

This difference in tax liability can significantly impact Mr. Johnson's retirement budget and overall financial well-being, highlighting the importance of considering state pension taxation when planning for retirement.

Navigating the Complexities of Pension Taxation

As retirees navigate the complexities of pension taxation, it's essential to seek professional advice. Financial advisors and tax experts can provide personalized guidance based on an individual's unique circumstances, helping retirees make informed decisions about their retirement destinations and financial strategies.

Additionally, staying updated on state tax laws is crucial. States may introduce changes to their tax codes, and retirees should be aware of any upcoming modifications that could impact their pension income. Subscribing to relevant newsletters or following reputable financial websites can ensure retirees stay informed about these changes.

Future Implications and Trends

The landscape of pension taxation is constantly evolving. States may introduce new legislation or amend existing laws to adapt to changing economic conditions and demographic trends. For instance, an increasing number of retirees may prompt states to reevaluate their pension tax policies to remain competitive in attracting retirement-age residents.

Furthermore, the rise of remote work and digital nomadism may also influence state pension taxation policies. As retirees have more flexibility in choosing their residence, states may need to reconsider their tax strategies to remain attractive destinations for this growing demographic.

| State | Pension Tax Exemption |

|---|---|

| Alaska | Yes |

| Florida | Yes |

| Nevada | Yes |

| New Hampshire | Yes |

| South Dakota | Yes |

| Tennessee | Yes |

| Texas | Yes |

| Washington | Yes |

| Wyoming | Yes |

| Illinois | Yes |

| Louisiana | Partial |

| New York | Partial |

| California | Tax Credit |

| Pennsylvania | No Exemption |

| Massachusetts | No Exemption |

Conclusion

The taxation of pensions in the United States is a complex and dynamic topic, with states taking various approaches to this issue. From tax-exempt states to those with partial exemptions or no exemptions, retirees face a diverse range of tax scenarios. Understanding these differences is crucial for effective financial planning and can influence the overall quality of retirement life.

As retirees navigate this landscape, staying informed and seeking professional advice can help ensure a financially secure and fulfilling retirement journey.

What is the federal government’s role in pension taxation?

+The federal government sets the framework for pension taxation through the Internal Revenue Code. It defines pensions as taxable income, but there are various deductions and tax advantages available, such as 401(k) plans and IRAs, which can reduce the overall tax burden on retirement savings.

Can states change their pension taxation policies frequently?

+Yes, states can amend their tax codes, including pension taxation policies. These changes can be influenced by various factors, such as economic conditions, political landscapes, and the state’s overall financial health. Retirees should stay updated on these potential changes.

Are there any states that offer unique tax benefits for retirees?

+Yes, some states go beyond pension tax exemptions and offer additional tax benefits to retirees. For example, New Hampshire has no state income tax, making it an attractive destination for retirees seeking tax relief on all forms of income.

How do states determine the tax rate for pension income?

+States have different tax structures, and the tax rate for pension income can vary based on the state’s tax brackets and the retiree’s overall income level. Some states have flat tax rates, while others have progressive tax systems.

Can retirees reduce their tax burden through tax planning strategies?

+Absolutely! Retirees can work with financial advisors to explore tax planning strategies, such as optimizing retirement account distributions, utilizing tax-efficient investments, and taking advantage of state-specific tax deductions or credits. Effective tax planning can significantly reduce the overall tax burden.