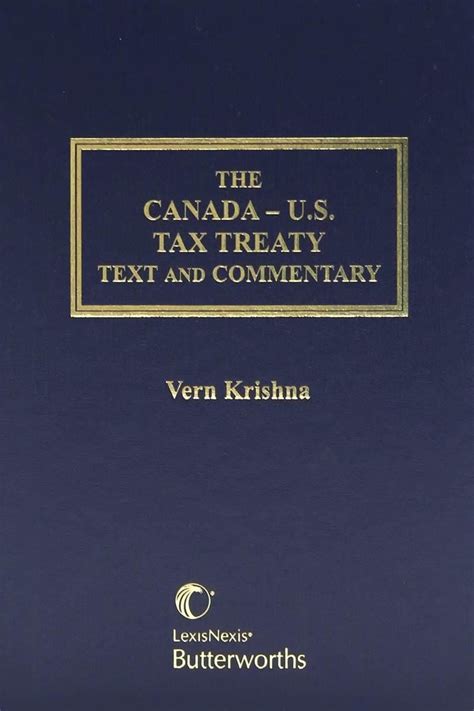

Canada Us Tax Agreement

The Canada-United States Tax Agreement, commonly referred to as the Canada-US Tax Treaty, is a comprehensive treaty that plays a crucial role in managing the complex tax relationship between two of the world's largest trading partners. With a rich history spanning several decades, this treaty aims to prevent double taxation, encourage cross-border trade and investment, and foster economic cooperation between Canada and the United States.

The Historical Context and Evolution

The origins of the Canada-US Tax Agreement can be traced back to the mid-20th century, with the initial treaty being signed in 1942. This agreement, however, focused primarily on income tax and was a relatively narrow scope. Over the years, the treaty has undergone significant revisions and updates to keep pace with the evolving tax landscapes of both countries and the growing economic interdependence between them.

The most recent version of the treaty was signed in 1980 and entered into force in 1984. This version expanded the scope of the agreement to include taxes on income, estates, and gifts. It also introduced provisions for the exchange of information between tax authorities and mechanisms to resolve tax disputes, thereby establishing a more comprehensive framework for tax cooperation.

Key Provisions and Benefits

The Canada-US Tax Agreement is a complex treaty with numerous provisions that impact individuals, businesses, and investors on both sides of the border. Here are some of the key aspects and benefits it offers:

Prevention of Double Taxation

One of the primary objectives of the treaty is to prevent citizens and residents of one country from being taxed twice on the same income by both countries. It achieves this by establishing rules on tax residency and outlining how income should be taxed in each country. For instance, it clarifies that income from employment is generally taxed in the country where the work is performed, while income from investments is taxed in the country of residence.

Reduced Withholding Taxes

The treaty also includes provisions for reduced withholding tax rates on various types of income, such as dividends, interest, and royalties. This benefit is particularly advantageous for Canadian businesses operating in the US or US businesses investing in Canada, as it lowers their tax liabilities and enhances their competitive position.

| Income Type | Standard Withholding Tax Rate | Treaty Withholding Tax Rate |

|---|---|---|

| Dividends | 30% | 15% (or lower under certain conditions) |

| Interest | 30% | 10% (or lower under certain conditions) |

| Royalties | 30% | 10% (or lower under certain conditions) |

Information Exchange and Tax Enforcement

The Canada-US Tax Agreement facilitates the exchange of information between tax authorities to prevent tax evasion and ensure compliance. This provision has become increasingly important in the era of enhanced tax transparency and the global fight against tax avoidance.

Tax Dispute Resolution

The treaty also establishes procedures for resolving tax disputes, providing a mechanism for taxpayers to appeal decisions and seek mutual agreement between the Canadian and US tax authorities. This process can help alleviate potential conflicts and uncertainties arising from cross-border tax issues.

Impact on Businesses and Investors

The Canada-US Tax Agreement has significant implications for businesses and investors operating across the border. It provides a clear and predictable tax environment, reducing uncertainties and potential double taxation risks. For example, Canadian businesses with operations or investments in the US can benefit from the reduced withholding tax rates on dividends and interest, thereby improving their cash flow and profitability.

Similarly, US businesses investing in Canada can take advantage of the treaty's provisions to minimize their tax liabilities and navigate the Canadian tax system more efficiently. The treaty also encourages cross-border mergers and acquisitions by providing clarity on tax treatments, especially regarding the transfer of assets and the continuity of business entities.

Cross-Border Investment and Economic Cooperation

The Canada-US Tax Agreement plays a vital role in fostering economic cooperation and facilitating cross-border investment. By providing a comprehensive framework for tax matters, it encourages businesses and investors to explore opportunities on both sides of the border. This, in turn, contributes to the growth and development of the North American economy, creating jobs and enhancing competitiveness on a global scale.

Challenges and Future Considerations

Despite its numerous benefits, the Canada-US Tax Agreement is not without its challenges. The complexity of the treaty can make it difficult for individuals and businesses to navigate, especially when dealing with cross-border transactions or investments. Furthermore, as tax laws in both countries evolve, keeping the treaty up-to-date and relevant becomes a continuous challenge.

Looking ahead, there are several considerations that may influence the future of the Canada-US Tax Agreement. These include the ongoing negotiations and implementation of the OECD's Base Erosion and Profit Shifting (BEPS) project, which aims to address tax avoidance by multinational enterprises. The treaty may also need to adapt to accommodate changes in digital taxation and the growing importance of the digital economy.

Additionally, with the increasing focus on tax transparency and the exchange of information, the treaty may need to enhance its provisions to meet the evolving standards set by international organizations and multilateral agreements.

Conclusion

The Canada-United States Tax Agreement is a vital instrument in managing the complex tax relationship between these two economic giants. By preventing double taxation, encouraging cross-border investment, and fostering economic cooperation, the treaty plays a critical role in supporting the growth and development of the North American economy. As the treaty continues to evolve and adapt to changing tax landscapes, it will remain a cornerstone in the economic relationship between Canada and the United States.

How does the Canada-US Tax Agreement benefit individuals and businesses?

+The agreement prevents double taxation, reduces withholding taxes on various income types, facilitates information exchange between tax authorities, and provides mechanisms for resolving tax disputes. These provisions create a more favorable tax environment for cross-border activities, benefiting individuals and businesses alike.

What are the key challenges associated with the treaty’s complexity?

+The complexity of the treaty can make it challenging for individuals and businesses to navigate, especially when dealing with cross-border transactions. This complexity may lead to increased compliance costs and potential misinterpretations, which could result in tax liabilities or penalties.

How might the treaty adapt to changing tax landscapes in the future?

+The treaty may need to align with the OECD’s BEPS project to address tax avoidance by multinationals. It may also adapt to changes in digital taxation and enhance provisions for tax transparency to meet international standards. Regular reviews and updates will be crucial to keep the treaty relevant and effective.