Does Pa Tax Social Security

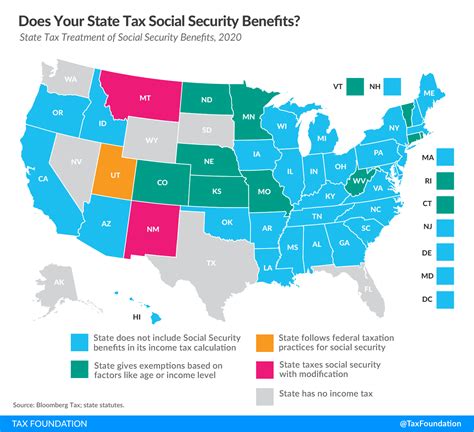

In the world of taxation, the treatment of social security benefits is a complex and often confusing topic. The Commonwealth of Pennsylvania, like many other states, has its own set of rules and regulations when it comes to taxing these benefits. Let's delve into the specifics of how Pennsylvania handles the taxation of social security to provide a comprehensive understanding of this matter.

Pennsylvania's Approach to Social Security Taxation

The taxation of social security benefits in Pennsylvania is governed by the Pennsylvania Personal Income Tax Act, which outlines the state's income tax laws. Unlike some other states, Pennsylvania does not have a blanket exclusion for social security benefits, meaning that these benefits are generally subject to state income tax.

However, it is important to note that Pennsylvania's taxation of social security benefits is not a straightforward process. The state employs a unique methodology that takes into account various factors, including the recipient's income level and the source of the social security benefits.

Taxation Based on Income Level

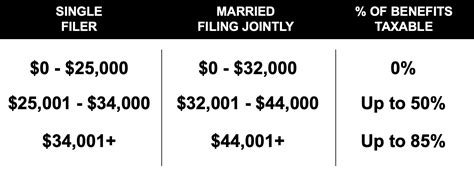

Pennsylvania's tax system for social security benefits is progressive, meaning that the amount of tax levied increases as the recipient's income rises. The state has established income thresholds that determine the percentage of social security benefits subject to taxation. These thresholds are adjusted annually to account for inflation and changes in the cost of living.

| Income Threshold | Percentage of Social Security Benefits Taxable |

|---|---|

| $35,000 or less (single filers) | 0% |

| $70,000 or less (married filing jointly) | 0% |

| Over $35,000 (single filers) and over $70,000 (married filing jointly) | Up to 50% of social security benefits are taxable |

For example, if a single individual with no other income receives $20,000 in social security benefits, none of those benefits would be subject to Pennsylvania state income tax. However, if that individual's income exceeds $35,000, a portion of their social security benefits would become taxable.

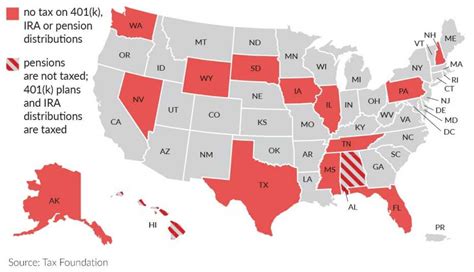

Source of Social Security Benefits

Pennsylvania's taxation of social security benefits also depends on the source of those benefits. The state recognizes different types of social security, including retirement benefits, disability benefits, and survivor benefits. Each type of benefit has its own set of rules regarding taxation.

- Retirement Benefits: These are the most common type of social security benefits and are generally subject to Pennsylvania's income tax. The percentage of taxability depends on the recipient's income level, as outlined above.

- Disability Benefits: Disability benefits received from the Social Security Administration (SSA) are not taxable in Pennsylvania. This exemption applies to both total and partial disability benefits.

- Survivor Benefits: Survivor benefits, which are paid to a deceased worker's family, are also exempt from taxation in Pennsylvania. This exemption covers benefits received by spouses, children, and other eligible survivors.

Calculating Social Security Tax Liability in Pennsylvania

Determining your social security tax liability in Pennsylvania involves a two-step process. First, you must calculate the amount of your social security benefits that are subject to taxation based on your income level. Then, you apply the appropriate tax rate to that amount.

Let's walk through an example to illustrate this process:

Suppose you are a single filer with an annual income of $50,000, and you receive $15,000 in social security retirement benefits. Since your income exceeds $35,000, a portion of your social security benefits will be taxable. The first $35,000 of your income is not subject to tax, so we focus on the remaining $15,000.

Using the income thresholds provided by the state, we can determine that up to 50% of your social security benefits are taxable. In this case, 50% of $15,000 is $7,500. Therefore, $7,500 of your social security benefits are subject to Pennsylvania's income tax.

Now, we apply the appropriate tax rate. Pennsylvania has a progressive tax system with six tax brackets, ranging from 3.07% to 3.85%. The exact rate depends on your total income, including the taxable portion of your social security benefits. For the sake of this example, let's assume the applicable tax rate is 3.5%.

By multiplying the taxable amount ($7,500) by the tax rate (3.5%), we can calculate your social security tax liability: $7,500 * 0.035 = $262.50.

Filing and Reporting Social Security Income in Pennsylvania

When it comes to filing your Pennsylvania state income tax return, you must include your social security benefits as part of your taxable income if they are subject to taxation based on the state's guidelines. This information is typically reported on Form PA-40, the Pennsylvania Individual Income Tax Return.

It is important to note that if you receive social security benefits, you may also need to file a federal income tax return with the Internal Revenue Service (IRS). The rules for federal taxation of social security benefits are different from those in Pennsylvania, and they may impact your overall tax liability.

Future Implications and Tax Planning

The taxation of social security benefits in Pennsylvania can have significant implications for retirees and individuals receiving disability or survivor benefits. Understanding these tax rules is crucial for effective tax planning.

For instance, if you are approaching retirement and anticipate receiving social security benefits, you may want to consider strategies to minimize your taxable income. This could involve optimizing your retirement plan contributions, adjusting your investment strategies, or exploring other income sources that may be exempt from Pennsylvania's income tax.

Additionally, the progressive nature of Pennsylvania's tax system means that higher-income earners may face a larger tax burden on their social security benefits. In such cases, exploring options to reduce overall taxable income, such as contributing to tax-advantaged accounts or utilizing certain deductions and credits, could be beneficial.

Conclusion

Pennsylvania's approach to taxing social security benefits is nuanced and depends on various factors, including income level and the source of the benefits. While some types of social security income are exempt from taxation, retirement benefits are generally subject to state income tax, with the percentage of taxability dependent on the recipient's income. Understanding these rules and seeking professional guidance can help individuals effectively manage their tax obligations and plan for a secure financial future.

Are all social security benefits taxable in Pennsylvania?

+No, not all social security benefits are taxable in Pennsylvania. Disability and survivor benefits received from the Social Security Administration (SSA) are exempt from state income tax. However, retirement benefits are generally taxable, with the percentage of taxability dependent on the recipient’s income level.

How can I calculate my social security tax liability in Pennsylvania?

+To calculate your social security tax liability, you first need to determine the portion of your social security benefits that is taxable based on your income level. Then, apply the appropriate tax rate to that taxable amount. You can find detailed instructions and tax rate information on the Pennsylvania Department of Revenue’s website.

Are there any ways to reduce my social security tax liability in Pennsylvania?

+Yes, there are strategies to potentially reduce your social security tax liability in Pennsylvania. These may include optimizing your retirement plan contributions, exploring tax-advantaged accounts, and utilizing deductions and credits to lower your overall taxable income. Consulting with a tax professional can help you identify the most suitable strategies for your situation.