Seattle Wa Sales Tax Rate

In the bustling city of Seattle, Washington, sales tax is an important aspect of doing business and managing personal finances. The sales tax rate in Seattle is not a uniform figure across the state; instead, it varies based on the specific jurisdiction and the type of goods or services being sold. Understanding the nuances of Seattle's sales tax landscape is crucial for businesses and consumers alike. This comprehensive guide will delve into the intricacies of Seattle's sales tax rate, providing a detailed analysis of the tax structure, its application, and its implications for both businesses and individuals.

The Complex Web of Sales Tax Rates in Seattle

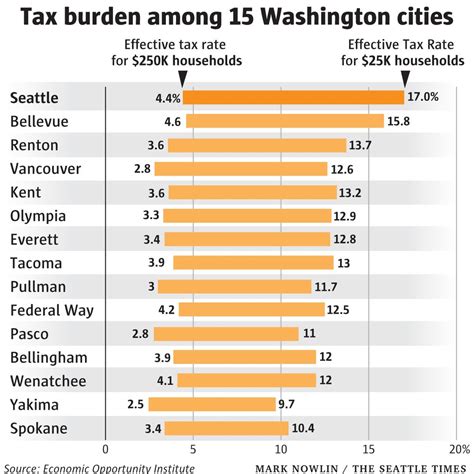

Seattle’s sales tax system is a complex interplay of local, county, and state taxes, each with its own rates and rules. This multifaceted structure adds a layer of complexity for businesses and consumers, requiring a nuanced understanding of the tax landscape.

The sales tax rate in Seattle consists of several components, including the state sales tax, the King County sales tax, and any applicable city or local taxes. The state sales tax rate is a uniform figure across Washington, but local jurisdictions have the authority to levy additional taxes, leading to variations in the overall sales tax rate.

State Sales Tax in Washington

As of [date], the state sales tax rate in Washington stands at 6.5%. This rate is applicable to most retail sales of tangible personal property and certain services. The state sales tax is a significant revenue source for Washington, contributing to the state’s budget and funding various public services.

However, it's important to note that certain items are exempt from the state sales tax. These exemptions can vary based on the nature of the item and the intended use. For instance, most groceries, prescription drugs, and medical devices are exempt from the state sales tax, providing relief to consumers and businesses in the healthcare and food industries.

King County Sales Tax

King County, where Seattle is located, imposes an additional sales tax on top of the state rate. As of [date], the King County sales tax rate is 0.4%, bringing the total sales tax rate in Seattle to 6.9%. This county-level tax is often used to fund specific projects or initiatives within the county, such as transportation improvements or public safety initiatives.

The King County sales tax is not limited to Seattle alone; it applies to all cities and unincorporated areas within the county. This means that businesses and consumers throughout King County are subject to the same sales tax rate, regardless of their specific location.

City and Local Taxes

In addition to the state and county sales taxes, certain cities within Seattle may levy their own sales taxes. These city-level taxes are often used to fund local projects or provide additional revenue for specific initiatives. For instance, the city of Seattle has a 0.1% sales tax dedicated to funding transportation improvements.

Furthermore, there may be other local taxes applicable to specific industries or services. For example, some jurisdictions in Seattle impose a lodging tax on hotel stays or a restaurant tax on food and beverage sales. These additional taxes can vary based on the nature of the business and the services provided.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.5% |

| King County Sales Tax | 0.4% |

| City of Seattle Sales Tax | 0.1% |

| Total Sales Tax Rate in Seattle | 6.9% |

The Impact of Sales Tax on Businesses and Consumers

The varying sales tax rates in Seattle have a significant impact on both businesses and consumers. For businesses, the complexity of the tax system can pose challenges in terms of tax compliance and administrative overhead. Businesses must stay abreast of the latest tax rates and rules to ensure accurate tax collection and reporting.

From a consumer perspective, the varying sales tax rates can affect purchasing decisions and overall spending habits. Consumers may compare prices across different jurisdictions or opt for online shopping to avoid higher sales taxes. This dynamic can influence the local economy and the competitiveness of businesses in the region.

Strategies for Businesses

Businesses operating in Seattle’s complex sales tax environment can benefit from implementing strategic tax management practices. Here are some strategies that businesses can consider:

- Tax Automation: Utilizing tax automation software can streamline the tax calculation and reporting process. These tools can help businesses accurately calculate the applicable sales tax rates and ensure compliance with the latest tax regulations.

- Price Optimization: Businesses can analyze the impact of sales tax on their pricing strategies. By understanding the tax rates in different jurisdictions, businesses can optimize their pricing to remain competitive while maintaining profitability.

- Tax Incentives: Businesses should explore tax incentives offered by the state or local governments. These incentives, such as tax credits or abatements, can provide relief and support for businesses operating in specific industries or meeting certain criteria.

Consumer Considerations

Consumers in Seattle should be aware of the varying sales tax rates to make informed purchasing decisions. Here are some tips for consumers:

- Comparison Shopping: Consumers can compare prices across different retailers or jurisdictions to find the best deals. By understanding the sales tax rates, consumers can make informed choices and potentially save money.

- Online Shopping: For certain items, online shopping can provide a tax advantage. Consumers can avoid the higher sales tax rates in Seattle by purchasing goods online from out-of-state retailers, although they should be aware of any shipping or delivery fees.

- Tax Exemptions: Consumers should familiarize themselves with the items that are exempt from sales tax. By understanding these exemptions, consumers can plan their purchases accordingly and take advantage of tax savings.

Compliance and Enforcement

Ensuring compliance with Seattle’s sales tax regulations is a critical aspect for businesses. The Washington State Department of Revenue is responsible for overseeing sales tax compliance and enforcement. Businesses must register with the department, collect the appropriate sales tax, and remit it on a regular basis.

The department employs various strategies to ensure compliance, including audits, inspections, and educational initiatives. Businesses that fail to comply with sales tax regulations may face penalties, fines, or legal repercussions. It is essential for businesses to maintain accurate records and stay updated on the latest tax rules to avoid any compliance issues.

Audit and Inspection Process

The Washington State Department of Revenue conducts audits and inspections to verify compliance with sales tax regulations. These audits can be triggered by various factors, such as random selection, complaints, or anomalies in tax returns.

During an audit, the department reviews a business's financial records, tax returns, and sales transactions to ensure accuracy and compliance. The process can be time-consuming and may require significant cooperation from the business. Businesses should maintain thorough documentation and be prepared to provide evidence of tax compliance upon request.

Future Implications and Potential Changes

The sales tax landscape in Seattle is subject to change over time. As economic conditions evolve and legislative priorities shift, sales tax rates and rules may undergo modifications. Here are some potential future implications and changes to consider:

- Economic Growth: As Seattle's economy continues to grow, the demand for public services and infrastructure improvements may lead to proposals for increased sales tax rates. This could provide additional revenue for critical projects while potentially impacting businesses and consumers.

- Legislative Initiatives: Changes in state or local legislation can bring about modifications to the sales tax structure. For instance, proposals for tax reform or budget adjustments may result in revised tax rates or the introduction of new taxes.

- Technology and E-Commerce: The rise of e-commerce and online shopping platforms has led to discussions about taxing online sales. As more purchases shift to the digital realm, policymakers may explore ways to ensure a level playing field between online and brick-and-mortar retailers, potentially affecting the sales tax landscape.

Staying Informed

To stay updated on potential changes to Seattle’s sales tax rates and rules, businesses and consumers should regularly monitor local news and government websites. Following relevant industry associations or subscribing to tax newsletters can also provide valuable insights into emerging trends and proposed changes.

Conclusion

Navigating Seattle’s sales tax landscape requires a thorough understanding of the complex web of taxes at the state, county, and local levels. For businesses, compliance and strategic tax management are essential to ensure accurate tax collection and maintain a competitive edge. Consumers, on the other hand, can benefit from understanding the tax rates to make informed purchasing decisions.

As Seattle continues to evolve, the sales tax system may undergo changes to meet the needs of a growing and dynamic city. Staying informed and adaptable is key for both businesses and consumers to navigate the complexities of Seattle's sales tax environment.

What is the total sales tax rate in Seattle as of the last update?

+As of the last update, the total sales tax rate in Seattle is 6.9%, consisting of the state sales tax of 6.5%, the King County sales tax of 0.4%, and the city of Seattle sales tax of 0.1%.

Are there any items exempt from sales tax in Seattle?

+Yes, certain items are exempt from sales tax in Seattle. Common exemptions include groceries, prescription drugs, and medical devices. These exemptions provide relief to consumers and businesses in the healthcare and food industries.

How often do sales tax rates change in Seattle?

+Sales tax rates in Seattle can change periodically, typically in response to economic conditions or legislative initiatives. While the state sales tax rate is relatively stable, local jurisdictions may adjust their tax rates more frequently to meet specific funding needs.

What are the potential future changes to Seattle’s sales tax system?

+Potential future changes to Seattle’s sales tax system may include increased rates to fund economic growth and infrastructure improvements, legislative initiatives to reform the tax structure, and the exploration of taxing online sales to create a level playing field between online and brick-and-mortar retailers.