Economics Tax Multiplier

The tax multiplier is a fundamental concept in economics that holds significant importance in understanding the impact of taxation on economic activity. It measures the change in aggregate income resulting from an initial change in taxes, and its understanding is crucial for policymakers, economists, and individuals interested in the dynamics of the economy. This article delves into the intricacies of the tax multiplier, exploring its definition, mechanics, and implications in a comprehensive manner.

The Tax Multiplier Effect

The tax multiplier refers to the magnified effect that a change in taxes has on a country’s economic output and income levels. It is a crucial tool for economists and policymakers to gauge the potential consequences of tax policy changes on the economy as a whole.

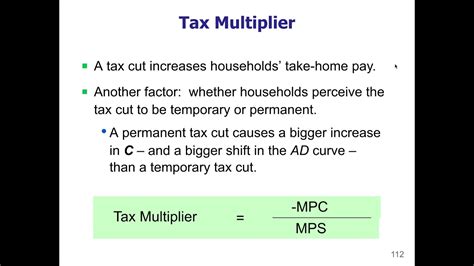

The concept is based on the understanding that a change in taxes can have a ripple effect throughout the economy. When taxes are increased, consumers and businesses may have less disposable income to spend or invest, leading to a potential reduction in economic activity. Conversely, a decrease in taxes can stimulate spending and investment, boosting economic growth.

Key Components of the Tax Multiplier

To comprehend the tax multiplier, it is essential to understand its underlying components:

- Initial Tax Change: This is the initial alteration in tax rates or structures that triggers the multiplier effect. It could be an increase or decrease in income tax, corporate tax, or any other form of taxation.

- Consumer Spending: The way consumers respond to a tax change is critical. If consumers reduce their spending due to higher taxes, it can lead to a decrease in aggregate demand, impacting businesses and the overall economy.

- Business Investment: Businesses may also adjust their investment strategies in response to tax changes. Higher taxes can discourage investment, while lower taxes can encourage businesses to expand and invest in new projects.

- Government Spending: The government's fiscal policy plays a role in the tax multiplier. If the government increases spending to offset the impact of higher taxes, it can mitigate the negative effects on the economy.

The tax multiplier is typically expressed as a numerical value, indicating the magnitude of the impact. For instance, a tax multiplier of 2.0 suggests that a $1 increase in taxes would result in a $2 decrease in aggregate income.

Factors Influencing the Tax Multiplier

The strength of the tax multiplier can vary based on several factors:

Marginal Propensity to Consume (MPC)

The MPC represents the proportion of additional income that individuals spend on consumption. A higher MPC indicates that consumers are more likely to spend, which can amplify the tax multiplier effect. Conversely, a lower MPC suggests that consumers are more likely to save, reducing the multiplier’s impact.

| Marginal Propensity to Consume (MPC) | Tax Multiplier Impact |

|---|---|

| High (0.8) | Strong Multiplier Effect |

| Moderate (0.5) | Moderate Multiplier Effect |

| Low (0.2) | Weak Multiplier Effect |

Time Horizon

The tax multiplier’s impact can vary over time. In the short run, the effect may be more pronounced as businesses and consumers adjust to the new tax rates. However, over the long run, the economy may adapt and mitigate some of the initial impacts.

Economic Conditions

The state of the economy also plays a role. During economic downturns, a decrease in taxes can have a more significant stimulative effect, as businesses and consumers may be more responsive to the change. Conversely, during boom periods, the impact of tax changes may be less pronounced.

Real-World Applications and Implications

The tax multiplier concept has practical applications in economic policy-making:

Fiscal Policy

Governments can use the tax multiplier to assess the potential impact of tax policy changes. For instance, a government considering a tax cut can estimate the potential boost to economic growth, helping them make informed decisions.

Economic Stimulus

During economic recessions, governments often implement stimulus packages that include tax cuts or rebates. Understanding the tax multiplier can help policymakers design effective strategies to boost economic activity.

Tax Reform

When proposing tax reforms, policymakers can use the tax multiplier to evaluate the potential consequences on different income groups and sectors of the economy. This can ensure that tax changes are equitable and do not disproportionately affect certain segments of society.

Critiques and Limitations

While the tax multiplier is a valuable tool, it has its limitations:

Assumptions and Simplifications

The tax multiplier model is based on certain assumptions, such as a closed economy and a stable income distribution. In reality, economies are interconnected, and income distribution can vary, affecting the model’s accuracy.

Behavioral Responses

The model assumes that consumers and businesses respond linearly to tax changes. However, real-world responses can be more complex and vary based on individual preferences and market conditions.

Time Lags

The tax multiplier effect may take time to materialize, and the actual impact can differ from initial estimates. This time lag can make it challenging to accurately predict the outcome of tax policy changes.

Conclusion

The tax multiplier is a powerful tool for understanding the intricate relationship between taxation and economic activity. While it provides valuable insights, policymakers and economists must consider its limitations and complement it with other economic models and real-world data. By doing so, they can make more informed decisions to promote economic growth and stability.

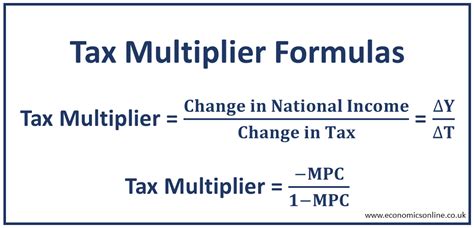

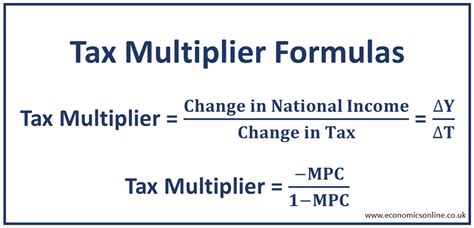

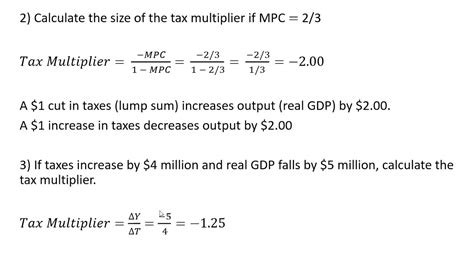

How is the tax multiplier calculated?

+The tax multiplier is calculated using the formula: Tax Multiplier = 1 / (1 - MPC). MPC represents the Marginal Propensity to Consume, which is the proportion of additional income spent on consumption. This formula helps economists estimate the impact of tax changes on aggregate income.

What is the significance of a high tax multiplier value?

+A high tax multiplier value indicates that a change in taxes has a significant impact on aggregate income. For instance, a tax multiplier of 3.0 suggests that a 1 change in taxes leads to a 3 change in income. This implies that the economy is highly sensitive to tax changes.

Can the tax multiplier be negative?

+Yes, the tax multiplier can be negative. This occurs when the Marginal Propensity to Consume (MPC) is greater than 1. In such cases, an increase in taxes can lead to a larger decrease in aggregate income, indicating a potential contraction in economic activity.