Colorado Automobile Sales Tax

The state of Colorado, nestled in the heart of the Rocky Mountains, boasts a vibrant automotive industry with a unique approach to taxation. The Colorado Automobile Sales Tax is a crucial component of the state's revenue system, impacting both residents and businesses. This article delves into the intricacies of this tax, exploring its rates, calculations, and the key considerations for anyone navigating the automotive sales landscape in Colorado.

Understanding the Colorado Automobile Sales Tax

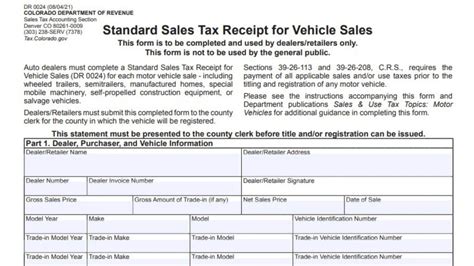

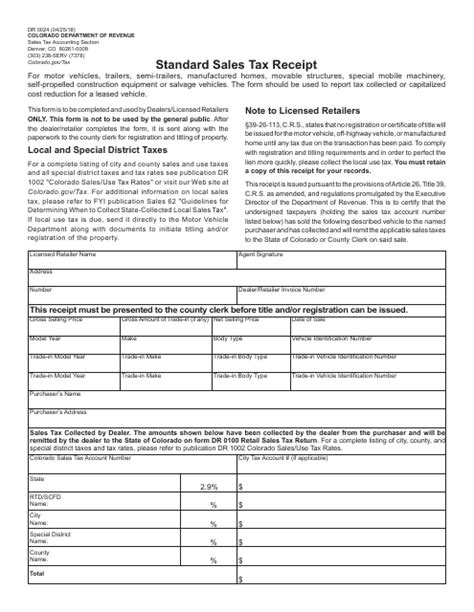

The Colorado Department of Revenue oversees the administration of the state’s sales and use tax on automobiles. This tax is applicable to the purchase of new and used vehicles, and it plays a significant role in the state’s revenue collection, contributing to infrastructure development, education funding, and other essential services.

What sets Colorado's automobile sales tax apart is its progressive nature. Unlike a flat rate applied uniformly across the state, Colorado employs a bracketed system, which means the tax rate varies based on the vehicle's purchase price. This approach aims to ensure fairness and generate adequate revenue to support the state's diverse needs.

The Bracketed System: A Closer Look

Colorado’s automobile sales tax is divided into five brackets, each with its own tax rate. These brackets are as follows:

| Bracket | Purchase Price Range | Tax Rate |

|---|---|---|

| 1 | $0 - $5,000 | 2.9% |

| 2 | $5,001 - $10,000 | 3.4% |

| 3 | $10,001 - $20,000 | 3.9% |

| 4 | $20,001 - $30,000 | 4.4% |

| 5 | $30,001 and above | 4.9% |

For instance, if you purchase a vehicle priced at $15,000, you would fall under Bracket 3, and your sales tax rate would be 3.9% of the purchase price.

Calculating the Tax: A Step-by-Step Guide

Calculating the Colorado automobile sales tax involves a straightforward process. Here’s a step-by-step breakdown:

- Determine the Purchase Price: Establish the total cost of the vehicle, including any additional features, dealer preparation fees, and destination charges.

- Identify the Applicable Bracket: Match the purchase price to the corresponding bracket. For instance, a vehicle priced at $12,000 falls within Bracket 3.

- Calculate the Tax: Apply the tax rate associated with the identified bracket to the purchase price. Using our example, the tax rate for Bracket 3 is 3.9%, so the tax amount would be $468 (3.9% of $12,000).

- Add Local and County Taxes: Consult your local tax authority to determine any additional taxes applicable to vehicle purchases. These taxes are added to the state sales tax to arrive at the total tax liability.

By following these steps, buyers and dealers can accurately determine the sales tax due on a vehicle purchase in Colorado.

Real-World Example

Let’s consider a scenario where a buyer purchases a new car for $25,000. Here’s how the tax calculation would unfold:

- The purchase price is $25,000, which falls within Bracket 4.

- The tax rate for Bracket 4 is 4.4%.

- The sales tax amount is calculated as $25,000 x 4.4% = $1,100.

- Assuming a local tax rate of 1%, the additional local tax would be $250 ($25,000 x 1%).

- The total tax liability for this purchase is $1,100 (state tax) + $250 (local tax) = $1,350.

Implications and Considerations

The Colorado automobile sales tax has several implications for both buyers and sellers. For buyers, it’s essential to factor in the sales tax when budgeting for a vehicle purchase. The progressive nature of the tax means that the tax liability increases with the vehicle’s price, which can significantly impact the overall cost.

Sellers, on the other hand, must be well-versed in the tax calculations to provide accurate quotes to potential buyers. Accurate tax calculations ensure transparency and build trust with customers. Additionally, sellers should be aware of any changes to the tax rates, as these can impact pricing strategies and overall sales.

Future Outlook

Colorado’s automobile sales tax is subject to periodic reviews and adjustments to ensure it aligns with the state’s financial needs and economic realities. While the current bracketed system provides a fair and balanced approach, there have been discussions about potential modifications to enhance revenue generation and address evolving transportation needs.

One proposed change involves introducing a hybrid tax system that combines elements of the current bracketed approach with a flat rate. This hybrid model aims to strike a balance between simplicity and fairness, potentially attracting more buyers and sellers to the Colorado automotive market.

Conclusion

The Colorado automobile sales tax is a vital component of the state’s revenue system, impacting the automotive industry and its stakeholders. By understanding the tax rates, calculations, and considerations, buyers and sellers can navigate the Colorado automotive market with confidence and ensure compliance with the state’s tax regulations.

Are there any exemptions or discounts for certain types of vehicles in Colorado’s automobile sales tax?

+Yes, Colorado offers exemptions and discounts for specific types of vehicles. For instance, certain alternative fuel vehicles, such as electric or hybrid cars, may qualify for a reduced sales tax rate. Additionally, there are provisions for tax credits or exemptions for vehicles purchased by individuals with disabilities. It’s advisable to consult the Colorado Department of Revenue for the latest information on these exemptions and the eligibility criteria.

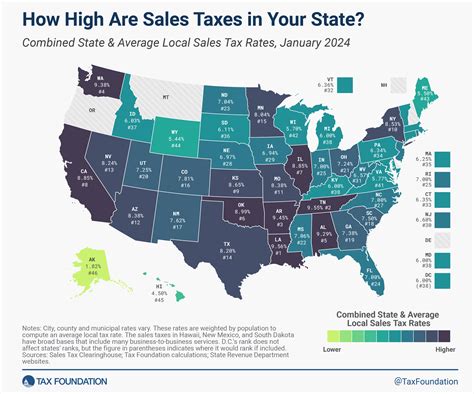

How does Colorado’s automobile sales tax compare to other states?

+Colorado’s automobile sales tax is relatively moderate compared to some other states. While it employs a progressive bracket system, the tax rates are generally lower than in many other regions. This competitive tax structure contributes to Colorado’s attractiveness as a market for automotive sales and may encourage buyers to consider purchasing vehicles in the state.

Are there any special considerations for out-of-state buyers purchasing vehicles in Colorado?

+Out-of-state buyers purchasing vehicles in Colorado are typically subject to the same sales tax rates as in-state residents. However, there may be additional registration or titling fees applicable to out-of-state buyers. It’s crucial for out-of-state buyers to understand these fees and the process for registering their vehicles in their home state after purchasing in Colorado.