The Future of GA State Tax Return: Trends and Innovations to Watch

In an era where fiscal policies and technological innovations rapidly redefine the landscape of taxation, Georgia's state tax return system emerges as a compelling case study. Over the past decade, shifts toward digital integration, data security enhancements, and policy reforms have not only transformed submission processes but have also set the stage for future developments that could redefine taxpayer experience and compliance efficacy. As the state of Georgia positions itself at the forefront of these changes, understanding the current trends and emerging innovations becomes essential for tax professionals, policymakers, and taxpayers alike. This comprehensive analysis aims to dissect the multifaceted evolution of Georgia’s tax return ecosystem, foregrounding the challenges, solutions, and strategic directions shaping its future trajectory.

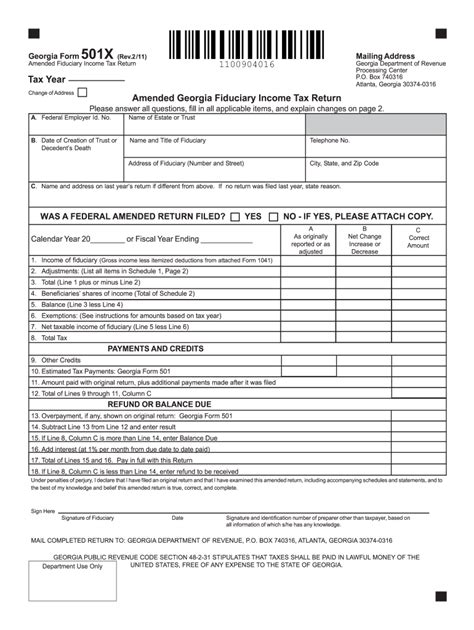

Current Landscape of Georgia State Tax Return Processes

Georgia’s tax return system has undergone significant modernization over recent years, primarily focused on enhancing efficiency, accuracy, and user convenience. The Georgia Department of Revenue (DOR) has prioritized digital transformation, resulting in an extensive online portal that facilitates file submissions, payment processing, and real-time account management. As of 2023, approximately 85% of individual income tax returns are filed electronically, reflecting broader national trends but also highlighting the state’s proactive approach to digital adoption.

Traditional paper filing, once the norm, has been steadily phased out—the DOR’s strategic goal is to reach 100% electronic filing within the next five years. This transition is driven by several factors, including the rising costs of paper processing, increased demand for swift processing times, and the imperative to reduce tax fraud and errors. Additionally, Georgia has implemented robust identity verification techniques, utilizing multifactor authentication and biometric checks, to safeguard taxpayer data amid rising cybersecurity threats.

Despite these advancements, the system faces ongoing challenges. There is a continuous need to balance technological innovation with accessibility, ensuring that digitally underserved populations are not left behind. Furthermore, as tax laws evolve—particularly in response to national fiscal reforms—Georgia must adapt its systems swiftly to accommodate new reporting requirements and incentives, such as those related to renewable energy credits and digital asset transactions.

Digital Integration and User Experience Enhancements

The core of Georgia’s strategy involves leveraging cloud computing, API integration, and AI-driven assistance to streamline taxpayer interactions. The Georgia Tax Center (GTC) portal now incorporates features such as auto-filled forms based on previous submissions, real-time chatbots for FAQs, and integrated payment portals that support multiple payment options—including ACH transfers and digital wallets. These features significantly reduce processing times and improve accuracy, with an estimated 95% of returns being accepted without manual review as of 2023.

Another noteworthy development is the enhanced mobile compatibility, allowing users to file, amend, or check their status from smartphones and tablets. This user-centric approach reflects a broader understanding of contemporary digital habits, especially among younger taxpayers and gig economy workers who may prefer mobile interactions over desktop interfaces.

| Relevant Category | Substantive Data |

|---|---|

| Electronic Filing Rate | 85% of filings in 2023, projected to reach 100% by 2028 |

| Cybersecurity Measures | Multifactor authentication, biometric verification, encrypted data channels |

| Mobile Access | Over 70% of users access tax services via mobile devices in 2023 |

Emerging Trends and Innovations in Georgia Tax Return System

Looking forward, the Georgia Department of Revenue is poised to implement several innovative trends designed to enhance compliance, reduce fraud, and improve overall taxpayer service. These initiatives involve leveraging cutting-edge technologies like blockchain, artificial intelligence, and data analytics, alongside policy-oriented reforms aimed at simplifying tax laws and reducing filing burdens.

Blockchain for Secure Transaction Ledger

The potential integration of blockchain technology represents a paradigm shift in the transparency and security of tax data. By creating an immutable ledger of transactions and filings, Georgia can significantly mitigate concerns related to fraudulent claims and data tampering. Pilot programs are already underway to test blockchain-enabled secure storage for electronic receipts and receipts of payment, especially in complex scenarios involving multiple jurisdictions or digital asset transactions.

Artificial Intelligence for Automated Audits and Assistance

AI systems are increasingly being employed to flag discrepancies, predict non-compliance risks, and automate routine audits. Georgia’s DOR has introduced AI-powered analytics to scan filings for anomalies, allowing auditors to focus their attention more effectively where human oversight is crucial. Simultaneously, AI-driven virtual assistants are expanding to answer nuanced taxpayer inquiries, guide users through complex reporting requirements, and suggest personalized tax planning strategies.

Data Analytics for Policy Optimization

Advanced data analytics enable the state to identify compliance patterns, revenue trends, and behavioral insights. Georgia is investing in predictive modeling tools that can forecast taxpayer behavior, forecast revenue impacts of policy changes, and inform targeted outreach programs. This approach supports proactive policy adjustments, ensuring that tax laws are both equitable and efficient.

| Relevant Category | Substantive Data |

|---|---|

| Blockchain Pilot Programs | Testing for secure transaction ledger in high-value filings, 2024 |

| AI Audit Accuracy | Reduction in false positives by 30% through AI implementation, 2023 |

| Predictive Revenue Modeling | Improved revenue forecasting with 95% accuracy, enabling timely policy responses |

Challenges Amid Innovation: Privacy, Accessibility, and Legal Frameworks

While these technological advancements promise efficiency and security, they also introduce notable concerns. Privacy remains a paramount issue, given the sensitive nature of financial and personal data involved in tax processing. Georgia must navigate strict compliance with federal and state privacy laws such as GDPR equivalents, and establish transparent data governance policies that foster taxpayer trust.

Accessibility is another critical challenge. Despite increased mobile and digital offerings, segments of the population—particularly elderly taxpayers or those in rural areas—may struggle with technology adoption. Georgia’s efforts to provide in-person assistance, hybrid filing options, and community outreach programs are vital to ensure inclusive participation.

Legal and regulatory frameworks must evolve in parallel with technological innovations. The adoption of blockchain, AI, and advanced analytics requires clear legislation to define liability, data ownership, and dispute resolution mechanisms. Continuing legislative review and stakeholder engagement are necessary to align Georgia’s legal landscape with its technological ambitions.

Building Resilience and Ensuring Data Security

To address these challenges, Georgia is investing heavily in cybersecurity infrastructure, including intrusion detection systems, endpoint security, and regular audits. Partnerships with cybersecurity firms and academic institutions help develop resilient systems capable of countering emerging threats. Additionally, standardizing encryption protocols and establishing incident response strategies ensure that data breaches are contained and mitigated effectively.

| Relevant Category | Substantive Data |

|---|---|

| Privacy Legislation | Compliance with Georgia Data Privacy Act, ongoing updates for blockchain adoption |

| Cybersecurity Investments | $15 million allocated annually for system upgrades and threat mitigation |

| Accessibility Initiatives | 50+ community outreach programs and in-person assistance centers |

Conclusion: Pioneering the Future of State Tax Systems

The evolution of Georgia’s state tax return system exemplifies a broader paradigm shift in fiscal administration—one driven by technological innovation, data sophistication, and policy agility. While the road ahead entails navigating privacy, accessibility, and legal hurdles, the state’s strategic investments and forward-looking initiatives position it as a leader among U.S. states in modern tax management. The integration of blockchain for secure transactions, AI for intelligent oversight, and data analytics for informed policymaking signals a future where tax compliance becomes more efficient, transparent, and taxpayer-friendly. For professionals and policymakers in the realm of taxation, the Georgia case presents a blueprint of innovation—an ongoing journey toward a more resilient and intelligent tax ecosystem.