California Payroll Taxes

Payroll taxes are a critical aspect of any business, and understanding the specific requirements of different states is essential for compliance and effective financial management. California, being the most populous state in the US, has unique payroll tax regulations that businesses must navigate. This comprehensive guide will delve into the intricacies of California payroll taxes, offering expert insights and practical advice to help businesses ensure compliance and optimize their payroll processes.

Understanding California Payroll Taxes

California’s payroll tax system is a complex web of regulations, encompassing various state and federal requirements. It involves a range of taxes, including income tax withholding, employment taxes, and disability insurance contributions. Each of these components has specific rules and rates that businesses must adhere to, making payroll management a critical and intricate task.

Income Tax Withholding

Income tax withholding is a crucial aspect of payroll management in California. Employers are responsible for withholding state income tax from employees’ wages, based on the employee’s withholding allowance and the applicable tax rates. These rates vary depending on the employee’s filing status and income level. The California Franchise Tax Board provides a Withholding Tax Table that employers can use to calculate the correct amount to withhold.

For example, an employee with a filing status of Single and an annual income of $50,000 would have a state income tax withholding of approximately $3,280, based on the 2023 tax rates.

| Filing Status | Annual Income | State Income Tax Withholding |

|---|---|---|

| Single | $50,000 | $3,280 |

| Married Filing Jointly | $100,000 | $5,200 |

| Head of Household | $75,000 | $4,140 |

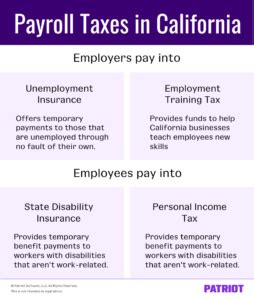

Employment Taxes

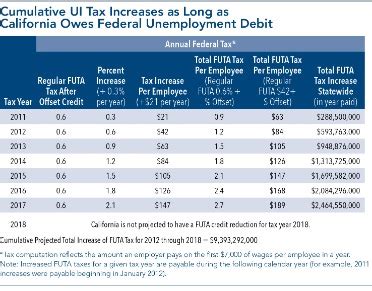

California employers are also responsible for paying employment taxes, which include contributions to the state’s Unemployment Insurance (UI) and Employment Training Tax (ETT). These taxes are based on the employee’s wages and are paid by the employer, with no deductions from employee paychecks.

The UI tax rate for 2023 is 1.5% of the first $7,000 of an employee's wages, with a maximum taxable wage base of $7,000. This means that for an employee earning $50,000 annually, the UI tax payable by the employer would be $105. The ETT rate, on the other hand, is 0.1% of the first $7,000 of wages, resulting in an ETT tax of $7 for the same employee.

| Tax | Rate | Wage Base | Example Tax Payable (Annual Salary of $50,000) |

|---|---|---|---|

| UI | 1.5% | $7,000 | $105 |

| ETT | 0.1% | $7,000 | $7 |

Disability Insurance

California is one of the few states that mandates disability insurance coverage for employees. The State Disability Insurance (SDI) program provides short-term disability benefits to employees who are unable to work due to non-work-related illnesses, injuries, or pregnancy. Employers are required to withhold SDI contributions from employee wages and remit them to the state.

The SDI contribution rate for 2023 is 1.2% of the first $135,840 of an employee's wages, with a maximum taxable wage base of $135,840. This means that for an employee earning $50,000 annually, the SDI contribution would be $600.

| SDI Contribution Rate | Wage Base | Example Contribution (Annual Salary of $50,000) |

|---|---|---|

| 1.2% | $135,840 | $600 |

Compliance and Reporting

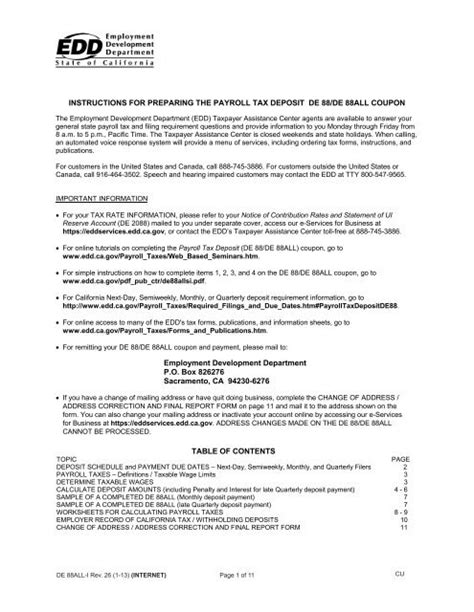

Ensuring compliance with California payroll tax regulations is a critical aspect of business operations. Employers must register with the California Employment Development Department (EDD) and obtain an Employer Tax Number. This number is used for all payroll tax reporting and remittance purposes.

Payroll Tax Deposits

California requires employers to deposit payroll taxes on a regular basis. The frequency of deposits depends on the employer’s tax liability. Generally, employers with a liability of 100,000 or more must deposit taxes semi-weekly, while those with a liability below 100,000 can deposit monthly. The EDD provides an online tool, the Tax Deposit Frequency Worksheet, to help employers determine their deposit frequency.

Payroll Tax Returns

Employers must file payroll tax returns quarterly, using the appropriate forms provided by the EDD. These returns include information on the total wages paid, taxes withheld, and contributions made during the quarter. The EDD provides detailed instructions and guidelines for completing these returns accurately.

Penalties and Audits

Non-compliance with California payroll tax regulations can lead to significant penalties and legal repercussions. The EDD conducts audits to ensure employers are meeting their payroll tax obligations. These audits can result in penalties for late payments, underpayments, or failure to withhold and remit taxes.

Penalties for late payments can be as high as 15% of the unpaid tax, while failure to withhold and remit taxes can result in penalties of up to 100% of the unpaid tax. Additionally, employers may be subject to interest charges on unpaid taxes, further increasing the financial burden of non-compliance.

Best Practices for Payroll Management

To ensure smooth payroll operations and compliance with California’s payroll tax regulations, employers should consider the following best practices:

- Utilize payroll software that is specifically designed to handle California payroll tax calculations and reporting.

- Stay updated with the latest tax rates, thresholds, and regulations to ensure accurate calculations and compliance.

- Maintain detailed records of all payroll transactions, including tax withholdings and contributions, to facilitate easy auditing and reporting.

- Establish clear communication with employees regarding their payroll deductions and contributions, ensuring transparency and understanding.

- Seek professional guidance from tax advisors or accountants who are familiar with California's unique payroll tax landscape.

Conclusion

California’s payroll tax system is complex but crucial for businesses operating within the state. By understanding the various components of payroll taxes, including income tax withholding, employment taxes, and disability insurance contributions, employers can ensure compliance and effective payroll management. Staying informed about the latest regulations, utilizing appropriate software, and seeking professional guidance are key steps towards navigating California’s payroll tax landscape successfully.

How often do employers need to deposit payroll taxes in California?

+The frequency of payroll tax deposits in California depends on the employer’s tax liability. Generally, employers with a liability of 100,000 or more must deposit taxes semi-weekly, while those with a liability below 100,000 can deposit monthly. The EDD provides a Tax Deposit Frequency Worksheet to help employers determine their deposit frequency.

What is the penalty for late payment of payroll taxes in California?

+Late payment of payroll taxes in California can result in penalties of up to 15% of the unpaid tax. Additionally, employers may be subject to interest charges on unpaid taxes, further increasing the financial burden of non-compliance.

Are there any online resources to help with California payroll tax calculations and reporting?

+Yes, the California Employment Development Department (EDD) provides several online tools and resources to assist employers with payroll tax calculations and reporting. These include the Withholding Tax Table, Tax Deposit Frequency Worksheet, and detailed instructions for completing payroll tax returns.