Hawaii State Sales Tax

Hawaii, the enchanting archipelago in the Pacific Ocean, boasts a unique tax system compared to the rest of the United States. One of the key components of this system is the Hawaii State Sales Tax, a consumption tax levied on the sale of goods and services within the state. This sales tax plays a significant role in Hawaii's revenue generation, contributing to the state's economic landscape and impacting businesses and consumers alike. In this comprehensive article, we will delve into the intricacies of the Hawaii State Sales Tax, exploring its history, rates, exemptions, and the impact it has on various sectors of the Hawaiian economy.

Understanding the Hawaii State Sales Tax

The Hawaii State Sales Tax is a broad-based tax applied to the retail sale, lease, or rental of tangible personal property and certain services within the state. It is an essential revenue stream for Hawaii, helping fund essential public services, infrastructure development, and state operations. The tax is administered by the Hawaii Department of Taxation, which oversees its collection, enforcement, and distribution.

Historical Perspective

The history of sales tax in Hawaii dates back to the 1930s, when the territory of Hawaii first introduced a sales and use tax. However, it was in 1957, when Hawaii gained statehood, that the sales tax system as we know it today began to take shape. Over the years, the tax rates and structures have undergone several revisions, reflecting the evolving needs of the state’s economy and public services.

Tax Rates and Structure

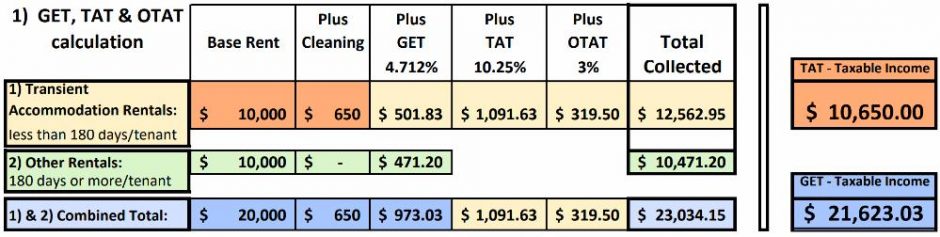

Hawaii’s sales tax is a multi-tiered system, with different rates applying to various goods and services. The base rate, applicable to most retail sales, is set at 4.0%. However, this rate is subject to additional surcharges at the county level, resulting in a combined state and county sales tax rate.

| County | State Rate | County Surcharge | Total Rate |

|---|---|---|---|

| Hawaii | 4.0% | 0.5% | 4.5% |

| Honolulu | 4.0% | 0.5% | 4.5% |

| Kauai | 4.0% | 0.5% | 4.5% |

| Maui | 4.0% | 0.5% | 4.5% |

It's important to note that these rates are subject to change, and it is advisable to refer to the Hawaii Department of Taxation's official website for the most up-to-date information.

Exemptions and Special Cases

While the Hawaii State Sales Tax applies to a wide range of goods and services, there are certain exemptions and special cases to consider.

- Food and Groceries: Food and grocery items are exempt from the state sales tax, providing some relief to households' daily expenses.

- Prescription Medications: Sales of prescription medications are also exempt, ensuring that essential healthcare items remain more affordable.

- Educational and Cultural Institutions: Certain sales to and by educational institutions, museums, and other cultural organizations are exempt, supporting Hawaii's commitment to education and the arts.

- Resale and Export: Sales for resale or items intended for export are not subject to sales tax, encouraging trade and supporting businesses engaged in these activities.

- Specific Services: Some services, such as medical, legal, and professional services, are exempt from sales tax.

Impact on the Hawaiian Economy

The Hawaii State Sales Tax is a critical component of the state’s revenue stream, contributing significantly to the overall economic health of the islands. Here’s a closer look at its impact on various sectors.

Tourism and Hospitality

Hawaii’s tourism industry is a major driver of its economy, and the sales tax plays a crucial role in generating revenue from this sector. Visitors to Hawaii are subject to the sales tax on their purchases, contributing to the state’s coffers. Additionally, the tax provides an incentive for tourists to explore local businesses and support the community.

Retail and E-commerce

The retail sector, including brick-and-mortar stores and online retailers, bears the brunt of collecting and remitting sales tax. For local businesses, the sales tax can be a challenge, especially for small and medium-sized enterprises. However, it also provides a level playing field, ensuring that online retailers are taxed similarly to traditional stores.

Agriculture and Food Industry

The exemption of food and groceries from sales tax has a positive impact on Hawaii’s agricultural sector and the food industry. It encourages local consumption, supports farmers and producers, and keeps the cost of living more manageable for residents.

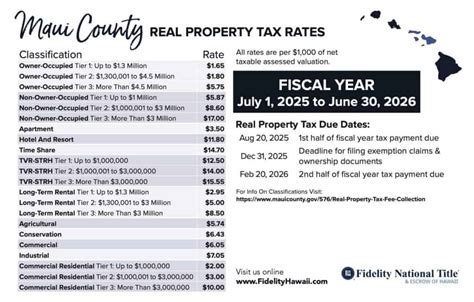

Construction and Real Estate

The sales tax applies to construction materials and services, impacting the construction and real estate sectors. While it adds to the cost of building and development, it also generates revenue for infrastructure projects and public works.

Compliance and Administration

Ensuring compliance with the Hawaii State Sales Tax is a critical responsibility for businesses operating within the state. The Hawaii Department of Taxation provides guidelines and resources to help businesses understand their obligations and navigate the tax system effectively.

Registration and Remittance

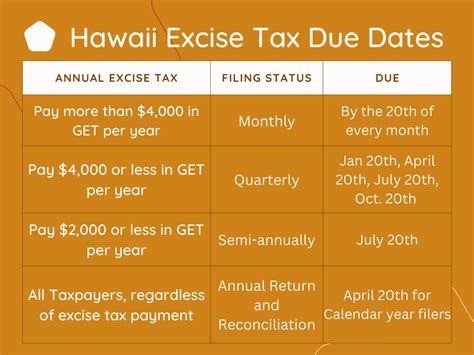

Businesses engaged in taxable sales must register with the Hawaii Department of Taxation and obtain a General Excise Tax License. They are then required to collect the applicable sales tax from customers and remit it to the department on a regular basis, typically quarterly or monthly, depending on their sales volume.

Record-Keeping and Audits

Accurate record-keeping is essential for sales tax compliance. Businesses must maintain detailed records of taxable sales, purchases, and returns to ensure they can provide accurate reports to the department. The Hawaii Department of Taxation conducts audits to verify compliance and ensure businesses are meeting their tax obligations.

Future Implications and Potential Changes

As Hawaii’s economy continues to evolve, so too might its sales tax system. The state’s unique economic landscape and its reliance on tourism make it a dynamic environment for tax policy. Here are some potential future implications and changes to consider.

Economic Growth and Development

As Hawaii’s economy grows and diversifies, the sales tax could play a more prominent role in funding essential services and infrastructure. The state might consider adjusting rates or exploring new tax structures to support its economic development goals.

Tax Reform and Simplification

The current multi-tiered sales tax system can be complex for businesses and consumers to navigate. Future tax reforms could aim to simplify the structure, making it more user-friendly and efficient.

Environmental and Social Initiatives

Hawaii has a strong commitment to environmental sustainability and social equity. The sales tax could be leveraged to support these initiatives, with potential exemptions or surcharges aimed at promoting green technologies or supporting social programs.

Conclusion

The Hawaii State Sales Tax is a critical component of the state’s revenue generation and economic health. It impacts various sectors, from tourism and hospitality to retail and agriculture, shaping the economic landscape of the islands. As Hawaii continues to thrive and evolve, the sales tax will remain a dynamic and essential part of its economic framework.

How often do businesses need to remit sales tax in Hawaii?

+The frequency of sales tax remittance depends on the business’s sales volume. Generally, businesses with higher sales volumes remit monthly, while those with lower sales remit quarterly. However, specific remittance schedules can be determined by consulting the Hawaii Department of Taxation’s guidelines.

Are there any special considerations for online retailers operating in Hawaii?

+Yes, online retailers must comply with the same sales tax obligations as traditional brick-and-mortar stores. They are responsible for collecting and remitting sales tax on taxable sales made to Hawaii residents, even if they do not have a physical presence in the state.

What are the penalties for non-compliance with the Hawaii State Sales Tax?

+Non-compliance with sales tax obligations can result in penalties, interest, and even criminal charges. The Hawaii Department of Taxation has a range of enforcement measures to ensure compliance, including audits, assessments, and legal actions.