Vegas Tax Rate

In the bustling city of Las Vegas, nestled amidst the neon lights and vibrant entertainment, understanding the intricacies of the tax system is crucial for both residents and visitors alike. The Vegas tax rate encompasses a range of taxes that impact various aspects of life and business in this dynamic metropolis. This article aims to delve into the specifics of the tax landscape in Las Vegas, shedding light on the rates, structures, and unique considerations that define the fiscal environment of this renowned city.

Unraveling the Complex Web of Taxes in Las Vegas

The tax system in Las Vegas is a multifaceted entity, encompassing a wide array of taxes that cater to the city’s diverse economic activities. From sales taxes on retail transactions to property taxes that contribute to the maintenance of the city’s infrastructure, each tax component plays a vital role in shaping the fiscal health of Las Vegas.

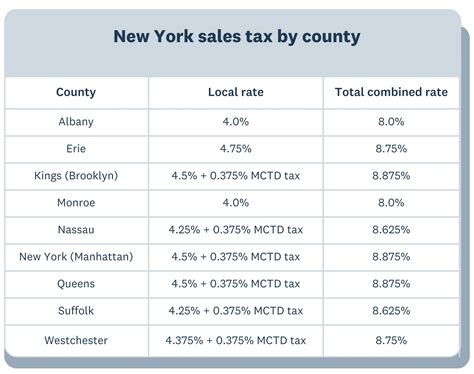

Sales and Use Taxes: Navigating the Retail Landscape

Sales and use taxes form a significant portion of the tax revenue in Las Vegas. These taxes are levied on the sale of goods and services within the city limits, impacting both local businesses and tourists alike. The current sales tax rate in Las Vegas stands at 8.25%, comprising a state sales tax of 4.6% and a local sales tax of 3.65%. This rate is subject to change, with the local sales tax varying across different counties in Nevada.

For businesses operating in the hospitality sector, such as hotels and casinos, there are additional taxes to consider. The Transient Room Tax, also known as the hotel tax, is levied on the rental of hotel rooms and is typically set at 13.38% in Las Vegas. This tax contributes significantly to the city's revenue and is often used to fund tourism-related initiatives and infrastructure development.

Furthermore, the Nevada State Business License Tax is applicable to businesses operating within the state. This tax is based on a business's gross revenue and is calculated as a percentage of the total revenue. The current rate for this tax is 0.045% of the business's gross revenue.

| Tax Type | Rate |

|---|---|

| Sales Tax | 8.25% |

| Transient Room Tax (Hotel Tax) | 13.38% |

| Nevada State Business License Tax | 0.045% of Gross Revenue |

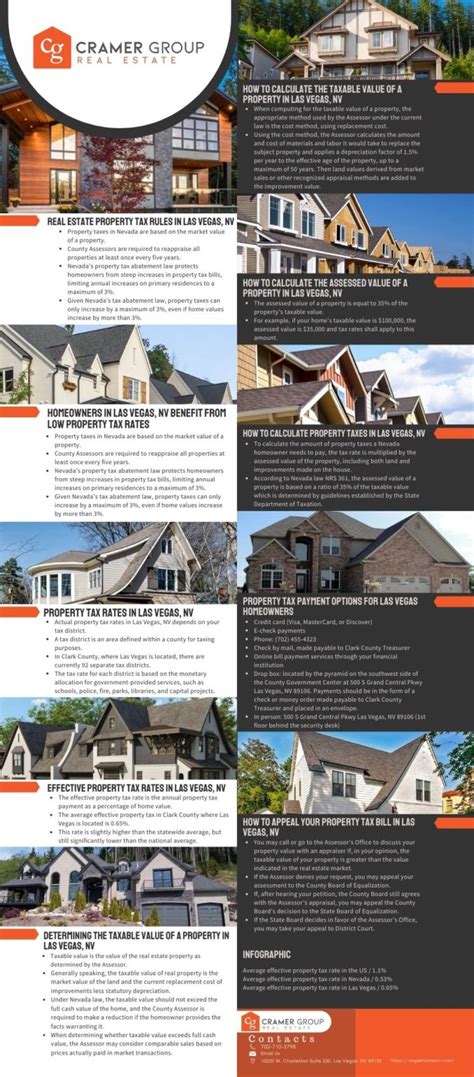

Property Taxes: A Pillar of Municipal Funding

Property taxes are a fundamental source of revenue for local governments in Las Vegas. These taxes are levied on both residential and commercial properties, with the rates varying depending on the assessed value of the property and its classification.

The current property tax rate in Las Vegas stands at 0.828% of the assessed value of the property. However, it is important to note that this rate is subject to change, and it may vary depending on the specific location within the city. Additionally, there are various exemptions and deductions available for property owners, such as the Homestead Exemption, which provides a partial exemption on the assessed value of a primary residence.

For businesses, the property tax landscape is slightly different. Commercial properties are assessed at a higher rate, typically 3.65% of the assessed value. This rate ensures that businesses contribute a larger portion of the tax revenue to support the city's infrastructure and services.

| Property Type | Tax Rate |

|---|---|

| Residential | 0.828% of Assessed Value |

| Commercial | 3.65% of Assessed Value |

Other Relevant Taxes in Las Vegas

In addition to the sales and property taxes, there are several other taxes that businesses and individuals in Las Vegas should be aware of. These include:

- Employment Taxes: Employers are responsible for paying various employment taxes, including Social Security, Medicare, and Unemployment Insurance taxes. These taxes are based on the wages paid to employees and are an important consideration for businesses.

- Gaming Taxes: The gaming industry is a significant contributor to the economy of Las Vegas. As such, there are specific taxes applicable to gaming activities, including slot machine taxes and casino licensing fees.

- Fuel Taxes: Las Vegas, like many other cities, imposes taxes on the sale of gasoline and diesel fuel. These taxes contribute to the maintenance of roads and transportation infrastructure.

- Tobacco and Alcohol Taxes: Taxes on the sale of tobacco products and alcoholic beverages are an additional revenue stream for the city. These taxes are often higher compared to other commodities to discourage consumption and generate additional revenue.

The Impact of Taxes on the Las Vegas Economy

The tax system in Las Vegas plays a pivotal role in shaping the economic landscape of the city. The revenue generated from these taxes is essential for funding various public services, infrastructure development, and initiatives that contribute to the overall prosperity of the city.

Funding Public Services and Infrastructure

Tax revenue in Las Vegas is directed towards funding a wide range of public services and infrastructure projects. These include:

- Education: Taxes contribute to the funding of public schools, ensuring access to quality education for the city's residents.

- Healthcare: Revenue from taxes supports public healthcare initiatives, providing essential medical services to the community.

- Public Safety: A significant portion of tax revenue is allocated to maintaining a robust public safety system, including police, fire, and emergency services.

- Transportation: Taxes help fund the maintenance and development of roads, highways, and public transportation systems, facilitating efficient movement within the city.

- Cultural and Recreational Facilities: Tax revenue contributes to the upkeep and development of parks, museums, and other cultural institutions, enhancing the quality of life for residents and visitors.

Economic Development and Tourism

The tax structure in Las Vegas is designed to support the city’s thriving tourism industry and promote economic development. The Transient Room Tax, for instance, generates significant revenue that is used to enhance the tourism experience and attract more visitors to the city.

Additionally, the Nevada State Business License Tax provides an incentive for businesses to operate within the state by offering a relatively low tax rate based on gross revenue. This encourages entrepreneurship and business growth, contributing to the overall economic prosperity of Las Vegas.

Conclusion: A Comprehensive Tax System

The tax system in Las Vegas is a complex and carefully crafted framework that supports the city’s vibrant economy and diverse range of industries. From sales and property taxes to gaming and employment taxes, each component plays a vital role in funding public services, infrastructure, and economic development initiatives.

For residents and businesses alike, understanding the intricacies of the Vegas tax rate is essential for financial planning and compliance. By staying informed about the latest tax rates and regulations, individuals and businesses can navigate the tax landscape with confidence and contribute to the continued success of this dynamic city.

How often are tax rates updated in Las Vegas?

+Tax rates in Las Vegas can be updated periodically, typically on an annual basis. It is important to stay updated on any changes to ensure compliance with the latest tax regulations.

Are there any tax incentives for businesses in Las Vegas?

+Yes, Las Vegas offers various tax incentives to attract and support businesses. These incentives can include tax abatements, tax credits, and reduced tax rates for specific industries. It is advisable to consult with a tax professional or the Nevada Department of Taxation for detailed information.

What happens if I fail to pay my taxes in Las Vegas?

+Failing to pay taxes in Las Vegas can result in penalties, interest charges, and legal consequences. It is important to stay compliant with tax obligations to avoid any adverse effects on your financial standing and legal status.