Florida Corporate Income Tax

The corporate income tax landscape in Florida is an intriguing aspect of the state's economic framework, offering unique features that set it apart from many other jurisdictions. Florida's corporate tax structure is designed to foster a business-friendly environment, attracting investors and corporations with its competitive tax rates and a range of incentives. This article delves into the specifics of Florida's corporate income tax, providing a comprehensive overview of the tax rates, applicable laws, and the benefits and challenges it presents to businesses operating within the state.

Understanding Florida’s Corporate Income Tax

Florida’s corporate income tax is a vital component of the state’s revenue generation strategy, contributing significantly to the overall fiscal health of the state. It is governed by a set of intricate laws and regulations that define the tax liability of corporations operating within Florida’s borders. Unlike some other states, Florida has opted for a straightforward tax structure, doing away with the complexities often associated with corporate taxation.

Florida's corporate income tax is levied on the income earned by C corporations, S corporations, limited liability companies (LLCs), and partnerships. The tax is computed based on the corporation's taxable income, which is derived from its total income minus allowable deductions and exemptions. This income is then subjected to a flat tax rate, making the tax calculation process relatively simple compared to states that employ a graduated tax system.

Key Features of Florida’s Corporate Income Tax

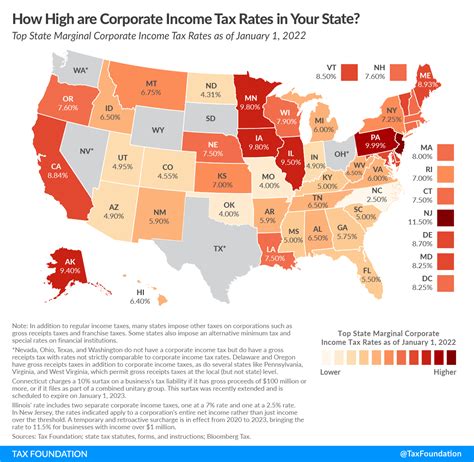

One of the standout features of Florida’s corporate income tax is its flat tax rate. As of 2024, the tax rate stands at 5.5%, which is competitive when compared to other states. This flat rate structure means that regardless of the size or revenue of the corporation, the tax rate remains the same, offering a level playing field for businesses of all sizes.

Florida also offers a range of tax incentives to encourage economic development and investment. These incentives are designed to attract new businesses and support existing ones, thereby fostering a robust business ecosystem. Some of the notable incentives include:

- Research and Development (R&D) Tax Credit: Corporations can claim a credit against their corporate income tax liability for qualified research activities conducted within Florida.

- Capital Investment Tax Credit: Businesses that make significant capital investments in Florida may be eligible for this credit, which provides a reduction in their corporate income tax liability.

- Job Growth Grant Fund: This program offers financial incentives to businesses that create a substantial number of new full-time jobs in Florida.

- Enterprise Zone Tax Incentives: Florida has designated specific Enterprise Zones across the state, offering various tax benefits to businesses that locate or expand within these zones.

Taxable Income and Deductions

Florida’s corporate income tax is based on the corporation’s taxable income, which is determined by subtracting allowable deductions and exemptions from the total income earned. The state allows a range of deductions, including ordinary and necessary business expenses, depreciation, and amortization. Additionally, Florida recognizes federal income tax deductions, providing a certain level of alignment with federal tax laws.

However, it's important to note that Florida does not allow the deduction of federal income taxes paid, which can result in double taxation for corporations with operations in multiple states.

| Taxable Income Bracket | Tax Rate |

|---|---|

| Up to $50,000 | 5.5% |

| $50,001 - $100,000 | 5.5% |

| Over $100,000 | 5.5% |

Registration and Compliance

To operate in Florida and be subject to corporate income tax, businesses must first register with the Florida Department of Revenue (FDOR). This registration process involves obtaining a corporate income tax account number and ensuring compliance with the state’s tax laws and regulations.

Businesses are required to file their corporate income tax returns annually, typically by the 15th day of the third month following the end of their fiscal year. For example, a corporation with a fiscal year ending on December 31st would typically have until March 15th of the following year to file its corporate income tax return.

It's crucial for corporations to maintain accurate financial records and comply with the reporting requirements set by the FDOR to avoid penalties and ensure smooth operations within the state.

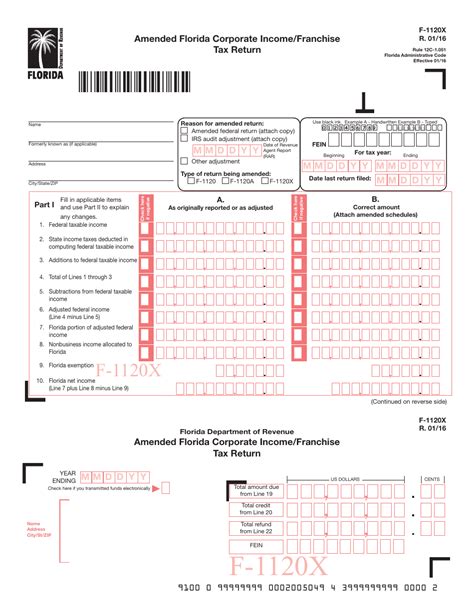

Tax Forms and Filing Requirements

The corporate income tax return in Florida is filed using Form F-1120 for C corporations and Form F-1120S for S corporations. These forms require detailed information about the corporation’s income, deductions, and tax calculations. Additionally, corporations must include any applicable schedules and supporting documentation to substantiate the information provided on the tax return.

LLCs and partnerships, on the other hand, are not required to file a corporate income tax return in Florida. Instead, their income and deductions are passed through to the members or partners, who report and pay tax on their respective shares.

Challenges and Considerations

While Florida’s corporate income tax structure presents several advantages, there are also some challenges and considerations that businesses should be aware of.

Limited Deductions and Exemptions

One of the key challenges for corporations operating in Florida is the limited availability of deductions and exemptions. While the state offers a range of tax incentives, the overall number of deductions and exemptions is more restricted compared to some other states. This can result in a higher effective tax rate for corporations, particularly those with complex financial structures or high levels of business activity.

Sales and Use Tax

Florida imposes a sales and use tax on the sale of goods and certain services within the state. While this tax is separate from corporate income tax, it can significantly impact a corporation’s overall tax liability. Corporations are required to collect and remit sales tax on taxable transactions, which can add to their administrative burden and financial obligations.

Compliance and Reporting

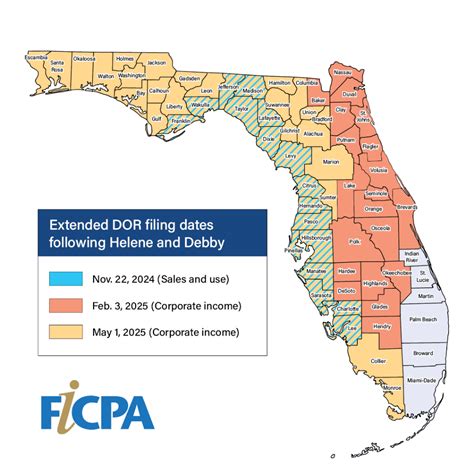

The compliance and reporting requirements in Florida can be intricate, particularly for businesses with multi-state operations. Corporations must ensure they understand and adhere to the specific rules and regulations set by the FDOR, including the timely filing of tax returns and the accurate reporting of income and deductions. Failure to comply with these requirements can result in penalties and interest charges.

Future Implications and Strategies

As Florida continues to evolve its economic landscape, the corporate income tax structure is likely to remain a key focus for policymakers and businesses alike. The state’s commitment to a flat tax rate and its offering of various tax incentives suggest a continued emphasis on attracting and retaining businesses.

For corporations looking to optimize their tax position in Florida, several strategies can be considered. These include leveraging the state's tax incentives, such as the R&D tax credit and capital investment tax credit, to reduce tax liability. Additionally, businesses can explore the possibility of locating or expanding within Florida's Enterprise Zones to take advantage of the targeted tax benefits offered in those areas.

Furthermore, corporations should stay abreast of any changes to Florida's tax laws and regulations, ensuring they adapt their tax strategies accordingly. This proactive approach can help businesses navigate the complexities of the corporate income tax landscape and make the most of the opportunities presented by Florida's tax structure.

Staying Informed and Adapting to Change

The corporate income tax landscape in Florida is subject to change, influenced by factors such as economic conditions, political decisions, and legislative updates. As such, it is crucial for businesses to remain informed about any potential alterations to the tax structure, rates, or incentives. Staying abreast of these changes can enable corporations to adjust their tax strategies and planning accordingly, ensuring they continue to benefit from the advantages offered by Florida’s tax system.

Regular engagement with tax professionals and legal advisors can provide businesses with valuable insights into the latest developments and ensure compliance with the evolving tax landscape. By staying informed and adapting their tax strategies, corporations can effectively manage their tax obligations and take advantage of the opportunities presented by Florida's corporate income tax structure.

How does Florida’s corporate income tax compare to other states?

+Florida’s corporate income tax is generally more competitive than many other states, particularly those with higher tax rates or more complex tax structures. Florida’s flat tax rate of 5.5% is lower than the majority of states, making it an attractive destination for businesses. Additionally, the state’s range of tax incentives further enhances its appeal.

What are the registration requirements for corporations in Florida?

+Corporations operating in Florida must register with the Florida Department of Revenue (FDOR) and obtain a corporate income tax account number. This process involves providing details about the corporation’s business activities, location, and ownership structure. The FDOR website provides comprehensive guidance on the registration process and the required documentation.

Are there any tax incentives available for businesses in Florida?

+Yes, Florida offers a range of tax incentives to encourage economic development and investment. These incentives include the Research and Development (R&D) Tax Credit, Capital Investment Tax Credit, Job Growth Grant Fund, and Enterprise Zone Tax Incentives. These programs provide corporations with opportunities to reduce their tax liability and enhance their business operations within the state.

How often do corporations need to file their corporate income tax returns in Florida?

+Corporations in Florida are required to file their corporate income tax returns annually, typically by the 15th day of the third month following the end of their fiscal year. For example, a corporation with a fiscal year ending on December 31st would have until March 15th of the following year to file its corporate income tax return.