Portland Oregon Arts Tax

The Portland Arts Tax is a unique initiative that has become a notable feature of the vibrant arts scene in Portland, Oregon. Implemented with the aim of fostering and supporting local artistic endeavors, this tax has sparked conversations and raised questions about its impact and effectiveness. In this article, we delve into the world of the Portland Arts Tax, exploring its origins, its mechanics, and its role in shaping the artistic landscape of the city.

A Creative City’s Innovative Approach

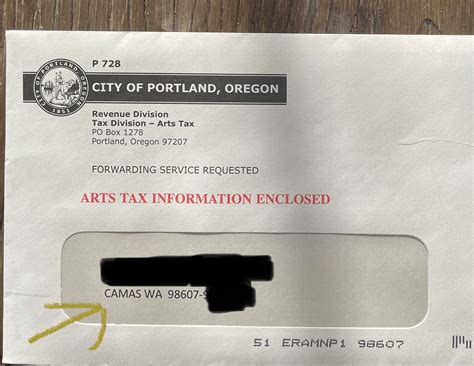

Portland, known for its artistic spirit and eclectic culture, took a bold step in 2012 by introducing the Arts Tax. This was a move to address the city’s commitment to the arts and its desire to ensure that creative pursuits remained accessible and thriving. The tax was designed as a resident-based fee, requiring individuals over the age of 18 and residing in Portland to pay an annual fee, with certain exemptions and waivers available.

The idea behind the Arts Tax was not just to generate revenue but to actively involve the community in supporting local arts and culture. By making it a resident-based contribution, the city aimed to foster a sense of ownership and pride in Portland's artistic offerings. This innovative approach set Portland apart, making it one of the few cities in the United States to implement such a direct and inclusive funding mechanism for the arts.

Mechanics of the Portland Arts Tax

The Portland Arts Tax operates on a straightforward principle: registered individuals pay an annual fee, which is then distributed to support various arts and cultural initiatives across the city. The tax amount, which has evolved over the years, currently stands at 35 per person, with a household cap of 70. This means that even in households with multiple adults, the maximum contribution is $70, ensuring fairness and affordability.

The tax is designed to be inclusive and accessible. Residents have the option to pay online, by mail, or in person, and there are provisions for those who cannot afford the full amount. Waivers are available for low-income individuals, and those facing financial hardship can apply for exemptions. This ensures that the tax does not become a barrier to anyone wishing to participate in the city's arts community.

Distribution and Impact

The revenue generated from the Arts Tax is distributed to a variety of arts and cultural organizations, schools, and initiatives. A significant portion goes towards funding arts education in public schools, ensuring that every student has access to creative learning opportunities. The tax also supports local artists, galleries, and cultural events, contributing to the city’s vibrant arts scene.

The impact of the Arts Tax can be seen in the diverse range of projects it has funded. From supporting emerging artists' residencies to funding community art workshops and cultural festivals, the tax has played a crucial role in fostering creativity and bringing the arts to all corners of Portland. It has also contributed to the city's reputation as a hub for artistic expression and innovation.

Community Engagement and Participation

One of the most notable aspects of the Portland Arts Tax is the way it engages the community. By requiring residents to contribute, the tax fosters a sense of collective responsibility and ownership. It encourages residents to become active participants in the city’s artistic life, whether through attending events, supporting local artists, or even creating art themselves.

The tax has also sparked conversations and community discussions about the value of the arts. It has brought to the forefront the importance of arts funding and the role it plays in shaping a city's identity and culture. These discussions have not only raised awareness but have also led to increased participation and support for local arts initiatives.

Challenges and Critiques

Despite its innovative nature and positive impact, the Portland Arts Tax has not been without its share of challenges and criticisms. Some residents have expressed concerns about the tax’s administrative burden and the potential for non-compliance. There have also been debates about the fairness of the tax, particularly in relation to the household cap, which some argue does not adequately reflect the actual costs of supporting the arts.

Additionally, the tax has faced scrutiny regarding its effectiveness in reaching certain demographics. Critics argue that the tax may disproportionately impact lower-income households, despite the waiver system, and that it may not adequately support the diverse artistic communities within Portland. These concerns have led to ongoing discussions and adjustments to ensure the tax remains equitable and inclusive.

The Future of the Portland Arts Tax

As Portland continues to evolve and its artistic landscape grows, the future of the Arts Tax remains an important topic of discussion. The tax has already undergone several revisions and amendments to address concerns and improve its effectiveness. Going forward, the city will need to carefully consider how to balance the tax’s impact on different income levels and ensure that it continues to support the diverse range of artistic endeavors that make Portland unique.

One potential direction for the Arts Tax could be to further emphasize its role in fostering artistic diversity. This could involve allocating a portion of the funds specifically for initiatives that support underrepresented artists and communities. By doing so, the tax could play a pivotal role in promoting inclusivity and equity within the arts sector.

Lessons and Inspirations

The Portland Arts Tax has served as an inspiring example for other cities and communities looking to support their local arts scenes. It has demonstrated the potential for direct community involvement and the positive impact such involvement can have on the arts. Other cities have taken note and are exploring similar models, adapting them to their unique contexts.

The tax has also highlighted the importance of community engagement and the role of the arts in building strong, vibrant communities. It has shown that when residents are actively involved in supporting the arts, the benefits extend beyond the artistic realm, contributing to a sense of community pride and well-being.

| Key Metrics | Value |

|---|---|

| Annual Tax Amount | $35 per person, $70 household cap |

| Exemptions/Waivers | Available for low-income individuals and financial hardship cases |

| Distribution | Funds arts education, local artists, galleries, and cultural events |

How does the Portland Arts Tax work, and who is required to pay it?

+The Portland Arts Tax is a resident-based fee, requiring individuals over the age of 18 who reside in Portland to pay an annual fee of 35. There is a household cap of 70, ensuring fairness. Certain exemptions and waivers are available for low-income individuals and those facing financial hardship.

What is the purpose of the Arts Tax, and how is it distributed?

+The purpose of the Arts Tax is to support local arts and culture, including arts education in schools, local artists, galleries, and cultural events. The revenue generated is distributed to a variety of arts organizations and initiatives, fostering a vibrant artistic community.

What are some of the challenges and criticisms associated with the Portland Arts Tax?

+Challenges include administrative burdens, potential non-compliance, and debates about fairness, particularly regarding the household cap. Critics argue it may disproportionately impact lower-income households and may not adequately support diverse artistic communities.