Va State Tax

Welcome to our comprehensive guide on the Virginia State Tax system, a crucial aspect of financial management for residents and businesses operating within the Commonwealth of Virginia. In this article, we delve into the intricacies of Va State Tax, exploring its structure, rates, filing requirements, and more. By the end of this guide, you'll have a deeper understanding of how the Virginia tax system works and how to navigate it effectively.

Understanding Va State Tax: An Overview

The Va State Tax, or Virginia State Income Tax, is an essential component of the state’s revenue system. It plays a significant role in funding various public services, infrastructure development, and social programs that benefit Virginia’s residents. Let’s break down the key elements of this tax system.

Tax Structure and Rates

Virginia employs a progressive income tax system, which means that taxpayers are subject to different tax rates depending on their income levels. As of the latest tax year, Virginia has five income tax brackets, each with its own marginal tax rate. These brackets are:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - 3,000</td> <td>2.0%</td> </tr> <tr> <td>3,001 - 5,000</td> <td>3.0%</td> </tr> <tr> <td>5,001 - 17,000</td> <td>5.0%</td> </tr> <tr> <td>17,001 - 100,000</td> <td>5.75%</td> </tr> <tr> <td>100,001 and above | 5.75% |

It's important to note that these rates are subject to change based on legislative decisions and economic conditions. Therefore, it's advisable to stay updated with the latest tax rates to ensure accurate filing.

Taxable Income and Deductions

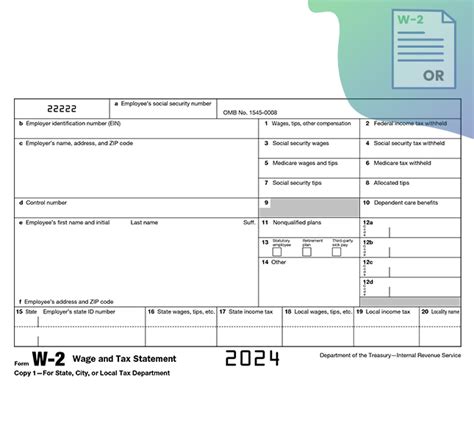

When calculating your Virginia state tax liability, you’ll need to determine your taxable income. This is typically your adjusted gross income from all sources, including wages, salaries, business income, investments, and other forms of earnings. However, Virginia allows certain deductions and credits to reduce your taxable income. These may include deductions for medical expenses, charitable contributions, and certain tax credits for specific circumstances.

Filing Requirements and Deadlines

All Virginia residents and businesses with income sourced from within the state are generally required to file a Virginia state income tax return. The filing deadline aligns with the federal tax deadline, which is typically April 15th of each year. However, it’s crucial to note that this deadline may be subject to change, especially during exceptional circumstances such as the COVID-19 pandemic.

For those who owe taxes, it's essential to make sure that the payment is received by the due date. Late payments may incur penalties and interest charges, so it's advisable to plan your tax payments accordingly.

Online Filing and Resources

Virginia offers a convenient online filing system, eFile, which allows taxpayers to file their state tax returns electronically. This system is secure, efficient, and often provides faster refunds compared to traditional paper filing. Additionally, the Virginia Department of Taxation provides a wealth of resources and guides to assist taxpayers in understanding their tax obligations and navigating the filing process.

Strategies for Effective Tax Management

To ensure a smooth and advantageous tax filing experience, consider the following strategies:

- Stay Informed: Keep yourself updated with the latest tax laws, rates, and regulations. This includes being aware of any tax reform initiatives or changes in tax brackets.

- Utilize Deductions and Credits: Maximize your deductions and take advantage of available tax credits to reduce your taxable income. Consult a tax professional or use reliable tax software to identify all eligible deductions.

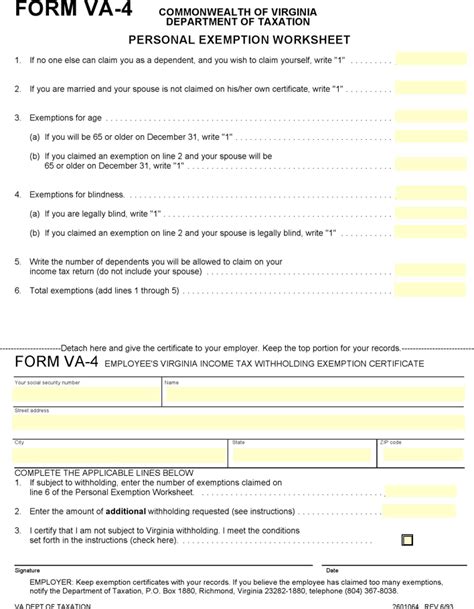

- Plan Your Withholdings: Adjust your tax withholdings throughout the year to ensure you're not overpaying or underpaying your taxes. This can help avoid unexpected tax bills or large refunds.

- Consider Professional Assistance: If you have a complex financial situation or are unsure about your tax obligations, seeking guidance from a certified tax professional can provide valuable insights and ensure compliance.

Conclusion: Navigating Va State Tax with Confidence

Understanding and managing your Va State Tax obligations is a crucial aspect of financial responsibility. By familiarizing yourself with the progressive tax structure, staying informed about tax rates and deadlines, and utilizing available resources, you can ensure a smooth and compliant tax filing experience. Remember, effective tax management not only ensures compliance but can also lead to significant savings and benefits.

Frequently Asked Questions

What is the difference between Virginia’s state income tax and federal income tax?

+

Virginia’s state income tax is a separate tax from the federal income tax. While both are based on your income, the rates, brackets, and filing requirements can differ. It’s essential to file both state and federal tax returns accurately to avoid penalties.

Are there any tax credits or deductions specifically for Virginia residents?

+

Yes, Virginia offers several tax credits and deductions tailored to its residents. These include credits for senior citizens, disabled individuals, and those with qualifying dependents. It’s advisable to review the Virginia Department of Taxation’s website for a comprehensive list of available credits and deductions.

How do I estimate my Virginia state tax liability for the current year?

+

Estimating your Virginia state tax liability involves calculating your taxable income, applying the appropriate tax rates based on your income bracket, and considering any eligible deductions or credits. Online tax calculators and software can assist in this process, providing a rough estimate of your potential tax liability.

What happens if I miss the tax filing deadline?

+

Missing the tax filing deadline can result in penalties and interest charges. It’s crucial to file your tax return as soon as possible to avoid further complications. If you’re unable to file by the deadline, consider filing for an extension, which can provide additional time to complete your return.

Are there any online resources to help me understand the Virginia tax system better?

+

Absolutely! The Virginia Department of Taxation’s website offers a wealth of resources, including guides, FAQs, and interactive tools to help taxpayers understand their obligations. Additionally, there are numerous reputable online tax resources and forums where you can find valuable insights and ask specific questions.