States Without Real Estate Tax

The concept of states without real estate tax is intriguing, as it raises questions about property ownership, tax systems, and their implications. While most states in the United States levy some form of real estate tax, often referred to as property tax, there are a few jurisdictions that operate without this specific tax category. Understanding the nuances of these tax systems provides valuable insights into the economic landscape and potential opportunities.

Exploring States Without Real Estate Tax

When we delve into the topic of states without real estate tax, it's essential to clarify that this absence of a specific tax does not necessarily mean that property owners are exempt from all forms of taxation. Instead, these states have unique approaches to generating revenue and funding public services, which can include alternative taxes and innovative funding mechanisms.

The Real Estate Tax Landscape in the United States

Real estate taxes, or property taxes, are a significant source of revenue for many state and local governments across the country. These taxes are typically calculated based on the assessed value of the property and are used to fund various public services such as schools, infrastructure, and emergency services. While the specific rates and methodologies may vary, the majority of states employ this tax to support their communities.

However, there are notable exceptions. Let's explore a few states that have implemented alternative tax structures, effectively operating without a dedicated real estate tax.

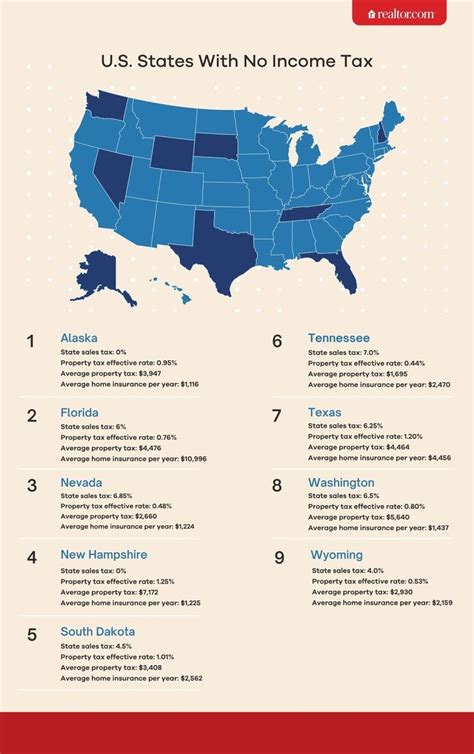

- Alaska: Alaska is renowned for its unique tax system, which includes no state-level income tax or sales tax. Instead, the state relies heavily on revenue from oil and gas production, as well as a corporate income tax. Property taxes are primarily managed at the local level, with municipalities having the authority to levy these taxes. This decentralized approach allows for flexibility in tax rates, benefiting both residents and businesses.

- Florida: Florida's tax system is characterized by its lack of a state income tax. To compensate, the state relies on sales tax, tourist-related taxes, and a range of other levies. Property taxes are primarily handled by local governments, with the state providing guidelines for assessment and collection. This system has made Florida an attractive destination for retirees and businesses, seeking tax-friendly environments.

- Texas: While Texas does not have a state income tax, it does impose a property tax. However, the state's property tax system is notable for its emphasis on local control. Property taxes are primarily collected and spent at the local level, providing funding for schools, roads, and other essential services. This decentralized approach allows for local communities to have a significant say in their tax rates and spending priorities.

- Nevada: Nevada's tax system is often associated with its gaming and tourism industries. The state does not have a personal income tax, instead relying on a modified business tax and sales tax. Property taxes in Nevada are managed at the local level, with counties and municipalities responsible for assessing and collecting these taxes. This approach has contributed to Nevada's reputation as a business-friendly state, attracting new businesses and residents.

- Washington: Washington State operates without a personal income tax, instead relying on a robust sales tax and business taxes. Property taxes in Washington are primarily levied by local governments, with funds allocated to support schools, fire departments, and other local services. This system has fostered a diverse economy, attracting businesses and individuals seeking tax-efficient environments.

It's important to note that while these states may not have a dedicated real estate tax at the state level, property owners are still subject to other forms of taxation and may face unique tax obligations. Understanding the specific tax landscape of each state is crucial for individuals and businesses considering relocation or investment.

The Impact and Considerations

The absence of a state-level real estate tax can have significant implications for property owners and the overall economic climate. While it may offer advantages such as lower tax burdens and increased financial flexibility, it also comes with trade-offs. States without real estate tax often rely on alternative revenue streams, which can result in higher sales taxes, business taxes, or other forms of taxation.

Furthermore, the decentralized nature of property tax systems in these states can lead to variations in tax rates and assessment methodologies across different regions. This can create complexities for individuals and businesses operating in multiple jurisdictions, requiring careful tax planning and consideration of the specific tax obligations in each location.

For investors and businesses, the absence of a real estate tax can be a significant factor in their decision-making process. It can provide an opportunity to reduce overall tax liabilities and enhance financial efficiency. However, it's essential to evaluate the overall tax environment, including other state and local taxes, to make informed decisions.

In conclusion, the concept of states without real estate tax offers a unique perspective on tax systems and their impact on property ownership. While these states have implemented innovative approaches to funding public services, they also present challenges and considerations for individuals and businesses. Understanding the specific tax landscape and its implications is crucial for navigating these jurisdictions effectively.

Real-World Impact and Case Studies

Let's delve deeper into the practical implications of states without real estate tax by examining real-world case studies and analyzing their impact on communities and businesses.

Alaska: The Power of Resource-Based Taxation

Alaska's tax system is a prime example of how a state can operate without a traditional real estate tax. The state's reliance on revenue from oil and gas production has allowed it to maintain a competitive tax environment while providing essential public services. This resource-based taxation model has contributed to Alaska's economic resilience, especially in regions with significant natural resource deposits.

One notable case study is the city of Prudhoe Bay, located on Alaska's North Slope. With a population of just over 2,000, Prudhoe Bay is home to one of the largest oil fields in the United States. The city benefits from substantial revenue generated by oil and gas production, which is distributed through state and local government entities. This revenue stream has enabled Prudhoe Bay to maintain a robust infrastructure, including a world-class school system and reliable public services, without relying on a traditional real estate tax.

However, the dependence on a single industry can present challenges. Fluctuations in oil prices and the potential for resource depletion are ongoing concerns. To mitigate these risks, Alaska has implemented a range of fiscal policies, including the Alaska Permanent Fund, which invests a portion of the state's oil revenues for long-term economic stability.

Florida: The Sunshine State's Tax Advantage

Florida's absence of a state income tax has made it a popular destination for retirees and businesses seeking tax-friendly environments. The state's reliance on sales tax and tourist-related taxes has contributed to its economic growth, especially in the tourism and hospitality sectors.

A case study worth examining is the city of Miami Beach. This vibrant coastal community is known for its thriving tourism industry, which generates significant revenue through hotel taxes, rental car surcharges, and other tourist-related levies. These funds are used to enhance public services, maintain infrastructure, and support local initiatives. Miami Beach's tax system, coupled with its world-class attractions, has made it a desirable location for tourists and residents alike.

However, the focus on tourism-related taxes can create challenges during economic downturns or periods of reduced tourism. To address this, Florida has implemented various initiatives to diversify its economy, including incentives for technology startups and efforts to attract new industries.

Texas: Balancing Local Control and State Revenue

Texas' decentralized approach to property taxes, where local governments have significant control over tax rates and spending, has resulted in a diverse economic landscape. This system has contributed to the state's reputation as a business-friendly environment, attracting a wide range of industries.

The city of Austin provides an excellent case study. Known as the "Live Music Capital of the World," Austin has a thriving technology and creative industries sector. The city's innovative culture and business-friendly tax environment have attracted numerous startups and established companies. While Austin does impose a property tax, the local government has the flexibility to set rates and allocate funds to support its vibrant economy and maintain a high quality of life for its residents.

However, the decentralized nature of property taxes in Texas can lead to variations in tax burdens across different regions. This has prompted ongoing discussions about tax reform and the need for a more equitable distribution of tax revenues.

Nevada: Gaming, Tourism, and Economic Diversification

Nevada's tax system, characterized by the absence of a personal income tax and a reliance on gaming and tourism-related taxes, has contributed to its reputation as a popular destination for businesses and tourists alike.

Las Vegas, the iconic city known for its casinos and entertainment, serves as a prime example. The city's world-renowned casinos generate substantial revenue through gaming taxes and tourist-related levies. These funds are used to support local government operations, infrastructure development, and community initiatives. Las Vegas' tax system, combined with its vibrant entertainment industry, has made it a global tourism hotspot.

While the gaming and tourism industries are the backbone of Nevada's economy, the state has recognized the need for economic diversification. Efforts to attract technology startups, foster renewable energy initiatives, and support small businesses have been underway to reduce the state's reliance on a single industry.

Washington: Sales Tax and Business-Friendly Environment

Washington State's tax system, which operates without a personal income tax, has contributed to its reputation as a business-friendly state. The reliance on sales tax and business taxes has attracted a diverse range of industries, from technology giants to small businesses.

The city of Seattle, home to global tech giants like Amazon and Microsoft, exemplifies Washington's economic landscape. The city's thriving technology sector and business-friendly tax environment have made it a hub for innovation and entrepreneurship. While Seattle does impose a property tax, the local government has the autonomy to set rates and allocate funds to support its growing economy and maintain a high quality of life for its residents.

However, the reliance on sales tax can present challenges for low-income individuals and businesses, as it can disproportionately impact their financial stability. Washington has implemented various initiatives to address these concerns, including tax incentives for low-income earners and support for small businesses.

Expert Insights and Future Implications

As we reflect on the states without real estate tax and their unique tax systems, several key insights emerge. These jurisdictions have demonstrated the potential for innovative tax structures and the impact they can have on economic development and community well-being.

One of the critical takeaways is the importance of balancing tax incentives with long-term economic sustainability. While the absence of a real estate tax can attract businesses and individuals, it also necessitates careful planning to ensure the stability and resilience of the state's economy. States like Alaska and Nevada, with their resource-based and tourism-centric tax systems, highlight the need for diversification and fiscal responsibility.

Additionally, the decentralized approach to property taxes, as seen in Texas and Washington, underscores the value of local control and community involvement in tax decision-making. This model empowers local governments to tailor tax rates and spending priorities to the specific needs and aspirations of their residents and businesses.

Looking ahead, states without real estate tax may face ongoing challenges and opportunities. As the economic landscape evolves, these jurisdictions will need to adapt their tax systems to remain competitive and address emerging needs. This could involve further diversifying revenue streams, implementing tax reforms, and exploring new technologies to enhance tax administration and compliance.

Furthermore, the absence of a real estate tax does not diminish the importance of efficient tax administration and compliance. States will need to continue investing in tax infrastructure, education, and enforcement to ensure that their tax systems are fair, effective, and beneficial to all stakeholders.

In conclusion, the exploration of states without real estate tax provides a fascinating glimpse into the diverse world of tax systems and their impact on communities. These jurisdictions have demonstrated the potential for innovative approaches to taxation, highlighting the importance of adaptability, local control, and long-term economic planning. As we navigate an ever-changing economic landscape, the insights gained from these states can inform tax policies and strategies, benefiting both residents and businesses alike.

How do states without real estate tax generate revenue for public services?

+States without real estate tax rely on alternative revenue streams such as sales tax, business taxes, and tourism-related levies. They may also have unique funding mechanisms, like Alaska’s reliance on oil and gas revenue. These diverse revenue sources allow states to fund public services and infrastructure.

What are the advantages of states without real estate tax for property owners and businesses?

+States without real estate tax can offer lower tax burdens for property owners and businesses. This can enhance financial flexibility and make these states more attractive destinations for investment and relocation. However, it’s important to consider the overall tax landscape, including other state and local taxes.

Are there any challenges associated with states without real estate tax?

+Yes, states without real estate tax may face challenges such as higher sales taxes or business taxes. Additionally, the decentralized nature of property taxes in some states can lead to variations in tax rates and assessment methodologies, requiring careful tax planning for individuals and businesses operating in multiple jurisdictions.

How do states without real estate tax ensure long-term economic sustainability?

+States without real estate tax often focus on economic diversification and fiscal responsibility. They may implement initiatives to attract new industries, support small businesses, and invest in renewable energy or technology sectors. This approach helps reduce reliance on a single industry and promotes long-term economic stability.

What role does local control play in states without real estate tax?

+Local control is a key aspect of states without real estate tax. In some states, local governments have significant authority over property tax rates and spending priorities. This decentralized approach allows communities to tailor tax systems to their specific needs, fostering a sense of ownership and involvement in tax decision-making.