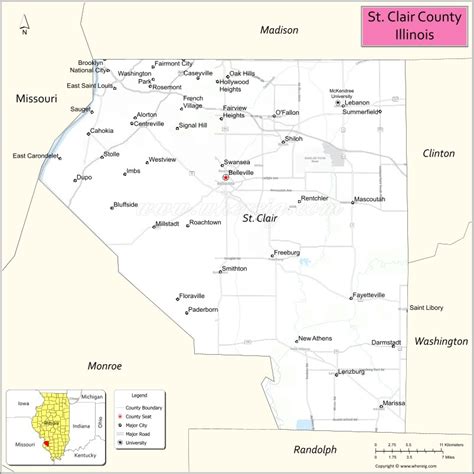

St Clair County Il Property Tax

Property taxes in St. Clair County, Illinois, are an essential aspect of local government funding and a significant expense for property owners. These taxes contribute to the maintenance and development of various public services and infrastructure. Understanding the intricacies of property taxation in St. Clair County is crucial for both residents and prospective buyers.

The Mechanics of St. Clair County Property Taxes

Property taxes in St. Clair County are determined by the assessed value of the property and the tax rates set by various taxing bodies. These taxing bodies include the county, municipalities, school districts, and special taxing districts. The assessment process involves evaluating the property’s fair market value, which forms the basis for calculating the tax liability.

The assessment cycle in St. Clair County typically occurs every four years, with the most recent general reassessment conducted in 2022. During this process, assessors evaluate properties to ensure the assessed values are accurate and reflect the current real estate market conditions. Property owners have the right to appeal their assessments if they believe the values are incorrect.

Once the assessments are finalized, taxing bodies determine their tax rates, which are expressed as a percentage of the property's assessed value. These rates are established based on the budget requirements of each taxing body and the total assessed value of properties within their jurisdiction.

Tax Rate Components

The property tax rate in St. Clair County is composed of several components, each representing a different taxing body’s rate. For instance, the rate may include components for county operations, school districts, fire protection districts, and other special taxing districts. These rates can vary significantly between different areas of the county, depending on the services and infrastructure provided by each taxing body.

Here's a simplified breakdown of the tax rate components:

| Taxing Body | Rate Component |

|---|---|

| St. Clair County | County Operations |

| East St. Louis School District | Education |

| Belleville Fire Protection District | Fire Protection |

| O'Fallon Park District | Parks and Recreation |

Calculating Property Taxes in St. Clair County

The property tax calculation in St. Clair County involves multiplying the property’s assessed value by the applicable tax rate. This process is straightforward for a single tax rate, but it becomes more complex when multiple taxing bodies are involved, each with their own rate.

For instance, consider a residential property in Belleville, St. Clair County, with an assessed value of $200,000. The property is located within the boundaries of the Belleville School District, the Belleville Fire Protection District, and the St. Clair County government. Each of these taxing bodies has its own tax rate, which we'll use as an example:

- St. Clair County: 4.50%

- Belleville School District: 3.75%

- Belleville Fire Protection District: 1.25%

To calculate the total property tax for this example, we multiply the assessed value by each rate and sum the results:

Total Tax = ($200,000 x 4.50%) + ($200,000 x 3.75%) + ($200,000 x 1.25%)

Simplifying the calculation, we get:

Total Tax = $9,000 + $7,500 + $2,500 = $19,000

So, the property owner in this example would owe a total of $19,000 in property taxes for the year.

Impact of Tax Exemptions and Credits

It’s important to note that various exemptions and credits can reduce a property owner’s tax liability. These include homeowner exemptions, senior citizen exemptions, and various other credits offered by the state and local governments. For instance, the Homestead Exemption in Illinois reduces the assessed value of a primary residence, effectively lowering the property taxes. Similarly, the Senior Citizens Real Estate Tax Deferral Program allows eligible seniors to defer a portion of their property taxes until the property is sold or the owner no longer occupies it.

These exemptions and credits can significantly impact a property owner's tax bill, making it crucial to understand eligibility criteria and application processes.

Property Tax Payment Options and Due Dates

Property owners in St. Clair County have several options for paying their property taxes. The most common method is through an annual payment, which is due in two installments. The first installment is typically due in March, and the second installment is due in September. However, property owners can also choose to pay their taxes in full by the first installment due date or opt for a monthly payment plan.

Late payments can result in penalties and interest, which are added to the outstanding balance. It's essential for property owners to stay informed about due dates and payment options to avoid any financial repercussions.

Payment Methods

The St. Clair County Treasurer’s Office offers a variety of payment methods to accommodate different preferences and needs. These include:

- Online payment: Property owners can pay their taxes securely online using a credit card, debit card, or electronic check.

- Mail-in payment: Owners can send a check or money order to the Treasurer's Office, ensuring the payment is received before the due date.

- In-person payment: Owners can visit the Treasurer's Office to pay their taxes using cash, check, money order, or credit card.

- Automatic withdrawal: Property owners can set up an automatic withdrawal from their bank account to pay their taxes on the due dates.

It's worth noting that some payment methods may incur additional fees, such as convenience fees for credit card payments. Property owners should carefully review the payment options and their associated fees to choose the most suitable method for their circumstances.

Challenging Property Tax Assessments

Property owners in St. Clair County have the right to appeal their property tax assessments if they believe the assessed value is inaccurate or unfair. The appeals process is overseen by the St. Clair County Board of Review, which reviews and adjusts assessments based on evidence provided by the property owner.

The Board of Review holds hearings where property owners can present their case and provide evidence supporting their appeal. This evidence can include recent sale prices of similar properties, appraisals, and other relevant documentation. The Board of Review's decision is final, and if the assessment is reduced, the property owner's tax liability will be adjusted accordingly.

Important Dates for Appeals

The timeline for appealing property tax assessments in St. Clair County is crucial. Property owners typically have a limited window of time, often 30 days from the date of the assessment notice, to file an appeal. It’s essential to act promptly to ensure the appeal is filed within the designated timeframe.

Additionally, the Board of Review sets specific dates for hearings, and property owners must attend these hearings to present their case. Missing the hearing can result in the appeal being dismissed, so it's crucial to be aware of these dates and make the necessary arrangements.

What is the average property tax rate in St. Clair County?

+The average property tax rate in St. Clair County can vary depending on the location and the taxing bodies involved. As of [latest data available], the average rate is estimated to be around [X]%, but it’s important to note that this can change annually based on budget requirements and legislative decisions.

How often are properties reassessed for tax purposes in St. Clair County?

+Properties in St. Clair County undergo a general reassessment every four years. The most recent general reassessment was conducted in 2022. However, property owners can also request a reassessment if they believe their property’s value has significantly changed due to improvements or other factors.

Are there any tax exemptions or credits available for property owners in St. Clair County?

+Yes, St. Clair County offers several tax exemptions and credits to eligible property owners. These include the Homestead Exemption, which reduces the assessed value of a primary residence, and the Senior Citizens Real Estate Tax Deferral Program, which allows eligible seniors to defer a portion of their property taxes. It’s important to research and understand the eligibility criteria for these exemptions and credits.

Can I pay my property taxes online in St. Clair County?

+Absolutely! The St. Clair County Treasurer’s Office provides an online payment portal where property owners can pay their taxes securely using a credit card, debit card, or electronic check. This method offers convenience and ensures timely payment, avoiding any late fees or penalties.

What happens if I don’t pay my property taxes on time in St. Clair County?

+Late payment of property taxes in St. Clair County can result in penalties and interest being added to the outstanding balance. It’s important to stay informed about due dates and payment options to avoid these financial repercussions. In some cases, failure to pay property taxes can lead to tax liens and potential legal action.