Tax Collector For Polk County

Welcome to this comprehensive guide about the Tax Collector's office in Polk County, Florida. This article aims to provide an in-depth look at the services, responsibilities, and impact of the Tax Collector's office on the community. With a focus on clarity and detail, we will explore the various aspects of this vital government entity, offering valuable insights and information for residents and businesses alike.

The Role of the Tax Collector in Polk County

The Tax Collector’s office in Polk County plays a crucial administrative and financial role within the local government. It serves as a vital link between the community and various state and local agencies, ensuring efficient management and collection of taxes, fees, and other revenue streams.

The Tax Collector, an elected official, holds a term of four years and is responsible for the overall management and operation of the office. This role involves a range of critical duties, including the collection of property taxes, vehicle registration fees, driver license-related services, and the administration of various other taxes and licenses.

Key Responsibilities and Services

The Tax Collector’s office in Polk County provides a wide array of services to the public. These services are designed to streamline the tax payment process, ensure compliance with state and local regulations, and facilitate the efficient operation of government agencies.

- Property Tax Collection: One of the primary responsibilities is the collection of property taxes. The office assesses and collects taxes on real estate properties, ensuring that residents and businesses pay their fair share. This process involves the accurate calculation of taxes based on property values, as well as the timely distribution of funds to the appropriate government bodies.

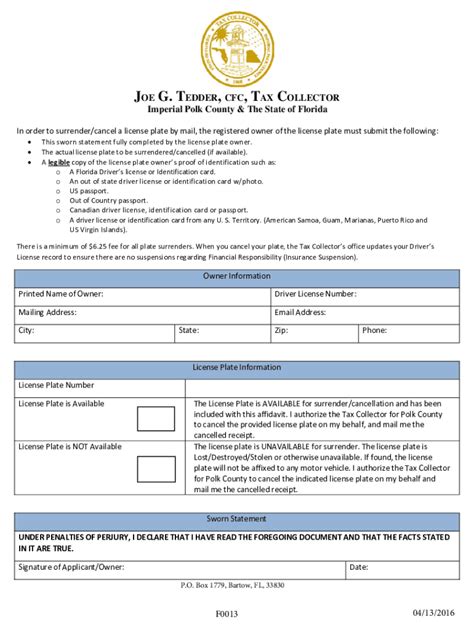

- Vehicle Registration and Title Services: The Tax Collector's office also handles vehicle registration and titling. This includes processing vehicle registration renewals, issuing new titles, and transferring ownership. These services are essential for ensuring road safety and proper vehicle identification.

- Driver License Services: In collaboration with the Florida Department of Highway Safety and Motor Vehicles, the Tax Collector's office offers driver license-related services. This includes issuing and renewing driver licenses, as well as providing identification cards and handling license suspensions or reinstatements.

- Specialty License Plates: Residents can personalize their vehicles with specialty license plates, supporting various causes and organizations. The Tax Collector's office processes these applications, ensuring the correct fees are collected and the plates are issued.

- Business Taxes and Licenses: For businesses operating in Polk County, the Tax Collector's office administers a range of business taxes and licenses. This includes occupational licenses, business tax receipts, and other industry-specific fees. These services ensure businesses comply with local regulations and contribute to the county's revenue.

- Hunting and Fishing Licenses: Outdoor enthusiasts can obtain hunting and fishing licenses through the Tax Collector's office. These licenses are essential for recreational activities and contribute to the conservation and management of natural resources.

- Notary Services: The office also provides notary public services, offering official document verification for various legal purposes.

These services are delivered through a network of physical offices and an online portal, ensuring convenience and accessibility for all residents and businesses in Polk County.

| Service Category | Key Metrics |

|---|---|

| Property Tax Collection | Over $300 million in annual property tax revenue |

| Vehicle Registration | More than 700,000 registered vehicles in Polk County |

| Driver License Services | Over 600,000 active driver licenses issued |

| Business Taxes and Licenses | Approximately 20,000 business tax receipts issued annually |

Impact on the Community

The Tax Collector’s office has a significant impact on the economic and social fabric of Polk County. The efficient collection and distribution of taxes and fees contribute to the overall financial health and stability of the county. This revenue supports critical infrastructure projects, public services, and community development initiatives.

Economic Development and Job Creation

The tax revenue generated by the Tax Collector’s office plays a vital role in attracting and supporting businesses in Polk County. The efficient administration of business taxes and licenses encourages economic growth, leading to the creation of new jobs and opportunities for local residents.

Additionally, the office's role in vehicle registration and titling facilitates the smooth operation of the automotive industry, from dealerships to repair shops. This, in turn, creates a ripple effect of economic benefits throughout the community.

Infrastructure and Public Services

A substantial portion of the tax revenue collected is allocated to essential public services and infrastructure projects. These funds support the maintenance and improvement of roads, bridges, and other transportation networks. They also contribute to the development and upkeep of public spaces, parks, and recreational facilities, enhancing the quality of life for residents.

Moreover, the revenue supports vital public services such as education, healthcare, and public safety. This includes funding for schools, emergency response teams, and community development programs, ensuring a well-rounded and vibrant community.

Community Engagement and Outreach

The Tax Collector’s office actively engages with the community through various outreach programs and initiatives. These efforts aim to educate residents about their tax responsibilities, provide assistance with tax-related matters, and foster a sense of civic duty.

The office organizes workshops, seminars, and information sessions to help residents understand the tax collection process, property assessments, and their rights and obligations as taxpayers. This proactive approach ensures that residents are well-informed and can actively participate in the financial well-being of their community.

Innovation and Technological Advancements

The Tax Collector’s office in Polk County embraces innovation and technological advancements to enhance its services and operations. By leveraging modern technology, the office aims to improve efficiency, reduce wait times, and provide a seamless experience for taxpayers.

Online Services and Digital Transformation

The office has invested in developing a user-friendly online portal, allowing residents and businesses to access a wide range of services digitally. This includes the ability to pay taxes, renew vehicle registrations, and apply for various licenses and permits without having to visit a physical office.

The online platform is designed with security and convenience in mind, offering a fast and secure way to conduct tax-related transactions. Users can track the status of their applications, receive notifications, and access their account information at any time.

Mobile App and Payment Options

To further enhance accessibility, the Tax Collector’s office has developed a mobile app. This app provides a convenient way for taxpayers to access their account information, make payments, and receive updates on the go. It is available for both iOS and Android devices, ensuring a seamless experience for all users.

In addition to online and mobile payments, the office offers a variety of payment options to cater to different preferences and needs. These include traditional methods such as checks and money orders, as well as modern options like credit and debit card payments, and even digital wallets.

Data Analytics and Efficiency

The Tax Collector’s office utilizes data analytics to optimize its operations and improve efficiency. By analyzing tax data, payment trends, and customer feedback, the office can identify areas for improvement and implement targeted strategies to enhance the overall taxpayer experience.

This data-driven approach allows the office to streamline processes, reduce administrative burdens, and allocate resources effectively. As a result, taxpayers benefit from faster processing times, reduced wait times, and a more efficient tax payment journey.

Future Outlook and Continuous Improvement

The Tax Collector’s office in Polk County remains committed to continuous improvement and adapting to the evolving needs of the community. With a focus on innovation, customer service, and fiscal responsibility, the office aims to remain at the forefront of modern tax collection practices.

Expansion of Services and Accessibility

Looking ahead, the office plans to expand its service offerings and improve accessibility for all residents. This includes exploring new technologies and partnerships to enhance the online and mobile experience, as well as improving physical office layouts and staffing to reduce wait times and provide a more welcoming environment.

Community Engagement and Education

The office recognizes the importance of community engagement and plans to strengthen its outreach efforts. This includes expanding educational programs, hosting community events, and collaborating with local organizations to ensure that all residents, regardless of their background or circumstances, understand their tax obligations and the impact of their contributions.

Sustainable Practices and Environmental Initiatives

With a growing emphasis on sustainability and environmental stewardship, the Tax Collector’s office aims to integrate eco-friendly practices into its operations. This may include adopting energy-efficient technologies, implementing paperless initiatives, and supporting community-wide sustainability projects.

By embracing sustainable practices, the office not only reduces its environmental footprint but also sets an example for the community, encouraging residents and businesses to adopt eco-conscious behaviors.

How can I pay my property taxes in Polk County?

+

You can pay your property taxes online through the Tax Collector’s website, by mail, or in person at any of the physical office locations. The office accepts various payment methods, including credit cards, e-checks, and cash.

What are the office hours for the Tax Collector’s physical locations?

+

The Tax Collector’s offices are typically open from 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding holidays. It’s recommended to check the official website for any updates or special holiday hours.

How do I renew my vehicle registration in Polk County?

+

You can renew your vehicle registration online, by mail, or in person. The process involves providing your vehicle information, paying the registration fee, and ensuring your vehicle meets the necessary requirements. The Tax Collector’s office will guide you through the steps and provide any necessary documentation.

What are the requirements for obtaining a driver license in Polk County?

+

To obtain a driver license in Polk County, you must meet certain eligibility criteria, including age requirements and passing a written and road test. The Tax Collector’s office works in conjunction with the Florida DHSMV to provide driver license services, including issuing new licenses, renewals, and replacement cards. They can guide you through the process and provide the necessary forms and requirements.

How can I obtain a specialty license plate in Polk County?

+

To obtain a specialty license plate, you need to visit the Tax Collector’s office or their online portal. You’ll need to provide the necessary information, select the desired plate design, and pay the applicable fees. The office will guide you through the process and ensure your application is processed correctly.