Tax Deferred

Tax deferral is a strategic financial tool that can significantly impact an individual's or business's overall tax liability and long-term financial planning. By understanding the principles of tax deferral and how it works, individuals can make informed decisions to optimize their financial strategies and potentially increase their wealth over time.

This comprehensive guide will delve into the intricacies of tax deferral, exploring its definitions, mechanisms, advantages, and real-world applications. We will also examine the different types of tax-deferred strategies, provide real-life examples, and offer insights into the potential benefits and considerations when utilizing these strategies.

Understanding Tax Deferral: Definitions and Mechanisms

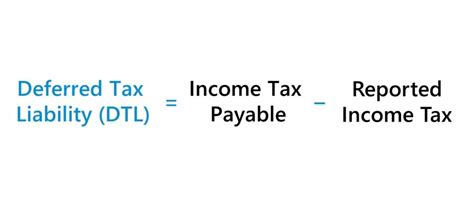

At its core, tax deferral refers to the postponement of tax payments on certain types of income, gains, or profits until a future date. This concept is rooted in the idea that individuals or entities can strategically manage their tax liabilities by controlling when and how they recognize income for tax purposes.

There are several key mechanisms that enable tax deferral:

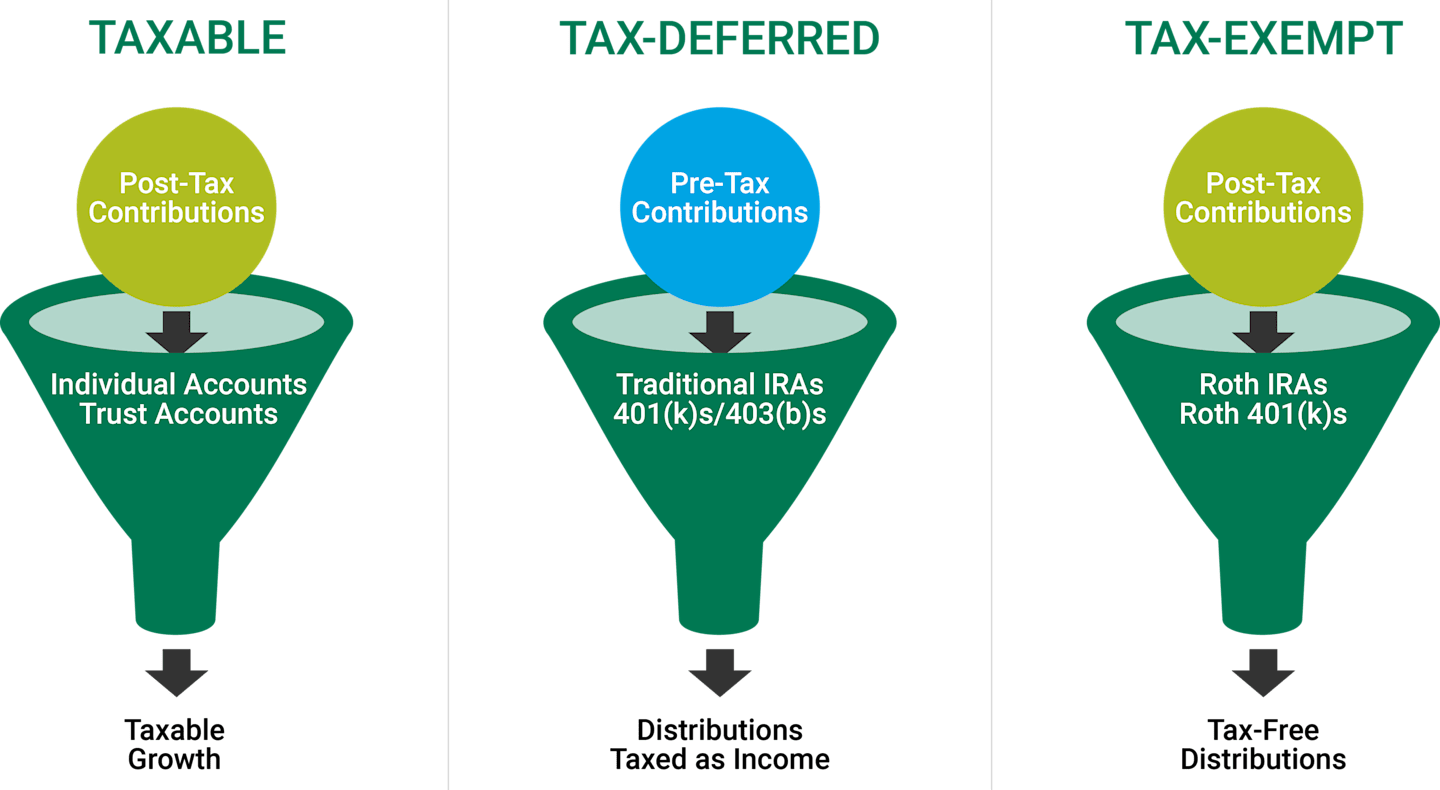

- Retirement Accounts: Tax-deferred retirement plans, such as 401(k)s and Traditional IRAs, allow individuals to contribute pre-tax dollars, deferring the taxes on these contributions until retirement. This strategy can significantly reduce taxable income in the current year and provide tax-free growth on investments within the account.

- Tax-Deferred Investments: Certain investments, like annuities and municipal bonds, offer tax-deferral benefits. With these instruments, capital gains, interest, or dividends are not taxed until the investment is sold or matured, providing tax-free compounding over time.

- Deferred Compensation Plans: Businesses can implement deferred compensation strategies, where employees agree to receive a portion of their income at a future date, often in the form of stock options or bonuses. This deferral can reduce the company's immediate tax burden and provide employees with potential tax advantages.

- Installment Sales: When selling assets, individuals can opt for installment sales, which spread the tax liability over the term of the sale. This method reduces the immediate tax impact and allows the seller to benefit from potential capital gains tax rates.

By utilizing these mechanisms, individuals and businesses can effectively manage their tax liabilities, optimize their financial strategies, and potentially enhance their overall financial well-being.

The Advantages of Tax Deferral

Tax deferral offers a range of benefits that can significantly impact an individual's financial journey:

- Reduced Current Tax Liability: By deferring taxes, individuals can lower their taxable income in the current year, potentially moving into a lower tax bracket and reducing their overall tax burden.

- Tax-Free Growth: Tax-deferred investments allow assets to grow without being subject to immediate taxation, providing the potential for substantial wealth accumulation over time.

- Long-Term Wealth Building: The power of compounding, combined with tax-deferred growth, can lead to significant wealth creation, especially when coupled with strategic investment choices.

- Financial Flexibility: Tax deferral strategies provide individuals with more control over their financial plans, allowing them to optimize tax payments according to their goals and needs.

However, it's important to note that tax deferral strategies should be carefully considered and tailored to an individual's unique financial circumstances and goals. While tax deferral can be a powerful tool, it may not be suitable for everyone, and there are potential drawbacks and limitations to consider.

Types of Tax-Deferred Strategies

Tax-deferred strategies can be broadly categorized into two main types: retirement-focused and investment-focused approaches.

Retirement-Focused Tax Deferral

Retirement-focused tax deferral strategies are primarily designed to optimize an individual's retirement savings and income. These strategies leverage tax-advantaged retirement accounts to provide significant tax benefits.

- 401(k) Plans: A popular retirement savings vehicle, 401(k) plans allow employees to contribute a portion of their pre-tax income, reducing their taxable income for the year. These contributions grow tax-deferred until withdrawal during retirement, when they are taxed at the individual's income tax rate.

- Traditional IRAs: Individual Retirement Accounts (IRAs) are another common retirement savings tool. Traditional IRAs offer tax-deferral benefits similar to 401(k)s, allowing individuals to contribute pre-tax dollars and defer taxes until retirement.

- Roth IRA Conversions: While Roth IRAs do not provide immediate tax deferral, they offer tax-free withdrawals in retirement. Some individuals opt to convert their traditional IRAs to Roth IRAs, paying taxes on the conversion amount but enjoying tax-free growth and withdrawals later.

Retirement-focused tax deferral strategies are often the cornerstone of an individual's long-term financial plan, providing a secure and tax-efficient path to retirement.

Investment-Focused Tax Deferral

Investment-focused tax deferral strategies aim to optimize the tax treatment of investments and capital gains. These strategies can be particularly beneficial for individuals with significant investment portfolios or those seeking to minimize the tax impact of their investment activities.

- Tax-Deferred Annuities: Annuities are financial products that provide a stream of payments over time. Tax-deferred annuities allow investors to defer taxes on the growth of their investments until the annuity payments begin. This strategy can be particularly useful for individuals seeking a steady income stream in retirement.

- Municipal Bonds: Municipal bonds are debt securities issued by local governments or municipalities. The interest earned on these bonds is typically exempt from federal taxes and often from state and local taxes as well. This tax-free status makes municipal bonds an attractive investment for tax-conscious individuals.

- Real Estate Investment Trusts (REITs): REITs are companies that own and operate income-producing real estate. These entities are required to distribute a significant portion of their income to shareholders, and these distributions are often taxed at lower capital gains rates rather than ordinary income rates.

Investment-focused tax deferral strategies can help individuals optimize their investment returns and reduce their overall tax burden, especially when coupled with strategic asset allocation and tax-efficient investment choices.

Real-World Examples of Tax Deferral Strategies

Let's explore some real-world examples of how tax deferral strategies can be implemented and the potential benefits they can offer.

Retirement Planning with a 401(k)

Imagine Sarah, a 30-year-old professional, who contributes $6,000 annually to her company's 401(k) plan. With a current marginal tax rate of 25%, Sarah effectively reduces her taxable income by $6,000 each year. Over a 30-year career, this tax deferral strategy can result in significant savings, potentially amounting to tens of thousands of dollars.

Furthermore, the tax-deferred growth within the 401(k) plan can lead to substantial wealth accumulation. Assuming an average annual return of 8%, Sarah's initial $6,000 contribution could grow to over $100,000 by the time she retires, all while enjoying tax-deferred growth.

Tax-Efficient Investing with Municipal Bonds

John, a retired individual, is seeking to generate a steady income stream while minimizing his tax burden. He invests a portion of his retirement savings in municipal bonds, which offer tax-free interest payments. With a marginal tax rate of 32%, John can enjoy the full benefit of the tax-free income, maximizing his after-tax returns.

Additionally, municipal bonds often carry lower default risk compared to corporate bonds, providing John with a relatively secure income stream that complements his retirement savings.

Deferred Compensation for Business Owners

Consider a small business owner, Emma, who wants to provide her employees with additional compensation while reducing the company's tax liability. Emma implements a deferred compensation plan, where employees can elect to receive a portion of their compensation in the form of stock options or bonuses at a future date.

By deferring the tax liability, Emma's business can retain more cash flow in the short term, potentially reinvesting it into the business for growth. Simultaneously, employees can benefit from potential capital gains tax rates when they exercise their stock options or receive their deferred bonuses.

Performance Analysis and Considerations

While tax deferral strategies offer numerous benefits, it's essential to consider the potential drawbacks and limitations.

Potential Drawbacks

- Limited Access to Funds: Tax-deferred retirement accounts often have strict rules and penalties for early withdrawals, which can limit an individual's access to funds in emergencies or unforeseen circumstances.

- Tax Liability in Retirement: While tax deferral reduces current tax liability, it often results in higher taxes during retirement when individuals may have lower incomes and less capacity to manage the tax burden.

- Investment Risk: Tax-deferred investments, such as annuities and municipal bonds, carry their own set of risks, including potential losses and reduced returns.

Considerations for Optimal Strategy

- Diversification: It's important to diversify one's tax-deferred investments to manage risk and optimize returns. A balanced portfolio of tax-deferred and non-tax-deferred investments can provide a more stable and flexible financial plan.

- Regular Review: Tax laws and regulations can change, impacting the effectiveness of tax-deferral strategies. Regularly reviewing and adjusting one's financial plan to align with the latest tax rules is crucial.

- Professional Advice: Tax-deferral strategies can be complex, and the specific benefits and limitations can vary based on individual circumstances. Seeking advice from a financial advisor or tax professional can help ensure that the chosen strategy aligns with one's goals and needs.

Future Implications and Trends

The landscape of tax deferral strategies is continuously evolving, influenced by changing tax laws and economic conditions. As such, individuals and businesses must stay informed about potential changes that may impact their financial strategies.

Currently, there is a growing focus on tax simplification and reform, which could potentially impact the effectiveness and availability of tax-deferral strategies. Additionally, the rise of alternative investment vehicles and the increasing complexity of financial markets may present new opportunities for tax-efficient investing.

As tax laws and financial markets evolve, individuals and businesses must adapt their financial strategies to ensure they remain tax-efficient and aligned with their long-term goals. Staying informed and seeking professional advice will be crucial in navigating these changes.

What are the key advantages of tax deferral strategies?

+Tax deferral strategies offer several advantages, including reduced current tax liability, tax-free growth on investments, long-term wealth building, and financial flexibility. These strategies can significantly impact an individual’s overall financial well-being and retirement planning.

Are there any potential drawbacks to tax deferral strategies?

+Yes, tax deferral strategies can have limitations. For instance, tax-deferred retirement accounts often restrict access to funds, and the deferred taxes may result in a higher tax burden during retirement. Additionally, tax-deferred investments carry their own set of risks and potential losses.

How can I optimize my tax-deferral strategy?

+To optimize your tax-deferral strategy, consider diversifying your investments, regularly reviewing your financial plan, and seeking professional advice. Diversification helps manage risk, and staying informed about tax laws ensures your strategy remains effective and aligned with your goals.