Tax Fraud Jail Time Myths Debunked: What You Need to Know

Tax fraud remains one of the most daunting legal issues faced by individuals and corporations alike, often shrouded in myths and misconceptions that can lead to unclear or exaggerated expectations about judicial outcomes. Understanding the realities of tax fraud charges, including jail time practices, is essential for anyone engaged in financial activities or advising clients on compliance. This comprehensive guide aims to demystify common myths surrounding tax fraud jail penalties, providing clarity through evidence-based insights and expert perspectives grounded in the latest legal standards and Enforcement Trends.

Unraveling Tax Fraud Jail Time Myths: A Step-by-Step Guide

Tax fraud involves deliberately falsifying or omitting information to reduce tax liabilities illegally. While criminal prosecution can result in jail time, many misconceptions persist about the duration, likelihood, and circumstances under which such penalties are imposed. This piece systematically addresses these misconceptions, offering a nuanced understanding based on legal precedents, IRS enforcement data, and judicial tendencies, equipping readers with accurate knowledge to navigate or advise on tax-related legal issues confidently.

Key Points

- Myth #1: All tax fraud cases lead to prison sentences.

- Myth #2: Jail time is inevitable even for minor discrepancies.

- Myth #3: Criminal charges are always pursued for tax errors, regardless of intent.

- Myth #4: The length of jail time is standardized across all cases.

- Myth #5: Convictions depend solely on the amount of money involved, not on intent or cooperation.

Understanding the Legal Framework of Tax Fraud and Jail Penalties

At its core, tax fraud is defined in the U.S. Internal Revenue Code (IRC) § 7201 as an act of willful attempt to evade or defeat federal tax. The legal distinction between criminal tax evasion and civil tax disputes hinges on intent. Criminal prosecutions are initiated when authorities establish that there was deliberate misconduct, often involving concealment or deception. The penalties include fines, back taxes, and potentially, imprisonment. The foundational reason for jail time emphasis is to deter egregious misconduct and uphold the integrity of tax laws.

The Severity Spectrum in Tax Fraud Cases

While criminal tax fraud can carry significant penalties—including possible prison sentences—most cases settle through civil penalties depending on the nature and gravity of the misconduct. It’s critical to understand the factors that influence whether jail time is pursued and its expected duration, including the level of intent, the amount of unpaid taxes, and the defendant’s cooperation with authorities.

| Relevant Category | Substantive Data |

|---|---|

| Average jail sentences for tax fraud | Typically range from 12 to 36 months, with variations depending on case specifics |

| Conviction rate | Approximately 80% of prosecuted criminal tax cases result in conviction (based on DOJ data) |

| Sentencing factors | Severity of violation, amount involved, cooperation, prior record |

Debunking Common Myths About Jail Time in Tax Fraud Cases

Myth 1: All Tax Fraud Cases Result in Jail Time

This misconception assumes that simply being accused of tax fraud guarantees incarceration, which is false. The reality is that many cases resolve or are dismissed without imprisonment, particularly if the defendant demonstrates lack of intent, demonstrates genuine cooperation, or the misconduct is not egregious.

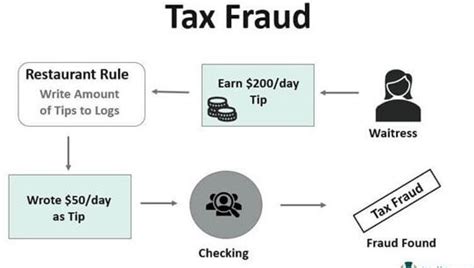

Myth 2: Minor Discrepancies Lead to Jail

Minor inaccuracies in tax filings, especially if unintentional, historically lead to penalties such as fines or repayment plans, as civil sanctions are prioritized. Criminal charges generally require proof of deliberate intent. The IRS and DOJ focus on suspicious behavior, concealment, or large-scale evasion for criminal prosecutions, not minor errors.

Myth 3: Criminal Charges Are Inevitable Regardless of Conduct

Criminal proceedings depend heavily on intent. Honest mistakes or poor bookkeeping typically are treated civilly, while cases involving fraud, deception, or concealment are escalated criminally. Prosecutors evaluate evidence thoroughly before pursuing jail sentences.

Myth 4: Jail Sentences Are Uniform Across Cases

The length of jail time varies significantly based on multiple factors: the scale of the fraud, the defendant’s history, cooperation level, and the presence of mitigating circumstances. Sentencing guidelines by the Federal Sentencing Guidelines (FSG) provide a framework but allow judicial discretion.

Myth 5: The Amount of Money Involved Is the Sole Determinant

While larger sums can lead to more severe penalties, the key aspect influencing jail time is intent. An attempt to conceal taxes involving smaller amounts but with clear evidence of willful misconduct can result in lengthy imprisonment, whereas larger inadvertent errors may be handled civilly.

Best Practices for Navigating Tax Fraud Allegations

If accused or under investigation, legal strategists recommend prompt, transparent, and cooperative engagement with authorities. Skilled legal counsel can assess the case’s nuances, identify mitigating factors, and potentially negotiate plea deals that avoid imprisonment.

Steps to Minimize Jail Time Risks

- Consult dedicated tax law professionals experienced in criminal defense.

- Gather all relevant documentation, including original filings, correspondence, and financial records.

- Demonstrate honest cooperation and willingness to rectify errors.

- Prepare a comprehensive explanation of the conduct in question, emphasizing lack of intent if applicable.

- Seek alternative sentencing options or plea agreements that prioritize penalties other than incarceration.

Can I avoid jail if I make a mistake on my taxes?

+Minor errors or honest mistakes typically result in civil penalties rather than criminal charges. Jail is usually reserved for cases involving willful intent to conceal or defraud.

What factors influence the length of jail time for tax crimes?

+Key factors include the amount involved, the defendant’s level of cooperation, prior history, and whether there was intentional fraud or concealment.

Is cooperation with IRS agents beneficial?

+Yes, cooperation often leads to reduced penalties, plea agreements, or alternative sanctions that can help avoid or lessen jail time.