What Is Sales Tax Florida

Sales tax is a crucial aspect of commerce and plays a significant role in the economy of any state. Florida, with its vibrant tourism industry and diverse population, has a unique sales tax structure that impacts both residents and businesses. Understanding the intricacies of sales tax in Florida is essential for consumers, entrepreneurs, and anyone interested in the economic landscape of the Sunshine State. In this comprehensive guide, we will delve into the world of Florida sales tax, exploring its history, current regulations, and practical implications.

A Brief History of Sales Tax in Florida

The implementation of sales tax in Florida dates back to the mid-20th century. In 1939, the state enacted the Sales Tax Act, introducing a 3% tax on retail sales of tangible personal property. This marked the beginning of a revenue-generating system that has since evolved to support various state initiatives and services.

Over the years, the sales tax rate has fluctuated, with adjustments made to accommodate economic changes and budgetary needs. The current sales tax structure in Florida is a result of numerous amendments and legislative actions, reflecting the state's commitment to balancing revenue generation and consumer affordability.

The Florida Sales Tax Structure

Florida’s sales tax system is a complex yet well-defined framework that applies to a wide range of transactions. The state’s sales tax rate is set at 6%, which is applicable to most goods and services. However, it’s important to note that Florida’s sales tax structure is not uniform across the state. Local governments, including counties and municipalities, have the authority to levy additional sales taxes, resulting in varying rates depending on the specific location.

Statewide Sales Tax Rate

The base sales tax rate of 6% is applied consistently across Florida, ensuring a uniform approach to taxation for many products and services. This rate is charged on the total purchase price, including any applicable surcharges or fees.

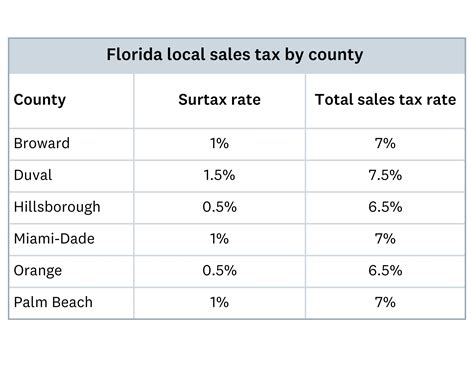

Local Sales Tax Variations

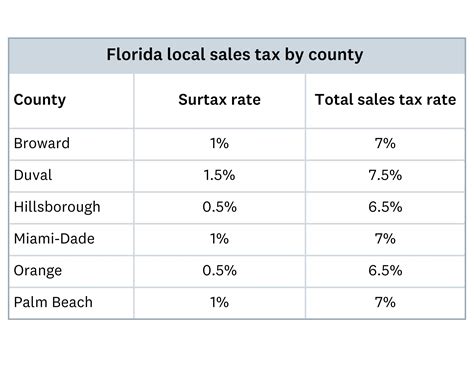

In addition to the statewide rate, local governments have the discretion to impose their own sales taxes. These local sales taxes, often referred to as discretionary sales surtaxes, can range from 0% to 1.5%. The specific rate varies depending on the county or municipality, resulting in a unique sales tax environment within Florida.

| County | Sales Tax Rate |

|---|---|

| Miami-Dade County | 7% |

| Broward County | 7% |

| Palm Beach County | 7% |

| Hillsborough County | 7% |

| Orange County | 7% |

These local variations create a diverse sales tax landscape, with some areas having higher rates due to the additional surtaxes. It's crucial for businesses and consumers to be aware of these variations, as they directly impact the final cost of goods and services.

Products and Services Subject to Sales Tax

Florida’s sales tax applies to a broad spectrum of goods and services, covering most aspects of daily life and economic activities. Here are some key categories that are typically subject to sales tax in Florida:

- Tangible Personal Property: This includes items such as clothing, electronics, furniture, and vehicles.

- Services: Various services like haircuts, repairs, legal services, and entertainment are taxable.

- Food and Beverage: Sales tax is applied to prepared foods and beverages, including restaurant meals and catering services.

- Lodging: Hotel and motel stays are subject to sales tax, often at a higher rate than the standard 6%.

- Admission Fees: Entry fees for attractions, amusement parks, and recreational activities are taxable.

However, it's important to note that there are exemptions and special provisions for certain goods and services. For instance, groceries, prescription medications, and some agricultural products are exempt from sales tax.

Sales Tax Collection and Remittance

The responsibility of collecting and remitting sales tax falls on the shoulders of businesses, known as sellers or retailers, who are registered with the Florida Department of Revenue (DOR). These businesses act as agents for the state, collecting the tax from customers at the point of sale and subsequently remitting it to the DOR.

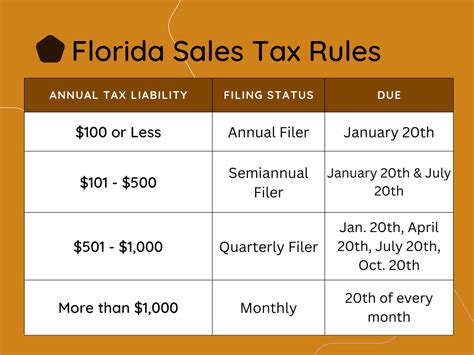

The process of sales tax collection involves calculating the tax amount based on the applicable rate and the total purchase price. Businesses are required to maintain accurate records and file periodic tax returns, typically on a monthly or quarterly basis, depending on their sales volume.

Registration and Compliance

To collect and remit sales tax in Florida, businesses must obtain a sales tax permit from the DOR. This permit authorizes the business to engage in taxable transactions and collect the appropriate tax. Compliance with sales tax regulations is essential to avoid penalties and legal repercussions.

Remote Sellers and Nexus

With the rise of e-commerce, Florida has implemented regulations for remote sellers, who conduct business in the state without a physical presence. These sellers are required to register with the DOR and collect sales tax if they meet certain thresholds or have a substantial presence in the state, known as nexus.

Sales Tax Exemptions and Special Provisions

Florida’s sales tax system includes a range of exemptions and special provisions that reduce or eliminate the tax burden on specific goods, services, and entities. These exemptions are designed to support certain industries, promote economic growth, and provide relief to specific groups.

Exemptions for Essential Goods

To alleviate the financial burden on residents, Florida exempts several essential goods from sales tax. This includes:

- Groceries: Sales tax is not applied to food items purchased for home consumption.

- Prescription Drugs: Medications prescribed by licensed healthcare professionals are exempt from sales tax.

- Certain Agricultural Products: Some agricultural inputs and products are exempt, supporting the state's agricultural industry.

Tax Holidays

Florida occasionally offers tax holidays, during which certain categories of goods are exempt from sales tax for a specified period. These tax holidays are designed to provide consumers with savings and stimulate spending during specific seasons or events.

Resale and Exempt Entities

Businesses engaged in the resale of goods are not required to pay sales tax on their purchases. Additionally, certain entities, such as government agencies, educational institutions, and charitable organizations, are exempt from sales tax.

The Impact of Sales Tax on Businesses

Sales tax has a significant impact on businesses operating in Florida, influencing their pricing strategies, operational costs, and overall profitability. Understanding the intricacies of sales tax is crucial for business owners to navigate the regulatory landscape effectively.

Pricing and Competitiveness

The inclusion of sales tax in the final price of goods and services can affect a business’s pricing strategy. To remain competitive, businesses often incorporate sales tax into their pricing models, ensuring that the displayed price is inclusive of tax. This approach simplifies the purchasing process for customers and avoids any surprises at checkout.

Operational Costs

The responsibility of collecting and remitting sales tax adds an administrative burden to businesses. They must allocate resources for sales tax compliance, including training staff, maintaining accurate records, and ensuring timely remittance to the DOR. These costs are often factored into the overall operational expenses of the business.

Sales Tax Compliance Challenges

Compliance with sales tax regulations can be complex, especially for businesses with multiple locations or online sales. Navigating the varying local tax rates, keeping up with legislative changes, and accurately calculating and remitting sales tax can be challenging. Businesses often rely on accounting software and tax professionals to ensure compliance and avoid penalties.

Sales Tax and Tourism: A Unique Perspective

Florida’s vibrant tourism industry plays a significant role in its economy, and sales tax contributes to the state’s revenue generation from this sector. The sales tax collected from tourist activities and purchases provides a substantial income stream for the state.

Tourist-Related Sales Tax

Visitors to Florida are subject to the same sales tax rates as residents. This means that tourist purchases, whether it’s a hotel stay, a theme park ticket, or a souvenir, are taxed at the applicable rate. The revenue generated from these transactions supports state initiatives and infrastructure development.

Impact on Tourism Businesses

Tourism-related businesses, such as hotels, restaurants, and attractions, must navigate the sales tax landscape carefully. They must collect and remit sales tax accurately, ensuring compliance with the varying local tax rates. Additionally, these businesses often face the challenge of managing pricing strategies to remain competitive while factoring in the sales tax burden.

Sales Tax and E-Commerce: The Online Marketplace

The growth of e-commerce has brought unique challenges and opportunities for sales tax collection in Florida. With the rise of online shopping, the state has implemented regulations to ensure that remote sellers contribute to the tax base.

Online Sales and Sales Tax

Remote sellers conducting business in Florida are required to collect and remit sales tax if they meet the state’s nexus thresholds. This includes online retailers who have a substantial presence in the state or exceed certain sales volumes. The implementation of these regulations aims to create a level playing field between brick-and-mortar stores and online retailers.

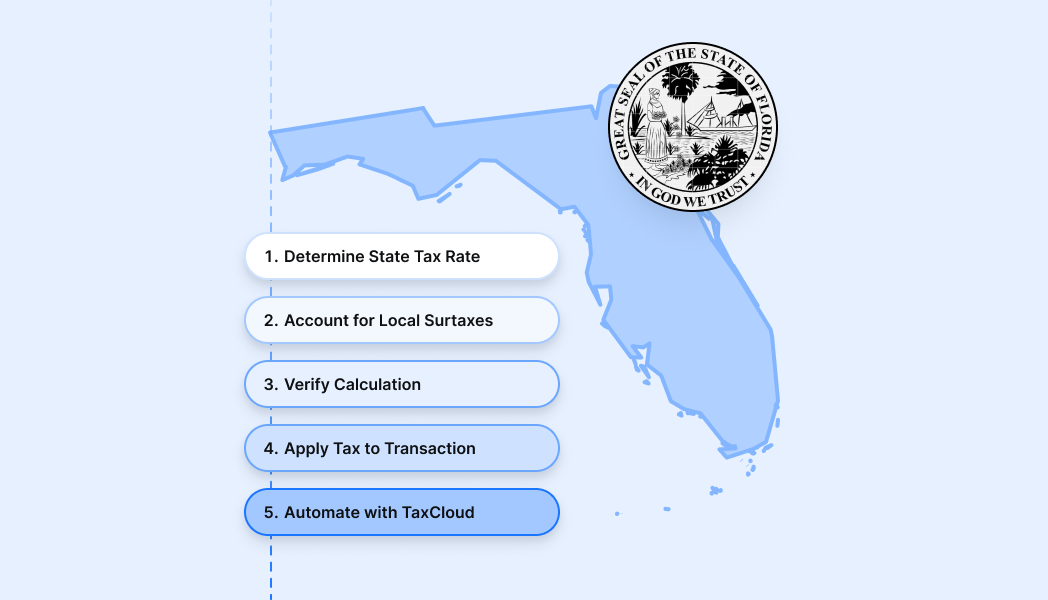

Simplifying Sales Tax for Online Sellers

To assist online sellers in navigating the complex sales tax landscape, Florida provides resources and tools. The DOR offers guidance and software solutions to help businesses calculate and remit sales tax accurately. This support ensures that online sellers can comply with regulations while minimizing the administrative burden.

Future Implications and Potential Changes

The landscape of sales tax in Florida is subject to change, driven by economic factors, legislative decisions, and technological advancements. As the state’s economy evolves, so too might the sales tax structure and regulations.

Potential Sales Tax Reform

There have been ongoing discussions about potential reforms to Florida’s sales tax system. These discussions often revolve around simplifying the tax structure, addressing the variability of local tax rates, and exploring alternative revenue-generating methods. Any significant reforms would require careful consideration of their impact on businesses and consumers.

Technological Advances and Sales Tax

The integration of technology into the sales tax landscape is an area of ongoing development. Florida, like many states, is exploring the use of digital tools and automation to enhance sales tax compliance. These advancements aim to streamline the tax collection process and reduce the administrative burden on businesses.

Impact on Small Businesses

Any changes to sales tax regulations can have a significant impact on small businesses, which often have limited resources for compliance. Simplifying the sales tax structure or providing small businesses with dedicated support and resources could alleviate some of these challenges.

Conclusion

Florida’s sales tax system is a dynamic and integral part of the state’s economic framework. From its historical origins to the present-day regulations, sales tax has evolved to support the diverse needs of the Sunshine State. Understanding the intricacies of sales tax is crucial for businesses, consumers, and policymakers alike.

As Florida continues to thrive economically, the sales tax structure will likely undergo further refinements and adaptations. Staying informed about these changes is essential for all stakeholders to navigate the evolving landscape successfully. Whether you're a resident, a business owner, or a visitor, a clear understanding of Florida's sales tax ensures a smoother and more informed experience in the state.

How often do businesses need to remit sales tax in Florida?

+The frequency of sales tax remittance depends on the business’s sales volume. Businesses with higher sales volumes typically remit sales tax monthly, while those with lower sales may remit quarterly. The Florida Department of Revenue provides guidance on the appropriate remittance schedule.

Are there any sales tax exemptions for specific industries in Florida?

+Yes, Florida offers specific sales tax exemptions for certain industries. For example, the manufacturing industry enjoys a sales tax exemption on certain machinery and equipment purchases. These exemptions aim to support specific sectors and promote economic growth.

What happens if a business fails to collect and remit sales tax in Florida?

+Failure to collect and remit sales tax can result in penalties and legal consequences. The Florida Department of Revenue has enforcement mechanisms in place to ensure compliance. Businesses should prioritize sales tax compliance to avoid these potential issues.

How can businesses stay updated on sales tax changes and regulations in Florida?

+Businesses can stay informed by subscribing to the Florida Department of Revenue’s email updates, which provide notifications about regulatory changes and important announcements. Additionally, consulting with tax professionals and utilizing reliable tax resources can ensure compliance.

Are there any plans to simplify the sales tax structure in Florida?

+There have been discussions about simplifying Florida’s sales tax structure to address the variability of local tax rates. However, as of the last update, no specific reforms have been implemented. Any changes would require careful consideration to balance revenue generation and consumer impact.